Annual property tax

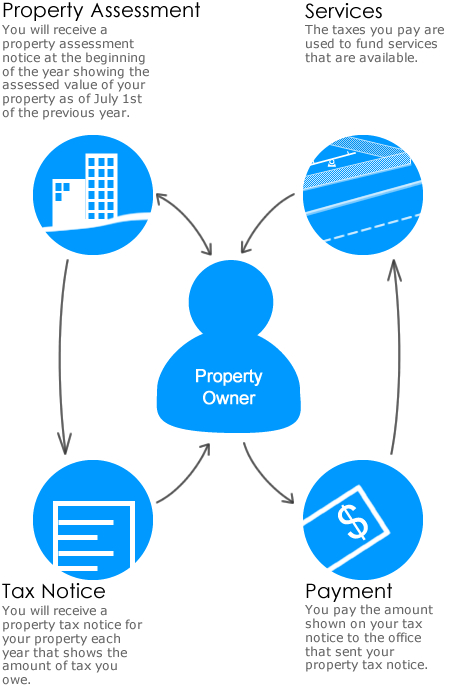

When you own or lease a property or manufactured home in B.C., property taxes must be paid yearly for each property.

The money raised from the property taxes you pay is critical to funding local programs and services, such as:

- Police and fire protection

- Emergency rescue services

- Road construction and maintenance

- Garbage services

- Recreation and community centers

- Parks

- Libraries

- Schools

- Hospitals

When a community starts a new service they are responsible for the costs. In some cases, the cost for the new service may be shared with other nearby communities. A recreation facility is a good example of when the cost to provide a new service may be shared.

How much property tax do I have to pay?

The amount you pay is based on the funds needed to provide services for the year. Tax rates are set to determine how to share the cost of providing the services.

Tax rates and your property assessment determine how much property tax you pay.

Each year you will receive a property tax notice for services available in your area. Your property taxes must be paid before the due date.

In addition to your annual property taxes you may receive a bill for services in your area. You may receive a separate bill from an improvement district, municipality or private company for services such as:

- Water

- Fire protection

- Street lighting

- Sewage

- Parks

Learn about the annual speculation and vacancy tax.

Subscribe to receive email notifications when we update our website.