Electricity as a renewable and low carbon fuel

Electricity has become an important low carbon fuel in transportation. Learn about responsibilities and reporting requirements for electricity suppliers under the Low Carbon Fuel Standard.

On this page

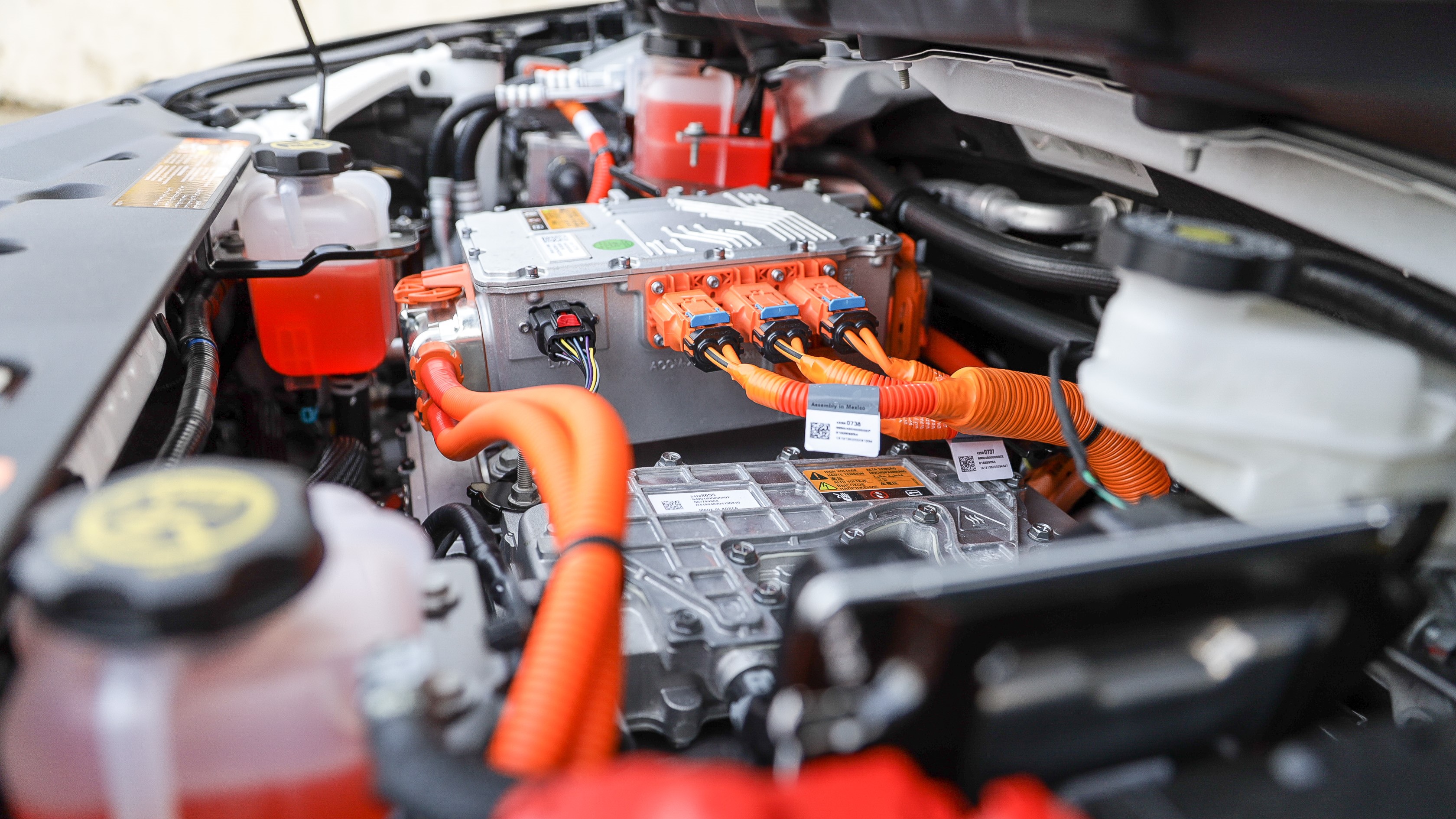

Using electricity as an alternative fuel

The number of electric vehicles in B.C. is growing. Electricity is reported for transportation and other prescribed purposes. Non-transportation purposes for electricity as an alternative fuel include:

- Cargo handling equipment at marine terminals

- Ground support equipment at airports

- Heavy forklifts

Review RLCF-022 Prescribed non-transportation purposes for the list of equipment types.

Electric vehicle (EV) charging fits into both the gasoline and diesel fuel categories:

- Gasoline category when used in light-duty vehicles

- Diesel category when used in heavy-duty vehicles exceeding a gross vehicle weight of 3,856 kg

Compliance and reporting

Organizations must report electricity on or before March 31 following the end of a compliance period. Each compliance period begins on January 1 and ends on December 31.

- Electricity should be reported if it is used instead of a fossil fuel for transportation and other prescribed non-transportation purposes

- To report electricity, you must be an organization with obligations or have an allocation agreement

Learn your reporting requirements or how to allocate responsibility

Identifying EV chargers

Before you report electricity supplied through the FSE you must identify all the electric vehicle chargers.

Complete your FSE Identification form in the reporting system

Electricity only suppliers

If you only supply electricity, you do not submit a compliance report in these situations:

- Your aggregate volume is less than 15,000 kWh for the compliance period

- You have allocated responsibility for all the electricity you supply to another organization through an allocation agreement

Reporting responsibilities

An organization is responsible for electricity supply if it supplies the electricity through the Final Supply Equipment (FSE), such as an EV charger, in B.C. This organization owns the electricity supplied through the FSE and is best understood as the utility account owner at the FSE’s location.

Under the Low Carbon Fuel Standard, electricity suppliers must report their electricity use to receive tradable compliance units (credits).

- You do not need to charge a fee to be responsible for reporting

- You must report on the quantity of electricity provided

Despite the definition above, the utility provider is considered the supplier in the following cases:

- EV charging stations at a residential building with less than five dwelling units

- TransLink trains and electric trolley routes in operation on December 31, 2020

Measuring electricity supply

You must accurately quantify the electricity supplied in each fuel category.

Options for measurement include:

- FSEs that are capable of measuring electricity

- Separate meters or submeters that measure the quantity of electricity used by the FSE only

If you do not have a device that measures electricity with reasonable accuracy, then you do not report the electricity.

How credits are calculated

Credits are calculated using the formula in Section 13 of the Low Carbon Fuels Act.

Use the Compliance Unit Calculator (XLSX, 74.9KB) to figure out the credits generated in a compliance period.

Contact information

LCFS@gov.bc.ca