Employer health tax examples of associated employers

Employer relationships and control influence how the association rules apply to employers who may be subject to the employer health tax in B.C. The following examples demonstrate how employers may be associated for the purpose of the tax.

On this page:

Relationships

For the purpose of applying the association rules for the employer health tax, relationships are defined as follows:

Related individuals

Individuals can be related by blood, marriage, or adoption. For tax purposes, you are related to your

- spouse or common‑law partner,

- parents and children and in‑laws,

- siblings and in‑laws,

- grandparents and in‑laws, and

- grandchildren.

However, you are not related to your uncles, aunts, nieces, nephews and cousins.

Related group

Related group is defined as a group of people, with each member related to every other member of the group.

For example, three brothers form a related group.

A group consisting of a son, father, and brother of the father does not form a related group, because an uncle and a nephew are not considered to be related for tax purposes.

Control

For the purpose of applying the association rules for the employer health tax, control means, “controlled directly or indirectly in any manner whatever”.

To determine whether one employer may control another employer, the following factors are examined in respect of share ownership:

- Whether a person owns enough shares to give him or her a majority of the votes.

- Whether a person has direct or indirect influence that, if exercised, would result in control of the employer. For example, the ability to cause the employer to change the board of directors, or to make decisions relating to vital actions of the employer, would result in control of the employer. A potential influence, even if it is not actually exercised, would be sufficient to result in control in fact. Control can occur regardless of share ownership.

- Whether a person owns more than 50% of the fair market value of all shares, regardless of whether or not these shares have voting rights.

Control may also exist where one person or group of persons are able to exert control over another person or group of persons. Examples include:

- The percentage of ownership of voting shares (when such ownership is less than 50%)

- Ownership of a large debt of an employer that may become payable on demand (unless exempted by subsection 256(3) or (6) of the Income Tax Act (Canada)) or a substantial investment in retractable preferred shares

- Shareholder agreements including the holding of a casting vote

- Commercial or contractual relationships of the employer, such as, economic dependence on a single supplier or customer

- Possession of a unique expertise that is required to operate the business

- The influence that a family member, who is a shareholder, creditor, supplier, etc., of an employer, may have over another family member who is a shareholder of the employer

Examples of associated employers

The following examples illustrate each paragraph of section 256(1) of the Income Tax Act (Canada) as it relates to the employer health tax in B.C.

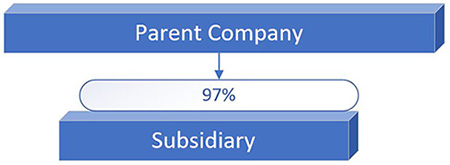

Section 256(1)(a)

One corporation controls another corporation.

For example, a parent company owns 97% of a subsidiary.

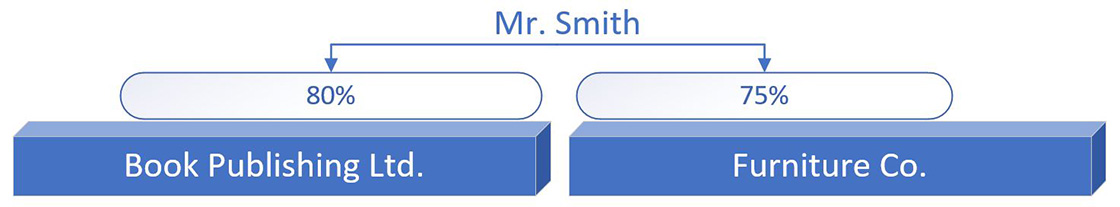

Section 256(1)(b)

Two corporations are controlled by the same person.

For example, Mr. Smith owns 80% of Book Publishing Ltd. and 75% of Furniture Co.

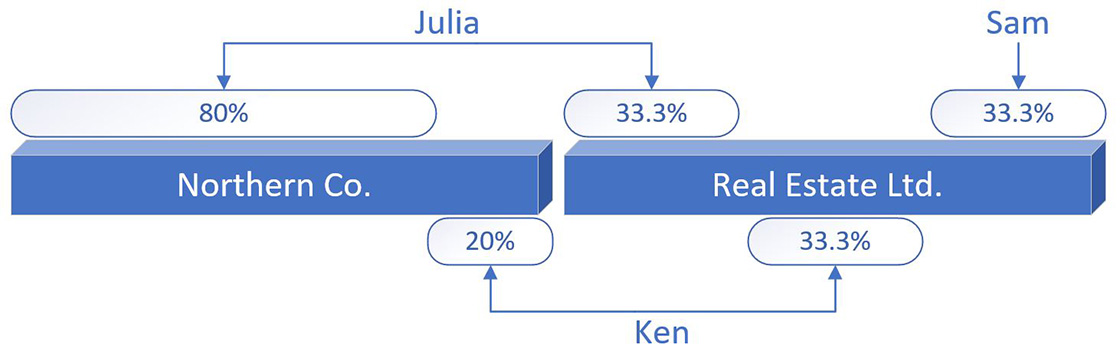

Or two corporations are controlled by a group of persons.

For example, Julia owns 80% of Northern Co. and 33.3% of Real Estate Ltd., while Ken owns 20% of Northern Co. and 33.3% of Real Estate Ltd., and Sam owns 33.3% of Real Estate Ltd.

In this example, both Northern Co. and Real Estate Ltd. are controlled by the group of Julia and Ken.

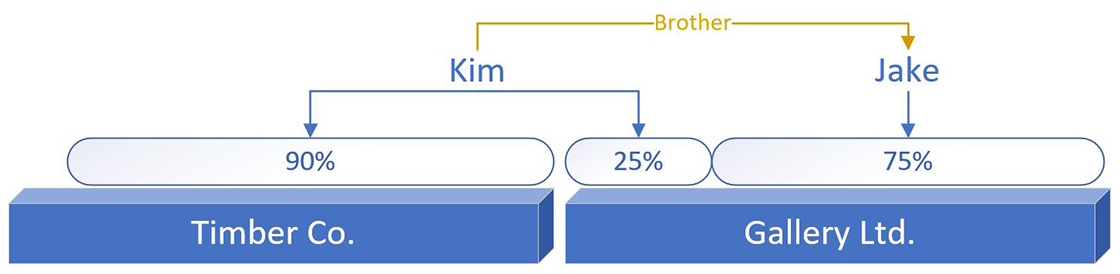

Section 256(1)(c)

Each corporation is controlled by a different person and they are related. One of them owns at least 25% of any class of shares of each corporation (other than shares of a specified class).

For example, Kim owns 90% of Timber Co. and 25% of Gallery Ltd, while her brother, Jake, owns 75% of Gallery Ltd.

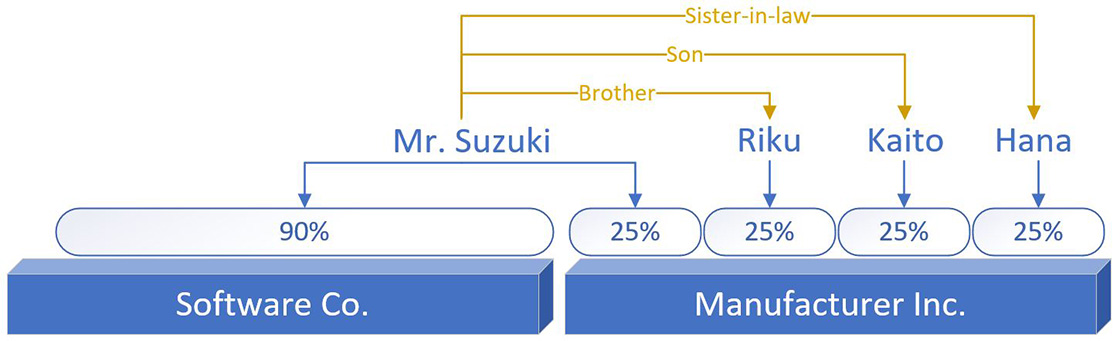

Section 256(1)(d)

One corporation is controlled by one person, and that person is related to all members of the group that controls the other corporation. That one person also owns at least 25% of the shares of the other corporation (other than shares of a specified class). It is not necessary that the members of the group be related to each other.

For example, Mr. Suzuki owns 90% of Software Co. and 25% of Manufacturer Inc. Riku (Mr. Suzuki’s brother), Kaito (Mr. Suzuki’s son) and Hana (Mr. Suzuki’s sister-in-law) each own 25% of Manufacturer Inc.

In this example, Mr. Suzuki controls Software Co., owns at least 25% of Manufacturer Inc., and is related to all members of the group that controls Manufacturer Inc. Therefore Software Co. and Manufacturer Inc. are associated employers. The relationship between Riku, Kaito and Hana is irrelevant for the purpose of this determination.

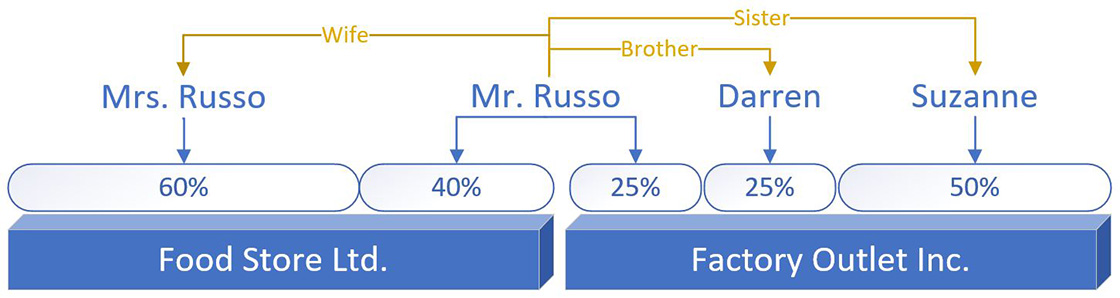

Section 256(1)(e)

Each corporation is controlled by a different related group, with all members of one group related to all members of the other group. One or more persons who are members of both groups, either alone or together, own at least 25% of the shares of each corporation (other than shares of a specified class). It is not necessary for every member of a group to own shares in the other corporation.

For example, Food Store Ltd. is owned by Mr. Russo (40%) and his wife, Mrs. Russo (60%). Factory Outlet Inc. is owned by Mr. Russo (25%), his brother Darren (25%) and his sister Suzanne (50%).

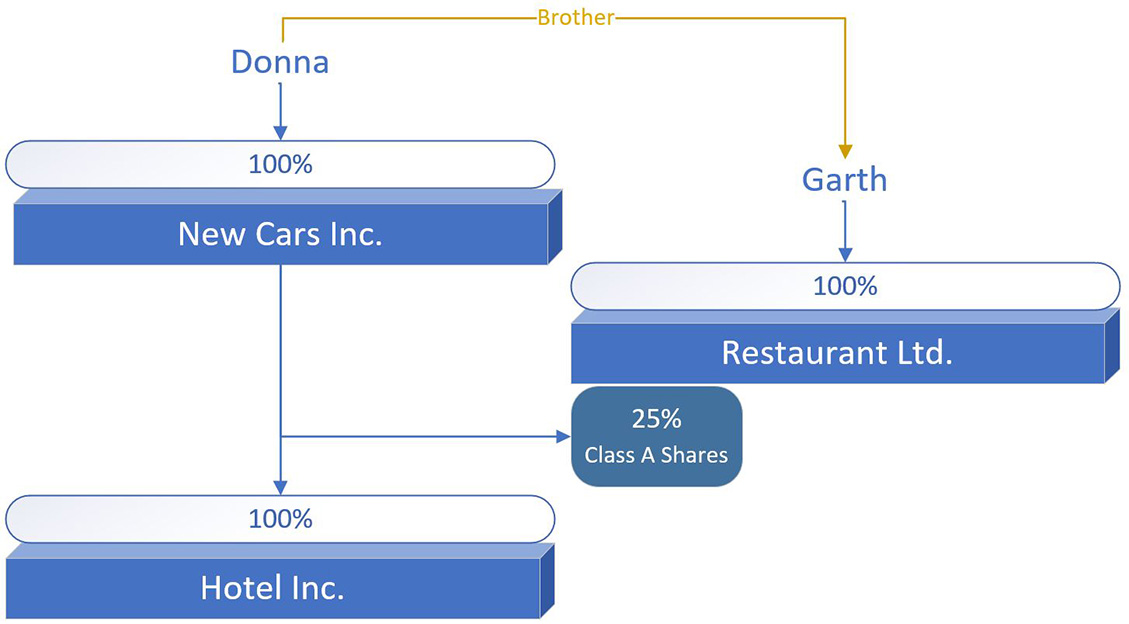

Section 16(3)(a) of the Employer Health Tax Act

If two employers are not otherwise associated with each other, but each of the two employers is associated with the same (third) employer – those two employers are deemed to be associated with each other.

For example, Donna owns 100% of New Cars Inc. New Cars Inc. owns 100% of Hotel Inc. and 25% (Class A Shares) of Restaurant Ltd. Garth (Donna’s brother) owns 100% of Restaurant Ltd.

In this example, New Cars Inc. and Hotel Inc. are associated with each other under section 256(1)(a) of the Income Tax Act (Canada) – one corporation controls the other.

New Cars Inc. and Restaurant Ltd. are associated with each other under section 256(1)(c) of the Income Tax Act (Canada).

Hotel Inc. and Restaurant Ltd. are associated with each other because both employers are associated with New Cars Inc.

Enrol for access to eTaxBC to manage your account, file returns or make payments online.

Already have an account? Log on to eTaxBC

For help, visit the eTaxBC help guide