Access other services in eTaxBC

You can perform a variety of basic tasks such as:

- Apply for a tax verification letter

- Send us a message

- Read your web messages or email notices

- Read your letters

- Navigate through pages

- View your eTaxBC activity history

- Submit documents

- File an application for clearance

- Verify a provincial sales tax (PST) account

Send us a message

To send a message:

- Log on to your eTaxBC account

- Under More..., in the Messages panel, select Contact the Ministry

- Select the Account and Period (if applicable) the message relates to

- Select a Message Type from the drop down list

- Complete the form

- Select Add Attachment if you want to send an attachment with your message. The maximum size of an attachment is 50 MB

- Select Submit

You won’t receive an email notification when your message has been responded to. To check if you’ve received a response:

- Under More..., in the Messages panel, select View Messages

- Select the messages shown under Inbox

You can select View Messages to view both read and unread messages. You may view both sent and received messages by selecting the Inbox (received) and Outbox (sent) tabs.

Read your web messages or email notices

To read web messages or email notices:

- Log on to your eTaxBC account

- Under More..., in the Messages panel, select View Messages

Messages are listed in the Inbox. You can view both sent and received messages by selecting the Inbox (received) and Outbox (sent) tabs.

Read your letters

To read your letters:

- Log on to your eTaxBC account

- Under More..., in the Letters panel, select View Letters

- If you do not see the letter you wish to view, select the Search option under Processed and then search your past letters by date range

- Select the link in the Type column to view a letter

Navigate through pages

There are a number of ways you can move through eTaxBC pages:

- Select any hyperlink after logging on to your eTaxBC account

- Select the Menu in the top right corner

- Select the breadcrumb trail at the top of the page

View your eTaxBC activity history

To view your previous eTaxBC account activities:

- Log on to your eTaxBC account

- Under More..., in the Submissions panel, select Search Submissions

- Select the hyperlinked title of a specific item and a summary of the item will load

Items in Submissions will be listed under one of the following statuses:

- Pending - The item has been submitted for processing. If it says Processing in the submission details page, the item has been received

- Processed - The item has been completed

- Deleted - The item has been cancelled

- Draft - The item has been saved, but not yet submitted

Submit documents

If you receive a request from us to submit documentation and the program area you are dealing with is set up to receive documents through eTaxBC:

- Go to eTaxBC

- Select Submit Requested Documents

- Select the program from the drop down box. This may be specified in correspondence from the program area

- Enter your personal details

- Enter one of the requested identifiers. The identifiers will be different depending on the program area you are submitting for

- Select Add to add a document from your device

- Choose a document Type and enter a Description, and then choose the file to be added

- You can add multiple documents by selecting Add again

- Documents that may be submitted include photos, PDF files, word processing documents and spreadsheet documents

- You will not be able to submit files greater than 50 MB

Note: If the file you're submitting is over 50 MB, contact the representative listed on the letter or email sent to you. You can also contact Taxpayer Services at 1-877-388-4440 for assistance.

- Once you have added all necessary documents, select Submit to complete your submission

File an application for clearance

Follow these step-by-step instructions to submit a clearance request through eTaxBC:

- Enter your business and contact information

- Select on whose behalf you are submitting the clearance (Purchaser, Seller, Lender, Other) and then select Next

- Enter the name and business number (if applicable) of the business you are requesting the clearance of

- Select the Tax Act(s) you are seeking a clearance under the provisions of and the account number(s) if known (Provincial Sales Tax Act, Tobacco Tax Act, Carbon Tax Act, Motor Fuel Tax Act)

- Select the type of ownership of the business you are seeking a clearance of, and the appropriate identification information (Corporation, Association, Partnership, Sole Proprietor/Individual, Other)

- Provide the requested information for each location, branch and/or division owned by the legal entity being searched and then select Next

- Select the purpose of the issuance of clearance and any required information related to said purpose

- Enter date of transaction, proposed purchaser’s name, proposed purchaser’s address

- “If the potential sale involves tangible personal property or software, which may be taxable under the provisions of the Provincial Sales Tax Act, provide description and value, if known” -- select Next

- Attach all applicable attachments (if any) and select Add Attachment (select Type from drop down list and enter a description of document being uploaded and select Choose File and then select OK) and then select Next

- Provide “Authorization to release information (from the entity on which the search is to be conducted)”

- Name, Title, Date Authorized

- Confirm you are the above named person and authorize the release of information, etc.

- Provide “Authorization to release information (from the entity on which the search is to be conducted)”

- Certify and select Submit

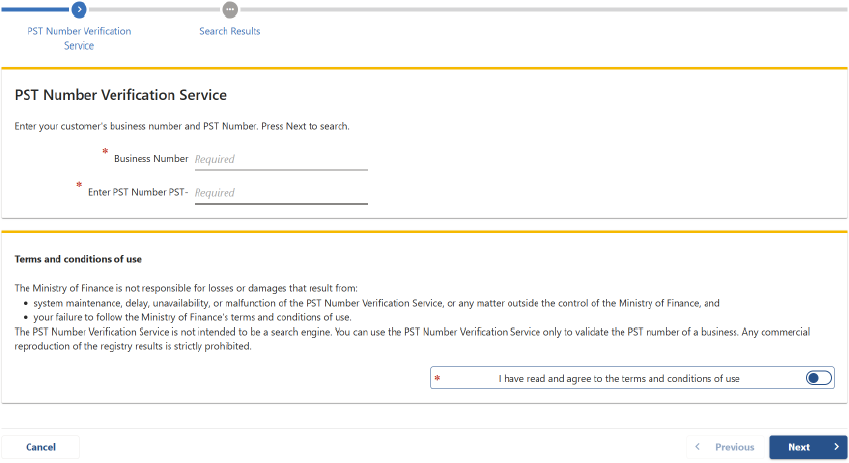

Verify a provincial sales tax (PST) account

To verify a provincial sales tax (PST) account number:

- From the eTaxBC homepage, select Provincial Sales Tax (PST) verification service

- Enter the Business Number (BN) and PST Number (screenshot below)

- Confirm that you've read and agree to the terms and conditions of use

- Select Next

- If the PST Number is valid and matches the Business Number, you'll be taken to the Search Results screen with “Result: PST number is valid”

- If the PST number is not correct or does not match the BN entered (for example, a typo or wrong BN), you'll stay on the PST Number Verification Service screen and see the message: “Result: No Match Found”

Manage your account, file returns or make payments online using eTaxBC.

Don't have access to eTaxBC? Enrol now.

eTaxBC is a convenient online service that allows you to manage your account, file returns, make payments and communicate with ministry staff.

Find out more about eTaxBC and what types of accounts are available.

Contact information

Our eTaxBC help desk is available on weekdays from 8:30 am - 4:20 pm Pacific Standard Time.

1-877-388-4440