Tax Interpretation Manual: Provincial Sales Tax Regulation

Part 1 — Definitions and Interpretation

Division 1 — Definitions

Section 1 – Definitions

PSTR - SEC.1/Act/Int.

Act

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 1 that in the PSTR, "Act" means the Provincial Sales Tax Act.

PSTR - SEC.1/Cannabis/Int.

Cannabis

References:

PSTR: Section 2.01; Section 86

Bulletin PST 141

Interpretation (Issued: 2021/07)

Effective October 17, 2018, B.C. Reg. 211/2018 amends PSTR section 1 to provide a definition of cannabis as having the same meaning as in the Cannabis Control and Licensing Act. Additional amendments to the PSTR were made effective the same day, consequential to cannabis legalization.

PSTR - SEC.1/Participating Savings Institution/Int.

Participating Savings Institution

References:

PSTR: Section 73; Section 78; Section 79; Section 82; Section 83

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 1 that in the PSTR, "participating savings institution" means a savings institution that will accept the payment or remittance of tax imposed under the Act to the account of the government.

Section 2 – Accommodation

PSTR - SEC.2/Int.-R.1

References:

Act: Section 1 "accommodation", "trailer", "use"

PSTERR: Section 1 “residential dwelling”

Bulletin PST 120

Interpretation (Issued: 2014/03; Revised: 2024/03)

Effective October 1, 2018, B.C. Reg. 185/2018 and B.C. Reg. 141/2018 amended PSTR section 2. The amendments are related to PSTA measures in Bill 2, Budget Measures Implementation Act, 2018, which enable online accommodation platforms to voluntarily register to collect and remit PST and municipal and regional district tax (MRDT).

B.C. Reg. 141/2018 replaced the word “trailers” with “stationary vehicles” in paragraph 2(2)(b) as a prescribed dwelling under the PSTA definition of “accommodation.” Stationary vehicles include trailers and vans, for example, when offered as stationary lodging. Additional changes to PSTR section 2 proposed by B.C. Reg. 141/2018 were replaced by amendments in B.C. Reg. 185/2018 before they came into force.

B.C. Reg. 185/2018 adds paragraph 2(2)(e), which provides that a “residential dwelling” is prescribed accommodation under the PSTA definition of accommodation. It also adds PSTR subsection 2(3), which provides that “residential dwelling” has the same meaning as in PSTERR. However, it excludes assisted living residences and long-term care facilities, as well as the exceptions found in paragraphs (i) to (m) of the PSTERR definition. For PSTR, “residential dwelling” also includes any part of a residential dwelling (e.g. a room in a house).

The amendments ensure lodging offered in all residential dwellings, including those listed through online accommodation platforms, online advertising sites, listing services and standalone websites, fall under the PSTA definition of “accommodation” and are subject to PST and, if applicable, MRDT.

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 2 the lodging and dwellings that are specifically excluded from the definition of accommodation in section 1 of the Act.

Subsection 2(1) provides that for the purposes of paragraph (a) of the definition of "accommodation" in section 1 [definitions] of the Act, lodging excluded from that paragraph is lodging provided in a unit that

(a) does not contain a bed, and

(b) is to be used to display merchandise, to entertain or to hold a meeting, dinner or reception.

Subsection 2(2) for the purposes of paragraph (b) of the definition of "accommodation" in section 1 of the Act, the following dwellings are prescribed:

(a) lodging houses other than hospitals, assisted living residences as defined in the Community Care and Assisted Living Act and long-term residential care facilities;

(b) bunkhouses, cabins, condominiums, dormitories, hostels, mobile homes, trailers and vacation homes;

(c) a dwelling operated by a club or association, whether or not a membership is required for use of the dwelling;

(d) that part of a ship or train in which lodging is provided while the ship or train is not in transit or is not making a scheduled stopover in British Columbia.

R.1 Accommodation Provided In Staterooms Onboard Vessels (Issued: 2014/04)

The dictionary definition of a hotel is a commercial establishment providing lodging and, often, meals and other services for the public. This definition encompasses accommodation provided in staterooms on vessels that are moored at one location for the duration of the guests' stay. Vendors providing accommodation on board such vessels are required to collect PST (and MRDT if applicable) on the accommodation, as they are providing accommodation in a hotel. This applies even if the accommodation is only available as part of a package (e.g., a packaged fishing vacation where the guests stay in rooms aboard the moored vessel and go out fishing on smaller boats).

The exemption under PSTR paragraph 2(2)(d) for lodging supplied to passengers in a ship while in transit or making a scheduled stopover in the province does not apply in this situation. This exclusion was intended to apply to cruise ships which make various ports of call. The word "passenger" refers to a person travelling or making a journey on board a conveyance. Guests staying on board the vessels referred to in the previous paragraph are not passengers, as the vessels remain in one place for the duration of the guests' stay. The fact that PSTR paragraph 2(2)(d) provides a specific exclusion for lodging on board a ship in certain circumstances implies that, in other circumstances, lodging provided aboard a ship falls within the definition of accommodation.

Section 2.01 – Eligible Tangible Personal Property

PSTR – Sec.2.01/Int.

References:

ACT: Section 1

PSTR: Section 2.01

Bulletin PST 003

Interpretation (Issued: 2021/07)

Effective October 17, 2018, B.C. Reg. 211/2018 adds PSTR section 2.01 which prescribes cannabis for the purposes of paragraph (e) of the definition of “eligible tangible personal property” in section 1 of the Act. As a result, cannabis does not qualify as eligible tangible personal property.

Section 2.1 – Excluded Online Accommodation Platforms

PSTR - SEC.2.1/Int.

References:

Act: Section 1 "accommodation", "online accommodation platform", "online marketplace facilitator"

Bulletin PST 120

Interpretation (Issued: 2023/07)

Effective July 1, 2022, B.C. Reg. 154/2022 repealed PSTR section 2.1. Online accommodation platforms now fall under the definition of "online marketplace facilitator."

Effective October 1, 2018, B.C. Reg. 141/2018 added PSTR section 2.1, which provides that if an online classified service or listing service does not collect payment on behalf of a person offering accommodation, it is not an online accommodation platform.

Section 2.2 – E-vaping Devices

PSTR – Sec.2.2/Int.

References:

Act: Section 1 “e-vaping device”, “vapour product”

Interpretation (Issued: 2023/03)

Effective September 20, 2020, B.C. Reg. 246/2020 added PSTR section 2.2 which, for the purposes of paragraph (b) of the definition of “e-vaping device” in section 1 of the Act, prescribes a product or device having both of the following characteristics:

(a) the product or device contains an electronic or battery-powered heating element;

(b) the purpose of the product or device is to heat a heated tobacco product within the meaning of the Tobacco Tax Act.

A product or device with both these characteristics is an e-vaping device for purposes of the Act.

Section 3 – Fair Market Value – Boats

PSTR - SEC.3/Int.

References:

Act: Section 1 "fair market value", "tangible personal property"

PSTERR: Section 34

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 3 that for the purposes of paragraph (a.1) of the definition of "fair market value" in section 1 [definitions] of the Act, the property prescribed is the tangible personal property referred to in subsection 34(1) [marine safety equipment] of the PSTERR.

Section 3.1 - Lease - Incidental Right To Use Tangible Personal Property

PSTR - SEC.3.1/Int.

References:

Act: Section 1 "lease"

Bulletin PST 315

Interpretation (Issued: 2014/09)

Effective April 1, 2013, B.C. Reg. 117/2014 adds PSTR section 3.1 which prescribes, for the purposes of paragraph (d) of the definition of "lease" in section 1 of the Act, the circumstances where the right to use TPP is merely incidental to an agreement for the right to use real property or the provision of services that are not subject to PST.

Therefore, in the circumstances prescribed in PSTR section 3.1, the provision of the right to use TPP is not considered a lease for the purposes of the Act.

Section 3.2 - Liquor Permit

PSTR - SEC.3.2/Int.

References:

Act: Section 1 "liquor permit"; Section 98; Section 182; Section 189; Section 190

PSTR: Section 86; Section 88.1

Bulletin PST 001; Bulletin PST 003; Bulletin PST 119; Bulletin PST 300; Bulletin PST 304; Bulletin PST 314; Bulletin PST 320; Bulletin PST 400

Interpretation (Issued: 2017/09)

Effective January 23, 2017, B.C. Reg. 291/2016 adds PSTR section 3.2, which prescribes a class of permit for the purposes of the definition of "liquor permit" in section 1 of the Act.

The "special event permit" referred to in section 3.2 is established under section 110 of B.C. Reg. 241/2016, Liquor Control and Licensing Regulation.

The amendment was consequential to a full rewrite of the Liquor Control and Licensing Act. As part of this rewrite, the "special occasion licence" used under the previous Liquor Control and Licensing Act for short-term events such as festivals, weddings, and community gatherings, was replaced by the liquor permit.

Section 4 – Meal

PSTR - SEC.4/Int.

References:

Act: Section 1 "meal"

Bulletin PST 120

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 4 that for the purposes of the definition of "meal" in section 1 [definitions] of the Act, the following meals are prescribed:

(a) a continental breakfast;

(b) a snack.

Section 5 – Passenger Vehicle

PSTR - SEC.5/Int.

References:

Act: Section 1 "accommodation", "motor vehicle", "passenger vehicle", "use" , "vehicle"

Bulletin PST 116

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 5 the motor vehicles that are specifically excluded from, and the vehicles that are specifically included under, the definition of passenger vehicle in section 1 of the Act.

Subsection 5(1) provides that for the purposes of paragraph (a) of the definition of "passenger vehicle" in section 1 [definitions] of the Act, the following motor vehicles are excluded:

(a) a truck that is larger than a 3/4 ton truck;

(b) a van that is larger than a 3/4 ton van;

(c) a camperized van that is designed to be used primarily for accommodation during travel or recreation and that contains built-in sleeping facilities, a built-in stove and one or more of the following:

(i) a built-in sink;

(ii) a built-in refrigerator;

(iii) a built-in cooler;

(d) a motor home, as defined in the Motor Vehicle Act;

(e) a bus, as defined in the Motor Vehicle Act;

(f) an ambulance;

(g) a hearse;

(h) a motorcycle, as defined in the Motor Vehicle Act, with an engine capacity of 250 cc or less.

Subsection 5(2) provides that for the purposes of paragraph (b) of the definition of "passenger vehicle" in section 1 of the Act, the following vehicles are prescribed:

(a) a truck that

(i) is or is smaller than a 3/4 ton truck, and

(ii) is not designed primarily as a means of transport for individuals;

(b) a van that

(i) is or is smaller than a 3/4 ton van, and

(ii) is not designed primarily as a means of transport for individuals;

(c) a station wagon, as defined in the Motor Vehicle Act.

Section 6 – Portable Building

PSTR - SEC.6/Int.

References:

Act: Section 1 "portable building"

Bulletin PST 133

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 6 that for the purposes of paragraph (f) of the definition of "portable building" in section 1 [definitions] of the Act, the following buildings are prescribed:

(a) a fabric-covered building;

(b) a fibreglass storage unit;

(c) a cargo container;

(d) a portable toilet building that is self-contained and designed for use by a single person;

(e) a hoop house;

(f) a greenhouse;

(g) a switch house.

Section 7 – Sale – Incidental Provision of Tangible Personal Property

PSTR - SEC.7/Int.-R.6

References:

Act: Section 1 "purchase price", "sale", "software", "tangible personal property", "telecommunication service", "use"

Bulletin PST 122; Bulletin PST 123; Bulletin PST 125; Bulletin PST 128; Bulletin PST 205; Bulletin PST 301; Bulletin PST 305

Interpretation (Issued: 2014/03; Revised: 2024/11)

Effective April 1, 2013, B.C. Reg. 233/2024 amended section 7 of the Provincial Sales Tax Regulation (PSTR) by adding subsection (1.1). The new subsection provides the prescribed software and telecommunication services for paragraph (k) of the definition of “sale” in section 1 of the Act.

Prescribed software and telecommunication services for the purpose of paragraph (k) of the definition of “Sale” in section 1 of the Act are the software and telecommunication services that provide or are used in the provision of providing support or technical assistance for other software or telecommunication service.

Under paragraph (k) of the definition of “Sale”, except for certain prescribed software and telecommunication services in prescribed circumstances, the provision of tangible personal property, software or a telecommunication service is merely incidental to a contract for the provision of services and are therefore excluded from the definition of sale. Subsection (1.1) of the PSTR prescribes that any software or telecommunication services that provides, or used in the provision of, support or technical assistance in relation to the other software or telecommunication services is not incidental to a contract for a non-taxable service and are therefore may be taxable.

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 7 for the purposes of paragraph (k) of the definition of "sale" in section 1 of the Act, the circumstances where the provision of tangible personal property, software or a telecommunication service is merely incidental to a contract for the provision of services that are not subject to tax. Therefore, in the specified circumstances, the provision of that tangible personal property, software or telecommunication service is excluded from the definition of sale.

Subsection 7(1) provides that in PSTR section 7, "original" and "master" mean the first final version and do not include any subsequent copies.

Subsection 7(2) provides that for the purposes of paragraph (k) of the definition of "sale" in section 1 [definitions] of the Act, the provision of tangible personal property, software or a telecommunication service is merely incidental to a contract for the provision of services that are not subject to tax under the Act in the following prescribed circumstances:

(a) in respect of the contract,

(i) the fundamental and overriding objective of the contract is the acquisition of the service and not the acquisition of the tangible personal property, software or telecommunication service,

(ii) there is no separate purchase price for the tangible personal property, software or telecommunication service, and

(iii) the total consideration payable for the service, including the tangible personal property, software or telecommunication service provided, is the same as, or only marginally different from, what would be the total consideration payable for the service if the tangible personal property, software or telecommunication service were not provided;

(b) the tangible personal property, software or telecommunication service is an original blueprint provided by an engineer or architect under a contract for professional services;

(c) the tangible personal property is a scale model provided by an engineer or architect under a contract for professional services;

(d) the tangible personal property, software or telecommunication service is a master audio recording provided under a contract with a recording studio for the use of the recording studio’s facilities and professional services;

(e) the tangible personal property, software or telecommunication service is a master recording, intended for general distribution, of

(i) a motion picture production,

(ii) a television production,

(iii) a radio production, or

(iv) a training video or film

provided under a contract with a producer for professional services;

(f) the tangible personal property, software or telecommunication service is an original graphic design provided by a graphic designer under a contract for professional services;

(g) the tangible personal property, software or telecommunication service is the original design of advertising material provided under a contract for professional services.

R.1 Specific Scenarios And The General Rule (Issued: 2014/08)

PSTR subsection 7(2) provides a general incidental rule in PSTR paragraph 7(2)(a) as well as six specific scenarios in PSTR paragraphs 7(2)(b) to 7(2)(g). For the purposes of interpreting the incidental provisions, the specific incidental scenarios are not captured by the general incidental rule in PSTR paragraph 7(2)(a). Had the intent been for the specific scenarios to be examples of the general incidental provision, PSTR section 7 would have been drafted differently. For example, different rules (e.g. no separate purchase price in the general rule, only master or original copies in the specific circumstances) would not apply to the general rule and the specific circumstances.

As a result, the general rule is not to be interpreted so broadly as to capture the specific scenarios. For example, PSTR paragraph 7(2)(e) provides that master recordings intended for general distribution of certain types of productions are merely incidental to a sale of non-taxable services. Master recordings of other types of productions (e.g. a film that is not for general distribution) would not qualify as incidental under the general incidental rule, even though the nature of the service (i.e. film production) and the TPP provided (i.e. DVD) are similar.

R.2 Multiple Copies (Issued: 2014/08)

The specific incidental scenarios, with the exception of PSTR paragraph 7(2)(c) (scale models), provide that only the original or master copy is incidental to the contract for non-taxable services. This same rule does not apply to the general incidental rule, meaning that more than one copy of the TPP, software, or telecommunication service may be provided and still be considered merely incidental as long as the conditions in PSTR paragraph 7(2)(a) are met. For example, an insurance provider may provide their client with multiple copies of an insurance contract describing their insurance coverage and those copies could still be considered incidental to the non-taxable insurance policy.

When additional copies are provided under the specific rules (PSTR paragraphs 7(2)(b) to 7(2)(g)), it does not necessarily make the non-taxable service subject to PST. For example, an original graphic design is considered incidental under PSTR paragraph 7(2)(g) when provided under a contract for graphic design services. Although only the original copy can qualify as incidental, if the graphic designer provides three paper copies of the graphic design to a customer so that multiple staff members can view the design, this does not make the graphic design service subject to PST. The second and third copies are subject to PST and, in this case, would likely be exempt under the small packages exemption (section 137 [Taxable component sold with non-taxable component for single price] of the Act). However, if the graphic designer prints off 100 posters using the graphic design under the contract for design services, the design services are subject to PST.

R.3 Written Content Creation (Issued: 2014/08)

In general, when a service to create written content is provided with a copy of the content in the form of a written document that is TPP, the TPP will be considered incidental to the service.

If the written document is provided on an electronic medium that is TPP (such as a disc or USB key), such TPP is also incidental to the service as long as it meets the criteria of the general incidental rule (PSTR paragraph 7(2)(a)). In particular, the total consideration must be the same as, or only marginally different from the consideration that would be provided for the service alone. For example, a hard drive with significant value would generally not qualify as incidental.

TPP that is provided with the following services is generally considered to be incidental if the total consideration is the same as, or only marginally different from, the consideration that would be provided for the service alone:

- medical transcription services,

- translation services,

- the preparation of research reports,

- court transcription services,

- script writing services, and

- other similar services to produce written content.

TPP provided with the following services is generally not considered incidental:

- the production of a sandwich board or sign (although these may contain writing these are not documents), and

- photocopying services because such services do not involve the creation of written content.

The number of copies that qualify as incidental in the above circumstances is to be determined on a case-by-case basis in accordance with what is reasonable and considering the following:

- The number of copies that is regularly provided with the type of service being provided (i.e. industry practice).

- The purpose of the copies may be an indication of whether they are incidental. In general, if the copies are provided to communicate the results to the purchaser, then they are likely incidental; however, if the copies are provided to communicate to someone other than the purchaser, then they are not likely to be incidental.

The following are examples of the number of copies that may or may not be considered incidental:

- Three copies of a consultant report provided to a company for review by the company's executive are generally incidental; however, 1,000 copies of a report provided to shareholders are not.

- Three copies of court transcripts made for the parties to an action would generally be considered incidental, while 50 reports created for attendees to a meeting are not.

R.4 Guiding Principles (Issued: 2014/08)

One of the conditions of the general incidental sale provision (PSTR paragraph 7(2)(a)) is that the "fundamental and overriding objective of the contract" is the acquisition of the non-taxable service and not the TPP, software or telecommunication service. There are unlimited scenarios that could arise and determinations of whether the provision of TPP, software or a telecommunication service is incidental must be made on a case-by-case basis. However, the following principles can help to inform determinations:

- What is the purchaser's objective in entering the contract? If the purchaser's objective in entering the contract is to obtain TPP (or software /telecommunication services), that TPP cannot be considered incidental to the provision of a service. Or put another way, are the services a necessary component of the production of TPP, which is what the purchaser really intends to buy? For example, a sandwich board provided by a sign maker is not "merely incidental" to the sign design service. The purchaser's intention is to buy the sandwich board.

- Is the provision of the TPP merely the method by which a professional communicates to his or her client about their work and the physical evidence that the professional services have been performed? Is the TPP provided merely to convey ideas to the customer? This is particularly relevant for TPP that is provided in a paper form (e.g. reports or transcriptions). For example:

If a consultant is hired to analyze an issue and provide their findings, the findings may be provided in a report.

The provision of the TPP (i.e. the report) is incidental to the service of analysis that the consultant is providing.

A survey provided in paper form or on a disk is incidental to surveying services.

A certificate showing the results of a test (e.g. documenting the accuracy of an instrument) is incidental to the testing /inspection service.A design layout on paper or on a disk is incidental to services such as interior design (e.g. a room layout). - To be incidental, the provision of the TPP (or software /telecommunication service) has to be insignificant, or of little importance, relative to the provision of the non-taxable service. In other words, the provision of the TPP can play only a minor role in relation to the provision of the non-taxable service. Where the provision of TPP plays an important role by itself in the context of a particular transaction, it is not likely to be reasonably considered as incidental to the provision of the service.

This concept is partially captured by the requirement in PSTR subparagraph 7(2)(a)(iii) that the total consideration without the TPP be only marginally different from the total consideration including the TPP.

- Is this consistent with similar rulings that have been previously issued? An important consideration is to maintain consistency with previously issued rulings. However, if previously issued rulings are inconsistent with the principles above and examples provided in R.5, they should be reconsidered.

R.5 Examples (Issued: 2014/08)

The following table provides examples of TPP /software /telecommunication services that are considered merely incidental to a non-taxable service:

| Incidental provision of TPP, software or telecommunication service | Rationale |

|---|---|

| Original research reports provided under a contract for research services | The fundamental and overriding objective of the contract is the acquisition of research services. The report is merely the method by which the professional communicates to their client the results of their work. Note that this was provided as an example of incidental TPP in the public information for Budget 2004. As such, it was considered to meet the test when the provision was drafted. |

| A paper ticket that provides the holder with an entry to a sporting event | The purchaser is purchasing entry to a sporting event, not a paper ticket. The ticket provides the purchaser with a way to gain entry to the event and has no value on its own. |

| Coupons/vouchers/coupon books that provide a purchaser with the right to discounts on goods /services, e.g. the Entertainment book |

In the circumstance where the purchaser is also the end user, they are purchasing these items in order to receive discounts on other purchases and not for the purpose of obtaining the TPP. Note that the purchase of coupons etc. by a vendor who is distributing the coupons to customers is not considered incidental. |

| Insurance papers that provide the details of an insurance policy | The purchaser is purchasing an insurance policy, not a booklet or series of papers. The papers only serve to communicate the details of the policy and have no value on their own. |

| The Insurance Corporation of British Columbia's provision of decals is incidental to their insurance services | The purchaser is purchasing an insurance policy, not a decal. The decal serves as proof that the purchaser has purchased the policy. |

| A certificate documenting test results is incidental to the test of the accuracy of an instrument | The purchaser is purchasing the testing of the instrument to ensure it is accurate, not the paper providing the test results. The paper result is merely the method of communicating the test results. |

| A written handout provided as part of a course or training program | The purchaser is purchasing a course or training program and not the handout that is provided at the training session. |

| Completed report, charts, etc. that are provided to the customer for a single charge with consulting services | The purchaser is purchasing consulting services. The report is merely the method by which the professional communicates to their client the results of their work. It is also consistent with longstanding administration of the PST. |

| A company inspects pipelines at weld sites and reports the conditions of the weld to the pipeline operator. They sometimes provide X-rays of the weld as part of the inspection service. The X-Ray is considered incidental. | The purchaser is purchasing a service to have their pipeline welds inspected to determine whether they require repairs. The purpose of the X-ray is merely to communicate the results of the inspection and condition of the pipeline. |

| A report or lab result provided with medical/health testing services | The purchaser is purchasing a medical /health testing service. The report is merely communicating the results of the test. |

| Clothing bags and hangers provided by dry cleaners as part of a dry cleaning service | The purchaser is purchasing a cleaning service. The hanger and bag are merely used to protect the cleaned and pressed clothing while waiting to be picked up and during travel. |

| CD, blueprint or other paper with designs as part of a contract for design /design consultant services (not by architect /engineer) |

The purchaser is purchasing a design /design consultant service. The professional communicates their work through the blueprint or CD (containing a blueprint or similar design layout). This interpretation is consistent with longstanding administration of the PST. Note that these designs are exempt under the general incidental rule (PSTR paragraph 7(2)(a)) and not under PSTR paragraphs 7(2)(b) or (f). The types of contracts captured are those where the fundamental objective of the contract is to obtain design services. For example, with respect to an interior designer that provides a design for a room, the customer is not purchasing a design in the form of TPP; the TPP is merely used to convey the designer's ideas for the room. An original graphic design (e.g. a logo) on the other hand would not be exempt under PSTR paragraph 7(2)(a) since obtaining the logo is the objective of the contract;- however, it is incidental because it falls under PSTR paragraph 7(2)(f). |

| The provision of an original copy of a map and/or a disk containing survey data is considered incidental to a non-taxable survey service, including GPS surveys. | The purchaser is purchasing a surveying service that may include physically establishing property boundaries. The data or map is the evidence by which the surveyor communicates the results of the survey service. |

| The provision of court transcripts is incidental to the extent that copies are provided to the judge and parties directly involved in the court action (or alternatively to a party who is not involved in the action, but who commissioned the transcription services). |

The purchaser wishes to obtain a transcription of an audio recording. The parties that order the transcription service may be provided with a paper copy and that paper copy considered incidental if there is no separate charge. This interpretation is consistent with longstanding ministry practice. Purchases of any subsequent copies ordered by a party that did not pay for the transcription services would be subject to PST. |

| Prepaid cards (e.g. credit cards) are merely incidental to the provision of the financial services being purchased by the customers. | The purchaser is providing money to a credit card company in advance to be able to make purchases using a credit card. The intent of the purchaser is not to purchase a plastic card, but the right to make purchases using a credit card. |

| A CD or DVD containing a database is incidental to the provision of a database creation service. |

The purchaser is purchasing a database creation service. If they were provided with an electronic file only that contained the database (e.g. sent via email or FTP), the provision of the electronic file would not be subject to PST because it would not meet the definition of a telecommunication service. The provision of the same electronic database file on a tangible medium such as a CD or DVD is considered incidental to the service of creating the database. Note that this is limited to a database creation service and does not capture a simple data transfer through tangible media. For example, the transferring of video files that were not created by the provider would be subject to PST if provided to a customer on a DVD, even if the DVD contains a database through which the files can be accessed. In addition, if the CD or DVD that contains the database also contains software to access the database, the incidental rule would not apply. |

| A copy of a website provided on TPP (e.g. DVD or thumb drive) as part of a website design service. |

Similar to the database described above, the purchaser is purchasing a web design service. Providing a copy of the website that is transferred electronically (e.g. a back-up copy on a DVD or thumb drive) is considered incidental to the website design service. Note that many websites contain a telecommunication service (e.g. video or audio files when provided electronically) or software that is subject to PST and the incidental rule may not apply. |

| Electronic file conversion services: a business takes paper records (e.g. legal records), scans the documents and provides them in the form of TPP (e.g. a CD) to the purchaser. |

Similar to the database described above, the purchaser is paying for a service to have documents converted from paper files to electronic files. The intent is not to purchase TPP (e.g. CDs). If no separate purchase price is charged for the CDs, they may be considered incidental to the non-taxable service. |

| A website is provided electronically and includes a short stock video. The provision of the video is considered incidental to the website design service. |

The purchaser is purchasing a web design service. That is the fundamental and overriding objective of the contract. The video, if purchased as a stand-alone video, would be subject to PST as a telecommunication service. However, if the purchase price of the web design service is the same or only marginally different because of the inclusion of the video, the video may be considered incidental to the web design service. |

The following table provides examples of TPP /software /telecommunication services that are not considered merely incidental to a non-taxable service:

| Not Incidental Provision of TPP etc. | Rationale |

|---|---|

| The original product on a tangible medium, such as a DVD or tape, of production and post-production services such as sound recording, sound dubbing (voice-over recording) and mixing. |

The purchaser wishes to obtain an edited video from the service provider. It is not distinguishable from the post-production services as the video is the result of those services. Whether the video is provided in tangible form (e.g. on DVD) or electronically (e.g. file transfer protocol), it is subject to PST as TPP or a telecommunication service respectively. The exemption under PSTR paragraph 7(2)(e) was deliberately limited to productions intended for general distribution, indicating that audio/video productions not for general distribution are not captured by the general incidental rule under PSTR paragraph 7(2)(a). |

| A DVD is not considered incidental to video editing and content creation services. |

The purchaser wishes to obtain an edited video from the service provider. It is not distinguishable from the post-production services as the video is the result of those services. Whether the video is provided in tangible form (e.g. on DVD) or electronically (e.g. file transfer protocol), it is subject to PST as TPP or a telecommunication service respectively. The exemption under PSTR paragraph 7(2)(e) was deliberately limited to productions intended for general distribution, indicating that audio/video productions not for general distribution are not captured by the general incidental rule under PSTR paragraph 7(2)(a). |

| A custom made chair provided by a custom furniture designer and maker. | The overriding objective of the purchaser is to obtain a custom chair, not to have a chair designed. |

| A custom work of art created by an artist for a specific purchaser (e.g. a painted portrait or a custom cartoon pencil /ink drawing). |

The overriding objective of the purchaser is to obtain the art and not design services. An original graphic design would also be considered taxable if it wasn't included under PSTR paragraph 7(2)(f) because it is the objective of the contract for graphic design services. This is one of the examples provided in the Budget 2004 bulletin, confirming the intent for the tangible art to remain taxable. |

| Animated imagery that is provided on a tangible medium (e.g. CD or hard drive) or electronically (e.g. FTP). The tangible medium (TPP) or the digital animation (telecommunication service) are both subject to PST and they are not considered incidental to the service of producing animation. |

The purchaser's primary objective is to obtain the animated imagery. This is consistent with the custom art work and production/post-production services interpretations above. |

| Buttons and zippers transferred as part of clothing alteration services are not incidental to clothing alteration services. | The customer's primary objective in entering the contract is clothing alteration, but the acquisition of the buttons and zippers is also a significant part of the contract. |

| Sandwich boards, signs and car decals, even if only a single copy is produced. | Unlike a master graphic design, these items of TPP are not meant to convey the graphic design to the customer, but are rather the end product resulting from the design service. |

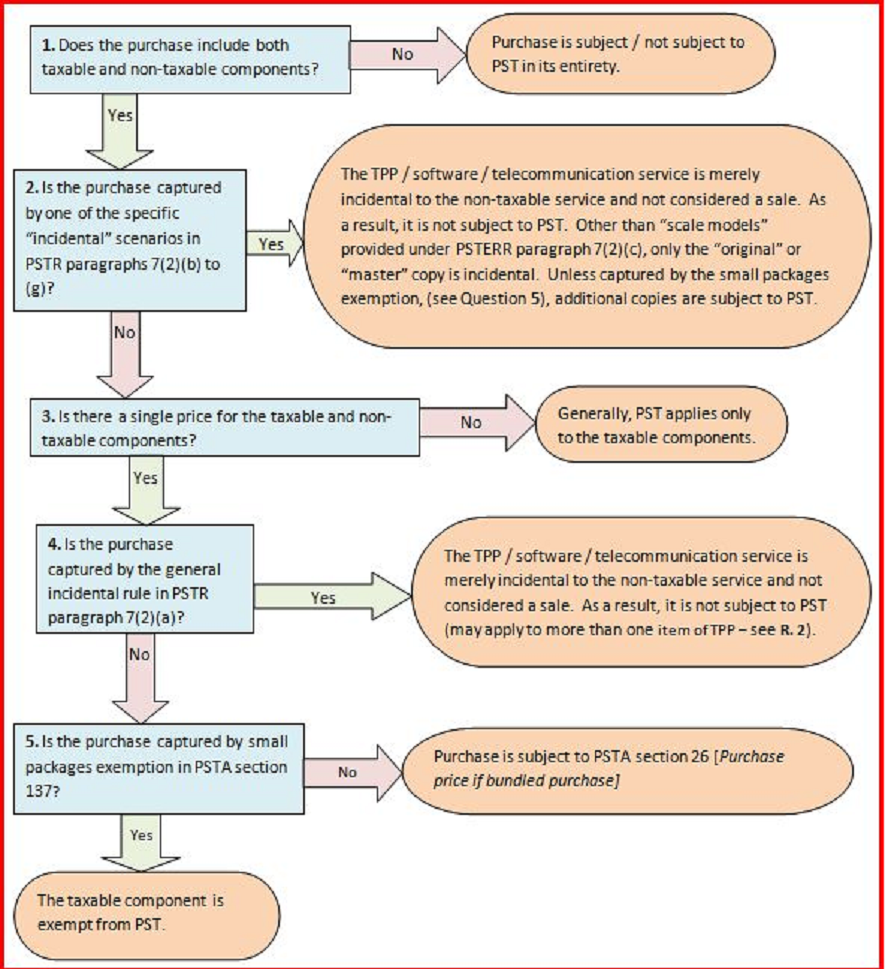

R.6 Process Flow Diagram For Bundled Purchases (Issued: 2014/08)

The following flow chart is intended to provide guidance in determining which of the following provisions applies to a purchase that includes taxable and non-taxable components: section 26 [Purchase price if bundled purchase] of the Act, section 137 [Taxable component sold with non-taxable component for single price] of the Act and PSTR section 7 [Sale - incidental provision of tangible personal property].

Division 2 — Purchase Price

Section 8 – Purchase Price If Accommodation Purchased With Other Services

PSTR - SEC.8/Int.

References:

Act: Section 1 "accommodation", "boat", "collector", "meal", "purchase price"; Section 19

Bulletin PST 120

Interpretation (Issued: 2014/03; Revised: 2014/09)

Effective February 19, 2014, B.C. Reg. 117/2014 repeals and replaces PSTR section 8. The amendment is consequential to an amendment to subsection 19(3) [Original purchase price of accommodation] of the Act that was part of Bill 8, Budget Measures Implementation Act, 2014.

PSTR section 8 provides, for the purposes of section 19(3) of the Act, the manner for calculating the purchase price of accommodation when the accommodation is provided with meals and other services for a single price.

If the accommodation is also offered by the seller by itself (i.e. without meals or other services), the purchase price is the price at which the accommodation is sold without meals or other services.

If the accommodation is never provided separately from the meal or services, then the purchase price is the lesser of:

- 15% of the total consideration accepted by the seller for the accommodation, meals and other services, and

- $100 per day.

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 8, for the purposes of subsection 19(3) of the Act, the prescribed services, prescribed person and related rule to calculate the purchase price of accommodation where the accommodation is purchased as part of a combination of accommodation, meals and prescribed services for a single price.

Section 9 – Purchase Price Of Legal Services – Excluded Fees And Charges

PSTR - SEC.9/Int.

References:

Act: Section 1 "legal services"; Section 20

Bulletin PST 106

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 9 that for the purposes of paragraph 20(2)(a) [original purchase price of legal services] of the Act, fees and charges for the transmission, printing or copying of documents are prescribed as excluded if the amount of the fees or charges is reasonably related to the cost of the transmission, printing or copying of documents incurred by the person providing the legal services.

Section 10 – Depreciated Purchase Price Of Tangible Personal Property

PSTR - SEC.10/Int.

References:

Act: Section 1 "affixed machinery", "purchase price", "tangible personal property", "use", "vehicle"; Section 9; Section 25

Bulletin PST 307

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 10, for the purposes of section 25 of the Act, the prescribed tangible personal property to which depreciation may apply for the purposes of determining the tax payable on that tangible personal property, as well as the formula to calculate the depreciated value of that tangible personal property.

Subsection 10(1) provides that in PSTR section 10, "partial year", in relation to tangible personal property, means a period that is less than a year and in which the tangible personal property was used by the person liable to pay tax under the Act.

Subsection 10(2) provides that for the purposes of section 25 [depreciated purchase price of tangible personal property] of the Act, the following tangible personal property is prescribed:

(a) aircraft;

(b) railway rolling stock;

(c) vehicles;

(d) vessels;

(e) equipment;

(f) furnishings;

(g) affixed machinery.

Subsection 10(3) provides that for the purposes of paragraph 25(2)(a) of the Act, the depreciated value of tangible personal property prescribed under PSTR subsection 10(2) is the amount determined by the following formula:

depreciated value = purchase price – [purchase price x rate]

where

purchase price = the purchase price of the tangible personal property under paragraphs 9(a) to 9(d.2) [purchase price of tangible personal property] of the Act;

rate = the rate of depreciation determined as follows:

(a) in relation to aircraft, the total of

- 25% for each year that the aircraft was used by the person liable to pay tax under the Act, and

- 2.0833% for each 30-day period in a partial year that the aircraft was used by the person liable to pay tax under the Act;

(b) in relation to railway rolling stock or equipment mounted on railway rolling stock, the total of

- 10% for each year that the railway rolling stock or equipment was used by the person liable to pay tax under the Act, and

- 0.8333% for each 30-day period in a partial year that the railway rolling stock or equipment was used by the person liable to pay tax under the Act;

(c) in relation to a vehicle or equipment mounted on a vehicle, the total of

- 30% for each year that the vehicle or equipment was used by the person liable to pay tax under the Act, and

- 2.5% for each 30-day period in a partial year that the vehicle or equipment was used by the person liable to pay tax under the Act;

(d) in relation to a vessel or equipment mounted on a vessel, the total of

- 15% for each year that the vessel or equipment was used by the person liable to pay tax under the Act, and

- 1.25% for each 30-day period in a partial year that the vessel or equipment was used by the person liable to pay tax under the Act;

(e) in relation to equipment, furnishings or affixed machinery not described in PSTR paragraph 10(3)(a), 10(3)(b), 10(3)(c) or 10(3)(d), the total of

- 20% for each year that the equipment, furnishings or affixed machinery was used by the person liable to pay tax under the Act, and

- 1.667% for each 30-day period in a partial year that the equipment, furnishings or affixed machinery was used by the person liable to pay tax under the Act.

Subsection 10(4) provides that for the purposes of PSTR subsection 10(3), depreciation must be determined separately for each item of equipment mounted on railway rolling stock, a vehicle or a vessel.

Subsection 10(5) provides that for the purposes of PSTR subsection 10(3), the use of tangible personal property by the person referred to in that subsection must be computed to the nearest 30-day period, with at least 15 days of use counted as one 30-day period.

Section 10.1 - Purchase Price Of Software If Bundled Purchase - Prescribed Programs

PSTR - SEC.10.1/Int.

References:

Act: Section 26

PSTERR: Section 1 "qualifying school"

Bulletin PST 315

Interpretation (Issued: 2014/09)

Effective April 1, 2013, B.C. Reg. 117/2014 adds PSTR section 10.1 which prescribes, for the purposes of subparagraph 26(4.1)(b)(i) of the Act, specific programs or activities.

Section 11 – Purchase Price Of Accommodation If Bundled Purchase With Meals

PSTR - SEC.11/Int.

References:

Act: Section 1 "accommodation", "meal", "purchase price"; Section 26

Bulletin PST 120

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 11 that for the purposes of subsection 26(6) [purchase price if bundled purchase] of the Act, the amount attributed to the purchase of accommodation is as follows:

(a) if accommodation without meals is also offered by the seller or the person from whom the accommodation is acquired, the purchase price at which accommodation without meals is offered;

(b) subject to PSTR paragraph 11(a), if accommodation with only one meal per day is also offered by the seller or the person from whom the accommodation is acquired, the purchase price at which the accommodation and one meal is offered;

(c) subject to PSTR paragraphs 11(a) and 11(b), if accommodation with 2 or more meals per day is also offered by the seller or the person from whom the accommodation is acquired, 60% of the purchase price at which the accommodation and meals are offered.

Part 2 — Tax Payment Agreements

Section 12 – When Director May Enter Into Agreement

PSTR - SEC.12/Int.

References:

Act: Section 1 "director", "lease", "registrant", "software", "tangible personal property", "use"; Section 32; Section 158; Section 158.1

PSTERR: Part 5

Bulletin PST 317

Interpretation (Issued: 2014/03; Revised: 2014/09, 2024/09)

Effective June 17, 2024, B.C. Reg. 137/2024 amends PSTR paragraph 12(1)(e) to clarify that the director specifies how an Application for Tax Payment Agreement (FIN 384) and any information required by the director must be submitted to the director (e.g., by mail, email, etc.).

Effective February 19, 2020, B.C. Reg. 244/2020 amends PSTR subparagraph 12(2)(b)(ii) to reference PSTA section 158.1 [Property used to improve real property situated outside British Columbia] in addition to PSTA section 158 [Property shipped out of British Columbia].

This amendment ensures the director may enter into a tax payment agreement if the person has, in the previous three calendar years, received a refund under PSTA section 158 or 158.1 on an average per calendar year of at least $125,000 worth of that property.

This change is consequential to amendments to PSTA sections 158 and 158.1 in the Budget Measures Act, 2020, which state that the director does not have to refund tax under section 158 if tax is required to be refunded under section 158.1 for the same tangible personal property. The amendments ensure there is no overlap between section 158 and section 158.1.

Effective April 1, 2013, B.C. Reg. 117/2014 amends PSTR section 12 to include references to "brought or sent into British Columbia, received delivery of in British Columbia".

The intent of this amendment is to ensure that a person is eligible to include machinery, equipment or software that they brought or sent into BC or received delivery of in BC, and not just machinery, equipment or software they purchased or leased, for the purposes of meeting the thresholds required under PSTR subsection 12(2).

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 12 the circumstances and the criteria that must be met for a person to enter into a tax payment agreement with the director under section 32 [tax payment agreements in relation to tangible personal property and software] of the Act.

Section 13 – Requirements When Making Purchases That Are Subject To Agreement

PSTR - SEC.13/Int.

References:

Act: Section 1 "collector", "director", "lease", "sale"; Section 32; Section 203

Bulletin PST 317

Interpretation (Issued: 2014/03; Revised: 2014/09)

Effective April 1, 2013, B.C. Reg. 117/2014 amends PSTR subsection 13(2) by striking out the reference to paragraph 32(3)(b) of the Act and replacing it with a reference to paragraph 32(3)(a) of the Act.

This amendment is consequential to an amendment to subsection 32(3) of the Act that was amended as part of Bill 8, Budget Measures Implementation Act, 2014.

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 13 the requirements that a person who has entered into a tax payment agreement with the director must meet when making exempt purchases under the agreement.

Section 14 – Prescribed Date for Payment of Tax Under Agreement

PSTR - SEC.14/Int.

References:

Act: Section 1 "eligible taxable service", "lease", "month", "reporting period", "software", "use"; Section 32; Section 60-66

Bulletin PST 317

Interpretation (Issued: 2014/03; Revised: 2014/09; Revised: 2022/12)

Effective June 4, 2022, B.C. Reg. 293/2022 amends PSTR section 14 to include the prescribed date for eligible taxable services and adds subsections for the purposes of differentiation. Subsections 14(1), 14(2), 14(3), 14(4) and 14(5) prescribe dates for remitting tax under agreement for the purposes of subsection 32(5) [tax payment agreement in relations to tangible personal property, software, and eligible taxable services], section 65 [estimate of hours or distance conveyance will travel] and section 66 [adjustment of tax] of the Act.

PSTR subsection 14(1) prescribes the date for paying tax on tangible personal property and software.

PSTR subsection 14(2) prescribes the date for paying tax on eligible taxable service.

PSTR subsection 14(3) specifies the number of months after which the tax must be self-assessed on unused goods, software and in relation to eligible taxable services.

PSTR subsection 14(4) prescribes that the tax to be paid under agreement on an estimate of hours or estimate of distance a conveyance used interjurisdictionally will travel is specified in subsection 14(1) or 14(2).

PSTR subsection 14(5) specifies the due date for the true-up return. (Refers to the adjustment of tax in relation to an estimate previously made for hours or distances a conveyance used interjurisdictionally anticipated to travel during a relevant period and reporting the actual number of hours or the actual distance travelled by the conveyance during that relevant period).

The intend of this amendment is to provide prescribed dates for self-assessing PST under a tax payment agreement owing on tangible personal property, software and eligible taxable service.

Effective April 1, 2013, B.C. Reg. 117/2014 amends PSTR section 14 to include references to "brought or sent into British Columbia, received delivery of in British Columbia".

The intent of this amendment is to ensure that the prescribed dates for self-assessing PST under a tax payment agreement applies to PST owing on TPP or software that is "brought or sent into British Columbia, received delivery of in British Columbia".

Effective April 1, 2013, B.C. Reg. 96/2013 adds PSTR section 14 that prescribes dates for the purposes of subsection 32(5) [tax payment agreements in relation to tangible personal property and software] of the Act.

Part 3 — Taxes in Relation to Tangible Personal Property

Division 1 — General

Section 15 – Documentation Requirements For Section 30 Of Act

PSTR - SEC.15/Int.

References:

Act: Section 1 "vehicle"; Section 30; Section 179

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 15 that for the purposes of paragraph 30(7)(b) [when tax is payable in respect of vehicles] of the Act, in relation to a person who alleges that tax has been levied in accordance with section 179 [collection and remittance of tax by collector] of the Act in respect of a vehicle, the Insurance Corporation of British Columbia is required to obtain a receipt, bill, invoice or other document that shows the tax as a separate item on the document.

Section 16 – Calculation And Payment Of Tax In Respect Of Vehicles Used In Petroleum Or Natural Gas Exploration Or Development

PSTR - SEC.16/Int.

References:

Act: Section 1 "registrant", "tangible personal property", "use"; Section 49; Section 51

Bulletin PST 115

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 16, in relation to the vehicles used in petroleum or natural gas exploration or development specified under subsection 51(8) of the Act, the amount of tax (1/36th) payable on those vehicles when brought into BC for temporary use, the prescribed period for calculating the tax, and the prescribed date for paying the tax.

Subsection 16(1) provides that in PSTR section 16, "month" has the same meaning as in the Interpretation Act.

Subsection 16(2) provides that for the purposes of paragraph 51(9)(a) [tax if tangible personal property brought into British Columbia for temporary use] of the Act, the amount of tax payable under subsection 51(3) of the Act in relation to tangible personal property is equal to 1/36th of the tax that would, but for section 51 of the Act, be payable under section 49 [tax if tangible personal property brought into British Columbia for use] of the Act by the person to whom section 51 of the Act applies in relation to the tangible personal property.

Subsection 16(3) provides that for the purposes of paragraph 51(9)(b) of the Act, the prescribed period is a month.

Subsection 16(4) provides that for the purposes of paragraph 51(9)(c) of the Act, the prescribed date for the payment of tax under subsection 51(3) of the Act by a person who is not a registrant is the last day of the calendar month after the month in which the property is used in British Columbia.

Section 17 – Prescribed Number Of Days For Section 53 Of Act

PSTR - SEC.17/Int.

References:

Act: Section 1 "tangible personal property"; Section 53

Bulletin PST 307

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 17 that for the purposes of section 53 [exemption if less than minimum threshold use in British Columbia] of the Act, the prescribed number of days is

(a) 41 days for barge-mounted cranes that have a lifting capacity of greater than 100 metric tonnes if those cranes are relieved, under the Vessel Duties Reduction or Removal Regulations (Canada), SOR/90-304, from customs duties, or

(b) 6 days for all other tangible personal property.

Section 18 – Prescribed Parts For Division 6 Of Part 3 Of Act

PSTR - SEC.18/Int.

References:

Act: Section 60; Section 63; Section 64

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 18 that for the purposes of subparagraph (b)(i) of the description of "BC usage" in subsections 60(2) [tax if conveyance purchased in British Columbia for interjurisdictional use], 63(3) [tax if conveyance brought into and used in British Columbia] and 64(2) [tax if change in use of conveyance acquired for resale] of the Act, the following parts are prescribed:

(a) an aircraft engine;

(b) an aircraft airframe.

Section 19 – Prescribed Jurisdictions For Section 70 Of Act

PSTR - SEC.19/Int.

References:

Act: Section 70

Bulletin PST 135

Interpretation (Issued: 2014/03; Revised: 2016/01)

Effective January 1, 2015, B.C. Reg. 80/2015 amended PSTR section 19. The amendment is strictly stylistic and ensures that PSTR section 19 conforms to linguistic conventions followed by the Legislative Counsel Office.

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 19 that for the purposes of subsection 70(2) [when tax under section 69 must be paid] of the Act, prescribed jurisdictions are those jurisdictions that are member jurisdictions in the International Registration Plan.

Section 19.1 - Travel Ratio

PSTR - SEC.19.1/Int.-R.4

References:

Act: Section 68 "travel ratio"; Section 69

PSTR: Section 19

Bulletin PST 135; Notice 2014-006

Interpretation (Issued: 2016/01)

Effective January 1, 2015, B.C. Reg. 80/2015 added PSTR section 19.1. This amendment coincides with the implementation of the "full reciprocity plan" (FRP) by the International Registration Plan.

PSTR subsection 19.1(1) defines a number of terms used in PSTR section 19.1.

PSTR subsection 19.1(2) provides for a reporting requirement that applies, in practical terms, to BC-plated carriers.

PSTR subsection 19.1(3) contains a rule for determining a travel ratio for a non-participating fleet. This rule brings the FRP concept of "average per-vehicle distance" into the multijurisdictional vehicle tax scheme, and replaces the rule found in paragraph 69(4)(a) of the Act as it read before the repeal of subsection 69(4) of the Act. See PSTR/Sec. 19.1/R.3.

PSTR subsection 19.1(4) contains a rule for the determination of a travel ratio for a participating fleet. This rule closely mirrors the rule found in paragraph 69(4)(b) of the Act as it read before the repeal of subsection 69(4) of the Act. See PSTR/Sec. 19.1/R.3.

R.1 Full Reciprocity Plan (Issued: 2016/01)

The FRP was implemented by the International Registration Plan on January 1, 2015.

Prior to the FRP, a licensee was required to indicate (to their jurisdictional licensing authority) their intention to travel in a participating jurisdiction, and the particular set of participating jurisdictions in which a licensee was authorized to operate would be printed on a cab card carried in the licensee's vehicle.

With the implementation of the FRP, a licensee is authorized to operate in all participating jurisdictions and is no longer required to specify a set of participating jurisdictions in which it intends to operate. The full list of participating jurisdictions is now included on all cab cards.

Tax changes related to the FRP are confined to the determination of the travel ratio (see PSTR/Sec. 19.1/R.3) and to the requirement to adjust tax paid under section 69 of the Act (see PSTA/Sec. 71/Int.).

R.2 Distance Reporting To ICBC (Issued: 2016/01)

PSTR subsection 19.1(2) requires carriers licensing in BC to report travel distances for the calculation year preceding their fleet licensing date. This rule ensures that ICBC has the data necessary to calculate travel ratios.

Under this rule, the carrier must report travel by all "vehicles in the fleet" during the relevant calculation year. This includes vehicles that were part of the fleet for all or part of the relevant calculation year, but which are no longer part of the fleet on the current fleet licensing date. For instance, if the fleet licensing date is March 1, 2015, the carrier must report distances for all vehicles associated with the fleet at any point during the July 1, 2013 to June 30, 2014 period, even if certain of those vehicles are no longer associated with the fleet.

R.3 Participating And Non-Participating Fleets (Issued: 2016/01)

Prior to the implementation of the FRP, travel ratios were based on (a) actual distances for fleets which held MJVs for at least 90 days during the relevant calculation year and (b) estimated distances for fleets which did not hold MJVs for at least 90 days during the relevant calculation year.

The International Registration Plan changed these rules with the implementation of the FRP. Both the 90 day threshold and the estimated distance concept were eliminated.

Under the FRP, there remains a binary rule for determining travel ratios. However, instead of using a 90 day threshold, the concepts embodied in the "participating fleet" and "non-participating fleet" terms determine which form of travel ratio applies to a vehicle.

A participating fleet is a fleet which, at any point during the relevant calculation year, contained a vehicle that (a) was licensed under prorate and (b) travelled in a prescribed jurisdiction. Note that BC is a prescribed jurisdiction under PSTR section 19. Therefore, even if a prorate-licensed vehicle only travelled in BC during the relevant calculation year, its fleet is a participating fleet. The travel ratio for a vehicle in a participating fleet is determined using actual distances as set out in PSTR subsection 19.1(4).

A non-participating fleet is a fleet that does not come within the definition of a participating fleet. The following are examples of non-participating fleets:

- A newly-formed fleet that did not operate during the relevant calculation year.

- A fleet that only held vehicles licensed for use solely within BC during the relevant calculation year.

- A fleet that held prorate-licensed vehicles for all or a portion of the relevant calculation year, but that did not accumulate any travel distances in any participating jurisdiction, including BC (for instance, as a result of having parked its vehicles while prorate-licensed).

The travel ratio of a vehicle in a non-participating fleet is determined using the industry-average calculation set out in PSTR subsection 19.1(3).

R.4 Reporting Year (Issued: 2016/01)

In order to calculate the form of travel ratio contemplated by subsection 19.1(3), ICBC produces a chart of average per-vehicle distances using information that it collects from licensing transactions on a calendar year basis. As a result, the term "reporting year" is precisely defined for BC to mean the calendar year before the current calendar year.

Other jurisdictions may use 12-month periods other than a calendar year to calculate the form of travel ratio contemplated by subsection 19.1(3). Therefore, the subsection 19.1(1) definition of "reporting year" includes a rule that permits this for jurisdictions other than BC.

Section 20 – Prescribed Date For Section 80.3 Of Act

PSTR - SEC.20/Int.

References:

Act: Section 1 "month", "registrant", "reporting period", "tangible personal property", "use"; Section 80.2; Section 80.3

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 20 that for the purposes of subsection 80.3(3) [tax on tangible personal property used to improve real property if contractor obtained refund] of the Act, the prescribed date is as follows:

(a) if the tax is payable by a person who is not a registrant and the tangible personal property is used so that it ceases to be personal property at common law before the contractor obtains a refund under section 80.2 [refund of tax paid by contractor under Division 5] of the Act in relation to the tangible personal property, the last day of the month after the month in which the contractor obtained the refund under section 80.2 of the Act in relation to the tangible personal property;

(b) if the tax is payable by a person who is not a registrant and the tangible personal property is not used so that it ceases to be personal property at common law before the contractor obtains a refund under section 80.2 of the Act in relation to the tangible personal property, the last day of the month after the month in which the tangible personal property is used in a manner such that the tangible personal property ceases to be personal property at common law;

(c) if the tax is payable by a registrant, the registrant’s reporting period is a period of one or more months and the tangible personal property is used so that it ceases to be personal property at common law before the contractor obtains a refund under section 80.2 of the Act in relation to the tangible personal property, the last day of the month after the end of the registrant’s reporting period in which the contractor obtained the refund under section 80.2 of the Act in relation to the tangible personal property;

(d) if the tax is payable by a registrant, the registrant’s reporting period is a period of one or more months and the tangible personal property is not used so that it ceases to be personal property at common law before the contractor obtains a refund under section 80.2 of the Act in relation to the tangible personal property, the last day of the month after the end of the registrant’s reporting period in which the tangible personal property is used in a manner such that the tangible personal property ceases to be personal property at common law;

(e) if the tax is payable by a registrant, the registrant’s reporting period is not a period of one or more months and the tangible personal property is used so that it ceases to be personal property at common law before the contractor obtains a refund under section 80.2 of the Act in relation to the tangible personal property, 30 days after the last day of the registrant’s reporting period in which the contractor obtained the refund under section 80.2 of the Act in relation to the tangible personal property;

(f) if the tax is payable by a registrant, the registrant’s reporting period is not a period of one or more months and the tangible personal property is not used so that it ceases to be personal property at common law before the contractor obtains a refund under section 80.2 of the Act in relation to the tangible personal property, 30 days after the last day of the registrant’s reporting period in which the tangible personal property is used in a manner such that the tangible personal property ceases to be personal property at common law.

Section 21 – Prescribed Provisions For Section 82.1 Of Act

PSTR - SEC.21/Int.

References:

Act: Section 82.1

PSTERR: Section 40; Section 46; Section 48; Section 49; Section 108

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 21 that for the purposes of paragraph 82.1(1)(a) [tax on parts or material if property containing parts or material used for new purpose] of the Act, the following provisions of the PSTERR are prescribed:

(a) PSTERR subsection 40(3) [printers and publishers];

(b) PSTERR subsection 46(3) [farmers];

(c) PSTERR subsection 48(3) [commercial fishers];

(d) PSTERR subsection 49(3) [aquaculturists];

(e) PSTERR section 108 [parts and materials].

Section 22 – Prescribed Provisions For Section 82.2 Of Act

PSTR - SEC.22/Int.

References:

Act: Section 82.2

PSTERR: Section 149; Section 151; Section 152

Bulletin PST 210

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 22 that for the purposes of paragraph 82.2(1)(a) [tax if conditions for exemption not maintained for specified period] of the Act, the following provisions of the PSTERR are prescribed:

(a) PSTERR section 149 [tangible personal property transferred between related corporations];

(b) PSTERR section 151 [tangible personal property transferred to new corporation – wholly owned and controlled];

(c) PSTERR section 152 [tangible personal property transferred to new corporation – not wholly owned and controlled].

Section 23 – Prescribed Date For Section 102 Of Act

PSTR - SEC.23/Int.

References:

Act: Section 1 "month", "registrant", "reporting period"; Section 102

Bulletin PST 315

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 23 that for the purposes of subsection 102(3) [tax on leased property occasionally supplied with operator] of the Act, the prescribed date for the payment of tax under subsection 102(1) or 102(2) of the Act is the following applicable date:

(a) if the tax is payable by a person who is not a registrant, the last day of the month after the month in which the person enters into the agreement;

(b) if the tax is payable by a registrant and the registrant’s reporting period is a period of one or more months, the last day of the month after the end of the registrant’s reporting period in which the person enters into the agreement;

(c) if the tax is payable by a registrant and the registrant’s reporting period is not a period of one or more months, 30 days after the last day of the registrant’s reporting period in which the person enters into the agreement.

Section 24 – Prescribed Provisions For Section 103 Of Act

PSTR - SEC.24/Int.

References:

Act: Section 103

PSTERR: Part 2; Part 5; Part 9

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 24 that for the purposes of paragraph 103(3)(d) [tax on subsequent purchase or lease after refund] of the Act, the following provisions of the PSTERR are prescribed:

(a) PSTERR Part 2 [Exemptions in Relation to Tangible Personal Property];

(b) PSTERR Part 5 [Production Machinery and Equipment];

(c) PSTERR Part 9 [Related Party Asset Transfers].

Division 2 — Change in Use of Motor Vehicle by Dealer or Manufacturer

Section 25 – Interpretation

PSTR - SEC.25/Int.

References:

Act: Section 1 "lease", "motor vehicle", "sale", "use"; Section 84.1

PSTR: Part 3 – Division 2; Section 26; Section 27; Section 28

Bulletin PST 117

Interpretation (Issued: 2014/03)

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 25 definitions and related interpretation rules for the purposes of PSTR Division 2 of PSTR Part 3.

Subsection 25(1) provides that in PSTR Division 2 [Change in Use of Motor Vehicle by Dealer or Manufacturer] of PSTR Part 3 [Taxes in Relation to Tangible Personal Property]:

"dealer" has the same meaning as in section 84.1 [tax if dealer or manufacturer changes use of motor vehicle] of the Act;

"dealer-use vehicle", in relation to a dealer, means a motor vehicle that is readily available for sale or lease by the dealer;

"donated vehicle" means a motor vehicle that

(a) is readily available for sale or lease, except while being provided to organizers or participants referred to in paragraph (b),

(b) is provided by the manufacturer or dealer, at the manufacturer or dealer's own expense, to organizers of or participants in a community event,

(c) is returned to the manufacturer or dealer at the conclusion of the event, and

(d) is, on return under paragraph (c), either returned to the sale or lease inventory of the manufacturer or dealer, or sold by the manufacturer or dealer;

"manufacturer" has the same meaning as in section 84.1 of the Act;

"parts delivery or shuttle vehicle", in relation to a dealer, means a motor vehicle that is readily available for sale or lease by the dealer and is used by the dealer to transport motor vehicle parts or the dealer's customers.

Subsection 25(2) provides that for the purpose of the definition of "dealer-use vehicle" in PSTR subsection 25(1), a vehicle is not readily available for sale or lease if the vehicle

(a) is dedicated to a specific use, including, without limitation, a vehicle used for racing or as a tow truck, or

(b) is not usually left on the business premises of the dealer during normal business hours.

Subsection 25(3) provides that for the purpose of the definition of "donated vehicle" in PSTR subsection 25(1), a vehicle is not readily available for sale or lease if the vehicle is not usually left on the business premises of the manufacturer or dealer during normal business hours when the vehicle is not being used during a community event.

Section 26 – Change In Use Of Motor Vehicle By Dealer

PSTR - SEC.26/Int.

References:

Act: Section 1 "lease", "month", "motor vehicle", "sale", "tangible personal property", "use", "vehicle"; Section 10; Section 84.1; Section 141

PSTR: Section 25 "dealer", "dealer-use vehicle", "donated vehicle", "parts delivery or shuttle vehicle"

Bulletin PST 117

Interpretation (Issued: 2014/03; Revised: 2021/02)

Effective March 1, 2020, B.C. Reg. 253/2020, amended sections 26(4) and 26(6) to include two new tax rates of 15% for motor vehicles with average vehicle value from $125,000 to $149,999.99 and 20% for motor vehicles with average vehicle value of $150,000 or greater. The amendment ensures that the PST rates on luxury vehicles in the dealer use formula are consistent with other PST rates on luxury vehicles.

Effective April 1, 2013, B.C. Reg. 96/2013 provides under PSTR section 26 the dealer use formulas, prescribed motor vehicles and prescribed uses of those motor vehicles for the purposes of subsections 84.1(2) and 84.1(3) of the Act.

Subsection 26(1) provides that in PSTR section 26, "business vehicle", in relation to a dealer for a month, means the following:

(a) a dealer-use vehicle that is used in the month only for a use prescribed under PSTR subparagraph 26(3)(a)(iii);

(b) a donated vehicle that is used in the month only for a use prescribed under PSTR paragraph 26(3)(b);

(c) a parts delivery or shuttle vehicle that is used in the month only for a use prescribed under PSTR paragraph 26(3)(c).

Subsection 26(2) provides that the following motor vehicles are prescribed for the purposes of subsections 84.1(2) and 84.1(3) [tax if dealer or manufacturer changes use of motor vehicle] of the Act:

(a) a dealer-use vehicle;

(b) a donated vehicle;

(c) a parts delivery or shuttle vehicle.

Subsection 26(3) provides that the following uses of a motor vehicle prescribed under PSTR subsection 26(2) are prescribed for the purposes of subsections 84.1(2) and 84.1(3) of the Act:

(a) in relation to a dealer-use vehicle, use in one or more of the following ways:

(i) by a dealer, or by an officer, salesperson or employee of the dealer, for any purpose related to the dealer's business as a motor dealer;

(ii) by a dealer, or by an officer, salesperson or employee of the dealer, for transportation between home and the dealer's place of business;

(iii) as a courtesy car;

(b) in relation to a donated vehicle, use by the organizers of or participants in a community event solely for use during the event;

(c) in relation to a parts delivery or shuttle vehicle, use only in one or both of the following ways:

(i) by a dealer, or by an officer, salesperson or employee of the dealer, to transport motor vehicle parts in the course of the dealer's business;

(ii) by a dealer, or by an officer, salesperson or employee of the dealer, to transport the dealer's customers while the customers' vehicles are being serviced in the course of the dealer's business.

Subsection 26(4) provides that for the purposes of subsections 84.1(2) and 84.1(3) of the Act, the amount of tax payable by a dealer in respect of the dealer-use vehicles that are used in a month only for a use prescribed under PSTR subparagraph 26(3)(a)(i) or 26(3)(a)(ii) is equal to the amount calculated by the following formula:

tax payable = 1.75% (average vehicle value x users x applicable percentage)

where

average vehicle value = the dealer's average vehicle value for the month as determined under PSTR subsection 26(5);

users = the number of the dealer's employees authorized to use dealer-use vehicles, other than courtesy cars, during that month;

applicable percentage = as follows:

(a) 7%, if the dealer's average vehicle value for the month is less than $55,000;

(b) 8%, if the dealer's average vehicle value for the month is $55,000 to $55,999.99;

(c) 9%, if the dealer's average vehicle value for the month is $56,000 to $56,999.99;

(d) 10%, if the dealer's average vehicle value for the month is $57,000 or more.

Subsection 26(5) provides that for the purposes of PSTR subsection 26(4), a dealer's average vehicle value for a month is equal to the amount determined by the following formula:

average vehicle value = total value /total vehicles

where

total value = the total of the following applicable amounts in respect of each vehicle that at the end of the month is in the dealer's sale or lease inventory for British Columbia in which the dealer-use vehicles are held:

(a) the total consideration paid for the vehicle by the dealer;

(b) the costs and expenses described in paragraph 10(2)(f) [original purchase price of tangible personal property] of the Act and incurred by the dealer in respect of the vehicle;

(c) the dealer's costs in manufacturing the vehicle;