Cost of natural gas for the natural gas tax credit

A qualifying corporation’s eligible cost of natural gas notionally acquired for a taxation year is used to determine the natural gas tax credit amount they’ll receive for that taxation year.

If a corporation owns natural gas immediately after it passes through the inlet meter at a major liquefied natural gas (LNG) facility, the corporation is deemed to have purchased (notionally acquired) that natural gas at that LNG facility inlet meter.

The corporation must maintain monthly records to calculate the cost of natural gas notionally acquired at each LNG facility inlet meter. Your natural gas tax credit application will require the data elements listed under Recording the cost of natural gas.

Record separate cost of natural gas calculations for each major LNG facility and each partnership.

Partnerships

The partnership calculates the partnership's annual natural gas tax credit based on the cost of natural gas notionally acquired. The cost is calculated monthly, by facility for the entire partnership. The partnership allocates a portion of the annual natural gas tax credit to partners. Partners may need access to partnership monthly records to help complete the partner's natural gas tax credit application.

Each qualifying corporation that is a partner of the partnership may include their share of the tax credit for the fiscal year of the partnership that ends within the corporation's taxation year.

A letter from the partnership must be provided to confirm the partner’s portion of the tax credit from the partnership. The letter must provide:

- Partnership name

- Partnership fiscal period end date

- Partner name

- Facility name

- Total annual natural gas tax credit by facility, and

- Annual natural gas tax credit by facility for the partner

Calculating the cost of natural gas

The notional cost of natural gas notionally acquired in a month by a qualifying corporation is determined by the formula:

Energy content

× (times)

Fuel and losses adjustment

× (times)

Reference price

+ (plus)

Transportation cost

Energy content

Energy content is the volume of natural gas notionally acquired in the month at the LNG facility inlet meter for the major LNG facility, multiplied by the heating value of that natural gas as determined at the LNG facility inlet meter.

Fuel and losses adjustment

The fuel and losses adjustment is 100% plus the corporation’s pipeline fuel and losses adjustment (PFLA) for the month for the major LNG facility.

PFLA is the pipeline fuel and losses rate on the feedstock pipeline.

If the PFLA is 2%, then the fuel and losses adjustment is 102%.

The feedstock pipeline is the portion of a natural gas pipeline from and including the feedstock pipeline inlet to a major LNG facility inlet meter.

The feedstock pipeline inlet is a meter station that is in B.C. on a natural gas pipeline and is designated by regulation for a major LNG facility.

Currently, no feedstock pipeline inlets are designated by regulation. We recommend you subscribe to our tax updates to get alerts to changes.

Calculating the pipeline fuel and losses adjustment (PFLA)

PFLA is calculated by each qualifying corporation based on the actual difference between the feedstock pipeline inlet volume and the LNG facility inlet volume (adjusted for change in line pack or draft). Purchases made at, or downstream of, the feedstock pipeline inlet will be recognized.

The PFLA ensures that qualifying corporations receive credit for gas that is lost between the feedstock pipeline inlet and the LNG facility inlet meter.

Use the following formula to calculate the PFLA:

Volume variance

÷ (divided by)

Adjusted LNG facility inlet volume

× (times)

100%

Volume variance = Feedstock pipeline inlet volume + acquisitions in the feedstock pipeline or at the LNG facility inlet meter - dispositions in the feedstock pipeline or at the LNG facility inlet meter - change in inventory in the feedstock pipeline - LNG facility inlet volume

Adjusted LNG facility inlet volume = Volume of natural gas notionally acquired + the volume of natural gas disposed in the month at the LNG facility inlet meter + the volume of natural gas disposed while in the feedstock pipeline

Volumes of fuel “taken in kind”, associated with shrinkage or compressor fuel included in the calculation of the pipeline fuel and losses adjustment cannot be included in transportation costs.

Reference price

The reference price is the fair market price of natural gas at the reference point.

The reference point is Compressor Station 2 located at 55°38'54.76"N 122°12'30.70"W on the natural gas pipeline known as the Westcoast Transmission System.

The reference price is a per gigajoule price and is determined monthly by the ministry charged with the administration of the Petroleum and Natural Gas Act. The reference price will be based on appropriate market indices that reflect the value of natural gas at the reference point.

Monthly reference prices are required to prepare your monthly cost of gas calculations.

We anticipate reference prices for the tax credit will be available soon. We recommend you subscribe to our tax updates to get alerts to changes.

Transportation costs

Allowable transportation costs incurred by a qualifying corporation may be used to calculate the cost of notionally acquired natural gas delivered to a major LNG facility inlet meter.

Non-allowable transportation costs may not be used to determine the cost of notionally acquired natural gas.

Allowable natural gas transportation costs

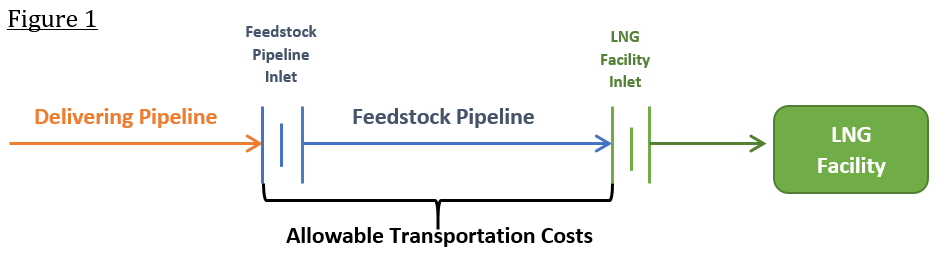

Allowable transportation costs include costs incurred by the qualifying corporation for the delivery of natural gas at or downstream of the feedstock pipeline inlet meter to the point where the natural gas is delivered to the LNG facility inlet meter. (Figure 1)

Transportation costs paid to transport natural gas in excess of the volume of the notionally acquired natural gas at the LNG facility inlet meter must be adjusted to ensure that the transportation cost claimed is only in respect of the volume measured at the LNG facility inlet meter.

Types of natural gas transportation costs

Qualified corporations may enter into different types of natural gas transportation arrangements. Allowable transportation costs may include one or more of the following:

-

Firm Service Demand Charge – This arrangement provides the shipper with a certain capacity to ship gas through the feedstock pipeline. Under this type of arrangement, the shipper pays for the entire contracted capacity, regardless of whether the capacity is used. The entire demand charge of the firm service is considered an allowable transportation cost unless the corporation has recovered any portion of this cost from another party or a portion relates to future capacity. Recovered transportation costs reduce the total amount of transportation cost.

-

Interruptible Service Toll – This arrangement provides the shipper with capacity on a best-efforts basis. Under this type of arrangement, the shipper pays a toll only for the volume of natural gas shipped on the pipeline.

-

Authorized Over-run Service Charges – This cost is incurred when volumes are shipped in excess of contracted firm service capacity.

-

Delivery – Certain pipelines charge shippers at the point where natural gas is removed from the pipeline or at the delivery meter.

-

Carbon Tax and Motor Fuel Tax – Carbon tax and motor fuel tax paid in relation to natural gas consumed along the feedstock pipeline.

-

Pipeline compressor fuel charge – Allowable only where fuel is not provided in kind.

-

Other surcharges – If surcharge is required to transport natural gas through a feedstock pipeline (e.g., abandonment surcharge).

Non-allowable transportation costs

Transportation costs that are not allowable include:

-

Compressor fuel taken in kind

-

Costs incurred for transportation upstream of the feedstock pipeline inlet (delivering pipeline costs)

-

Costs incurred for transportation at or downstream of the LNG facility inlet meter

-

Optional services provided by the pipeline owner that are not for transporting natural gas through a feedstock pipeline (e.g., CO2 removal, storage, measurement)

-

Firm service fees for priority rights on future pipeline expansions or related pre-development costs

-

Prepaid charges or refundable deposits not relating to current transportation of notionally acquired natural gas

Recording the cost of natural gas

The qualifying corporation must maintain monthly records to calculate the cost of natural gas notionally acquired at each major LNG facility inlet meter. Records will need to include the following data elements each month by facility. These monthly data elements will be required to complete your natural gas tax credit application in eTaxBC:

- LNG facility inlet volume

Note: LNG facility inlet volume refers to the volume of natural gas notionally acquired in the month by the corporation at the LNG facility inlet meter for the major LNG facility

- Feedstock pipeline inlet volume

- Acquisitions (in the feedstock pipeline or at the LNG facility inlet meter)

- Dispositions (in the feedstock pipeline or at the LNG facility inlet meter)

- Change in inventory month-to-month in the feedstock pipeline

- Volume of natural gas disposed at the LNG inlet meter

- Volume of natural gas disposed while in the feedstock pipeline

- Monthly transportation costs

- Monthly heating value of LNG facility inlet volume

Required units of measure and rounding:

- Natural gas volumes – megaliters (103m3), rounded to one decimal place

- Heating values (GJ/103m3) rounded to two decimal places

Contact information

Contact us with your questions about the natural gas tax credit.

1-877-387-3332

250-387-3332