How AgriStability Works

AgriStability is tailored to each farm operation’s unique activities and financial performance - regardless of where they are located. Tailored support ensures both small family farms and large commercial operations can access meaningful, affordable protection.

To stay continuously enrolled in AgriStability, all you need to do is:

- Pay your enrolment fee at the start of the year, and

- Complete the Statement A form, including the:

- Income and expenses related to your operation

- Production details – the commodities produced on your farm

- Farm size – including the amount of land and/or number of animals

This information is used to calculate your Reference Margin and determine any payment if you experience a loss. Full details are outlined in the AgriStability SCAP Guidelines.

If you are new to AgriStability additional information is needed to get started. Go to our New to AgriStability page for details on how to register.

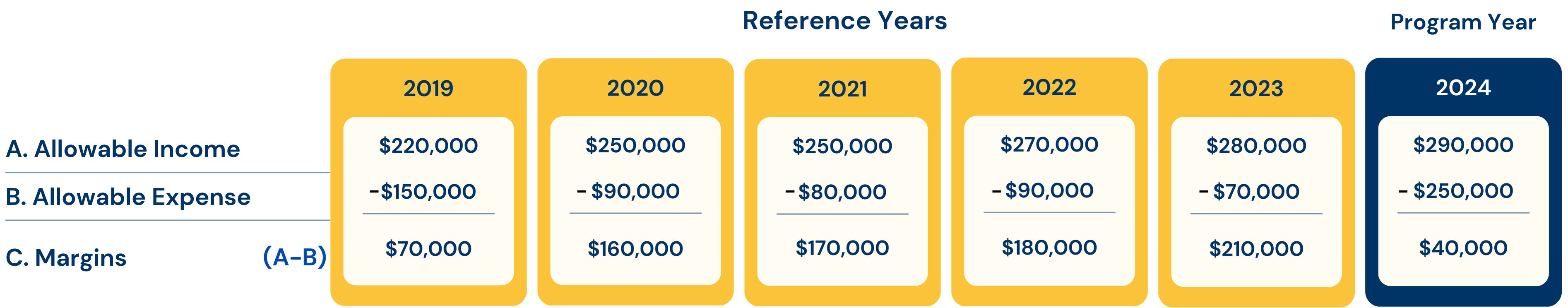

Margins

AgriStability is a margin-based program. When your Program Year Margin falls more than 30% below your Reference Margin, AgriStability will provide a payment.

Your program year margin is calculated by subtracting allowable expenses from allowable income. Your Program Year Margin is updated annually by the information received on your Statement A. This calculation ensures that deferred income and receivables, unpaid expenses and purchased inputs are considered.

- Allowable Income is the money received from the sale of commodities produced on your farm.

- Allowable Expenses are costs that are directly related to the production of commodities on your farm. This includes expenses like fuel, fertilizer, seed, feed, and labour. Fixed costs (repairs, rent, mortgage, etc) are not included.

*A payment is only triggered when the loss is beyond the farmer’s control.

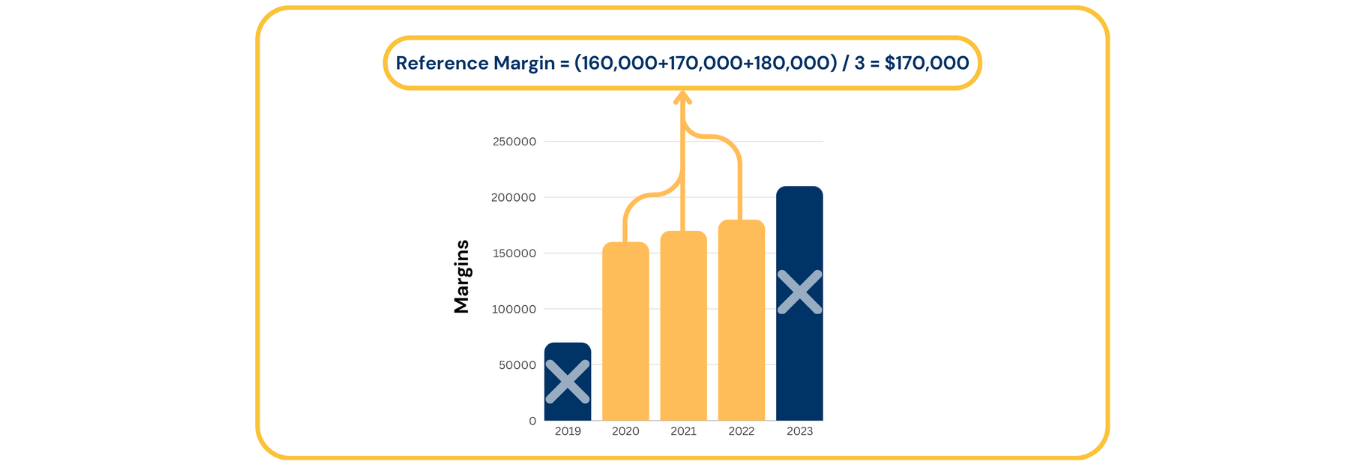

Your Reference Margin is calculated using your average profits from the past 5 years of production, after removing the most and least profitable years. The average is used so that your Reference Margin best represents a normal profit margin for your operation.

- Reference Years are the past 5 years of farming income and expense data that were used to calculate your reference margin. Industry averages are used when a new farm does not have 3-5 years of farm history.

Your Reference Margin is determined by the historical profits of your farm and is used to calculate your:

- Program fee,

- Payment trigger, and

- Payment

In AgriStability, your Reference Margin is very important!

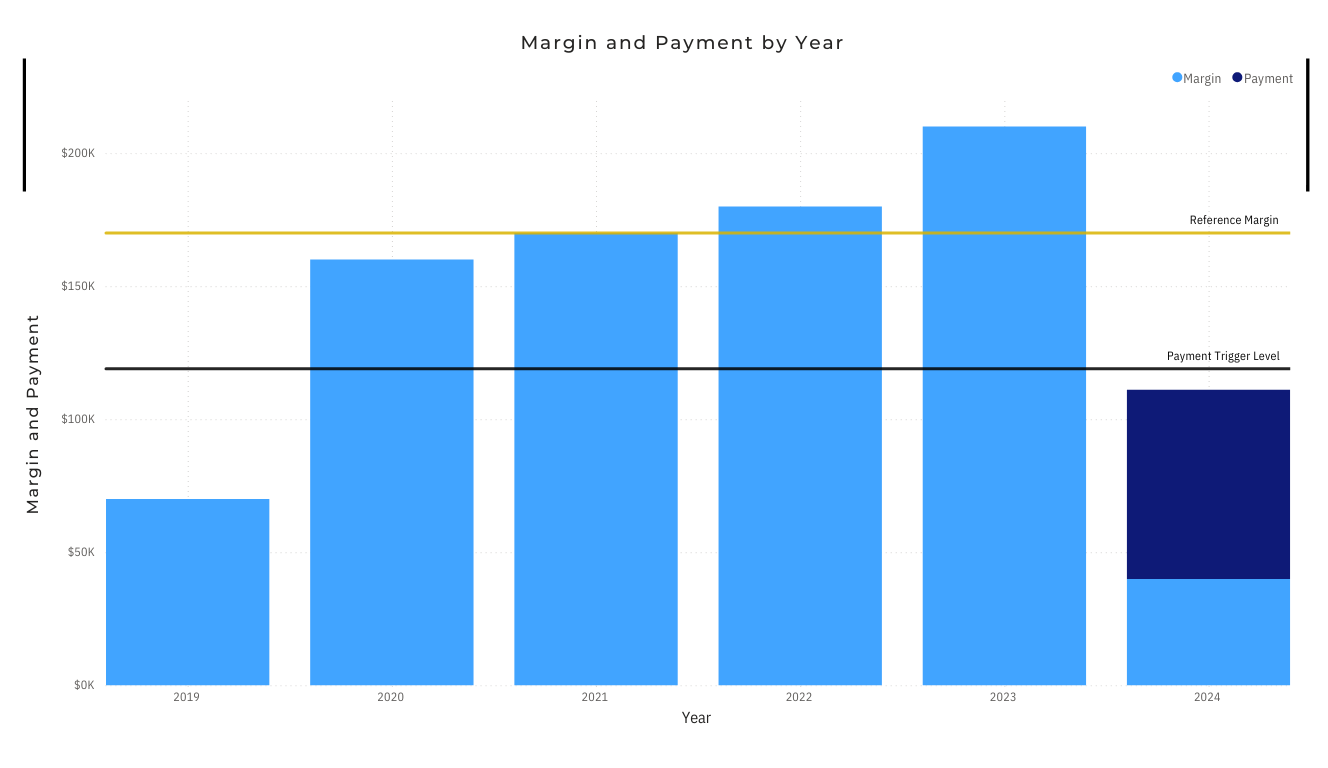

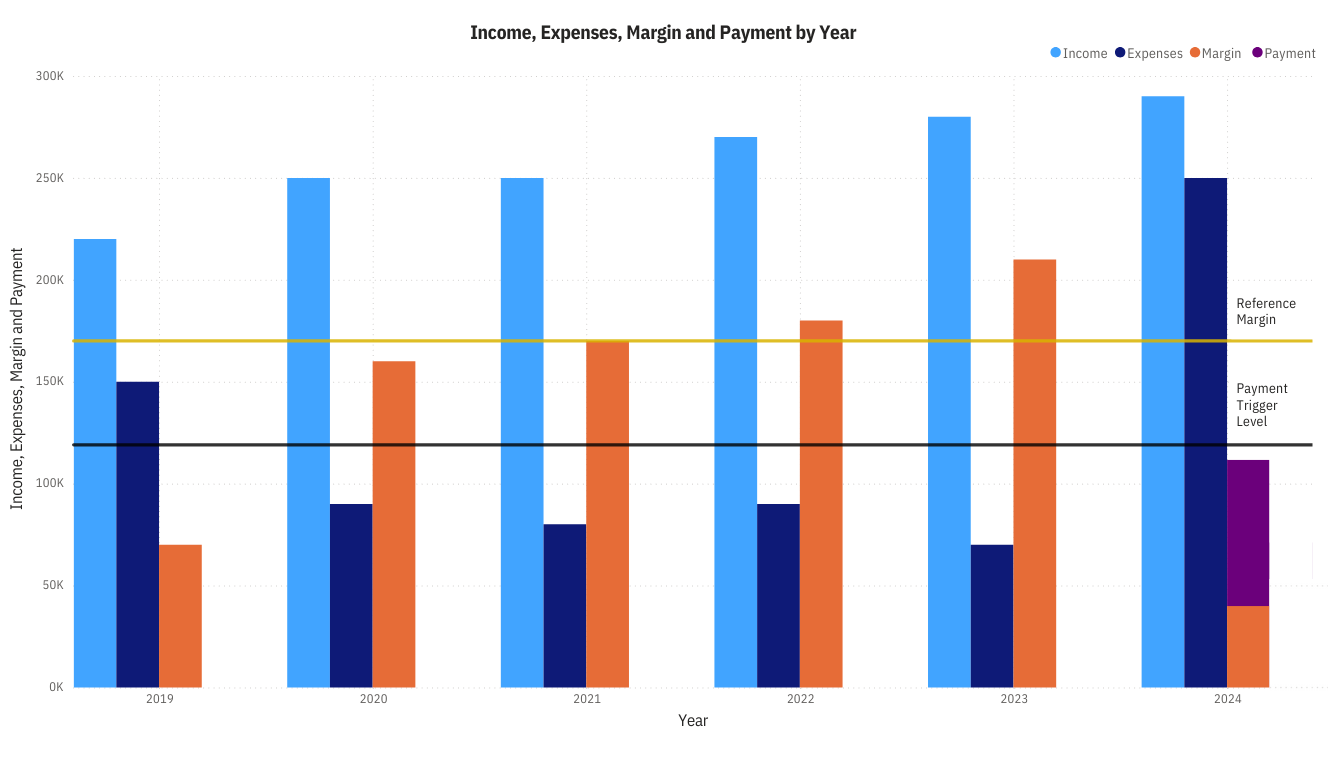

Reference Year Margin and Program Year Margin Calculations

In the diagram, the margins for 2020, 2021, and 2022 are averaged to create a Reference Margin of $170,000 for the 2024 program year. The least profitable year (2019) and the most profitable year (2023) are not used to calculate your Reference Margin.

What happens if my farm size changes (Structure Change)?

AgriStability helps protect you when your margin declines for reasons beyond your control. Sometimes, you might choose to increase or decrease production, try new crops or livestock, or stop producing something you’ve grown for years. This is what we call a Structure Change.

When you change what you grow or increase or decrease your farm size, your margins will likely change too.

For example, if you double your acreage, you might expect your income to double as well. This means your old reference margin is no longer a fair comparison to your current farm size.

To keep things fair, AgriStability makes a Structure Change adjustment to your previous years’ margins (reference margin). We look at your past margins and compare them to what a farm your size would normally earn in that year. Then, we calculate a ratio to adjust your reference margin to match the current size of your farm.

AgriStability Payment

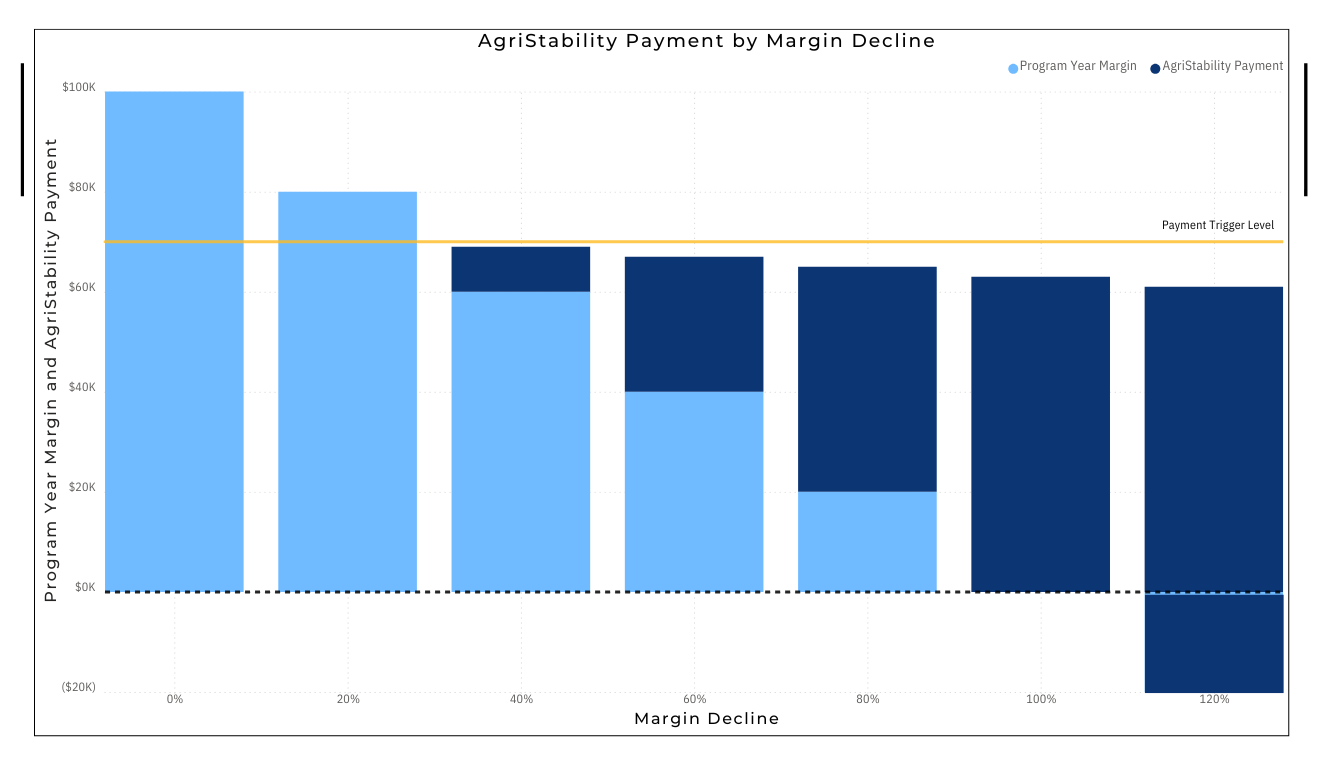

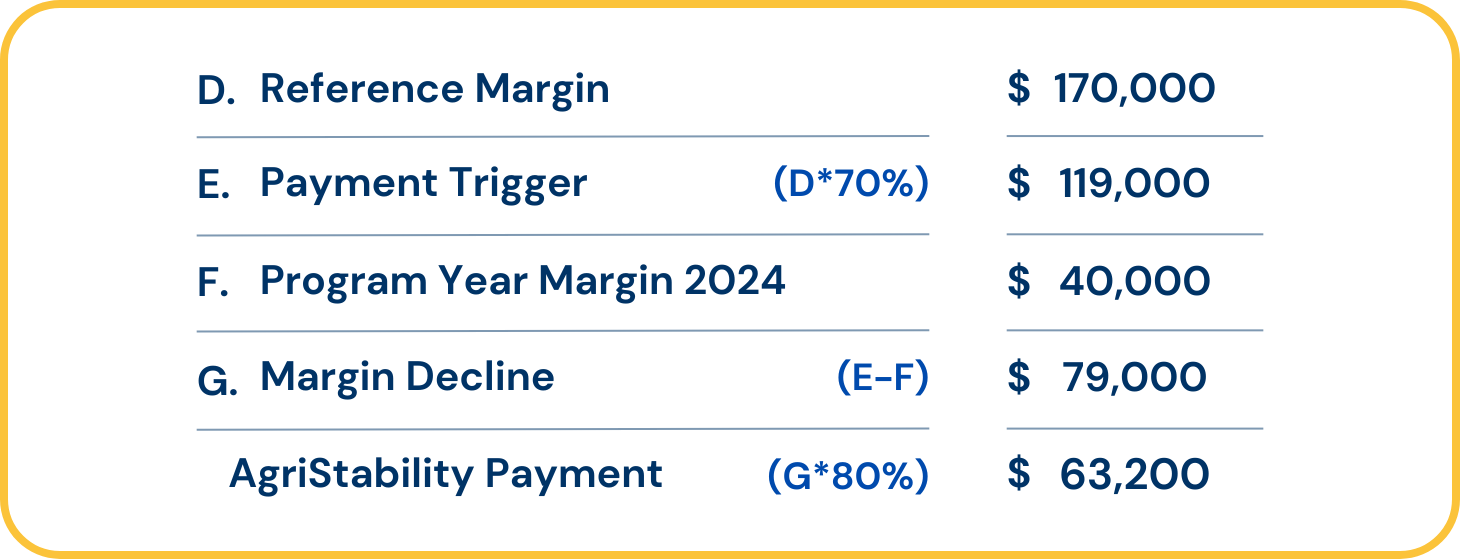

AgriStability payments are triggered at 70% of YOUR calculated reference margin. When your program year margin drops below the value of your payment trigger, you will receive a payment. Request a Coverage Notice to get an estimate of your payment trigger for the current program year.

See how an AgriStability payment increases as your margin declines:

Take a look at how AgriStability payments are calculated:

AgriStability pays 80 cents for every dollar of margin decline. AgriStability offers a minimum payment of $250 and a maximum payment of $3,000,000 in a typical year. All payments are cost shared by the federal and provincial governments.

Using the Reference Margin calculation from above, this farm will receive a payment of $63,200 to help offset their income decline experienced in the 2024 Program Year.

See margins and payments in action

The graphs below use the numbers from the example above.

Graph 1: Margins and Payment Graph

Graph 2: Detailed Income, Expense, Margin, and Payment Graph

Receive an Advance (Interim) Payment

You can receive up to 50% of your AgriStability payment early to help with expenses before the end of your production cycle. Advance (Interim) Payments are only available in the current program year. You must be enrolled and have paid your program fees to be eligible.

Advance (Interim) Payments provide:

- The opportunity to receive a partial payment before the end of your fiscal year, and before you file your farm taxes to Canada Revenue Agency.

- Quicker payments to give you cash flow to cover losses (requests are processed within 30 days of receiving them).

Apply for Advance (Interim) Payment now!

AgriStability Administration may not consider negative margin losses when calculating Advance (Interim) Payments. This prevents overpayment to the participant. Overpayments must be paid back after your final benefit has been calculated. A negative margin occurs when your allowable expenses exceed your allowable income. When we calculate your final benefit, the entire loss will be considered.

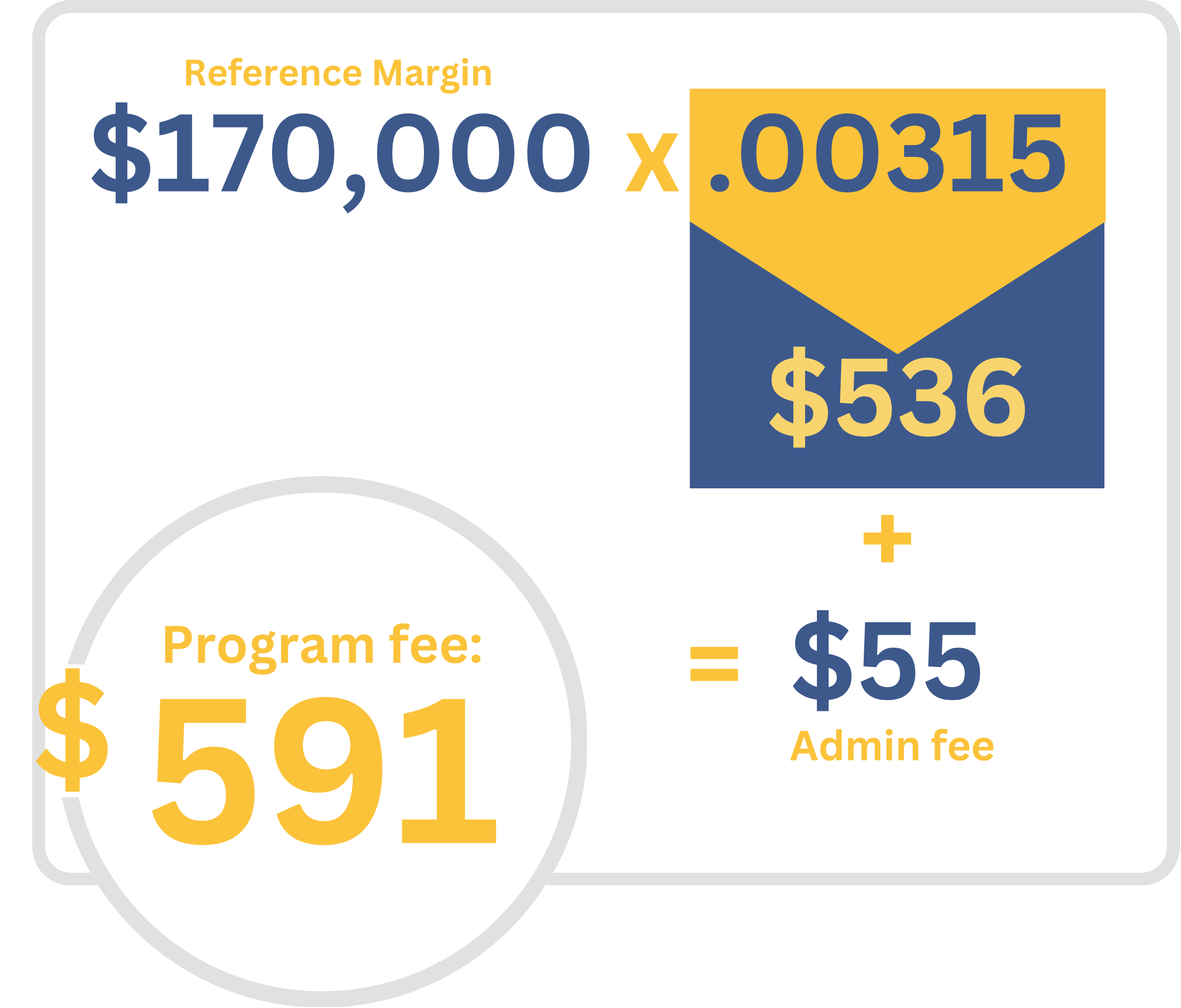

AgriStability Fee

Your AgriStability Fee is based on your Reference Margin. The AgriStability Fee is $315 for every $100,000 of Reference Margin, plus a $55 administrative fee that helps cover the cost of delivering the AgriStability program. The minimum fee to participate is $100.Let’s summarize the benefit to the producer in the examples above:

- The farm’s Reference Margin was calculated to be $170,000.

- The farm paid the program fee of $591.

- The farm received a payment of $63,200.

Enrolment Notice

An Enrolment Notice outlining your AgriStability Fee for the year will be sent to you every spring.

Program Fees are due by April 30th to avoid paying a penalty.

Every farm should participate in AgriStability! Call us to learn more about how stabilizing your farm income can help your farm operation today!

If you have any questions, AgriStability Customer Support is available:

Toll-free: 1-877-343-2767

Email: AgriStability@gov.bc.ca

Contact information

Agriculture Insurance and Income Protection Programs help manage production risk and stabilize income.

Regional offices are located around the province.

1-877-343-2767

1-877-605-8467

AgriStability@gov.bc.ca

https://www.gov.bc.ca/AgriStability