Overdue rural property taxes

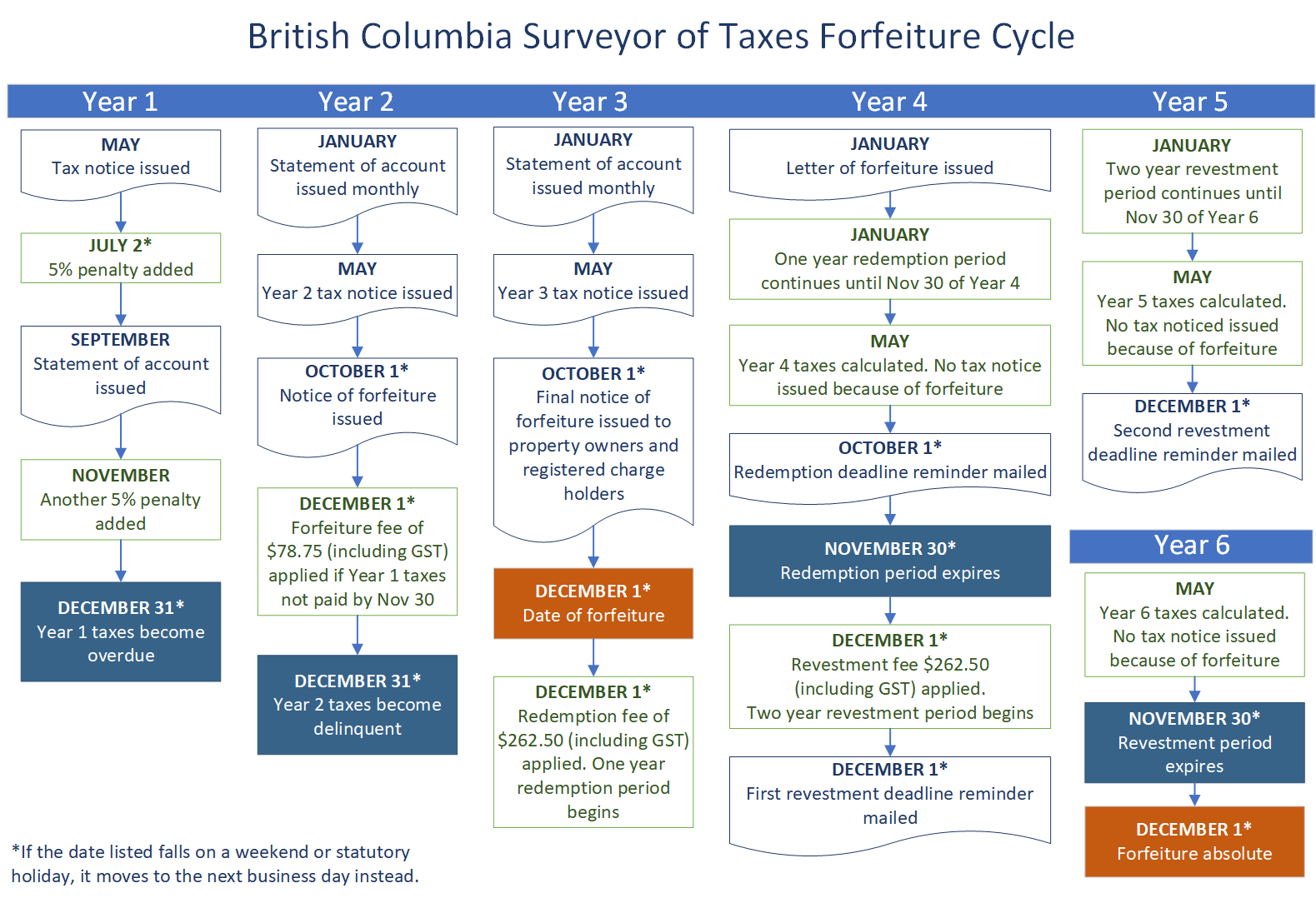

If you do not pay your property taxes by the due date, your property taxes will become overdue and a penalty may apply. You’ll receive a Statement of Account each month showing the overdue amounts you owe. You may not receive your first Statement of Account until September.

Unpaid property taxes become delinquent after December 31 of the current tax year and collection action will begin.

Collection action may include:

- Notifying the Canada Revenue Agency to set aside money owing to you

- Registering a lien against your property or personal belongings

- Requiring your employer to deduct money from your pay cheque

- Issuing a demand notice to your bank, credit union or trust company to pay from your account(s)

- Seizing your personal belongings

- Forfeiture of your property to the Province of British Columbia

Over the following two years, the province will take steps to collect any unpaid balances, including transferring ownership of your property to the Province of British Columbia.

2nd Year

| January 1 |

|

| May 31 |

|

| October 1 |

|

| December 1 |

|

3rd Year

| May 31 |

|

| October 1 |

|

| November 30 |

|

| December 1 |

|

Forfeiture

If any balance remains outstanding on December 1 of the 3rd year, your property will forfeit to the Province of British Columbia. When a property is forfeited, ownership of the property is transferred to the Province of British Columbia and a Certificate of Forfeiture is registered at the Land Title Office.

The following image shows the forfeiture cycle. Click the image to download the full size as a printable PDF (110 KB).

Redemption

The one-year redemption period begins from the date the property forfeited to the province. To restore ownership of the property, you need to pay:

- Your unpaid balance in full, plus the redemption fee of $262.50 (includes GST)

- If applicable, all maintenance, insurance or security costs the province has paid for since forfeiture

If your outstanding balance is not paid by the end of the redemption period, monthly interest will continue to be added and you will move into the revestment period.

Revestment

The two-year revestment period begins at the end of the redemption period. To restore ownership of the property, you need to pay:

- Your unpaid balance in full, plus the revestment fee of $525 (includes GST)

- If applicable, all maintenance, insurance or security costs the province has paid for since forfeiture

If your outstanding balance is not paid by the end of the revestment period, the forfeiture becomes final and the ownership of the property can’t be restored.

Find out what the important dates are for the current tax year.

You can make a payment in full, or contact the collection officer responsible for your account to arrange a payment plan.

Contact information

250-356-1090

1-866-566-3066

250-387-6727