1. Indirect control through a single intermediary

An individual must be listed as an interest holder on a transparency report if the individual controls a relevant intermediary which owns 10% or more of the shares or votes of the relevant corporation which has an interest in land.

An individual generally controls an intermediate entity or a person if they have the legal authority to direct the intermediate entity or person on how to exercise any of the rights that are attached to the shares of the relevant corporation.

On this page

- Indirect control through an intermediate agent

- Indirect control through intermediate trustee of a trust

- Indirect control through intermediate personal or legal representative

Because the right to elect, appoint or remove the directors of a corporation is often linked to share ownership, all the examples below assume that an individual holding more than 50% of the voting shares of a corporation will be able to elect or remove a majority of the directors.

It is possible for an individual to be given the right or ability to appoint or remove directors (separate from shares) under the articles of the corporation or through provisions in a shareholders’ agreement.

a. What do I do when a shareholder of my corporation is not a natural person?

Because natural persons can only be listed in a transparency report you will have to provide information about who controls that shareholder.

Control of intermediate corporation

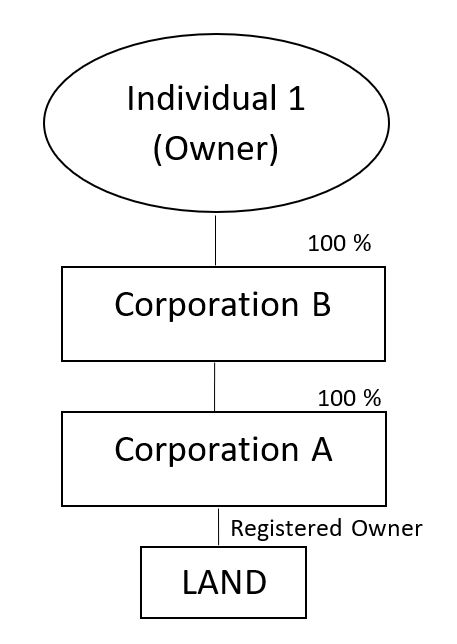

The simplest form of indirect control can be seen in this example below and is commonly referred to as a holding company, in which an individual holds shares of a corporation through a holding company rather than in their own name. In such case, you must ask who the shareholder of the holding company is and whether the shareholder controls the holding company (owns more than 50% of the voting shares).

Example 1 - Control of intermediate corporation

In the diagram above, Corporation A owns a parcel of land. Corporation B owns 100% of the shares of Corporation A so, as a result Corporation A is required to find the natural person that controls Corporation B. As the sole shareholder of Corporation B, Individual 1 has indirect control over Company A and must be listed as a corporate interest holder on Corporation A’s transparency report.

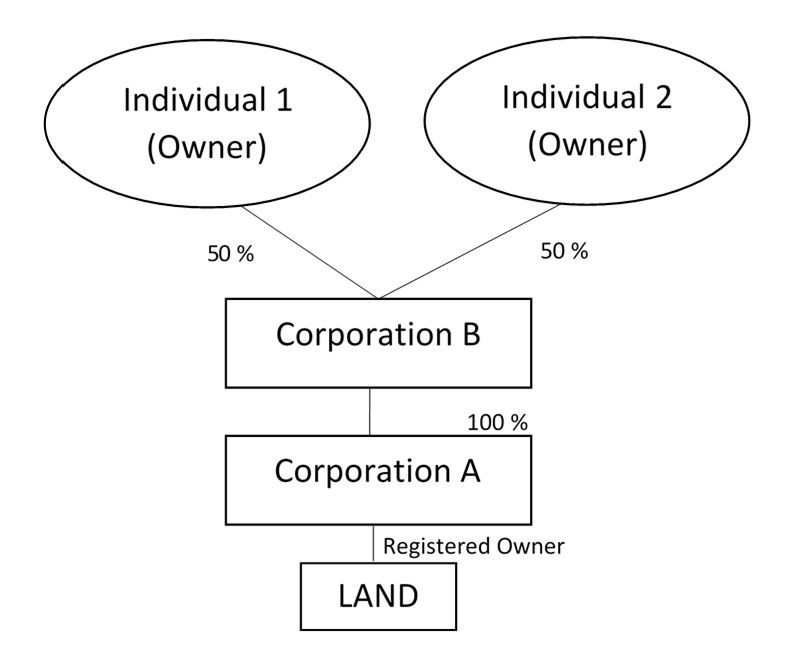

Example 2 - No control of intermediate company

If no one owns more than 50% of Corporation B’s shares and no one can otherwise appoint a majority of Corporation B’s directors, then no one controls Corporation B. If no one controls Corporation B, then no one indirectly controls the shares of Corporation A. Nobody is listed as an interest holder on Corporation A’s transparency report. However, the reporting body must include a statement on the transparency report indicating that there are no individuals who are interest holders.

In the diagram above, because neither of the two owners has the ability to elect, appoint or remove a majority of the directors on their own (they do not hold more than 50% of the shares and do not have any special right to appoint directors) and they are not acting in concert, they do not control Corporation B. As a result, Individual 1 and Individual 2 do not have indirect control of Corporation A. Nobody via Company B is listed as an interest holder of Corporation A’s land.

Note: Remember, once the test of control fails, it is no longer possible to have indirect control.

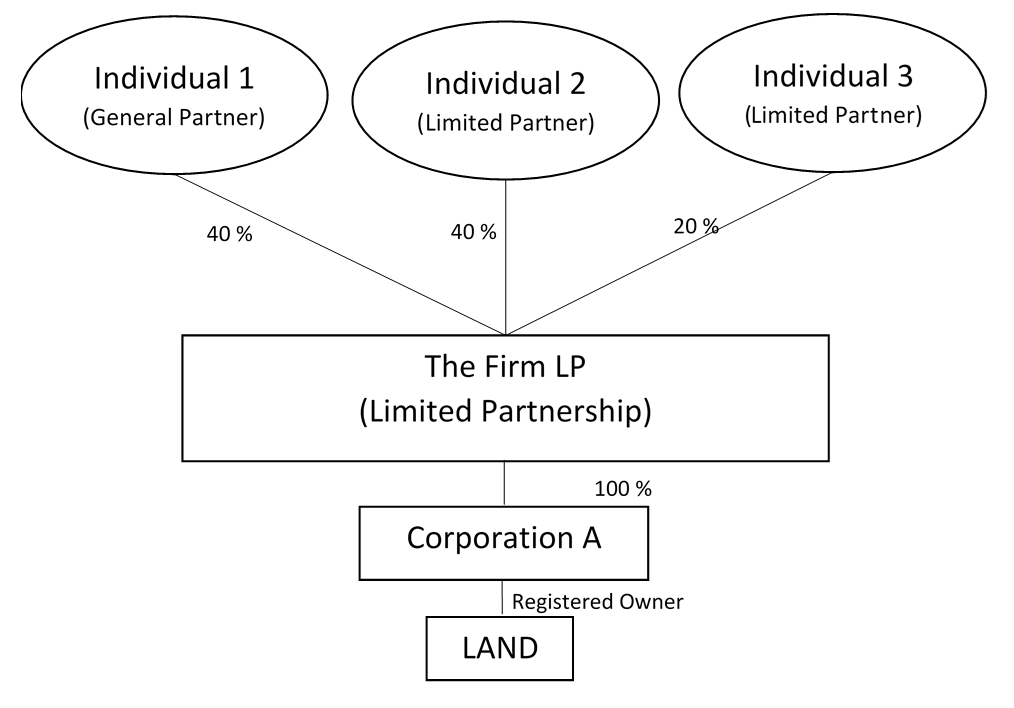

Control of intermediate partnership

Another simple example is indirect control through a partnership. If the shareholder of the corporation is a partnership, list all the general partners and non-limited partners as interest holders in your transparency report.

Limited partners must only be listed if they meet one of the following criteria:

- entitled to at least 25% of the profits of the partnership

- entitled to at least 25% of the assets of the partnership on windup

- has at least 25% of the votes in partnership management

- has the right to appoint or remove the majority of the partnership's management

The partnership agreement should be consulted in order to determine who, if anyone, meets the above criteria.

Example - Control of intermediate partnership

In the diagram above, Corporation A must look through to the partnership to determine who, if anyone has indirect control. Based on the rules of indirect control as they relate to partnerships, Individual 1 controls the partnership because Individual 1 is a general partner. Individual 2 also controls the partnership because Individual 2 is a limited partner entitled to at least 25% of the profits of the partnership. Individual 3, however, will not control the partnership because Individual 3 is a limited partner entitled to less than 25% of the profits of the partnership. As a result, both Individual 1 and Individual 2 are beneficial owners since they have indirect control of the shares of the corporation which owns land.

b. What do I do when a shareholder of my corporation is a natural person but is holding the votes or shares on behalf or for the benefit of another person?

If the shareholder holds shares of your corporation on behalf or for the benefit of another person, you will have to get information about who they hold the shares for and whether that person can tell them how to exercise the rights associated with those shares.

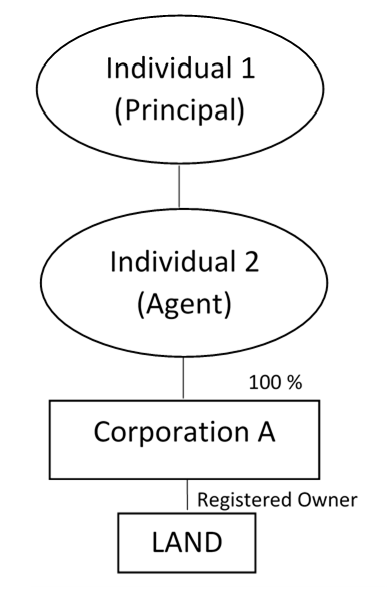

Indirect control through an intermediate agent

A good example is a registered owner who holds shares on behalf of the true owner. The registered owner is the agent and the true owner is the principal. By operation of law, the agent must follow the directions of the principal. So, it can be said that the principal controls the agent.

Example - Indirect control through an intermediate agent

In the diagram above, the Corporation A is owned by the agent who holds 100% of Corporation A’s shares on behalf of the principal. Individual 1, the principal, directs or has the right to direct how individual 2, the agent, exercises the rights attached to these shares. In other words, Individual 1 controls Individual 2. As a result, Individual 1 has indirect control of the shares or votes of Corporation A and must be listed as an interest holder on Corporation A’s transparency report.

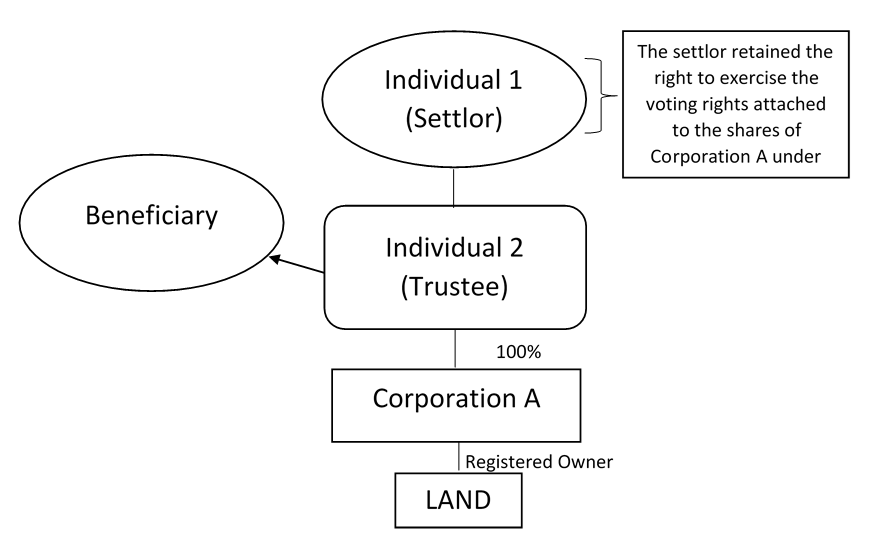

Indirect control through intermediate trustee of a trust

Another example is the trustee of a trust who owns shares of a corporation for the benefit of the beneficiaries of the trust. In most cases the trustee will have control over the property of the trust, including the rights associated with shares and therefore is a corporate interest holder.

However, the individual who set up the trust, known as the settlor, may have retained the right to control and direct the trustee in matters relating to the trust property, or may have given that right to a beneficiary. If the trustee is taking instructions from the settlor or beneficiary, that individual must also be listed in the transparency report.

Example - Indirect control through intermediate trustee of a trust

In the diagram above, the shares of Corporation A are held in trust for the benefit of the beneficiary. Under the trust instrument, Individual 1, the settlor, controls how the rights attached to Corporation A’s shares are to be exercised and must be listed as an interest holder in Corporation A’s transparency report. In this case, because the shares of Corporation A are owned directly by the trustee for the benefit of the beneficiary, both the trustee, as registered owner, and the beneficiary, as beneficial owner, should also be listed in the Corporation A’s transparency report.

Note: Where the shares of a corporation are not owned directly by the trustee of a trust for the benefit of a beneficiary, the beneficiary is not required to be listed in the transparency report.

Indirect control through intermediate personal or legal representative

In some cases, a personal or legal representative, such as an attorney or individual under a power of attorney, exercises the rights attached to the shares of the corporation which has an interest in land. The represented person must be listed as a corporate interest holder on the appropriate transparency report if the represented person:

- kept the legal authority to direct the representative as to how to exercise the rights attached to the shares, or

- has the ability to regain control of the voting rights, the represented person needs to be listed in the corporation’s register too

The terms of a representation agreement are generally such that a represented shareholder or rightsholder will keep actual control – or at least the ability to regain control – of how the rights attached to the shares of a corporation are to be exercised. As a result, it is almost always the case that the represented person will have to be listed in the transparency report.

This information is provided for your convenience and guidance and is not a replacement for the legislation.

For information about the Land Owner Transparency Registry, visit landtransparency.ca or the following quick links:

Contact information

For questions about filing, contact the administrator.

For other questions, contact the Ministry of Finance:

1-855-504-7889

LOTAENQ@gov.bc.ca