Capital Asset Management Framework: 1. Introduction

1.1 Overview of the Guidelines

These capital asset management guidelines were developed to support provincial public-sector agencies to find the best solutions and apply best practices in managing capital assets on behalf of British Columbians.

The Capital Asset Management Framework includes:

- a set of guidelines (this document), articulating the Province’s minimum standards, as well as more detailed policies and processes, for capital asset management, and

- tools that support best practices in capital asset management

All framework documents are available online under the Capital Asset Management Framework Tools & Resources.

1.2 Organization

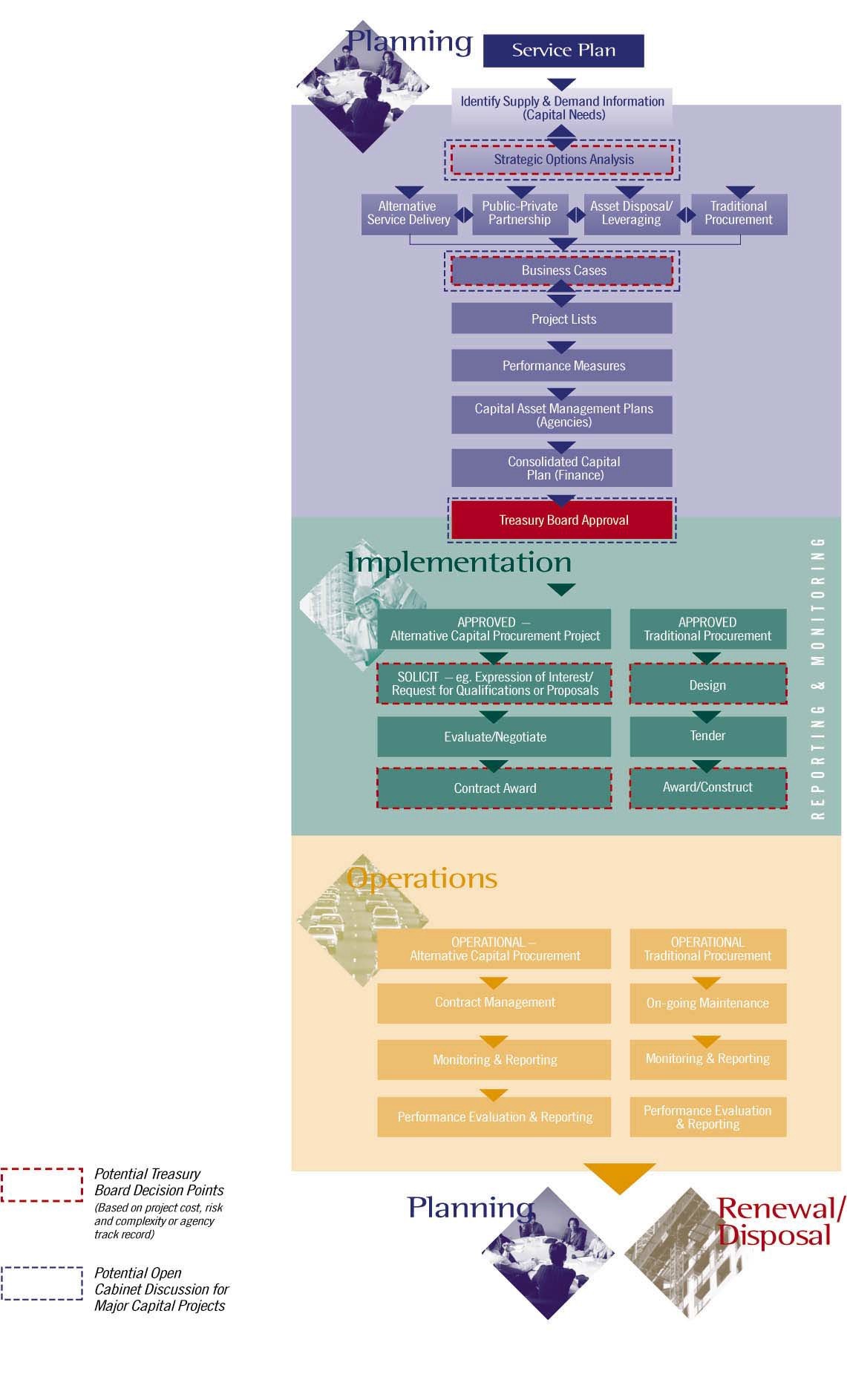

Capital asset management refers to the standards and processes applied through an asset’s full life cycle – from planning and acquisition through to operation, maintenance and disposal or renewal – as illustrated in Figure 1.2. The guidelines are organized according to this model with additional sections dedicated to overarching issues such as governance, risk and cost management.

Agencies are not expected to undertake the processes described in these guidelines in the order in which they appear. Capital asset management is not a linear process; it happens continuously, with a range of activities often happening simultaneously. The guidelines include links between various chapters and sections, and links to other documents, which agencies are encouraged to follow according to their needs.

The guidelines address:

- the roles and responsibilities of various levels of government involved in capital asset management

- minimum standards agencies should meet in planning and managing their asset bases through every phase of the life cycle

- the Province’s policy to oversight, including the approval and reporting requirements that may apply, based on the agencies’ or projects’ risk profiles

- capital-related budget processes and factors for both alternative and traditional asset procurement

Figure 1.2

1.3 Application

These guidelines apply to all public-sector agencies, and to the management of all public capital assets, regardless of their dollar value, the method of procurement, how they are financed (e.g. debt financed or expensed), or their accounting treatment.

Agencies are encouraged to find innovative solutions by focusing first on service delivery needs (rather than service delivery methods) and choosing the approach that:

- best meets service needs

- protects the public interest, and

- provides value for taxpayers

Specific direction on the guidelines’ application to individual agencies (e.g. project types, financial thresholds, approval requirements) is included as part of the broader guidance in Treasury Board Budget or Decision Letters, Mandate Letters or Treasury Board Directives. For further information see Section 5.3, Treasury Board Approval Requirements.

The capital asset management guidelines are directly relevant to ministries, Crown corporations and local agencies. Ministries are encouraged to develop their own policy approaches to the oversight of any local agencies in their purview.

Table 1.3

| Agencies should follow Generally Accepted Accounting Principles (GAAP) and their own accounting policies when classifying capital-related expenditures for budgeting, accounting and financial statement reporting. The columns below outline the major types of capital expenditure covered by the Capital Asset Management Framework and the typical accounting treatment required for each: | ||

|

New Capital Assets All direct acquisition, construction and/or development costs related to new capital assets may be capitalized. |

Rehabilitation (Betterments) Expenditures on rehabilitation projects may be capitalized. Rehabilitation projects are those that result in any of the following material changes to an existing asset:

|

Maintenance Capital asset related expenditures that do not qualify for capitalization as new capital assets or rehabilitation of existing assets are considered maintenance expenditures and should be expensed. These include the costs of maintaining assets for their intended purpose and service life, and repairs that do not prolong an asset’s original life expectancy. |

| Agencies with specific questions regarding accounting treatment should first consult their in-house accounting professionals. Further advice may then be sought from the sponsoring ministry and, finally, the Office of the Comptroller General. | ||

1.4 Clarifications & Amendments

These guidelines and the other documents that make up the Capital Asset Management Framework are maintained by the Ministry of Finance. Clarifications or amendments may be made in response to:

- concerns identified by Treasury Board, the Ministry of Finance or affected agencies

- changes in legislation or regulations or

- regular reviews of the framework’s effectiveness by the Ministry of Finance

View current versions of all framework documents

| Next > 2. Governance & Oversight