Transfers in the course of subdivisions

Transfers made in the course of subdivisions or to facilitate an amendment to a strata plan under the Strata Property Act may be exempt from property transfer tax if certain criteria are met.

Different exemptions are available for transfers made:

- Full exemption

- Partial exemption

If you do not meet the requirements for a full exemption, you may qualify for a partial exemption.

When calculating the fair market value to determine eligibility for a subdivision exemption, you may consider consulting with a professional appraiser. For calculation examples, see the sections below.

Transfers before a subdivision plan is filed at the land title office, also called preplan transfers, are not eligible for an exemption. For questions on preplan transfer, contact the PTTENQ@gov.bc.ca.

Full exemption

Subdivision of a single parcel

When a single parcel of land, registered in the name of one or more owners, is subdivided into smaller parcels, the transfer is exempt, if:

- The transferees of the new smaller parcels are the registered owners of the original parcel, and

- The transferees’ proportionate share of the fair market value of the land after the subdivision (calculated immediately after the subdivision) is not greater than their proportionate share of the total fair market value of the original parcel (calculated immediately before the subdivision)

Legislative reference: Section 14(3)(j) of the Property Transfer Tax Act

To claim this exemption, select exemption 34 – Subdivision – Single Lot on the property transfer tax return.

Subdivision of two or more adjacent parcels

To subdivide adjacent parcels of land, the registered owner(s) (original owners) must transfer the parcels to a trustee to facilitate the subdivision.

The transfer to the trustee is exempt if:

- The trustee is registered as a trustee under the Land Title Act,

- The transfer is to facilitate the subdivision of the original parcels, and

- After the subdivision plan has been registered, the trustee transfers all of the new smaller parcels created by the subdivision, back to the original owners, or to any one or more of them.

Legislative reference: Section 14(4)(k) of the Property Transfer Tax Act

The transfer of the new smaller parcels created by the subdivision from the trustee to the original owners or any one of them is fully exempt if:

- The transferees’ proportionate share of the fair market value of the land after the subdivision (calculated immediately after the subdivision) is not greater than their proportionate share of the total fair market value of the original parcels (calculated immediately before the subdivision)

Legislative reference: Section 14(4)(k.1) of the Property Transfer Tax Act

To claim this exemption, select exemption 10 – Subdivision – Multi Lot on the property transfer tax return.

Amendment to a strata plan

A transfer to facilitate an amendment to a strata plan is exempt if:

- The amendment of the strata plan is executed under the Strata Property Act, and

- The transferees’ proportionate share of the fair market value of all the parcels involved in the amendment (calculated immediately after the amendment) is not greater than their proportionate share of the fair market value of all the parcels before the amendment (calculated immediately before the amendment)

Legislative reference: Section 14(3)(p.3) of the Property Transfer Tax Act

To claim this exemption, select exemption 47 – Strata Plan - Amendment on the property transfer tax return.

Partial exemption

Subdivision of a single parcel

When a transferee’s proportionate share of the fair market value of the subdivided land, after the subdivision, is greater than the proportionate share of the fair market value of the land as immediately before the subdivision, the transfer may qualify for a partial exemption.

Property transfer tax is payable on the net increase in the proportionate share of the fair market value.

Legislative reference: Section 3(3.2) of the Property Transfer Tax Act

Subdivision of two or more adjacent parcels

If an original owner receives a greater proportionate share of the fair market value of the subdivided land than they had in the original parcels, property transfer tax is payable on the net increase in the proportionate share of the fair market value.

Legislative reference: Section 3(3.4) of the Property Transfer Tax Act

Trustee or 3rd party retain interest post subdivision

If a trustee retains a portion in any of the new smaller parcels after the subdivision, or, transfers any of the small parcels to someone other than the original owners (a 3rd party), there is no exemption available to the trustee or the 3rd party.

Property transfer tax is payable on the fair market value of the interest retained by either the trustee or acquired by the 3rd party or by both as a single taxable transaction.

Legislative reference: Section 3(3.3) of the Property Transfer Tax Act

Amendment to a strata plan

If an original owner receives a greater proportionate share of the fair market value than they had before the amendment, property transfer tax is payable only on the net increase in their proportionate share of the fair market value.

Legislative reference: Section 3(3.21) of the Property Transfer Tax Act

Calculation examples

(*FMV = fair market value)

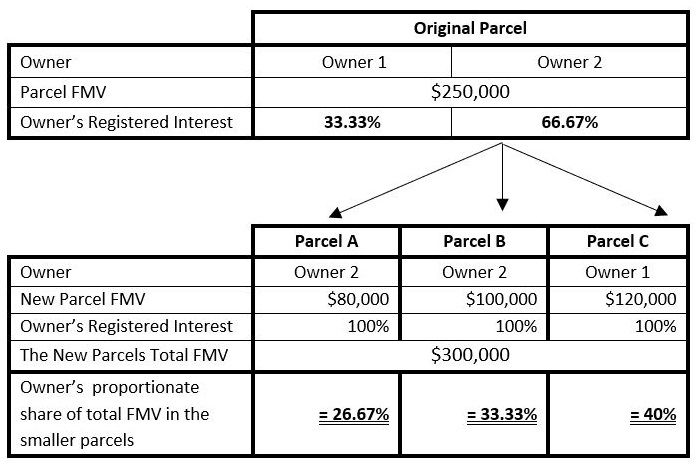

Single parcel subdivision

Each owners’ proportionate share after the subdivision is calculated as following:

The new parcel FMV divided by the total FMV of all the new parcels.

After the subdivision:

- Owner 2’s proportionate share of the fair market value of the new smaller Parcel A and Parcel B is 60% and did not increase (it went from 66.67% before the subdivision to 60% after the subdivision)

- Owner 1’s proportionate share of the fair market value of the Parcel C is 40% and it increased (it went from 33.33% before the subdivision to 40% after the subdivision)

Property transfer tax is payable on the net increase by Owner 1. To calculate the fair market value subject to property transfer tax payable, use the following formula:

|

FMV |

= |

(Total proportionate share of FMV of smaller parcels, as a percentage, immediately after subdivision |

— |

Proportionate share of FMV of original parcel, as a percentage, immediately before subdivision) |

× |

FMV of new parcels, calculated at time of transfer |

|---|

FMV subject to property transfer tax = (40% - 33.33%) × $300,000 = $20,010

Property transfer tax payable is $201.

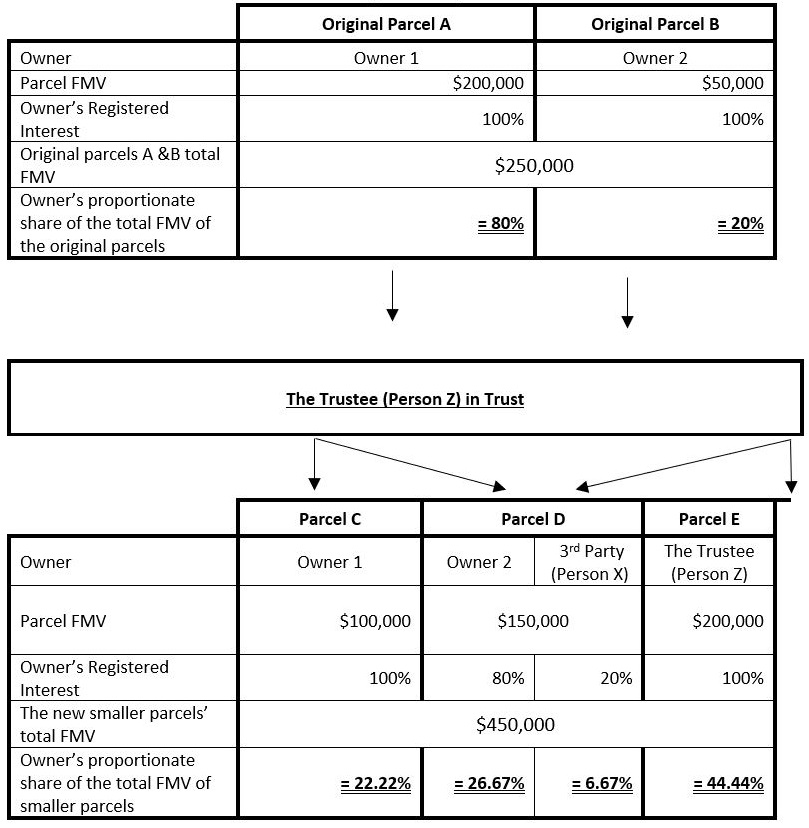

Subdivision of two or more adjacent parcels

To facilitate the subdivision, Owner 1 and Owner 2 transferred their interests in the Original Parcels A and B to the Trustee (Person Z) in trust to create the new smaller Parcels C, D and E.

After the subdivision, the Trustee (Person Z) transfers to:

- Owner 1 - 100% interest in Parcel C

- Owner 2 - 80% interest in Parcel D

- 3rd party (Person X) - 20% interest in Parcel D, and

- The trustee (Person Z) - 100% interest in Parcel E

Transfers post subdivision to trustee and 3rd party

The interests acquired by the trustee, the 3rd party and Owner 2 are taxable. The fair market value of the interest acquired by the Trustee (Person Z) is calculated using the following formula:

|

FMV |

= |

(3rd party’s proportionate share of FMV of smaller parcels, as a percentage, immediately after subdivision |

— | Trustee’s proportionate share of FMV of smaller parcels, as a percentage, immediately after subdivision) | × |

FMV of all original parcels, calculated immediately before subdivision |

|---|

FMV subject to property transfer tax for the Trustee = (6.67% + 44.4%) × $250.000 = $127,800

Property transfer tax payable is $1,278.

Transfers post subdivision to owner 1 and owner 2

After the subdivision:

- Owner 1’s proportionate share of the fair market value did not increase (it went from 80% before the subdivision to 22.2% after the subdivision). Owner 1 is fully exempt

- Owner 2’s proportionate share of the fair market value increased (i.e., it went from 20% before the subdivision to 26.67%, after the subdivision). Owner 2’s net increase in the proportionate share of the fair market value is taxable

To calculate the fair market value subject to property transfer tax payable by Owner 2, use the formula:

|

FMV |

= |

(Proportionate share of FMV of smaller parcels, as a percentage, immediately after subdivision |

— | Proportionate share of FMV of original parcels, as a percentage, immediately before subdivision) | × |

FMV of new parcels, calculated at time of transfer |

|---|

FMV subject to property transfer tax = (26.67% - 20%) × $450,000 = $30,015

Property transfer tax payable is $301.

Transfers post subdivision to 3rd party

The interest acquired by a 3rd party is a taxable transaction. The 3rd party pays tax on the fair market value of their registered interest in the parcel they acquire.

FMV subject to property transfer tax = 20% × $150,000 = $30,000

Property transfer tax payable is $300.

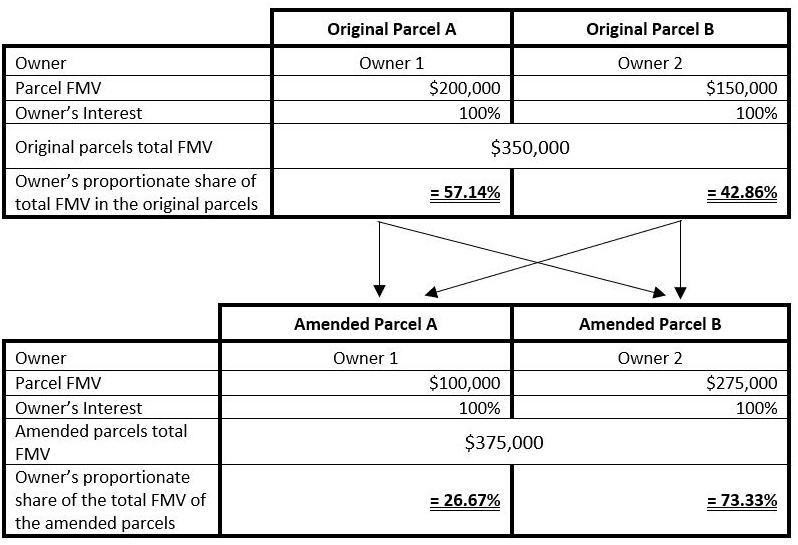

Amendment to a strata plan

After the amendment of the strata plan:

- Owner 1’s proportionate share of the fair market value of the Amended Parcel A did not increase (it went from 57.14% before the amendment to 26.67% after the amendment). Owner 1 is fully exempt

- Owner 2’s proportionate share of the fair market value of the Amended Parcel B increased (it went from 42.86% before the amendment to 73.33% after the amendment). Property transfer tax is payable on the net increase in the fair market value

To calculate the fair market value subject to property transfer tax payable by the Owner 2, use the formula:

|

FMV |

= |

(Proportionate share of FMV of amended parcels, as a percentage, immediately after amendment |

— | Proportionate share of FMV of original parcels, as a percentage, immediately before amendment) | × |

FMV of amended parcels at the time of transfer |

|---|

FMV subject to property transfer tax = (73.33% - 42.86) × $375,000 = $114,263

Property transfer tax payable by Owner 2 is $1,143.