Apply for the home owner grant

If you qualify for the home owner grant, you must apply each year to receive the grant on your principal residence.

Your principal residence is the usual place that you make your home. It's where you live and conduct your daily affairs, like pay bills and receive mail. It's also generally the residence used in your government records for your income tax, medical services plan, driver's licence and vehicle registration.

Your principal residence must be assessed and taxed as an improvement, such as a single family dwelling, a strata duplex or condominium, a townhouse, a manufactured or modular home.

The fastest and easiest way to apply for your home owner grant is online. Be sure to apply before your property tax due date to avoid late payment penalties.

Learn about

Updating your address

The information you provide on your home owner grant application is not shared with your municipality or BC Assessment. If your address or contact information has recently changed, you must advise your municipality and BC Assessment separately.

Who can apply

Only one qualifying owner can claim the home owner grant for a property each year.

The grant amount may be higher for a homeowner who is a senior, veteran or person with a disability, and that homeowner must be the one who is the applicant to receive the higher grant amount for the principal residence.

Anyone with your permission can apply on your behalf.

Note: If you pay your property taxes through your financial institution, your financial institution will not apply for the home owner grant on your behalf. You or someone with your permission needs to claim the grant.

Building and land owners: Determine if you should apply and how to apply for the multiple home owner grant, if you are claiming a home owner grant on behalf of eligible occupants living in your building or on your property.

Separated spouses

If you and your spouse are separated and living apart in different residences, you may each claim a home owner grant for your principal residences respectively, if other eligibility requirements are met.

If each of you wants to claim the home owner grant for your principal residences, before applying for the grant, you must have lived separately and apart for a period of at least 90 days because of the marriage or marriage-like relationship breakdown, or you are subject to a court order recognizing the separation.

You may be required to provide documents that confirm the separation.

When to apply

You can submit your grant application online any time during the tax year. However, the best time to apply is after you receive your property tax notice and before your property tax due date. If you apply before your property tax notice is available, your home owner grant application will remain in a pending status until your tax notice is made available.

You can check the status of your application online using your application confirmation number.

If you apply for the grant after your property taxes are due, late payment penalties may apply to the unpaid portion of your property taxes. The home owner grant is a form of payment towards your property taxes and it's considered a late payment if you apply after the property taxes due date.

You can apply for the home owner grant up to December 31 of the current tax year, even if you have not paid your property taxes.

If you qualified for the grant for the year prior to the current tax year, and you did not apply, you may be able to apply and claim the grant retroactively.

How to apply

The fastest and easiest way to apply for your home owner grant is online. You can also apply by phone.

If you do not have a computer or access to the internet, you can visit a Service BC location.

Anyone with your permission can apply on your behalf.

Apply online

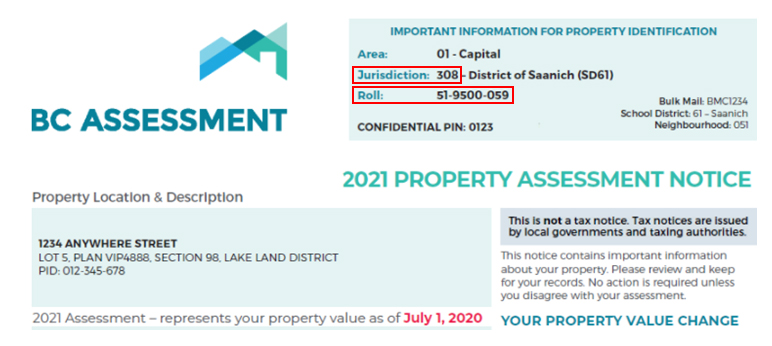

To apply, you need the jurisdiction and roll number for the property. These numbers can be found on any of the following:

- Your property tax notice

- Your BC Assessment notice you received in January (see sample below)

- The BC Assessment website

You’ll also need your social insurance number. Your personal information is encrypted at the time of entry to ensure your personal information is kept secure.

We will contact you if we require additional documents to support your application. To provide additional documentation, use our secure portal through eTaxBC to upload your documents.

After you apply, you can check your status online using your confirmation number or case ID.

Apply by phone using automated self-service

You can apply by phone 24 hours a day, 7 days a week using the self-serve phone system. If you need assistance, agents are available Monday to Friday, 8:30 am to 5:00 pm, excluding statutory holidays. Translation services are available.

Note: The automated system uses voice recognition and keypad entry from a touch phone or keyboard. Rotating dial phones do not work.

Grant applications are audited for up to 7 years to make sure taxpayers are eligible for the grants they receive.

Contact information

Contact us if you have any questions about the home owner grant.