Reconsiderations and appeals of oil and natural gas royalties, taxes, penalties or producer prices

If you are a producer and disagree with an assessment of royalties, freehold production tax, penalties or producer prices, you may take the following steps:

Learn about these steps below.

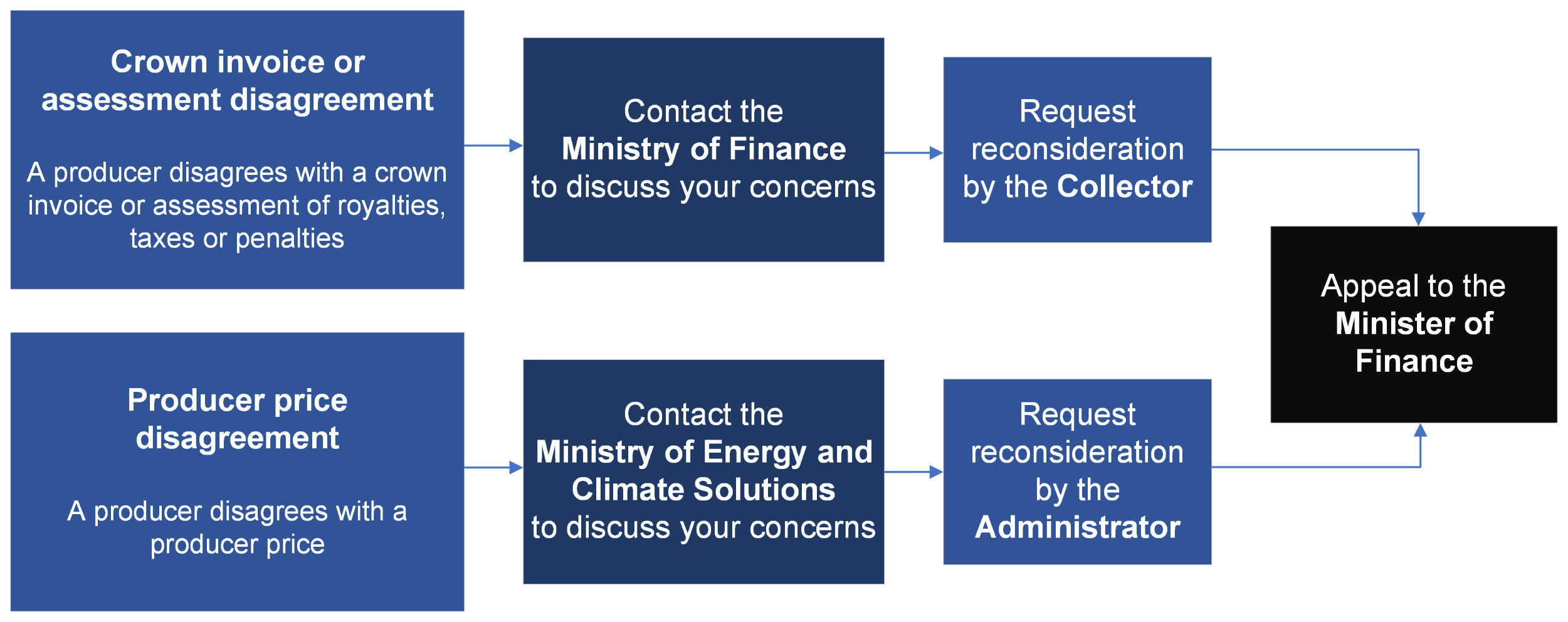

Overview of resolution process

If you disagree with a Crown invoice of royalties, tax or penalties:

- Contact the Ministry of Finance to discuss your concerns

- If your concerns are not resolved, you may then write to request reconsideration by the Collector

- If your concerns are still not resolved, you may then appeal to the Minister of Finance

If you disagree with a producer price:

- Contact the Ministry of Energy and Climate Solutions to discuss your concerns

- If your concerns are not resolved, you may then write to request reconsideration by the Administrator

- If your concerns are still not resolved, you may then appeal to the Minister of Finance

Outstanding invoices are payable even if you request a reconsideration or file an appeal. Interest applies to late payments.

1. Contact us

Contact us by phone to discuss your concerns. We recommend this as a first step before submitting a formal request for reconsideration as we can often help resolve your concerns at this stage.

Crown invoice disagreement: Email the Ministry of Finance at Oil&GasRoyaltyQuestions@gov.bc.ca.

Producer price disagreement: Email the Ministry of Energy and Climate Solutions at PData.PData@gov.bc.ca or call 778-698-7100.

2. Request a reconsideration

You can formally request a reconsideration if you still have concerns after contacting us.

Crown invoice or disagreement: Submit details of your request for reconsideration in a formal letter addressed to:

Collector

Mineral, Oil and Gas Revenue Branch

Ministry of Finance

PO Box 9328 Stn Prov Govt

Victoria, BC V8W 9N3

Send the letter by mail, fax or email:

Mail: to the address on the letter

Fax: 250-952-0191

Email: As an attachment in an email to Oil&GasRoyaltyQuestions@gov.bc.ca

The Collector will review your request and determine whether to change or uphold the original invoice.

Producer price disagreement: Submit details of your request for reconsideration in a formal letter addressed to:

Administrator

Royalty Policy and Administration Branch

Ministry of Energy and Climate Solutions

PO Box 9326 Stn Prov Govt

Victoria, BC V8W 9N3

Send the letter by mail, fax or email:

Mail: to the address on the letter

Fax: 250-952-0926

Email: PData.PData@gov.bc.ca

The Administrator will review your request determine whether to change or uphold the original producer price.

3. Appeal to the Minister

You can formally appeal a reconsideration of the Collector or Administrator to the Minister of Finance if you still have concerns after you have followed the steps above for your disagreement type.

We must receive your notice of appeal within 90 days of the date on your reconsideration decision letter from the Collector or Administrator. You must provide a statement of all material facts and reasons in support of your appeal.

The Minister's decision will be communicated to you in writing. The decision is final and may not be appealed in courts.

You must maintain records for at least seven years (84 months) in the event you are audited or wish to request a reconsideration or appeal.

Find out about audit assessments.

Contact information

Find out who to contact for your questions about oil and natural gas in B.C.