Capital Asset Management Framework: 5. Consolidated Capital Plan Process & Approvals

- 5.1 Overview

- 5.2 Consolidated Capital Planning (CPP) Process

- 5.3 Treasury Board Approval Requirements (Oversight)

5.1 Overview

Consolidated capital planning (CCP) refers to the process whereby public agencies’ capital plans are rolled into a single provincial capital plan, as part of the government’s annual budgeting and approval process.

This approach allows the Provincial Government to:

- establish fiscal controls such as capital expenditure limits, debt targets or debt-service limits commensurate with government's overall fiscal priorities

- assess whether agencies’ plans are consistent with government’s objectives and priorities

- assess agencies' performance in achieving their plans

- make informed decisions or set oversight conditions in the context of fully-disclosed agency risk profiles, and project cost

- identify and assess critical capital funding issues or pressures (e.g. deferred maintenance, seismic risk) and develop provincial strategies to address them, and

- allocate capital resources to meet competing needs and make informed trade-offs (e.g. investment in health care vs. transportation or education infrastructure)

5.2 Consolidated Capital Planning (CPP) Process

The annual CCP process generally follows these steps:

- Agencies develop and refine their service plans, identifying all related capital asset needs

- As directed by Treasury Board, the Ministry of Finance issues budget instructions, outlining the budget schedule and priorities with specific instructions included related to capital asset management plans. These instructions should address, at a minimum:

- any strategic government priorities for the budget cycle

- schedules for developing and submitting capital plans, with guidance regarding their form or content; and

- if applicable, notional or actual capital expenditure limits for taxpayer-supported agencies

- Where applicable, ministries prepare and issue annual capital budget instructions to local agencies addressing, at a minimum, the ministry-level version of the factors listed above for provincial capital budget instructions. Consistent with these instructions, agencies submit capital plans to ministries. Ministries consolidate and prioritize local agency plans, and prepare their own ministry-level capital asset management plans

- Consistent with the budget instructions (and/or specific Treasury Board requirements as per Decision or Mandate Letters), ministries and Crown corporations submit capital asset management plans to Treasury Board as part of the overall budget process. Submissions are signed by the minister, or CEO responsible for Crown corporations

- The Ministry of Finance Treasury Board Staff consolidates the spending intentions of ministries, local agencies and taxpayer-supported agencies into a consolidated capital plan. Treasury Board assesses the plan’s implications in the context of:

- its overall fiscal and debt strategy

- strategic provincial capital management issues, and

- provincial program priorities

- If agency plans are inconsistent with the province's fiscal (e.g. debt) strategy, or if Treasury Board identifies strategic capital allocation or management issues, some agencies may be required to adjust their plans

- Treasury Board issues or updates Mandate Letters (or decision letters) respecting capital asset management plans

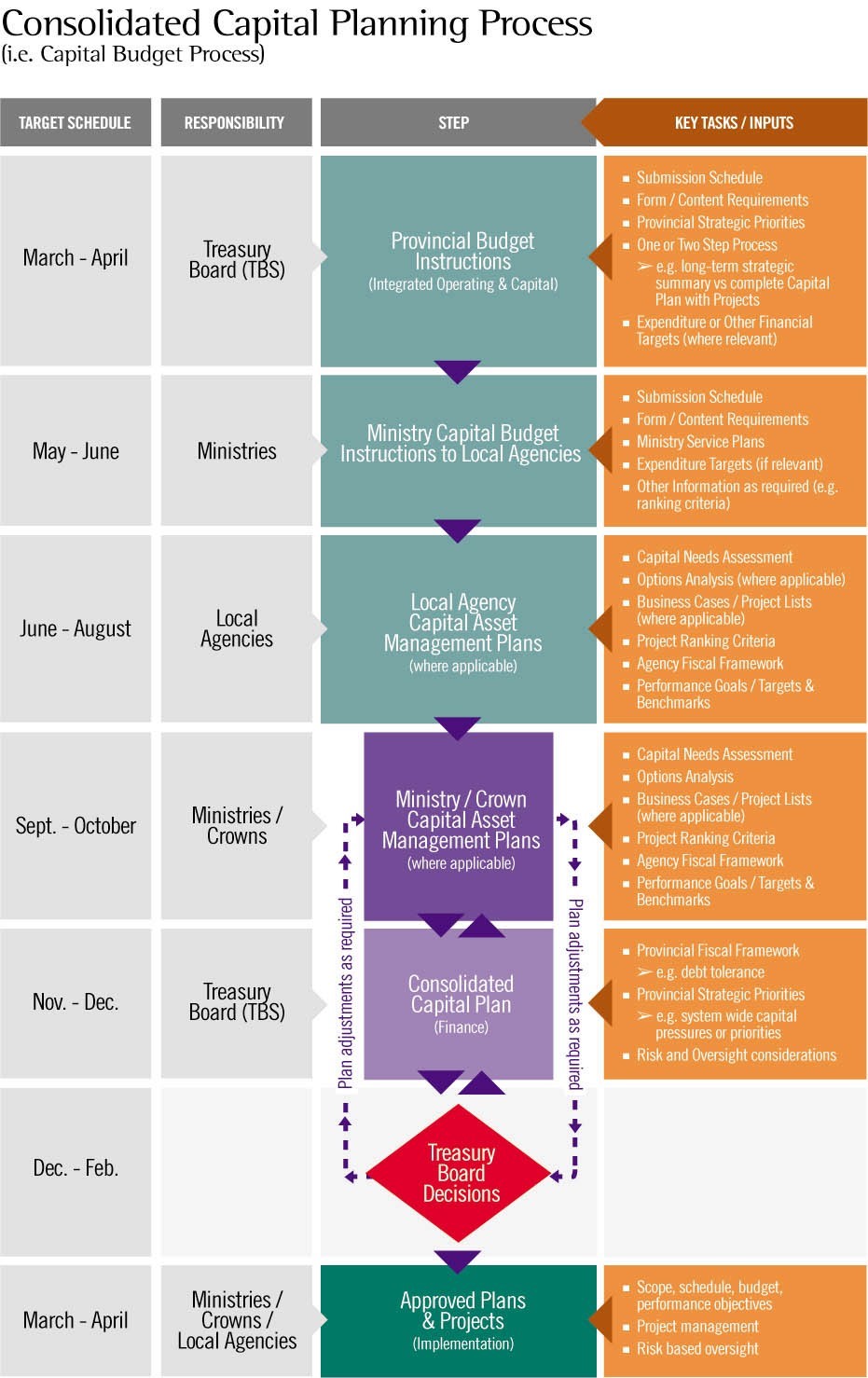

Figure 5.2 offers an overview of the CCP process, illustrating major approval points, decision factors and target timelines.

5.2.1. Mid-year Projects/Proposals

Capital proposals may be submitted to Treasury Board outside the annual budget process. Agencies should ensure that any such submissions meet the standards articulated in these guidelines and are:

- justified (e.g. with a business case that clearly supports the project)

- consistent with the agency's priorities, and

- supported within the agency's capital and fiscal plans

Figure 5.2

5.3 Treasury Board Approval Requirements (Oversight)

5.3.1 Overview

British Columbia uses a risk-based approach to capital management oversight. That means submission, approval and reporting (i.e. oversight) requirements vary according to an individual project or agency’s risk profile. Generally, the lower the risk and the better the agency’s track record, the fewer conditions Treasury Board requires for central oversight. Treasury Board Staff consults with agencies before determining specific approval conditions.

5.3.2 Decision Letters (or Mandate Letters)

The majority of Treasury Board’s agency-specific oversight conditions are communicated through Treasury Board Decision Letters or Mandate Letters. These letters typically address a wide variety of service, governance, operating, or budget issues. Figure 5.3.2a below lists a range of capital related elements that may be included in these letters or in stand-alone capital-related letters.

Ministries responsible for the oversight of local agencies may wish to use a similar process to clarify their own capital-related expectations.

Figure 5.3.2.a

Potential Capital Related Elements of a Treasury Board Decision Letter or Mandate Letter:

- Roles and Responsibilities

- Overview of any key capital related responsibilities or governance issues that may vary from the roles defined in the Capital Asset Management Framework

- Strategic Government Capital Priorities, such as:

- Addressing deferred maintenance liability or seismic risk

- Agency Specific Capital Performance Goals or Limits, such as:

- Capital expenditure or debt limits, and

- Asset utilization or cost control targets

- Framework Compliance Requirements, such as:

- Meeting business case standards

- Adhering to a specific reporting format, and

- Meeting inventory assessment requirements

- Submission and Approval Requirements, such as:

- Approval of capital asset management plans

- Specific capital project or program related Treasury Board approval requirements (based on project or agency risk assessments) such as:

- large or complex projects over a defined threshold or risk profile

- phased approval for selected alternative procurement projects

- third party oversight for high-risk projects, and

- responsibility for scope changes

- Reporting Requirements (as outlined in Section 10), such as:

- Non-discretionary public related reporting requirements;

- Capital asset management plan general performance reporting requirements, and

- Specific capital project or program related reporting requirements (based on project or agency risk profiles)

- Post-Implementation Review Requirements, such as:

- Identification of projects requiring post-implementation reviews for accountability purposes

- Timeline

- Length for implementation, additional approvals if applicable, reporting, and assessment.

- Accountability

- Identification of key personnel responsible for specific deliverables

Figure 5.3.2.b below provides a high-level summary of key approval and reporting roles and responsibilities among the various provincial capital agencies.

Figure 5.3.2.b

Key Approval and Reporting Roles and Responsibilities

|

|

Treasury Board/ |

Ministry |

Local Agency |

Crown Corporation |

|

Capital Asset Management Plans |

Review and approve ministry and Crown capital plans |

Key Approval and Reporting Roles and Responsibilities Execute capital plan Approve local agency plans where applicable |

Prepare and submit plans to ministry Execute local agency capital plan |

Prepare and submit plan to Treasury Board in accordance with Mandate Letter Execute capital plan |

|

Capital Budget Allocations (e.g. Capital Expenditure or debt limits) |

Adjust or approve ministry and tax- supported Crown capital expenditure limits, consistent with provincial fiscal framework and strategic priorities |

Ministry determines its own limits based on affordability Adjust/approve local agency limits where applicable |

Establish according to affordability |

Establish according to affordability |

|

Specific Project Approvals |

Approve |

Submit to Treasury Board in accordance with guidance guidance |

Submit to ministry according to ministry requirements |

Submit to Treasury Board according to Mandate Letter |

|

Capital Related Policy |

Develop provincial Capital Asset Management Framework |

Develop ministry policies consistent with provincial framework |

Develop local agency policies consistent with provincial framework |

Develop corporate policies consistent with provincial framework |

|

Risk Based Reporting (e.g. Financial, Performance, etc.) |

Receive for review according to Decision or Mandate Letters |

Submit to Treasury Board according to Decision or Mandate Letters |

Submit to ministry according to ministry requirements |

Submit to Treasury Board according to Decision or Mandate Letters |

|

Public Financial Reporting (e.g., Quarterly reporting requirements) |

Receive for review & publication |

Prepare and submit to Treasury Board Receive for review from local agencies |

Prepare and submit according to ministry requirements |

Prepare and submit to Treasury Board |

|

Project Monitoring |

Oversight according to Decision or Mandate Letters |

Ongoing monitoring Day-to-day delivery responsibility where applicable |

Day-to-day delivery responsibility |

Day-to-day delivery responsibility |

|

Funding and Cash Flow Management |

Provincial Treasury is fiscal agent |

Direct responsibility for funding Approve, disburse, and manage cash flow to local agencies where applicable |

Direct responsibility for funding |

Direct responsibility for funding |

|

Project Related Communications |

N/A |

Responsible |

Responsible |

Responsible |

4. Planning < Previous | Next > 6. Public Communications