Dispute resolution fees and fee waivers

When you apply for dispute resolution, you need to pay a filing fee. In some circumstances, you can apply for a fee waiver.

English | Français

On this page

- Be prepared to pay the filing fee

- Understand the types of waivers

- Apply for a low-income fee waiver

- Apply for an extraordinary expense fee waiver

- Apply to have your filing fee reimbursed

- Choose a payment method

- Resources

- I need help

Be prepared to pay the filing fee

When you submit your application for dispute resolution, you need to pay the $100 filing fee.

In some circumstances, you can apply to have the fee waived.

Understand the types of fee waivers

You can apply to have the dispute resolution fee waived if you have:

- Low income and you cannot pay the dispute resolution filing fee

- Extraordinary expenses that would make paying the filing fee a hardship

- Won your hearing and want the other party to reimburse you for the application filing fee:

- You still need to pay the fee upfront

- You must make this request in your dispute resolution application form

Apply for a low-income fee waiver

You qualify for a fee waiver if your household income is below the Government of Canada's Low-Income cut-offs (LICOs) or if you’re enrolled in an income assistance program.

If you're unsure if you qualify, submit the required details about your income, household, and your enrollment in an income assistance program and the Residential Tenancy Branch (RTB) will make an assessment.

Tenants with low income

For applying online and by paper, you need to include details about your income and household and your enrollment in an income assistance program.

Online

Apply at the same time as you apply for dispute resolution

- Tenants using the Online Application for Dispute Resolution can request that the fee be waived on the payment screen.

In-person by paper

Apply by submitting a paper Application to Waive Filing Fee (PDF, 539KB) - Form RTB-17 to:

Landlords with low income

You need to include details about your income and household and your enrollment in an income assistance program.

Online

This application cannot be completed online, only paper applications are accepted.

If you are using the Online Application for Dispute Resolution:

- Select that you will make your payment at the Residential Tenancy Branch or Service BC office

- Submit your fee waiver in person

In-person by paper (only)

Apply by submitting a paper Application to Waive Filing Fee (PDF, 539KB) - Form RTB-17 to:

Deadline to apply for a low-income fee waiver

Generally, fee waiver applications are submitted at the same time a person applies for dispute resolution online or in person. If a person applies for dispute resolution online but chooses to submit a fee waiver application in person, they must do so within three days of when they applied for dispute resolution.

Apply for an extraordinary expenses fee waiver

Landlords or tenants who have incurred extraordinary expenses within the past 8 weeks that would make paying the filing fee a hardship, can apply for a fee waiver.

This application cannot be completed online, only paper applications are accepted.

Requirements for extraordinary expenses

Extraordinary expenses may include:

- Extraordinary medical expenses for you or your dependents

- Extraordinary transportation costs for medically necessary procedures not available in your community

- Funeral expenses including travel costs for immediate family. For example:

- Parent

- Spouse

- Child

- Grandchild

- Grandparent

- Sibling

- Parent, child, grandchild, grandparent or sibling of your spouse

- Costs associated with an emergency such as a fire, flood, or other catastrophic event

- Loss of income because you:

- Have lost your job but are not yet receiving unemployment benefits

- Are not working due to illness or injury, but are not yet receiving disability benefits

How to apply

Landlords and tenants apply by submitting a paper Application to Waive Filing Fee (PDF, 539KB) - Form RTB-17, to the Residential Tenancy Branch or Service BC office

You need to include details about your income and household.

Deadline to apply for an extraordinary expenses fee waiver

If a person applies for dispute resolution online, they must submit their extraordinary expenses fee waiver application in person within three days of when they applied for dispute resolution.

Income and household details

You must include details about income for all household members to support your fee waiver application.

- This is all occupants of the rental unit, including dependents

Monthly income

Tenants

- The total monthly income before deductions of all tenants and family members or dependents. Make sure to include all sources.

Landlords

- The total monthly income before deductions of the landlord and landlord's family members or dependents. Make sure to include all sources.

Provide details of your request

Include any other related information.

Household details

You must provide information to support the fee waiver including:

Community size

- The size or population of the city, town or community where the rental address is located

Household size

Tenants

- The total number of tenants and their family members or dependents living in this rental unit or site

Landlords

- The total number of landlord and their family members or dependents living in the landlord's residence

Enrollment in income assistance program

You can also qualify for a low-income fee waiver if you are enrolled in any of the following income assistance programs:

- British Columbia Income Assistance

- British Columbia Income and Disability Assistance

- Canada Guaranteed Income Supplement

- Canada Employment Insurance

Apply to have your filing fee reimbursed

In your initial dispute resolution application form, you can request a filing fee reimbursement. The arbitrator makes this decision after your hearing.

To be reimbursed, you must have won your hearing and have checked the correct box in your dispute resolution application.

How to apply

Online

Apply at the same time as you submit your application for dispute resolution.

In-person by paper

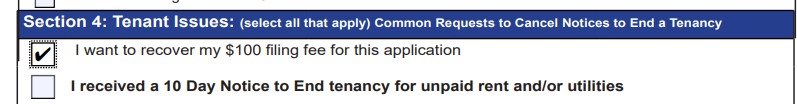

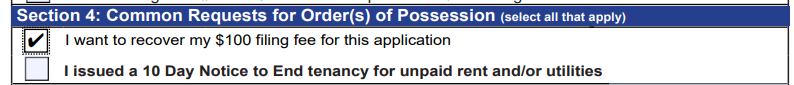

Check off the box in section 4 of the application.

Tenant application

Landlord application

Choose a payment method

Online

Pay the filing fee online by:

- Credit card (Visa, Mastercard or American Express )

- Visa Debit

- MasterCard Debit

At a Residential Tenancy Branch or Service BC Office

You may pay the filing fee in person at the Residential Tenancy Branch or Service BC office by:

- Cash

- Debit

- Credit card (Visa, Mastercard or American Express)

- Visa Debit

- MasterCard Debit

- Certified cheque or money order payable to the Minister of Finance

By Mail or courier

Sending a certified cheque or money order payable to the Minister of Finance to the:

Resources

- Application to Waive Filing Fee (PDF, 539KB) - Form RTB-17