Attainable Housing Initiative Heather Lands

The Attainable Housing Initiative (AHI or Initiative) provides approximately 2,600 strata leasehold homes at an initial 40 percent below market value at the Heather Lands in Vancouver.

The Initiative is intended to provide homes that middle-income, first-time homebuyers can own themselves and live in. It is not intended as an investment vehicle, to generate homes for rent, or to benefit households living outside of B.C.

On this page

- Location

- Partnership

- Overview

- Eligibility

- Prioritization and selection process

- Recovering the provincial contribution

- Cost of Units

- Secondary Sales

- Ongoing requirements of the Initiative

- Initiative administration

Location

The Heather Lands property is 8.5 hectares (21 acres) in size located on Heather Street between West 33rd Avenue and West 37th Avenue in Vancouver. The property is located within the xʷməθkʷəy̓əm (Musqueam), Sḵwx̱wú7mesh (Squamish), and səlilwətaɬ (Tsleil-Waututh) (MST) Nations’ traditional territory and units will be sold as 99-year strata leaseholds on MST Nations owned land.

Image Copyright: MST Partnership and Canada Lands Company

Partnership

The Province and MST Nations have come together to deliver this new housing Initiative. A comprehensive planning program of the Heather Land Site began in 2016, jointly overseen with the City of Vancouver's planning department.

Overview

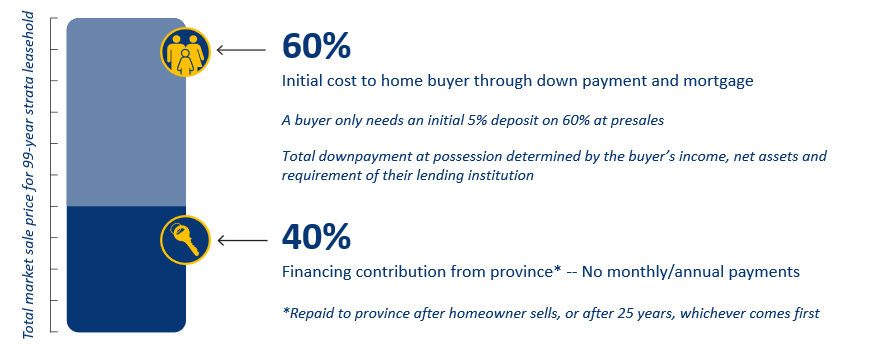

The Initiative will allow for studio, one-, two- and three-bedroom 99-year strata leasehold homes to be initially purchased and financed by middle-income earners at below-market prices through a 60/40 purchase financing arrangement.

The framework of the 60/40 purchase financing arrangement includes:

- A buyer owns the home but initially finances and pays only 60 percent of the market price for unit using a traditional real estate transaction (such as down payment and financing through a mortgage with the buyer’s financial institution)

- The Government of B.C. initially finances and covers the remaining 40 percent of the market price with the land owner and developer

- The 40 percent contribution is then repaid by the buyer to the Province either when the owner sells an AHI unit or after 25 years, from the purchase date, whichever comes first

- A buyer under the initiative only needs an initial five percent deposit (at presale) on 60 percent of the initial market purchase price

- AHI units will be sold as 99-year strata leaseholds on MST Nations-owned land

- The Initiative and 60/40 purchase financing arrangement only applies to the original first-time purchase of the unit and not to secondary or subsequent purchase/sale transactions

Eligibility

Eligibility for the AHI that must be met at the time of pre-sale:

- Have a total annual household income below $131,950 (as of 2024) and net household assets below $150,000, to be eligible for studio and one-bedroom leasehold homes

- Have a total annual household income below $191,910 (as of 2024) and net household assets below $250,000, to be eligible for 2-bedroom, or larger leasehold homes

- Buyers must be a citizen or permanent resident of Canada

- One buyer must have resided in B.C. for the past 24 months consecutively

- Buyers must be at least 18 years of age

- Buyers must not own an interest in any other property anywhere else in the world at the time of purchase closing

- Buyers must prequalify for a mortgage and must have the minimum deposit of at least 5 percent of the value equal to 60 percent of the market purchase price

- Use the home as the owner’s principal residence

Net assets include:

- Stocks

- Bonds

- Term deposits

- Mutual funds

- Cash

- Real estate equity, net of debt

- Business equity in a private incorporated company including cash

- Guaranteed Investment Certificates (GICs)

Assets do not include personal items such as:

- Vehicles

- Jewelry and furniture

- Education-related bursaries or scholarships for current students

- Registered Education Savings Plans (RESPs)

- Registered Retirement Saving Plans (RRSPs)

- Registered Disability Savings Plans (RDSPs)

If a buyer’s life circumstances change after qualifying at the pre-sale (such as a buyer’s income increases), the buyer remains eligible. Homebuyers in the Initiative must continue to keep the home purchased through this Initiative as their primary residence, or else the 40 percent provincial financing will become due (see below).

Prioritization and selection process

Applicants who meet the above criteria and are eligible to participate in the Initiative will be tentatively prioritized by the following:

- First-time home buyers who live in B.C.

- Previous homeowners who currently do not own property at the time of the proposed purchase

- Current owners with minor-aged children, who will be selling their existing home prior to purchase closing with respect to the AHI strata leasehold unit

Any remaining unsold units through the Initiative will be sold through traditional market transaction without the 60/40 purchase financing arrangement applied.

Prospective buyers are encouraged to visit The New Village website, and register to be notified of updates on the program and registration process. The formal process to register and confirm eligibility is expected to open early in 2026.

Recovering the provincial contribution

Eligible middle-income households will own and live in these strata leasehold homes like any other strata owner. However, buyers will only be responsible for initially qualifying for financing (through their own financial institution) and making a down payment on 60 percent of the market value of the home at the time of purchase. The remaining 40 percent of the market price will be initially financed through the Province’s AHI contributions to the original owner/developers, and will be recovered through a low-interest financing arrangement (like a second mortgage) that will not require buyers to make regular monthly payments of principle and interest. However, the provincial financing must be repaid when any of the following events occurs:

- The owner sells or is deemed to have sold the unit

- After 25 years from the purchase closure date

- The owner no longer uses the home as the owner’s principal residence or is no longer meeting the ongoing requirements of the Initiative

Cost of units

Unit prices will be determined at time of sale. If units were to be sold under current market conditions under this Initiative, example pricing using the 60/40 purchase financing arrangement could be as follows:

| Unit Type | Market Price | AHI Buyers 60% | Province Initially Finances |

|---|---|---|---|

| Studio | $ 620,000 | $ 372,000 | $ 248,000 |

| 1 Bedroom | $ 850,000 | $ 510,000 | $ 340,000 |

| 2 Bedroom | $ 1,300,000 | $ 780,000 | $ 520,000 |

| 3 Bedroom | $ 1,500,000 | $ 900,000 | $ 600,000 |

Secondary Sales

The original buyer through the AHI may sell their strata leasehold unit after possession, but will only be allowed to receive net sales proceeds equal to the original purchase equity interest (in other words, equivalent to 60 percent of the original purchase price minus costs), plus the following share of any market value appreciation realized through the first subsequent strata leasehold unit sale transaction:

- Zero percent if the sale occurs within the first year of occupancy

- 20 percent if the sale occurs within the second year of occupancy

- 40 percent if the sale occurs within the third year

- 60 percent if the sale occurs within or after the fourth year of occupancy (4-25 years)

If the original buyer has not sold their home by the end of 25 years after the original purchase date, the buyer is required to repay (or refinance privately) the original 40 percent market purchase price portion secured through a provincial financing arrangement (like a second mortgage), plus 1.5 percent interest compounded annually. This could be done through a replacement mortgage with a financial institution or a lump sum repayment. At this point, the original buyer has no further obligations to the AHI and may sell the strata leasehold unit and keep 100 percent of any market appreciation on the unit.

If a buyer wishes to leave the Initiative before 25 years (like through a unit sale), the buyer must repay the provincial financing with an amount equivalent to 40 percent of the market value of the strata leasehold unit at that time. In this situation, the AHI will require the return of the original 40 percent provincial financing obligation, plus a 40 percent share of any market appreciation of the strata leasehold unit at the point of leaving the Initiative. At this point, the original buyer will have no more requirements within the Initiative and could assume 100 percent of any future unit market appreciation (or depreciation).

No 'flipping' of pre-sold AHI units will be allowed. If a pre-sale buyer wishes to back out of a pre-sale contract, the buyer can only assign their contract back to the developer for the price it was originally purchased, not for a profit.

Recovering the provincial contribution will support the Province by making returned funds available for future provincial programs – which may include housing.

Ongoing requirements of the Initiative

The owner must use the home as their principal residence. Use of the home as a secondary residence, as a short-term rental, or as a long-term rental, will trigger repayment of the provincial financing, which is 40 percent of the market value of the home at the time the use changed.

A buyer participating in the AHI will have full ownership of the strata leasehold home and therefore full responsibility of home ownership. Owners will be required to pay all the property transfer taxes, ongoing property taxes, utilities and strata fees/levies, plus comply with any other terms of the strata entity.

Obligations and benefits related to the Property Transfer Tax and First-Time Home Buyers Program will be calculated on the full market value of the strata leasehold unit, not on the 60 percent purchase share financed by the buyer and/or its financial institution. Strata fees are the responsibility of the homeowner in the Initiative, not the Province.

Initiative administration

A process to verify eligible households will be conducted by an independent third-party and the process will be co-developed and approved by the Province.

BC Housing will be responsible for direct oversight of the Initiative and implement safeguards to ensure qualifying purchasers meet the terms of ownership.