Taxable areas for the speculation and vacancy tax

Only those owning property classed as residential and located in a designated taxable area in B.C. must complete a declaration for the speculation and vacancy tax. For a complete definition of "ownership," see Terms and definitions.

On this page

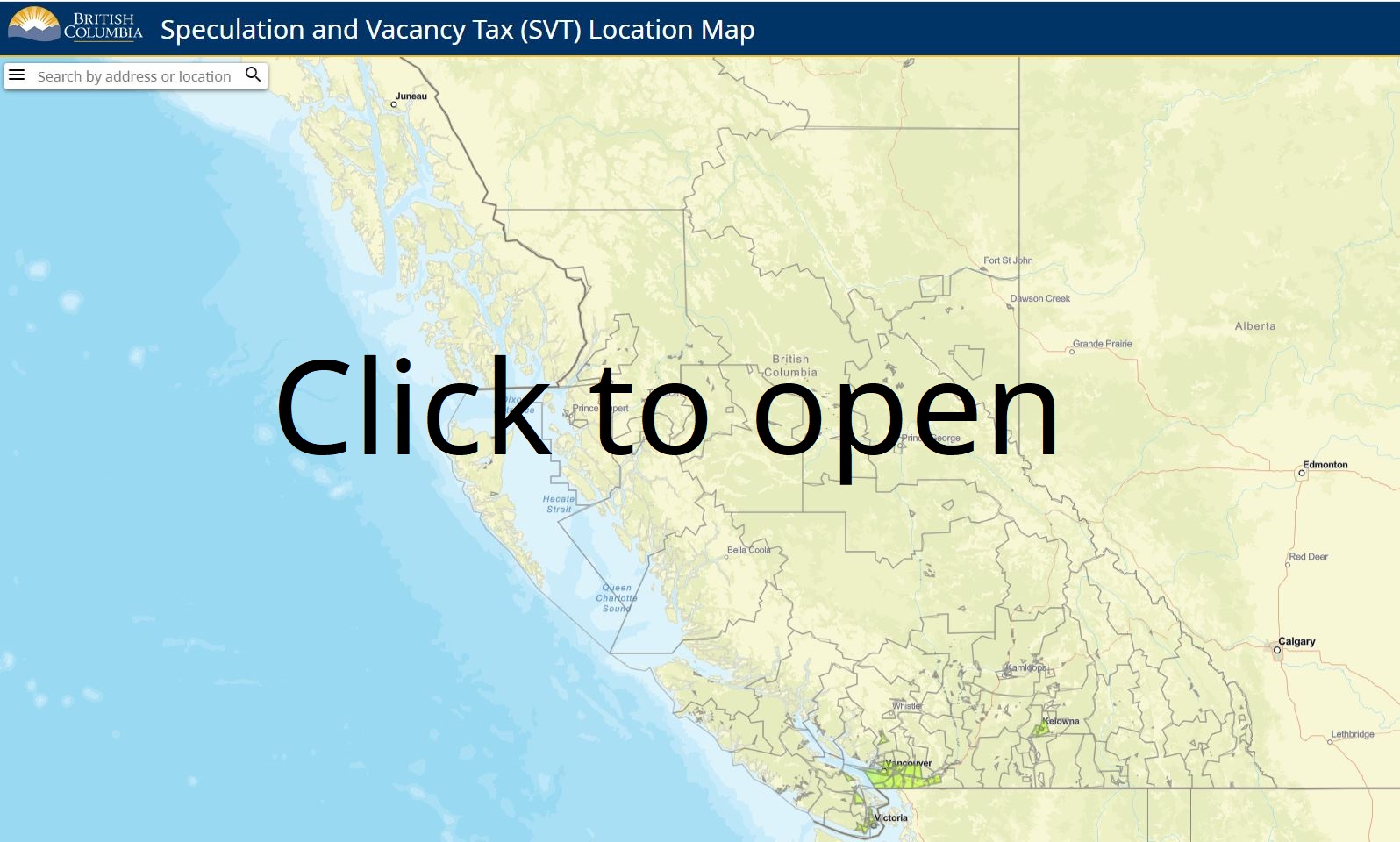

Speculation and vacancy tax location map

Use our interactive location map to find out if your property is in a designated taxable area.

Note: This map is for your convenience only. Refer to the legislation for details.

You can also use the Local Government Boundaries map to find out if your property lies within the boundaries of a specific municipality.

Find out when to expect your declaration letter.

Learn about excluded areas and other exclusions from the tax when your property is in a taxable area.

List of taxable areas

- City of Abbotsford

- City of Chilliwack

- City of Courtenay

- City of Duncan

- City of Kamloops

- City of Kelowna

- City of Nanaimo

- City of Parksville

- City of Penticton

- City of Salmon Arm

- City of Vernon*

- City of West Kelowna

- District of Coldstream

- District of Lake Country

- District of Lantzville

- District of Mission

- District of North Cowichan

- District of Peachland

- District of Squamish

- District of Summerland

- Town of Comox

- Town of Ladysmith

- Town of Lake Cowichan

- Town of Qualicum Beach

- Village of Cumberland

- Village of Lions Bay

*See Excluded areas.

Capital Regional District

- City of Colwood

- City of Langford

- City of Victoria

- District of Central Saanich

- District of Highlands

- District of Metchosin

- District of North Saanich

- District of Oak Bay

- District of Saanich

- District of Sooke

- Town of Sidney

- Town of View Royal

- Township of Esquimalt

Metro Vancouver Regional District

- City of Burnaby

- City of Coquitlam

- City of Delta

- City of Langley

- City of Maple Ridge

- City of New Westminster

- City of North Vancouver

- City of Pitt Meadows

- City of Port Coquitlam

- City of Port Moody

- City of Richmond

- City of Surrey

- City of Vancouver

- City of White Rock

- District of North Vancouver

- District of West Vancouver

- Township of Langley

- UBC lands

- University Endowment Lands

- Village of Anmore

- Village of Belcarra

Excluded areas

Reserve lands, treaty lands and lands of self-governing Indigenous Nations are not part of the taxable areas.

Islands that are accessible only by air or water are not part of the taxable areas, except for Vancouver Island.

The Predator Ridge resort in the City of Vernon is not part of the taxable areas.

This information is provided for your convenience and guidance and is not a replacement for the legislation.

Contact us if you have any questions about the speculation and vacancy tax or if you need translation services.