Monthly Reporting Requirements

Overview

All recipients of Income Assistance, Hardship Assistance, or Disability Assistance must report monthly when required to do so. The monthly report lets the ministry know you are still in need of assistance and if there are any changes to your circumstances. This section explains when you need to submit a monthly report and what to include.

Monthly reporting is based on the calendar month. If you’re required to report, you must include information for the entire month and submit it by the 5th of the next month. The monthly report can be provided online, by phone or on paper.

The ministry may also ask for additional information or proof to confirm your eligibility. For example, if you report income from a job, you should provide pay stubs. See related topic: Information and verification.

Knowing your reporting responsibilities helps avoid delays in getting your assistance and reduces the chance of being overpaid.

Policy

Monthly report form

Effective: July 1, 2025

The Monthly Report (HR0081) is available:

- Online through My Self Serve (myselfserve.gov.bc.ca)

- By printing a paper form from the Ministry website (https://www2.gov.bc.ca/gov/content/family-social-supports/income-assistance/on-assistance)

- By calling the ministry toll-free at 1-866-866-0800 to request a paper form

- In-person by attending a ministry office

- Attached to your monthly direct deposit notification document (if applicable)

- Attached to your monthly cheque (if applicable)

Reporting requirements for income assistance or hardship assistance recipients

Effective: September 1, 2024

If you receive income assistance or hardship assistance, you must report the following every month to stay eligible:

- Identify if you still need assistance

- Report all money received

- Report any changes in your circumstances, such as:

- Address

- Rent or utility costs

- Assets

- Income (new or ended, and where it came from)

- Employment

- School or training

- Family members living with you

- Marital status

- Outstanding warrants, and

- Time spent or planning on being spent outside of BC

Exceptions:

If you are in the persons with persistent multiple barriers (PPMB) category or live in a special care facility, you do not need to report every month – only when you have earned income or changes in your circumstances (see below).

Reporting requirements for income assistance recipients who are persons with persistent multiple barriers (PPMB) or living in a special care facility

Effective: September 1, 2024

If you receive income assistance and are in the persons with persistent multiple barriers (PPMB) category or live in a special care facility, you must report when:

- You earn income;

- You receive new income and/or money, or if the amount has changed; or

- There is a change in your circumstances, such as:

- Address

- Rent or utility costs

- Assets

- Income (new or ended, and where it came from)

- Employment

- School or training

- Family members living with you

- Marital status

- Outstanding warrants, and

- Time spent or planning on being spent outside of BC

You must report earned income every month, even if the amount stays the same. You only need to report other income if it’s new or the amount changes.

You don’t need to report WorkSafeBC, or Insurance Corporation of BC (ICBC) specified income replacement benefit every month unless it is the first time you receive them or the amount changes.

Reporting requirements for Disability Assistance recipients

Effective: September 1, 2024

If you receive Disability Assistance, you must report when one or more of the following occur:

- You earn income

- You receive a specified income replacement benefit from WorkSafeBC or Insurance Corporation of BC ICBC

- You receive new income and/or money, or if the amount has changed; or

- There is a change in your circumstances, such as:

- Address

- Rent or utility costs

- Assets

- Income (new or ended, and where it came from)

- Employment

- School or training

- Family members living with you

- Marital status

- Outstanding warrants, and

- Time spent or planning on being spent outside of BC

You must report earned income and WorkSafeBC and ICBC benefits every month, even if the amount stays the same. Other income only needs to be reported if it is new or the amount changes.

If you have used up your annual earnings exemption (AEE) limit for the year, any earned income will be deducted dollar-for-dollar from your assistance. See related topic: Income treatment and exemptions.

If your earnings are higher than your amount of Disability Assistance, you may be eligible for Medical Services Only.

If you are receiving Medical Services Only because your income was higher than your AEE, keep reporting each month. This helps the ministry check if you are eligible for Disability Assistance when:

- Your income drops below your Disability Assistance rate; or

- A new calendar year starts and your AEE limit resets

See related topic: Medical Services Only

If you have been approved for exemptions under the Self-Employment Program (SEP) and are running a small business, you must submit a monthly report and additional self-employment form(s) to report the business activities, earnings, expenses, assets and liabilities. Learn more about SEP by reviewing the Self-Employment Program (SEP) for PPMB & PWD topic.

Changes that must be reported

Effective: September 1, 2024

If your circumstances change, such as:

- Address

- Rent or utility costs

- Assets

- Income (new or ended, and where it came from)

- Employment

- School or training

- Family members living with you

- Marital status

- Outstanding warrants, and

- Time spent or planning on being spent outside of BC

You must report those changes on the monthly report by the 5th of the calendar month following the calendar month in which the change occurred.

If the monthly report does not have a specific spot for the change in circumstance, then report the change using the open-text box on the monthly report or by submitting a signed statement.

Example: Time spent or planning on being spent outside of BC

If you are going to be away from B.C. for more than 30 days in a row, it could affect your eligibility. You need to get approval from the ministry before leaving B.C. See related topic: Absent from BC.

There is no specific spot on the monthly report to report your absence from BC. You can report this using the open-text box on the monthly report or send a signed statement to the ministry by the 5th of the next month.

Monthly reporting, time frame and additional documentation

Effective: July 25, 2022

You must report all changes that occurred during the calendar month when required to do so. You must submit the Monthly Report (HR0081) by the 5th of the following month.

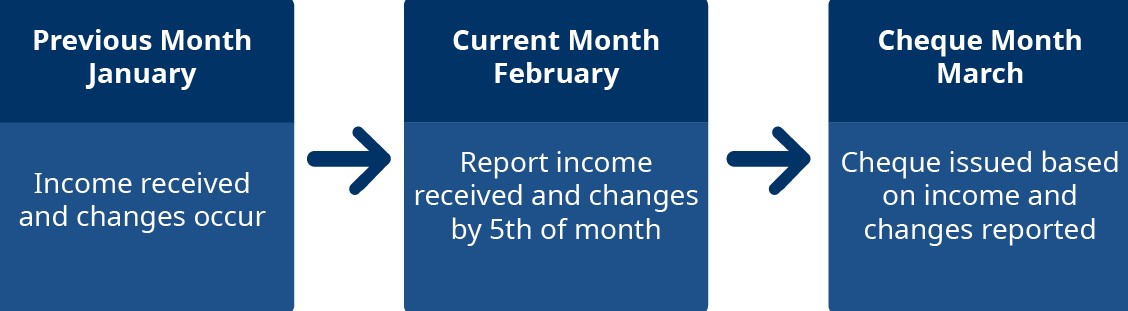

For example, changes between January 1st and January 31st must be reported and submitted by February 5th. The information provided from January determines the amount of assistance provided at the end of February for March benefits. This three-month time period of when a change occurs (such as January), when it is reported (such as February), and which benefit month it affects (such as March) is called the reporting cycle.

You can submit your monthly report:

- Online: through My Self-Serve MySS

- Telephone: toll-free at 1-866-866-0800 and accessing the self-serve telephone system

- By mail: to any of the Ministry or Service BC offices

- In person: by attending a Ministry or Service BC office during office hours or dropping off using the outside drop box

Identify all changes in circumstances that occurred during the calendar month on the Monthly Report (HR0081) and attach documents (like pay stubs or statements) to verify the changes.

If you report online (MySS):

- Upload the documents online or send them by mail, fax or deliver in person

- If you need to fix a mistake on your monthly report, you can restart the report in MySS (within the same benefit month) or submit a paper form

If you report by phone:

- Send documents by mail, fax or deliver in person

- If you need to fix a mistake on your monthly report, you will need to complete a paper form

The monthly report must:

- Be signed by you and your spouse if you have one

- Clearly show the date of the reporting cycle, and

- Identify all details of all the changes

How the ministry uses the monthly report

Effective: July 1, 2025

The ministry updates your case with the changes you report. The information is used to calculate your next assistance month payment amount.

The ministry may ask for additional information or documentation to confirm your eligibility or how the income you reported should be treated.

Monthly reports that are received after the 5th of the following month may not be processed in time, and may result in a delay receiving your next assistance month payment.

See related topic: Income treatment and exemptions

Procedures

How to submit your Monthly Report (HR0081)

Effective: July 1, 2025

You can submit your Monthly Report in one of these ways:

- Online: through My Self-Serve MySS

- Telephone: toll-free at 1-866-866-0800 and accessing the self-serve telephone system

- By mail: to any of the Ministry or Service BC offices

- In person: by attending a Ministry or Service BC office during office hours or dropping off using the outside drop box

If you have trouble filling out the monthly report, you can ask for help. You can ask a friend, family member or an advocate. Ministry staff can answer your questions, but they cannot fill out or change the monthly report for you.

Medical Services Only (MSO):

If you are a Person with Disabilities (PWD) and only receive MSO because you maximized your annual earnings exemption (AEE):

- Submit your Monthly Report (HR0081) every month.

- This helps the ministry check if you are eligible for Disability Assistance when:

- Your income drops below your Disability Assistance rate; or

- A new calendar year starts and your AEE limit resets

See related topic: Medical Services Only

What makes a Monthly Report (HR0081) complete?

Effective: July 1, 2025

Your monthly report is complete if it includes:

- Your signature and your spouse’s if you have one

- The date of your signature and your spouse’s if you have one

- The month when the changes you are reporting occurred

- All questions answered

- Explanations are provided for any changes

- Income listed in the right sections for you and your spouse if you have one

- Proof of income or changes (like pay stubs, rent receipts, etc.)

The ministry uses this report to determine if you are still eligible for ministry assistance and the amount you are eligible to receive.

If you report changes (like moving or new income) but do not provide proof or documentation with your monthly report, the ministry may not be able to update your case and your assistance may be reduced or delayed.

For example, if you report a new address but do not attach the new rental agreement or a Shelter Information form (HR3037) with the monthly report, the ministry may end your shelter allowance for the old address and not pay it for the new address until the address is verified.

If something is missing or incorrect

Effective: July 1, 2025

You are responsible for making sure your Monthly Report (HR0081) is correct and complete. You should include documents to prove any income or changes. For example:

- Pay stubs for income

- Birth certificate/hospital bracelet to add a child

- School letter to show you are a student

- Rental documents/Shelter Information form (HR3037) if you move

If something is missing or incorrect on the Monthly Report (HR0081), the ministry will try to contact you. For example:

- Missing answers or signatures

- Missing documents to prove income or changes

- Incorrectly answering the questions (not declaring an outstanding warrant)

How to fix a Monthly Report (HR0081)

Effective: July 1, 2025

Ministry staff can answer your questions about the report, but they cannot fill out or change the monthly report for you.

If you Submitted Online (My Self Serve):

- The ministry may send your monthly report back to you online if something needs to be fixed

- You can restart your monthly report once per month to make corrections

- You can also:

- Upload a signed paper copy of the corrected Monthly Report (HR0081)

- Take a photo or scan of the signed paper Monthly Report (HR0081) and upload it into My Self Serve

- Staff can send your monthly report back to you more than once during the reporting cycle, if needed

If you Used the Telephone self-serve system:

- You must fix mistakes using a paper Monthly Report (HR0081)

If you Mailed or Dropped Off a Paper Report:

- You can:

- Correct the original monthly report paper form and sign the changes

- Or fill out a new monthly report paper form with the correct information

- If needed, the ministry may call you or send you a message through your online account about the changes needed

What happens if there are problems with your monthly report?

Effective: July 1, 2025

- Ministry staff will try to contact you twice if your monthly report is missing information or has mistakes

- You are responsible for fixing the monthly report

- If the ministry cannot confirm your information, your cheque may be delayed or held at the local office until the information is received

What is a “hold” or “signal” on my cheque?

Effective: July 1, 2025

Sometimes, the ministry may delay your payment or send it to your local office instead of issuing through direct deposit or mail. This is called putting a “hold” or a “signal” on your payment.

This can happen if:

- You didn’t submit your monthly report

- You sent your monthly report late (after the 5th of the month) and it hasn’t been processed yet

- You didn’t include all the documents or proof needed to check your eligibility

- You were asked for more information and haven’t provided it yet

- You need to go to the Ministry or Service BC office to sign a form before your payment can be released

The ministry only puts a “hold” or “signal” on your payment as a last resort, when they don’t have enough information to verify eligibility.