2. Indirect control through two or more intermediate entities or persons

In cases where there is more than one intermediary in the chain of intermediaries, you must continually look through this chain of intermediaries until you find the natural person at the top of the chain (corporate interest holder), or conclude there are no corporate interest holders with indirect control.

On this page

- Control of intermediate partnership

- Control of intermediate trustee of a trust

- Control of intermediate personal or legal representative

Under the Land Owner Transparency Regulation (PDF, 620KB), a chain of intermediaries exists when there are two or more intermediaries between the land-owning corporation and the corporate interest holder. An intermediate entity or person can be a:

- relevant corporation

- partnership

- agent

- trustee of a relevant trust

- personal or legal representative

a. What do I do when the corporation which owns the interest in land is at the end of a chain of ownership of subsequent corporations?

If the shares of the corporation which owns the interest in land are held through a chain of relevant corporations, you must obtain information on every intermediary in the chain until you identify the natural person at the top of the chain. Note that only the information about the natural person at the top of the chain (as well as the primary identification about the land-owning corporation) needs to be included in the transparency report.

Control of a chain of intermediate companies

The test for control of a company or corporation is the ability to elect or appoint a majority of the directors of the company or corporation. This ability can come through holding enough shares with votes (more than 50%) or through being given the right to appoint directors (separate from shares) in the articles or other shareholders’ agreements.

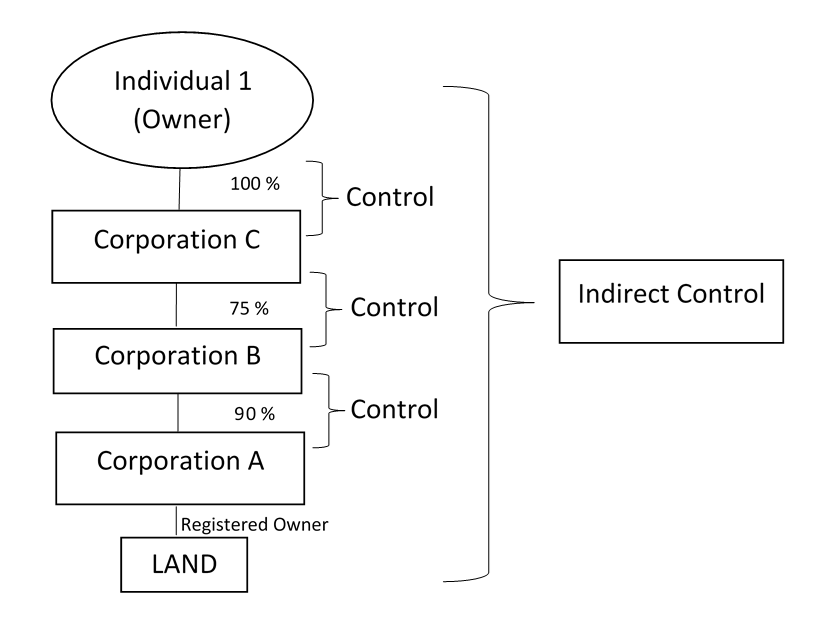

Example 1 - Control of a chain of intermediate companies

In the diagram above, there is an unbroken line of control from Individual 1 to Corporation A. As a result, Individual 1 has indirect control of over 10% of the shares of Corporation A and is therefore a corporate interest holder who must be listed in Corporation A’s transparency report.

Note: If the test of control is not met at every link in the chain, then there is no indirect control as defined in the legislation. See example below.

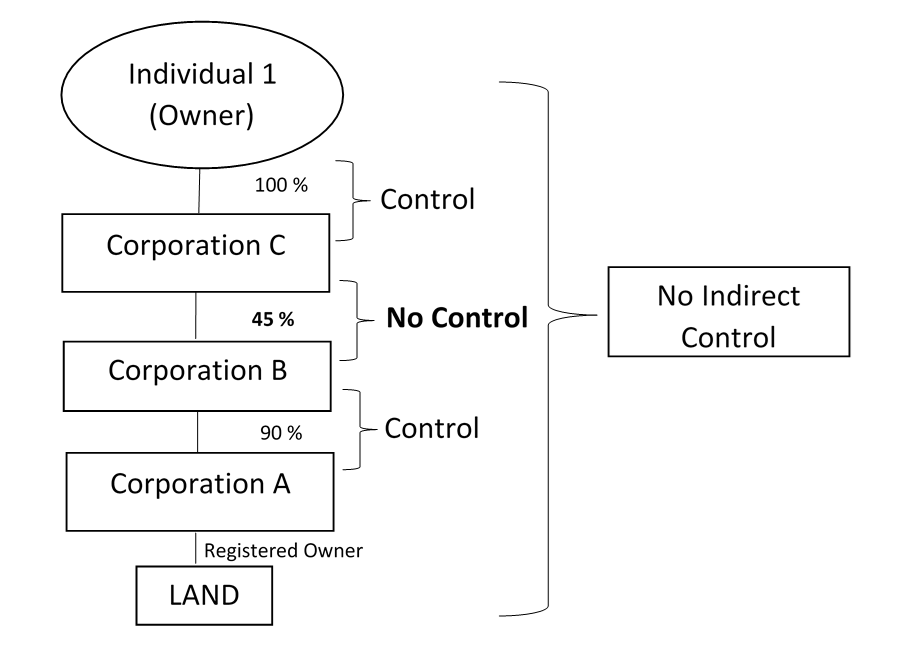

Example 2 - No control of a chain of intermediate companies

b. What do I do when an intermediate entity or person in the chain of intermediaries is a partnership, an agent, a trustee of a trust, or a personal or legal representative?

It is possible for a partnership, an agent, a trustee of a trust or a personal or legal representative to be an intermediary in a chain of intermediaries.

Each of these types of intermediary has its own test of control set out in the Land Owner Transparency Regulation.

Control of intermediate partnership

The shares of a corporation can be held by a partnership. Every general partner and non-limited partner in the partnership is considered to control the partnership.

Limited partners are considered to control the partnership if they meet one of the following criteria:

- Entitled to at least 25% of the profits of the partnership

- Entitled to at least 25% of the assets of the partnership on windup

- Have at least 25% of the votes in partnership management

- Have the right to appoint or remove the majority of the partnership's management

The partnership agreement should be consulted in order to determine who, if anyone, meets the above criteria.

If the partner controls the partnership and is a corporation then you will need to apply the test for control of a corporation described above to determine who, if anyone, controls the corporate partner.

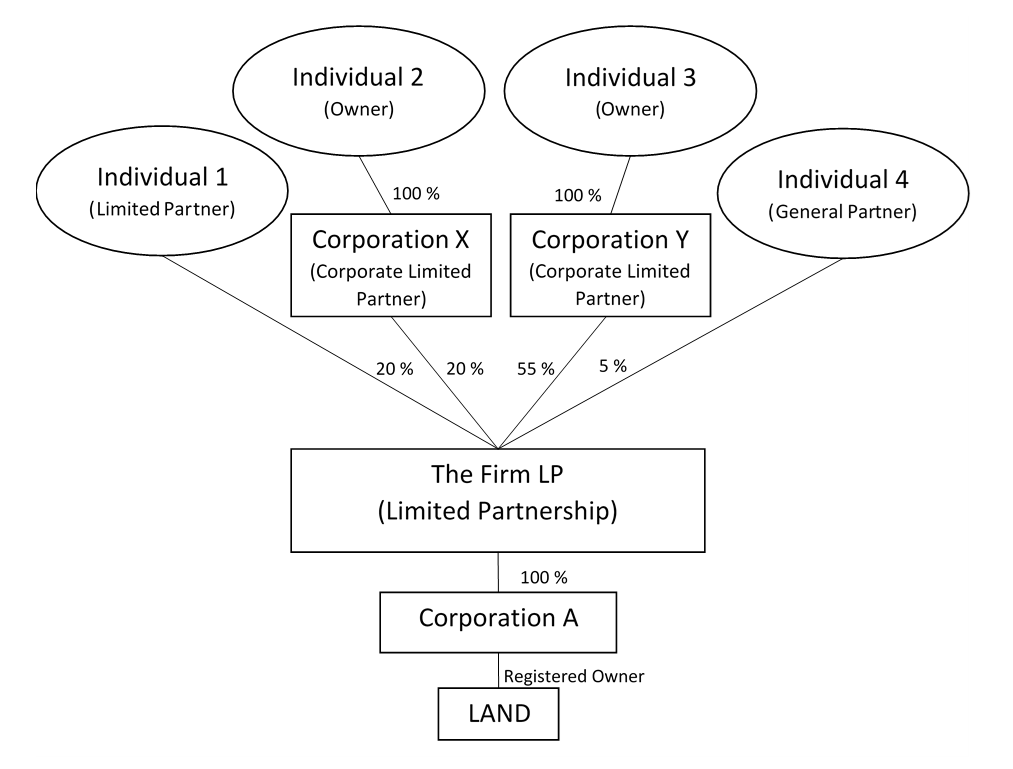

Example - Control of intermediate partnership

In the diagram above, Individual 1 does not control the partnership because Individual 1 is a limited partner entitled to less than 25% of the profits of the partnership. Individual 4 controls the partnership because Individual 4 is a general partner.

Corporation X does not control the partnership since Corporation X is a limited partner entitled to less than 25% of the profits of the partnership. As a result, the chain of control does not continue from the partnership through to Individual 2.

Corporation Y does control the partnership since Corporation Y is a limited partner entitled to at least 25% of the profits of the partnership. Since Individual 3 controls Corporation Y, Individual 3 controls the partnership as well and has indirect control of the shares of the corporation.

Overall, Individual 4 and Individual 3 are both corporate interest holders of Corporation A by having indirect control of the shares of Corporation A which owns an interest in land.

Control of intermediate trustee of a trust

A trustee is the legal owner of trust property that is held “in trust” for others (the beneficiaries). As a result, the trustee controls the trust property. Trustees of a trust will typically hold the control of the voting rights, shares or right or ability to elect, appoint or remove directors of a private company.

If the trustee is a corporation then you will need to apply the test for control of a corporation described above to determine who, if anyone, controls the trustee.

It is also possible that the instrument creating the trust may provide this control to another individual or group of individuals, such as the settlor. For example, the terms of the trust may specify an individual with the power to direct how the trustee is to exercise:

- Any of the rights of the property

- Any right to elect directors

- Control over an intermediary

If any of the above is true, then that individual is also considered to control the trustee. That individual should also be listed on the transparency report, along with the trustee.

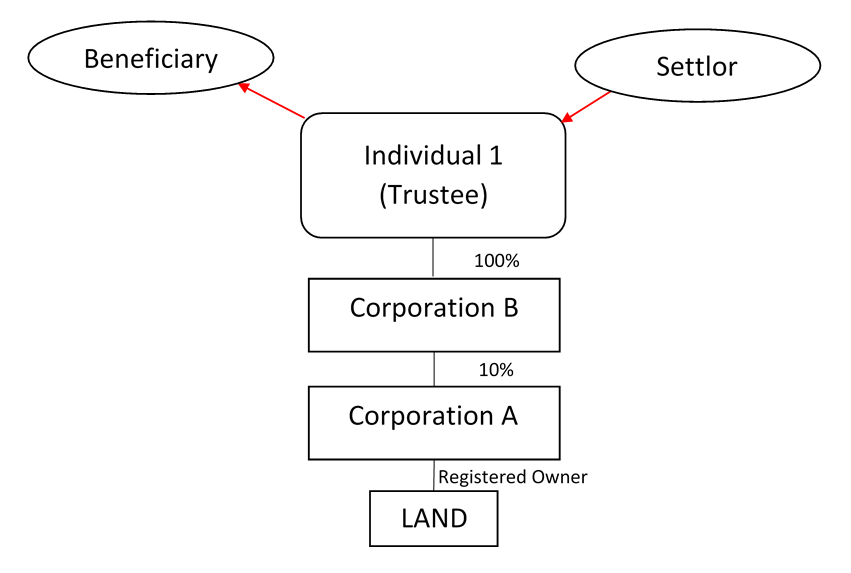

Example - Control of intermediate trustee of a trust

In the diagram above, Individual 1, (the trustee), controls Corporation B. Corporation B holds 10% of the shares of the Corporation A (which owns the interest in land). As a result, Individual 1 has indirect control of 10% of the shares or votes of Corporation A and must be listed in the transparency report. (In this example, the trustee is listed as a corporate interest holder with indirect control, but not as a registered owner. The trustee is the registered owner of Corporation B, not a registered owner of the Corporation A.)

The beneficiary and the settlor are not considered to control the trustee, unless there is evidence in the instrument creating the trust that they can direct how the trustee is to exercise control over Corporation B. The beneficiaries do not need to be listed in the Corporation A’s transparency report.

Note: Where the trustee of a relevant trust is the registered owner of an interest in land, reporting bodies should refer to the refer to the section of the Act that relate to transparency reports filed by the trustee of a relevant trust.

Control of intermediate personal or legal representative

A person can appoint a personal or other legal representative, such as an attorney under a power of attorney, to represent or act for them with respect to their property. The represented person retains legal ownership but delegates control of the property to another. For instance, an individual can appoint their spouse as their representative to exercise their voting rights in the family business in case they are unable to do so themselves, or otherwise become incapacitated. The incapacitated individual legally retains ownership, but the individual's spouse now exercises the voting rights in the business.

Just like the trustee of a trust, the personal or legal representative is considered to control the property they hold on behalf of another person, including the rights attached to the shares of a corporation. Therefore, the personal or legal representative must be listed as a corporate interest holder in the corporation’s transparency report.

It is generally the case that the representation agreement will not provide the personal or legal representative with full control of the rights attached to the shares of the company with no direction from the represented person. In such a case, both the represented person and the personal or legal representative must be listed in the transparency report.

This information is provided for your convenience and guidance and is not a replacement for the legislation.

For information about the Land Owner Transparency Registry, visit landtransparency.ca or the following quick links:

Contact information

For questions about filing, contact the administrator.

For other questions, contact the Minister of Finance:

1-855-504-7889

LOTAENQ@gov.bc.ca