CPPM Procedure Chapter I: Tangible Capital Assets

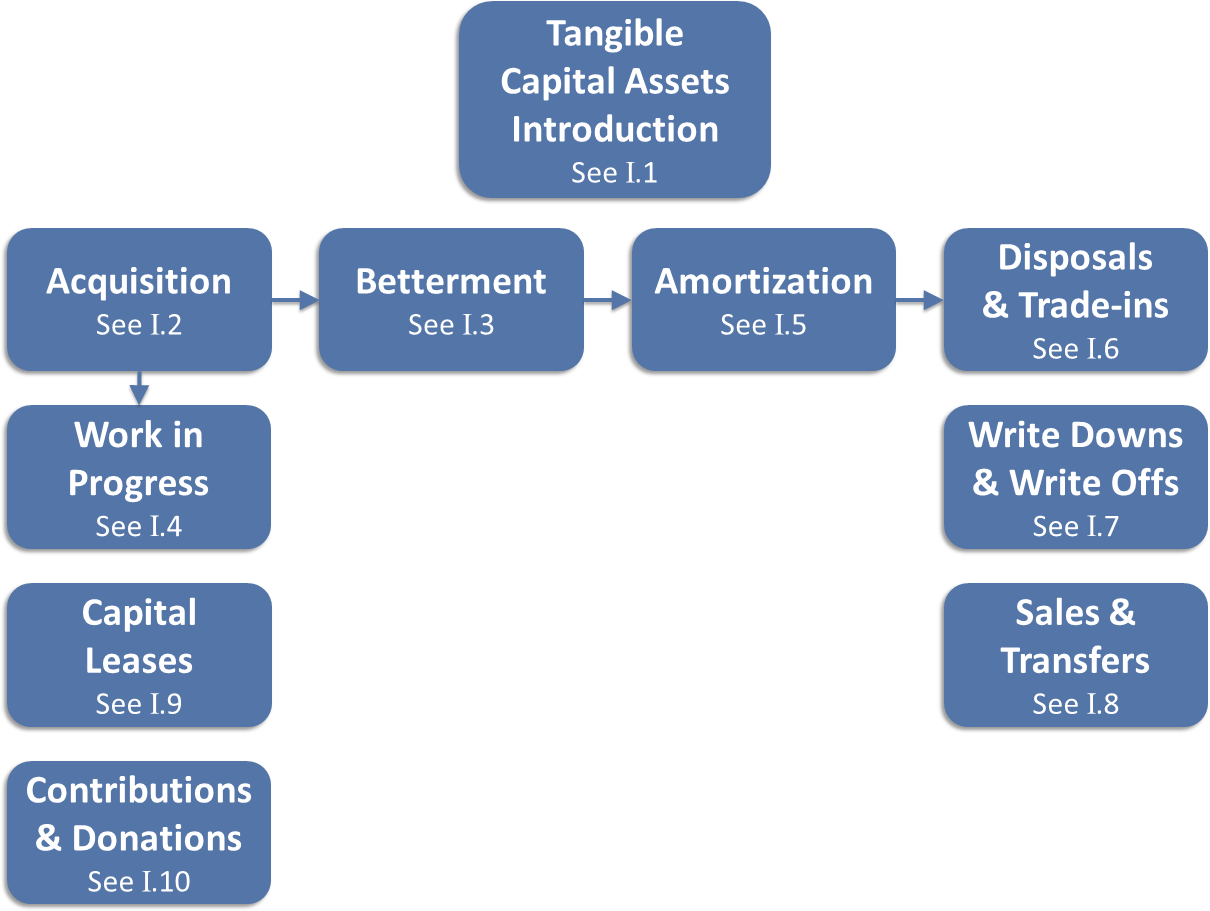

This chapter of the Core Policy and Procedures Manual describes the accounting requirements that are supplementary to Chapter 3, Part III on the accounting for tangible capital assets.

- I.1 General

- I.2 Acquisition of New Assets

- I.3 Betterments

- I.4 Work-In-Progress

- I.5 Amortization

- I.6 Disposals

- I.7 Asset Write-downs & Write-offs

- I.8 Sales and Transfers of Tangible Capital Assets

- I.9 Capital Leases

- I.10 Contributions and Donations

- Appendix A: Useful Life and Thresholds

I.1 General

The objectives of capitalizing tangible capital assets are:

- to maintain appropriate accountability for government's tangible capital assets;

- to ensure accounting consistency across the public sector, regardless of the legal form of the entity concerned;

- to measure and report the full cost of government operations; and

- to ensure efficient and effective use of assets.

See Appendix A for detail on the reported asset classes and the proposed timetable for the addition of future classes.

Tangible capital assets do not include such things as:

- inventories held for consumption or resale (including land);

- assets acquired by Right, such as forests, water and mineral resources;

- heritage assets;

- capital grants;

- intangible assets, except for software which is a tangible asset for purposes of capitalization;

- works of art and historical treasures, as a reasonable estimate of the future benefits cannot be made, nevertheless, their existence and nature must be disclosed;

- feasibility studies, business cases, management reviews (e.g., post implementation); and

- assets below threshold (except heavy equipment assets below $10,000 threshold; $1,000 and above are capitalized as operating equipment).

Policy

Tangible capital assets are reported in the government's financial statements when:

- a reasonable estimate can be made of the cost involved; and

- future economic benefits associated with the asset are likely to be received.

Tangible capital assets are reported on the Statement of Tangible Capital Assets in the following major categories:

- opening balances;

- additions;

- disposals;

- the amount of any write-downs in the period;

- the annual amortization;

- accumulated amortization;

- net book value; and

- comparatives for the prior year end.

The cost of a tangible capital asset must be capitalized at the time of acquisition or construction and amortized over its useful life.

Tangible capital asset cost and amortization information should be generated and maintained at the major program, responsibility centre and activity levels.

Tangible capital assets must be reported on a historical cost basis.

Land must always be separately identified, recorded and reported.

Work-in-progress and related carrying costs must be capitalized.

I.2 Acquisition of New Assets

The cost of a tangible capital asset includes direct construction or development costs (such as materials and labour) and overhead costs directly attributed to the acquisition, construction, development or retirement of the asset. These costs may include, but are not limited to:

- amounts paid to vendors;

- transportation/freight charges to the point of initial use;

- handling and storage charges;

- direct production costs (for assets produced or constructed), such as labour (non-government employee costs), materials, supplies, etc.;

- engineering, architectural and other outside services for designs, plans, specifications and surveys;

- acquisition and preparation costs of buildings and other facilities;

- an appropriate share of the costs of the equipment and facilities used in construction work and office improvement costs;

- fixed equipment and related installation costs required for activities in a building or facility;

- direct costs of inspection, supervision and administration of construction contracts and construction work;

- legal and recording fees and damage claims;

- fair values of land, facilities and equipment donated to the province;

- appraisal costs;

- advertising costs;

- application fees;

- management fees;

- utility costs;

- site preparation costs;

- transportation insurance costs;

- customs and duty charges;

- interest charges during acquisition, construction or development (up to substantial completion of 97%).

- asset retirement costs associated with legal obligations to retire a tangible capital asset.

Working papers are to be prepared to verify that the Government's financial statements fairly present the tangible capital assets owned by the province. Ministry records must be reconciled to central accounts balances, errors and omissions corrected and all capital asset working papers must possess auditable backup documentation.

Effective April 1, 2003 the province will capitalize employee salary and employee travel for large projects when these are capitalized under Generally Accepted Accounting Principles (GAAP) and the province's thresholds.

On large capital projects such as information technology ($5 million threshold), the cost of a tangible capital asset may include direct salary, travel and interest during construction or development may be capitalized (thresholds of $250,000 respectively). These costs are considered to be incremental costs that may be capitalized if they are directly related to the capital project. Period costs (sunk costs which would have otherwise been expensed during the fiscal period) are not capitalized and are recorded as operating costs.

Effective April 1, 2022, Asset Retirement Obligations (AROs) will be capitalized as part of the acquisition costs of a tangible capital asset. These asset retirement obligations must be a legal obligation resulting from agreements, contracts, legislation or promissory estoppel. The liability on government financial statements occurs from past transactions or events such as acquisition, construction, development or normal use of a tangible capital asset. The estimated cost to retire a tangible capital asset would be added to the cost of the asset and amortized over the estimated useful life of the asset. Retirement costs include decommissioning, remediation, monitoring and other post-retirement activities. Other activities associated with AROs include:

- Obligations associated with fully amortized tangible capital assets.

- Obligations associated with unrecognized tangible capital assets (including Crown lands.)

- Obligations associated with tangible capital assets no longer in productive use.

See the Asset Retirement Obligation Practice Standard

Salary costs which are capitalized must be supported by a documented business rationale. For clarity, the business rationale would include supporting the incremental nature of the employee positions being capitalized (including backfill arrangements, assigned duties, arrangements for the capitalized employee to revert back to the original employee position upon completion), and by a financial audit trail such as time sheets or a similar tracking method. Travel would be capitalized only for project specific travel where the related employee salaries are capitalized.

For highway construction/rehabilitation projects (asset threshold $100,000+), salaries, travel and interest during construction may be capitalized.

Calculation Principles:

- Employees should be directly involved in acquisition, construction, development or betterment of the tangible capital asset, including installing the asset at the location and in the condition necessary for its intended use.

- For employees who work 100% of their time on such projects, 100% of their salaries and benefits will be charged to the capital project. This could be demonstrated by:

- A net new position to Government is created specifically for, and applied 100% to a specific IM/IT capital project. The new position would be expected to cease at the end of the specific IM/IT project development.

- If the FTE is allocated from an existing position, the original position would be back-filled where appropriate.

- For employees who work a portion of their time on such projects, the calculation for salaries and benefits would be # of project hours x rate per hour x 1.4 (includes impact of statutory holidays and vacation time to reflect the all-in-cost of salaries to be capitalized); see Appendix B, Sample 11 (DOC) (government access only). Time sheets or a similar tracking method must support these salary costs. The amount charged to a capital project for salaries and benefits cannot exceed 100% of the salary and benefit for an employee.

The costs of risk and controls reviews are not capitalized; however, there is one exception. If the risk and controls review forms an integral part of a contract external to government for the development of major systems software and this review relates to the implementation phase, it may be included in the capitalization of the system.

Costs of a general nature such as expenditures for feasibility studies, post implementation reviews, training, training materials, etc. are never capitalized. See sample System Development Process: Operating Expense or Capital Cost (DOC). If in doubt whether a cost should be capitalized, please contact the ministry chief financial officer.

Under the Whole Asset approach, an asset that is an assembly of connected parts would be capitalized and amortized as one asset.

In the purchase of a combination of assets, the cost of each is determined by allocating the total price on the basis of its relative fair value at the time of acquisition to each one.

Under the Component approach, assets consist of a number of self-sustaining components and each component should be accounted for as a separate asset, where the cost/benefit supports detailed breakdown reporting of information. The component assets could have different useful lives or provide economic benefits or service potential to the entity in a different pattern, which can result in different amortization periods.

Considerations that would assist in determining whether to use the Whole Asset approach or the Component approach are:

- the similarity of the life expectancy of all assets acquired;

- the assets can function as stand-alone versus the assets are required to be integrated together;

- the significance and functionality of the individual assets;

the level of information required for the asset management and reporting of the assets; and - the stewardship (ownership) of the individual assets remains with the entity that has the capital budget.

Where the purchase of land is one part of a packaged deal or a series of transactions, the substance of all elements of the agreements must be analyzed to determine whether or not they impact the capitalized value of the land. Such packaged deals/serial transactions should clearly identify which costs relate to land acquisition and which costs relate to other government objectives such as regional development or industrial incentive. Please contact Financial Reporting and Advisory Services, OCG for guidance.

When an acquired tangible capital asset includes a portion that will not be used, the asset cost shall include all components and disposal costs. For example, the cost of acquired land that includes a building that is to be demolished includes the cost of the land and building, and the cost of demolishing the building.

Where a replacement that substantially improves the existing asset's capacity for generating output or the quality of the output, lowers its operating costs or extends its original useful life, it is considered a new acquisition.

If the historical cost and accumulated amortization of fully amortized assets are not available, the assets are to be recorded at their residual value, when it is material and can be estimated, or at nominal value.

The acquisition date is the earliest of:

- the date the asset is received by the ministry; or

- the date legal ownership of the asset passes from the seller to the purchaser.

Items not meeting the capitalization threshold shall be expensed in the appropriate STOB.

See Capitalization Decision Tree (PDF).

Public Private Partnership (P3) Planning Costs

Where P3 planning costs (PDF) are related to the acquisition or development of a capital asset that will be owned by the province or one that will be a capital lease asset of the province, costs similar to those capitalized under traditional procurement (see above), should be capitalized. Only P3 planning costs incurred after the commencement of the preparation of a request for proposal directly related to the acquisition or development of the asset should be capitalized. Where the P3 planning costs relate to the acquisition of both a capital asset of the province and future operating costs only the portion that relates to the acquisition of the asset are capitalized. The ratio between capital and operating costs in the concession agreement may be used to determine the allocation.

Recording Assets Purchased in a Prior Year

Assets that should have been booked but were overlooked in a prior year should be recorded as a current year acquisition. It is not anticipated that any adjustment to equity will be permitted. Ministries are not permitted to use the equity STOB unless prior approval is obtained from Financial Reporting and Advisory Services, OCG.

I.3 Betterments

A betterment is a material cost incurred to enhance or better an existing asset’s service potential (i.e. service capacity, efficiency, useful life or quality of output) of a tangible capital asset. A betterment will:

- increase the previously assessed physical output or service capacity; and/or;

- significantly lower associated operating costs (efficiency); and/or;

- extend the life of the property; and/or

- improve the quality of the output.

An example of a betterment would be a newly refurbished asset that was restored to the condition that substantially improves its capacity for generating output and/or the quality of the output, and/or lowers its operating costs and/or extends its original useful life. Examples of betterments include:

- Major Replacements and Upgrades - Significant enhancements or upgrades to the major building components of an existing building which are considered betterments.

- Building Renewals - Major modifications to the existing building which is expected to revitalize or extend useful life.

A betterment does not include replacing a building component which does not significantly enhance the useful life of the building. For example, a new roof is not classified a betterment; it is only allowing the building to obtain or sustain its original life.

Maintenance and expenditures for repairs that do not prolong an asset's economic life (i.e., only maintain service potential) or improve its efficiency are not betterments. These costs are charged to the accounting period in which they are incurred. They would include such things as:

- Repairs to restore an asset to its original condition such as fire damage or water damage repairs;

- Replacement of an asset with a similar component such as:

- Replacing one boiler with two smaller boilers which produce the same amount of BTUs and do not significantly lower the associated operating costs; or

- Replacing the existing exterior cladding with similar technology.

- Expenditures necessary to realize the benefits originally projected such as:

- Replacing a similar boiler that does not meet one of the betterment conditions, or

- Replacing a roof with a new roof.

Maintenance is never capitalized regardless of costs.

Betterments, which extend the useful life or improve the efficiency of the asset and meet the capitalization threshold of the asset class to which it relates, must be added to the historical cost and amortized.

Betterments may be recorded as a substitution:

Substitution Method

This method assumes disposal of the portion of the old unit being replaced or bettered and acquisition of the new portion.

- the cost of the replacement portion is removed from the asset's historical cost; the accumulated depreciation on the old portion is removed and the loss on disposal is recognized

- the betterment is paid for

- the replacement portion is treated as an acquisition.

The Substitution Method can be applied only when the cost of the old unit and related accumulated depreciation are known or can be reasonably estimated.

See Appendix B, Sample 7 (DOC) (government access only).

The amortization rate applied to the betterment should reflect the increase in the useful life of the asset. However, the amortization period of the betterment cannot exceed that of the asset class to which it relates.

See Betterment vs. Maintenance Decision Tree (PDF).

I.4 Work-In-Progress

Work-In-Progress (or "Construction in Progress") represents the costs incurred to date on a project, which is not substantially complete (<97% complete) or for systems, the earlier of 97% complete or when the system is not in production at the end of the fiscal year. Examples include highways or custom developed computer/software systems that are not ready for use. See sample System Development Process: Operating Expense or Capital Cost (DOC).

Work-In-Progress for assets under development or construction (as described above) must be recorded on the Balance Sheet for the accounting period. All costs including carrying charges and property taxes associated with holding assets (for land, please contact Financial Reporting and Advisory Services, OCG for guidance) that are currently in the construction phase are to be capitalized.

If an incomplete project is terminated or put on hold indefinitely, any costs currently recorded as Work-In-Progress must be written off.

Where a project uses a phased-in approach, it has distinct, multiple, completely self-contained phases that will be brought into production or use at different points of time. When determining the allocation of project costs in a phased-in project (e.g., customized software), the following should be considered:

- Project costs transferred to a related asset when it is ready for use (i.e. completed but not yet brought into use). These would be initial costs that must be incurred in the initial phase before any other phase can be completed.

- Project costs transferred to a related asset when it is brought into use (e.g. brought into production, rolled-out with staggered implementation dates). These would be costs incurred in each phase that has been completed but do not include initial costs associated with the initial phase.

Project costs that are incurred subsequent to the transfer from Work-In-Progress to Asset may be added to the acquisition cost of the asset.

The ministry should use professional judgement and consult with the Office of the Comptroller General to determine the appropriate timing for transfers from Work-In-Progress to Assets. Amortization does not begin until the asset is ready for use or brought into use.

Work-In-Progress is not amortized. Work-In-Progress balances must be reconciled and the appropriate transfers made to completed assets or written off to insure that only active, but incomplete Work-In-Progress is carried forward to the next period. This reconciliation should be done monthly but at a minimum must be done quarterly.

I.5 Amortization

Unless otherwise stated, the acquisition cost (historical cost) less the residual value of capital assets must be amortized over estimated useful life, on a straight-line basis. Ministries wishing to use amortization methods other than straight line are required to obtain prior approval from the Office of the Comptroller General.

The amortization period for a tangible capital asset shall be limited to 40 years unless it can be clearly demonstrated with supporting documentation that the useful life of the asset is expected to exceed 40 years. Ministries wishing to use an amortization exceeding 40 years are required to obtain prior approval from the Office of the Comptroller General.

Land normally has an unlimited life and is not amortized.

Useful Life and Thresholds

See Appendix A for detail on the reported asset classes.

Recording Amortization

Mid-Month Rule

For all tangible capital assets (including large EDP mainframe and LAN systems, heavy equipment, buildings, highways, bridges, etc.) that are acquired or constructed with a completion date of the first of the month or prior to the sixteenth, amortization will be taken for the current month. If assets are acquired or construction completed on or after the sixteenth of the month, amortization will not start until the following month.

Effective April 1, 2003, minor tangible capital assets (such as personal computers, office furniture and equipment, operating equipment) will follow the mid-month rule.

Amortization Review and Revision

The estimate of the remaining unamortized portion of a tangible capital asset should be reviewed on a regular basis and revised when a change is clearly appropriate.

Significant events, which may indicate a need to revise the amortization estimate of the remaining useful life of a tangible capital asset, include:

- a material change to the extent to which the tangible capital asset is used;

- a material change in the manner in which the tangible capital asset is used;

- removal of the tangible capital asset from service for an extended period of time;

- physical damage;

- significant technological developments;

- a material change in the demand for the services provided through use of the tangible capital asset; or

- a material change in the law or environment affecting the period of time over which the tangible capital asset can be used.

I.6 Disposals

In the case of legacy pooled assets acquired prior to April 1, 2003, (such as personal computers, office furniture and equipment and operating equipment), when a pool of assets acquired in a given fiscal year has been fully amortized that pool must be written out of the books. This is referred to as "deemed disposition" and applies only to legacy pooled assets. See Appendix B, Sample 4 (DOC) (government access only). The deemed disposition takes place the year following the final year in which amortization is posted for the asset pool, regardless of whether or not the individual assets within the asset pool are still in use.

No tangible capital asset may be disposed of without the authorization of an officer delegated with the appropriate authority by the Asset Investment Recovery Branch, Shared Services BC, Ministry of Citizens' Services.

On disposal of a tangible capital asset, the historical cost and accumulated amortization must be removed from the books. The difference between the net proceeds on disposal and the net book value must be recorded in the Statement of Operations as a gain or a loss for the accounting period.

Tangible capital assets that are identified as surplus properties for resale purposes must be reclassified as properties for resale, and recorded or accounted for in the ministry accounting records as STOB 1531. Note that tangible capital assets that have been reclassified as properties for resale that are still in use are required to continue to amortize and expense monthly until disposition.

Gains and losses on the disposal of capital assets are included as part of the operating vote and form part of ministry spending targets and are recorded in the appropriate gain or loss expenditure STOBs. Proceeds from the sale of the asset should be debited to cash and credited to the expenditure STOB 7499 "gain or loss proceeds of disposal of capital asset".

If the disposal and sale transaction occur in the same fiscal year, the difference between the net book value and the proceeds will be recognized as a gain/loss on disposal of capital assets. If the two events occur in different fiscal years, the ministry will experience a loss on disposal in one year and a gain on disposal in a subsequent year.

Disposal Costs

Loss anticipated on disposal:

If there is an estimated loss on disposal of a government asset, the loss would be recognized as an expense, at the date on which management adopts a formal plan of disposal. Disposition costs are all expensed.

Gain anticipated on disposal:

If there is an estimated gain on disposal of a government asset, the disposition costs may be treated in several ways.

For the disposition of a government asset which will occur within a fiscal period, whether or not a formal plan of disposition has been adopted, disposition costs are all expensed.

For the disposition of a government business segment or asset that will occur over several fiscal periods and before the date of adoption of a formal plan of disposition, disposition costs are all expensed until a formal plan of disposition is adopted.

Deferral of disposal costs when a gain is anticipated on the sale of Inventory - properties for resale:

Deferral of disposal costs on the sale of Inventory – properties for resale are permitted if all of the following conditions are met:

- The ministry has authority under its voted appropriation to perform the transaction using the “Financing Transactions, Loans, Investments and other requirements – Schedule D”, and

- The tangible capital asset must be reclassified as Inventory - properties for resale (STOB 1531), and

- A formal plan of disposition has been adopted, and

- The disposal takes place over a long period of time (minimum one year): e.g., it is anticipated that it will take at least a year from the formal adoption of a plan of disposition to the actual disposal of the asset or business segment; and

- The disposal costs are material; and

- The disposal is expected to generate a net gain in revenue after taking into consideration the costs of disposal.

Costs incurred after the adoption of a formal plan of disposition and prior to receipt of the proceeds of disposition would be eligible for deferral. Any deferred costs would be deducted from gross proceeds in calculating the net gain on disposal. Once a decision has been made to defer project costs, the decision applies to all costs associated with the project. It is not permissible to defer the costs in one fiscal year and expense them in another fiscal year unless there has been an abandonment of the disposal plan or there has been a revision of the expected gain on disposal such that the anticipated gain is insufficient to cover the full costs of disposal.

Any gain arising from net proceeds on disposition should be recognized only when realized.

Disposal costs directly related to the disposition of an asset classified as properties for resale, which can be deferred, may include but not limited to the following:

- Broker / Sales Commissions;

- Appraisals;

- Survey (including subdivision fees);

- Legal;

- Consulting fees including Environmental;

- Cost to prepare property for sale after the date a formal plan has been adapted;

- Incremental salaries and travel directly related to the disposition of an asset classified as properties for resale may be deferred until the sale proceeds are received where they meet the province's materiality thresholds. The historical cost or market value of the asset is in excess of $5 million and the salary costs associated with the disposal are equal to or greater than $250,000. These salary costs must be supported by an audit trail (e.g., time sheets or a similar tracking method) for those employees not dedicated 100% to the project.

Calculation Principles:

The calculation for salaries and benefits for staff that allocate a portion of their time to a project would be # of project hours x rate per hour x 1.4 (includes impact of statutory holidays and vacation time to reflect the all-in-cost of salaries to be capitalized). The total amount of salary and benefits deferred cannot exceed 100% of the salary and benefit for an employee.

Trade-ins occur when an asset is disposed of and replaced with a new asset through the same supplier in the same transaction (see CPPM 6, Procurement). This transaction should be accounted for as two separate entries. The trade-in value should be treated as proceeds of disposal and is used in calculating the gain or loss on the disposal of the assets being traded in. The new asset acquired is recorded at its full cost – it is not reduced by the trade-in value of the old asset.

Insurance Proceeds – Asset Loss

Proceeds from insurance claims are to be recorded as proceeds of disposal and form part of the gain/loss on disposal of the original asset. The proceeds cannot be used to purchase a new asset.

I.7 Asset Write-downs & Write-offs

A write-down is used to reflect a partial impairment in the value of an asset. A write-off is used to reflect 100 percent impairment in the value of an asset.

Capital assets are written-off in instances where they are destroyed, stolen, lost or obsolete. The write-off of a tangible capital asset requires approval by a properly authorized officer and the delegated authority of the Asset Investment Recovery Branch. Ministries must seek Treasury Board approval for any additional expenses incurred in writing off tangible capital assets.

Any abandoned or indefinitely postponed projects must be written-down to their net realizable value and charged to the period in which the abandonment or indefinite postponement occurs.

When the reduction in the value of the asset can be objectively estimated and it is expected to be permanent, the tangible capital asset must be written down.

An asset write-down cannot be reversed.

An asset is never written up except on initial capitalization or as the result of a betterment.

Conditions, which may indicate a write-down is necessary, include:

- a change in the manner or extent to which the tangible capital asset is used;

- removal of the tangible capital asset from service;

- physical damage;

- significant technological developments;

- a decline in, or cessation of, the need for the service provided by the asset;

- a decision to halt construction of the asset before it is complete or in usable or saleable condition; or

- a change in the law or environment affecting the extent to which the asset can be used.

I.8 Sales and Transfers of Tangible Capital Assets

Transfers of tangible capital assets from one Consolidated Revenue Fund (CRF) ministry, special account or special fund to another must occur at the net book value to ensure that gains/losses are not recorded.

Land transfers related to aboriginal land claims are recorded at net book value. Please contact Financial Reporting and Advisory Services, OCG for guidance.

Sales or transfers between CRF entities and Crown Corporations or external bodies where there is an exchange transaction (the Province is the direct beneficiary of the sale or transfer of tangible capital asset) should be recorded at the exchange price (fair market value). The impact of sales/transfers within the summary entity is eliminated in the consolidation process by the Office of the Comptroller General.

Exchanges of similar assets between CRF and external entities: If the fair market value of the assets exchanged is materially the same, only a memo notation is required. If the consideration given up is greater than the value acquired, the difference is recorded as an expense. If the value received is greater than the value given up, the difference is recorded as revenue, gain on disposition of assets.

Sales/Transfers Between Crowns and the CRF

In order to record these transfers at fair market there must be:

- an independent appraisal of the value of the assets to be transferred;

- a genuine business reason for the transfer; and

- an intended, productive use for the asset (i.e., not just holding for resale).

If any of these conditions are not met, the transfer will be recorded at net book value.

If the asset is transferred at fair market value, the historical cost and accumulated amortization (and other asset details) is to be removed from the tangible capital asset records of the entity along with the recording of a loss or gain on disposal.

When the net book value of the asset is higher than the fair market value of the asset, the asset should be written down. If the fair market value exceeds the book value of the asset, a gain on disposal results.

If the gain on disposal of land or an asset is immaterial (up to $3 million), the amount is recorded as a gain or loss on disposal (provided that the land or asset has been capitalized) or revenue at the CRF level (if the land or asset was not capitalized or is material). The impact of any inter-company gains must be noted and will be eliminated at the Summary level.

If the gain is material (greater than $3 million), the amount is to be recorded as deferred revenue until the asset is disposed of to an independent third party external to the government or to a commercial Crown corporation. Upon disposal by the Crown corporation, the Crown corporation shall notify the ministry from which it acquired the asset so that the ministry may clear out the balance in deferred revenue into current year revenue.

Because commercial Crown corporations are reported on a modified equity basis and have commercial goals as their primary focus, fair market value gains are to be recorded in full as incurred; however, the impact of any inter-company gains must be noted and be eliminated at the Summary level.

In rare circumstances when a Crown corporation receives assets from CRF or another Crown as a result of restructuring from the CRF (or restructuring occurs causing a Crown Corporation to become a part of the CRF), the assets are transferred at net book value. In this case, the historical cost and accumulated amortization would be the same on the Crown corporation's books as it was on the donating Crown Corporation/CRF organization's books.

Ministries should discuss the details of asset transfers to/from the CRF from/to Crown corporations with the Financial Reporting and Advisory Services Branch, Office of the Comptroller General.

Sales/Transfers to External Third Parties

Where assets are transferred from a CRF organization to an external party, the assets are removed from the tangible capital asset records of that organization. In addition, the gain or loss on disposal is recorded immediately. Gains and losses on disposal are recorded as expenditures. Proceeds of disposal are to be credited to the expenditure STOB 7499 for recoveries to gain or loss on disposal.

These transfers are to be made at fair market value. The difference between the fair market value and the book value of a transferred asset will be recorded as an expense of the transferring ministry.

Transfers resulting from aboriginal land claims are excluded from this accounting policy. Please contact Financial Reporting & Advisory Services, OCG for guidance.

Exchange of Similar Assets with External Parties

Where similar assets with similar fair market values are exchanged, the details of the old asset must be removed from the tangible asset records and the details of the new asset added. There would be no change in net book value of reported assets (i.e., there is no write-up to fair market value for the old asset or the new asset).

If the fair market value of the asset given up exceeds the fair market value of the similar asset acquired, the difference is recorded as an expense. There would be no change in net book value of reported assets unless the fair market value of the asset received is less than the book value of the asset given up.

If the fair market value of the asset given up is less than the fair market value of the similar asset acquired, the difference is treated as revenue. The net book value of the reported assets would also have to be written up by that same difference.

If the assets are not similar, the transaction is recorded separately as a sale and purchase.

I.9 Capital Leases

A capital lease is accounted for as though the asset had actually been purchased. From the view-point of the lessee, a lease would normally transfer substantially all the benefits and risks of ownership from the lessor to the lessee when, at the inception of the lease, one or more of the following conditions are present:

- There is reasonable assurance that the lessee will obtain ownership of the leased property by the end of the lease term or when the lease provides for bargain purchase option. A bargain purchase option is a provision allowing the lessee an option to purchase the leased property for a price that is sufficiently lower than the expected fair value of the property at the date the option becomes exercisable that, at the inception of the lease, exercise of the option appears to be reasonably assured.

- The lease term is of such duration that the lessee will receive substantially all the economic benefits expected to be derived from the use of the leased property over its life span. This condition is considered to be met if the lease is for a term equal to or greater than 75% of the economic life of the leased property.

- The lessor would be assured of recovering the investment in the leased property and of earning a return on the investment as a result of the lease agreement. This condition would exist if the present value at the beginning of the lease term, of the minimum lease payments, excluding any portion relating to executory costs, is equal to 90% or more of the fair value of the leased property. In calculating the present value of the stream of lease payments, at the inception of the lease, the discount rate used by the lessee would be the lower of the lessee's rate for incremental borrowing for a term equal to the initial lease term and the interest rate implicit in the lease, if known.

Even if the lease does not meet any of the three tests, if it transfers substantially all of the benefits and risks of ownership to the lessee, the transaction should be accounted for as an acquisition of an asset and an incurrence of an obligation by the lessee. Accounting advice from ministry financial staff or the Office of the Comptroller General should be sought.

At the inception of a capital lease, an asset and a liability must be recorded at the lesser of:

- the present value of the minimum lease payments, and

- the property's fair value at the beginning of the lease.

The capitalized value of an asset under a capital lease must be amortized consistent with the following:

- if the lease has a bargain buy out option or allows ownership to pass to the lessee (ministry), the asset must be amortized on a straight-line basis over the useful life of the associated asset class.

- in all other circumstances the asset should be amortized on a straight-line basis over the lesser of the lease term and the useful life of the associated asset class.

Assets leased under a capital lease must be disclosed separately to distinguish between assets that the government owns and those that it only has the right to use.

All other leases are to be accounted for as operating leases, where rental payments are expensed as incurred.

To record the capital lease expenditure and its related liability, the present value of the minimum lease payments must be calculated at the beginning of the lease term. The discount rate to use for the present value calculation would be the lower of the government's borrowing rate and the interest rate implicit in the lease (if known).

For purposes of calculating the 90% criterion, the province's rate is the medium to long-term borrowing rate provided to chief financial officers each quarter. Interest rates are also available on the CPPM website.

For subsequent lease payments (principal and interest), the principal portion is to be charged against the liability STOB. The interest portion of these payments will be expensed to the interest STOB against the ministry's operating budget.

The interest is calculated on the outstanding balance of the lease liability for the period since the last payment at the same interest rate as used in the original present value calculation. See Appendix B, Sample 17 (DOC) (government access only) for an example of a capital lease and the applicable journal entries.

The capitalized value of an amortizable asset under a capital lease is amortized on a basis that is consistent with the amortization policy for similar capital assets.

I.10 Contributions and Donations

Contributions received from outside a ministry budget for the acquisition of an asset fall into two categories:

- External – coming from an entity outside the CRF

- Internal – coming from another ministry or entity reported within the CRF

See CPPM 4.3.15, Payments Based on Contributions, and section 25 of the Financial Administration Act. Assets that are donated or contributed to the province, which meet the requirements for capitalization and the asset class thresholds are treated in the same manner as cash contributions and donations.

Internal Contributions

Internal capital contributions towards the acquisition of an asset are not permitted. Shared use assets and the related amortization must be recorded by the ministry deemed to own the asset and the related funding must be available within that ministry's capital and operating budget allocation. Ministries or CRF entities sharing in the use of such assets should enter into a 'fee for service' type of agreement that extends over the life of the related asset. It is the responsibility of the ministries or CRF entities to negotiate the appropriate level of operating funding for this type of arrangement.

Amounts received by the ministry owning the asset should be recorded as an internal operating recovery. Amounts paid by the contributing ministry should be recorded as an operating expense.

External Contributions Under $50,000

External contributions less than $50,000 are to be netted against the acquisition cost of the asset. The net amount of the asset is the amount set up as the historical cost for the asset and the ministry will be responsible for accommodating the related amortization expense.

As long as the gross acquisition cost of the asset exceeds the required threshold for the asset, the difference between the purchase price and the contribution towards the asset will be set up and amortized. See Appendix B, Sample 13 (DOC) (government access only). However, contributions for land should be recognized as revenue in the year it is received (not deferred revenue as there is no amortization related to land).

External Contributions Equal to or Greater Than $50,000

If the asset or contribution singularly or in combination equal to or greater than $50,000, then the asset is to be capitalized at gross acquisition cost and be recognized in accordance with CPPM 21, Government Transfers.

Appendix A: Useful Life and Thresholds

Tangible Capital Assets include:

| Year of Capitalization | Tangible Capital Asset | Useful Life | Threshold |

|---|---|---|---|

| 1* | Land | Indefinite | None |

| 95/96 | Buildings | 40 years | ≥$50,000 |

| 95/96 | Computer hardware, servers and related software (existing, developed and/or purchased systems) | 5 years | ≥$10,000 |

| 95/96 | Major computer systems – software | To be determined by independent external evidence or assessment | ≥$10 million |

| 95/96 | Vehicles | 7 years | None |

| 97/98 | Personal computer hardware, software and related peripherals | 3 years | ≥$1,000 effective April 1, 2003 |

| 97/98 | Ferries and ferry landings | 25 years | None |

| 98/99 | Highways (in TFA) | 40/15 years | $100,000 |

| 99/00 | Heavy equipment | 10 years | ≥$10,000 * If the item meets the definition, but not the threshold, set up as operating equipment to reflect the prescribed useful life of the item. |

| 99/00 | Operating equipment | 5 years | ≥$1,000 |

| 99/00 | Short Term Tenant Improvements | Lesser of 5 years or lease term | ≥$50,000 |

|

18/19 |

Long Term Tenant Improvements | Lesser of 10 years or lease term | ≥$500,000 |

| 00/01 | Office furniture and equipment Photocopiers |

5 years 6 years |

≥$1,000 ≥$1,000 |

| 01/02 | Land improvements: Recreation Areas Dams and Water Management Systems |

30 years 40 years |

≥$50,000 ≥$100,000 |

| Betterments and replacements | Same as associated asset class | Same as associated asset class | |

| Work-In-Progress (WIP), constructed or developed and not yet in use and/or substantially complete (97%) | No amortization taken until WIP transferred to asset | Same as associated asset class |

* 1 – Land was initially being treated as a discrete asset class and was brought into the Public Accounts for 95/96 on a partial basis. It was then reversed for the 96/97 Public Accounts, as it did not represent an accurate estimate of the complete land class. Land is now capitalized when the related asset category is capitalized. Please contact Financial Reporting and Advisory Services, OCG for guidance.

Buildings – (threshold equal to or greater than $50,000) - from tool sheds to office buildings and consideration to their building types (concrete, wood frame, temporary), as well as more complex structures, such as fish hatcheries, greenhouses, highway and campsite rest rooms, toll-booths, forest lookout towers, major replacements and upgrades, building renewals, and energy projects where primary purpose and justification is for energy savings or carbon reduction), whether purchased or constructed. See details on what a building includes (PDF).

Excluded from the building are Mandatory Operating Equipment, Tenant Improvements and chattels.

The useful life of a building may be up to but must not exceed 40 years, unless it can be clearly demonstrated with supporting documentation and obtain prior approval from the Office of the Comptroller General that the useful life of the asset is expected to exceed 40 years.

Freshwater Ferries and Landings – including dry docks, tugs and barges.

Heavy Equipment – (threshold equal to or greater than $10,000*) – forklifts, tractors, trailers, trucks (that are not classified as vehicles) or chassis that have specialized enhancements to meet operational usage for health or corrections purposes, fire protection, telecommunications equipment (repeater sites) and other heavy equipment, such as:

- buses (registered and licensed for more than 10 passengers)

- trailers (ATCO-type and equipment trailers)

- heavy-duty trucks/equipment (one-ton and larger trucks with dual rear wheels [dump trucks, tractors, graders, etc.])

- fish hatchery equipment (tanks, pumps, water lines, etc.)

- cable cars, rail portage

- specialized enhancement of all one ton standard and extended passenger and cargo vans for use in corrections

- specialized enhancement of chassis for use in corrections

- ambulances

* If an item meets the definition of Heavy Equipment, but not the threshold, it must be capitalized in the operating equipment class to reflect the prescribed useful life of the item.

Operating Equipment (threshold equal to or greater than $1,000 per item/unit) – not otherwise classified, including tools, workshop equipment (table saws, drill presses), printing presses, maintenance equipment, fire suppression equipment, lab equipment, survey equipment, motorcycles (on or off-road), snowmobiles, etc.

Highways – Infrastructure – formation works, road structure, drainage works, bridges, culverts, tunnels, livestock/pedestrian underpasses, overpasses, river protections works, right-of-ways.

Surfacing – including paving and traffic facilities, fencing, lighting, etc.

Land – purchased or acquired for value, for parks and recreation, building sites, infrastructure (dams, bridges, tunnels, etc.) and other program use but not land held for resale. Please contact Financial Reporting and Advisory Services, OCG for guidance.

Land Improvements – the government regularly develops vacant land for recreational, environmental preservation and economic pursuits, and capitalizes the cost in the land improvement category. This category includes dams and water management systems; recreation sites and roads providing access to these sites. The first criterion to consider is whether or not the cost meets the criteria for capitalization and then apply the appropriate threshold. If these costs are for an existing land improvement the criteria relating to betterment must be applied (see I.3).

Expenditures on land improvements where land is being returned to its natural state are not capitalized. Some examples are reforestation projects, contaminated land clean-up projects and mining reclamation projects.

Dams and Water Management Systems (threshold equal to or greater than $100,000) – an artificial barrier constructed for the purpose of storing and managing water. A water management system includes reservoirs, stream diversion systems (fish ladders, etc.) and water pumping facilities not directly attached to a building.

Recreation areas (threshold equal to or greater than $50,000) – includes campgrounds, campsites, recreation furniture and equipment, access roads, circulating roads within a campground, trails, trailheads, parking lots and buildings, which individually may cost less than $50,000 but when combined within an area do meet the threshold.

Computer Hardware, Servers and Related Software (Non PC) (threshold equal to or greater than $10,000) – computer hardware including mainframe, servers and software both purchased packages and internally developed or customized packages.

Major Computer Systems Software (threshold equal to or greater than $10 million) – independent external evidence or assessment of useful life is required to establish the useful life beyond five years.

Office Furniture and Equipment (threshold equal to or greater than $1,000 per item/unit – Photocopiers (threshold equal to or greater than $1,000 per item/unit).

Personal Computer Hardware and Software (threshold equal to or greater than $1,000 per item/unit – personal computers and related peripherals (computer monitors, keyboards, printers, etc.), software packages, laptops, palmtops, combination equipment (printer/fax/photocopier in one unit).

Short Term Tenant Improvements (threshold equal to or greater than $50,000) – are construction requests by occupants (as tenant or owner) who are in market or market comparable buildings to accommodate their particular work function over and above that which is provided by the Building definition. New office space may be acquired as “Base Building Shell” which may mean no drop ceilings, no interior lighting, no interior mechanical /electrical, no interior walls, no interior finish and concrete floors. Previously occupied space may not be configured appropriately for the program, or the improvements may not be usable, so minor modifications or enhancements to the existing space are done to meet the new program needs. See details on what tenant improvements include (PDF).

Long Term Tenant Improvements (threshold equal to or greater than $500,000) - requests for major modifications or enhancements to the existing space of market or market comparable buildings (leased or owned) to meet government’s needs beyond basic space requirements. These improvements are generally more generic in nature and are not tied explicitly to a client or ministry program. They can be used by other occupants or any program area. These modifications help to increase the service capacity by creating flexibility of space to allow for additional personnel and allow for movement of programs between buildings or floors without extensive modifications. These improvements will have a higher portion of long-lived components, which will yield a useful life greater than 5 years and a lease term greater than 5 years. The generically designed office improvements will increase space utilization within the existing real estate portfolio. See details on what long term tenant improvements include (PDF).

Vehicles – including all subcompact, compact, mid-size and full-size sedans and wagons; all compact two-wheel drive (electric) including: 1/2 ton; 3/4 ton; 1/2 ton and 3/4 ton 6.5 box; extended cab or crew cab, two-wheel drive or four-wheel drive pickup trucks; all mini passenger, extended passenger and cargo vans, 1/2 ton, 3/4 ton, one ton, standard and extended passenger and cargo vans; all utility (sports utility vehicles, i.e., Jeeps, Broncos, etc.) compact, full-size two-wheel drive and four-wheel drive 1/2 ton and 3/4 ton, 6 and 8 passengers two-wheel drive and four-wheel drive Suburban.

For leased vehicles, the asset should be amortized on a straight-line basis over the lesser of the lease term and the useful life of the associated asset class (See I.9).

Financial Reporting < Previous | Next > Miscellaneous Administration

Referenced Chapters

Referenced Information

Resources

Contact information

Financial Management Branch

OCGMANUALS@gov.bc.ca