Filing instructions for associated employers for the employer health tax

This guide explains how to complete the employer health tax return for associated employers.

- Due date

- Before you file

- Step 1: Declarations

- Step 2: Associated Employer Declaration

- Step 3: Exemption Eligibility

- Step 4: Tax Payable

- Step 5: Payments

- Step 6: Summary and Certification

- Confirmation

Due date

Your annual employer health tax return is due on March 31 of the following calendar year.

If this is your final taxation year for the employer health tax, your return is due either:

- 90 days after the date you cease your permanent establishment in B.C.

- 90 days after the date you become bankrupt

Before you file

Before you file your return, ensure you have the following:

- Your username and password for your employer health tax account in eTaxBC

If you do not have an eTaxBC logon set up for your employer health tax account, you'll need to:- Enrol for access to eTaxBC

- Log on and add access to your employer health tax account

-

T4 Summary or Summaries from all payroll accounts under the same business number, which is the first nine digits of the Canada Revenue Agency (CRA) payroll account number

-

The total Non-BC Remuneration from all payroll accounts that were included on Line 14 of the T4 Summary or Summaries

-

If applicable, your T4 Slips from all payroll accounts

-

If applicable, your T4A Slips from all payroll accounts

-

If applicable, your associated employers information such as business number, legal name, B.C. remuneration amount and the exemption allocation agreement signed by all employers that are getting a share of the exemption if the associated employers group is eligible for the exemption

Note: Each associated employer must log on to their own respective eTaxBC account to file an employer health tax return.

Once you have all the above, you can begin filing your employer health tax return:

- Log on to your eTaxBC account

- Select Employer Health Tax under Accounts

- Select File Return for the period you wish to file

Step 1: Declarations

Follow the instructions below for the Declarations step.

-

Period Covered

Defaults to the taxation year you’re filing for -

Date Due

Defaults to the due date of the return -

Did you amalgamate within the calendar year?

-

Select Yes if an amalgamation happened during the taxation year. Then:

-

Indicate if you’re filing the return as the predecessor or successor

-

Enter the effective date of the amalgamation

If you’re filing as the successor corporation, you’re deemed to be a new employer starting on the effective date of the amalgamation. The exemption and notch rate amounts will be prorated accordingly.

If you’re filing as the predecessor, go to Step 2: BC Remuneration in the filing instructions for employers.

-

-

Otherwise, select No

-

Were you an associated employer on December 31?

-

Select Yes if you were part of an associated group as of December 31 of the taxation year

-

Otherwise, select No and refer to the filing instructions for employers

-

Is the combined BC remuneration of the associated employers greater than $1.5 million?

-

Select No if your combined B.C. remuneration is less than $1.5 million

-

Otherwise, select Yes and refer to the filing instructions for employers

-

Is this the final taxation year for this employer?

-

Select No if you’ll be subject to the employer health tax after this filing

-

Otherwise, select Yes and select the reason for the account closure

- Did you have at least one Permanent Establishment in BC on December 31?

-

Select Yes if you had at least one permanent establishment in B.C. on December 31 of the taxation year

-

Otherwise, select No and you’re not an associated employer as you did not have a permanent establishment in B.C. on December 31. Refer to filing instructions for employers.

Step 2: Associated Employer Declaration

Follow the instructions below for the Associated Employer Declaration Step.

-

Were you an associated employer on December 31?

Defaults to the answer provided in Step 1 -

Is the combined BC remuneration of the associated employers greater than $1.5 million?

Defaults to the answer provided in Step 1 -

Did all of the associated employers have a permanent establishment in BC at Jan. 1?

-

Select Yes if all employers who were part of an associated group have a permanent establishment in B.C. on January 1

-

Otherwise, select No. Did at least one of the associated employers have a permanent establishment in BC at Jan. 1?

-

Select Yes if one or more employers who is a part of an associated group has a permanent establishment in B.C. at January 1

-

Otherwise, Select No and enter the earliest date that an employer who is a part of an associated group first had a permanent establishment in B.C.

-

-

-

Total BC remuneration of associated employers

Shows the total Taxable BC Remuneration calculated from what you’ll enter in the Association Summary. -

Total exemption applied

Shows the total Exemption calculated from what you’ll enter in the Association Summary. -

Exemption threshold: (number of days in the taxation year / number of days in year) x $1,500,000.00

Shows the calculation of the exemption threshold based on the number of days that the associated employer group has had a permanent establishment in B.C. in a calendar year. -

Exemption limit available (number of days in the taxation year / number of days in year) x $1,000,000.00

Shows the calculation of the exemption amount available based on the number of days that the associated employer group has had a permanent establishment in B.C. in a calendar year. -

Line 100 – Total Remuneration

Enter the total remuneration reported on Line 14 of the current employer’s CRA T4 Summary for the calendar year.

If you have multiple CRA payroll accounts (for example, to track employment income from different provinces, employment types, payment types), add the amounts reported on Line 14 of all T4 Summaries from all CRA payroll account(s) of the same business number and enter that amount. -

Line 110 – Remuneration paid to employees outside BC

From the amount entered in line 100, enter the amount of remuneration paid to employees who report for work at the employer’s permanent establishment outside B.C. for all or substantially all of the calendar year. -

Line 120 – Subtotal

Shows the difference between lines 100 and 110 -

Line 130 – BC Remuneration not declared on T4 Summary

Enter the amount that was not included in line 100 but is part of B.C. remuneration (for example, taxable remuneration reported on T4A or other slips). -

Line 190 – BC Remuneration

Shows your B.C. remuneration, the sum of lines 120 and 130.

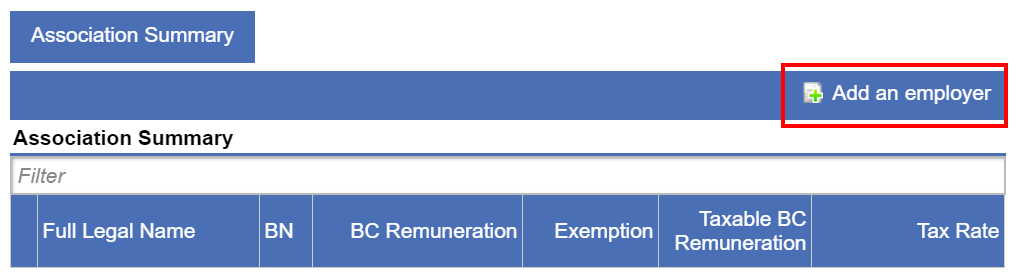

Association Summary

The Association Summary allows you to add and provide details of the associated employers. It must be used to allocate the exemption amount among associated employers if the associated employers group is eligible for the exemption. If the Association Summary is not completed, an exemption will not be applied to the current employer you’re filing the return for.

To add an employer, select Add an Employer. The first employer you add is you. You must then add at least one other associated employer to continue.

-

Current Employer

-

For the first employer added, defaults to Yes

-

For all subsequent employers added, defaults to No

-

-

Full Legal Name

-

For the first employer added, defaults to the name on your account

-

For all subsequent employers added, enter the associated employer’s legal name as it appears on your incorporation certificate or partnership agreement

-

-

Business Number

-

For the first employer added, defaults to your nine-digit Business Number (BN)

-

For all subsequent employers added, enter their nine-digit Business Number (BN)

-

-

Line 190 – BC Remuneration

-

For the first employer added, defaults to line 190 above

-

For subsequent employers added, enter their total B.C. remuneration

-

-

Share of Exemption Limit

For each employer added, enter the exemption amount being claimed as agreed upon by the associated group -

Line 320 – Taxable BC Remuneration

Shows the difference between line 190 and the Share of Exemption Limit for each employer -

Line 700 – Tax Rate

Shows the tax rate. This is the same for all employers added. -

Operational Days

Shows the number of days in the calendar year the employer had a permanent establishment in B.C. -

Exemption Limit

Shows the exemption limit for the employer. This is based on the Operational Days of each employer.

After you’ve added yourself as the Current Employer, click Add an employer again to add your associated employers.

At any time, you can select Association Summary to view a summary of all employers entered.

When all employers are entered, select Next.

Step 3: Exemption Eligibility

The Exemption Eligibility step shows the following automatically calculated fields:

-

Line 200 – Number of Days in your taxation year

The number of days the associated group has had a permanent establishment in B.C. -

Line 202 – Exemption threshold: (number of days in the taxation year / number of days in year) x $1,500,000.00

The calculation of the associated group’s exemption threshold based on the number of days the associated group has a permanent establishment in B.C. in a calendar year -

Line 204 – Exemption limit available (number of days in the taxation year/ number of days in year) x $1,000,000.00

The calculation of the exemption amounts available for the associated group based on the number of days the associated group has a permanent establishment in B.C. in a calendar year

Step 4: Tax Payable

The Tax Payable step shows the following automatically calculated fields:

-

Line 300 – BC Remuneration

The B.C. remuneration from line 190 in Step 2 -

Line 310 – Exemption applied

The ‘Share of Exemption Limit’ in Step 2 -

Line 320 – Taxable BC remuneration

The difference between lines 300 and 310 -

Line 700 – Tax rate

The tax rate -

Line 770 – Tax payable

The employer health tax payable for the taxation year, which is line 320 multiplied by line 700

Step 5: Payments

The Payments step shows the following fields. These fields are automatically calculated except for the last bullet:

-

Line 840 – Instalment payments received

The total of all instalment payments paid to date -

Line 842 – Prior year’s overpayment applied

Any credit balance carried over from the previous year -

Line 844 – Subtotal

The total of lines 840 and 842 -

Line 846 – Tax due (or overpaid)

Your account balance, which is the difference between line 770 in Step 4 and line 844. This is your amount payable or overpayment. -

If applicable, overpayment to be:

Select one of the following, regardless of whether you’ll have an amount payable or an overpayment:

-

Applied to subsequent year if you want to carry forward your overpayment to the subsequent year

-

Refunded if you want your overpayment amount to be refunded

Step 6: Summary and Certification

The Summary and Certification step allows you to review and make changes to your tax return before submitting it. If you need to make changes in the Association Summary, go back to Step 2.

To submit your tax return, you must certify it by:

- Entering your first name

- Entering your last name

- Entering your position title

- Reading and checking the box beside the certification statement

- Selecting Submit

Confirmation

Once the return is submitted, a confirmation number will be issued as proof of your submission. It’s recommended that you print or take a screen shot of the confirmation page for your records.

If your tax return has a balance due, see payment options.

Enrol for access to eTaxBC to manage your account, file returns or make payments online.

Already have an account? Log on to eTaxBC

For help, visit the eTaxBC help guide.

You can pay your employer health tax balance:

Filing instructions are also available for:

Contact information

1-877-387-3332

250-387-3332