Chicken Production Pricing in BC: Frequently Asked Questions

1) Who is involved in producing and pricing chicken in British Columbia?

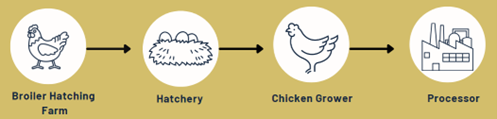

The supply chain that brings chicken to consumers in British Columbia involves many different stakeholders:

Broiler breeding farms breed hatching eggs to grow chickens for eating, as opposed to eggs for eating. These farms are operated by broiler hatching egg producers and raise female (hens) and male (roosters) birds to breed fertilized broiler chicken eggs. Hatcheries then purchase the fertilized eggs from the hatching egg producers and incubate these eggs until the chicks are hatched. Once hatched, the chicks are purchased by and transported to chicken farms and raised there until they are transported live to processors for processing into food products and marketing (selling) to consumers either directly or indirectly (e.g., through distributors or directly to restaurants, grocery stores, etc.).

In British Columbia, two regulators set pricing for chicken production:

-

British Columbia Broiler Hatching Egg Commission (BCBHEC) is the regulator that has authority to set the minimum price that hatching egg producers are paid by hatcheries for their hatching eggs, and the price that hatcheries are paid by chicken growers for their chicks (‘saleable chicks’).

-

British Columbia Chicken Marketing Board (BCCMB) is the regulator that has authority to set the minimum price that chicken growers are paid by processors for their chicken.

Prices within this ‘chicken production supply chain’ are each set by BCBHEC and BCCMB for each pricing period (every 8 weeks).

While BCBHEC and BCCMB set prices within BC’s chicken production supply chain, these regulators operate within a federal-provincial supply management system. For example, the amount of chicken production (quota) that BCCMB receives and can allocate to BC chicken growers is determined at the national level by Chicken Farmers of Canada (CFC). For eight-week periods throughout each year, CFC sets out the total number of kilograms of chicken to be produced nationally and then distributes this allocation of quota to each province. This system is meant to ensure that all provinces can and do produce the supply of chicken that will meet each province’s demand for chicken products.

2) Why did the British Columbia Farm Industry Review Board (BCFIRB) undertake a Supervisory Review in broiler hatching egg and chicken pricing, and what is BCFIRB’s role?

Under Section 7.1 of the Natural Products Marketing (BC) Act (NPMA), the BC Farm Industry Review Board (BCFIRB) has supervisory authority over the eight agriculture regulated marketing boards and commissions in British Columbia, including the BC Broiler Hatching Egg Commission (BCBHEC) and the BC Chicken Marketing Board (BCCMB), to ensure orderly production and marketing in BC of the regulated agriculture commodities.

From 2009 to 2019, pricing issues and uncertainties in the hatching egg and chicken sectors led to various actions by BCBHEC and BCCMB and direction to them from BCFIRB to address underlying challenges for BC within the national quota and pricing system.

In 2019, BCFIRB received appeals under the NPMA from the Primary Poultry Processors Association of BC (PPPABC) and the BC Chicken Growers Association (BCCGA) challenging the formula BCCMB was using to set the live price of chicken every eight weeks. As part of its decision upholding the formula, BCFIRB directed BCCMB to develop and issue a decision on a long-term pricing formula by January 2020.

In January 2020, BCBHEC also gave notice that it intended to exit a price linkage agreement that had been in place between BCBHEC and BCCMB since 1995, alleging the agreement was no longer resulting in a sustainable price for hatching egg producers.

In response to these issues, BCFIRB established a supervisory review (Review) in March 2020 that went on to include long-term pricing formulas for both hatching eggs and live chicken in BC.

The purpose of the Review was to ensure BCBHEC and BCCMB, as hatching egg and chicken regulators, developed pricing models that would enable orderly production and marketing in their respective sectors. BCFIRB approved a Terms of Reference for the Review that would support a procedurally fair and inclusive process. In addition to BCBHEC and BCCMB, industry participants in the process included the Primary Poultry Processors Association of BC (PPPABC), the BC Chicken Growers Association (BCCGA), the BC Broiler Hatching Egg Producers Association, and the BC Egg Hatchery Association.

The Review required that both BCBHEC and BCCMB provide their recommendations for long-term cost of production formulas to the Panel for review and approval

3) Why is pricing uncertainty in BC’s hatching egg and chicken sectors a problem?

Pricing uncertainty in BC’s hatching egg and chicken sectors negatively impacts the chicken production supply chain. Pricing uncertainty for an indefinite period of time is not sound marketing policy nor is it sustainable; it puts BC farmers at risk of not being able to cover their production costs or move towards greater production efficiencies, and detrimentally affects the ability of the chicken industry to plan for the future. Long-term pricing solutions that are based on the verifiable costs of production support increased certainty across broader chicken supply chain.

4) What were the industry pricing uncertainties and challenges that led to this Supervisory Review?

There is a lengthy history of pricing challenges and appeals in the BC hatching egg and chicken sectors. Each decision contains a helpful chronology. Please see BCFIRB’s decision on BCCMB’s recommendation and BCFIRB’s decision on BCBHEC’s recommendation for more detail. A high-level summary of some of the pricing uncertainties over the past 15 years is outlined below.

In 2010, after BC’s chicken processors had raised issues and concerns with chicken pricing through 2009, BCCMB adopted a pricing formula using a weighted average of Ontario and prairie provinces and other pricing factors.

This pricing formula reflected a degree of agreement in BC’s chicken industry that a workable pricing model for the sector should be consistent, predictable, and transparent, and result in a live price that provides farmers a reasonable return and for processors to be competitive. However, this pricing approach only lasted until 2015, when Chicken Farmers of Ontario changed their formula, creating a large price difference between British Columbia and Ontario chicken.

By 2016, differences in feed and chick costs and the resulting differences in live price for chicken between Ontario and British Columbia led BCCMB to review its pricing formula. The BCCMB released a new pricing formula in May 2017, which was appealed by Primary Poultry Processors Association of British Columbia (PPPABC), resulting in a mediated agreement.

In 2018, in accordance with the mediated agreement, BCCMB released a revised interim formula, which was appealed in 2019 by PPPABC and the BC Chicken Growers’ Association (BCCGA)[1].

This appeal coupled with other pricing issues and challenges led to BCFIRB directing BCCMB to issue a decision on a long-term pricing formula by January 2020.

See 2) above “Why did BCFIRB undertake a Supervisory Review in broiler hatching egg and chicken pricing…” for further detail.

5) Why does the live price of chicken differ in BC compared to other provinces?

‘Live price’ is the price at which chicken growers sell their chicken to processors. In BC, prior to BCFIRB's decision approving BCCMB's recommendation, BCCMB used a pricing model that utilized the Ontario price for live chicken plus a percentage of the difference in feed costs between Ontario and BC. Ontario uses a cost of production formula to set their live price, but information on the formula is not publicly available. All other provinces, aside from Nova Scotia, base their live price for chicken on the Ontario price with additional provincial cost factors.

Processors of chicken in BC operate in a national marketplace. Historically, Ontario has had a lower cost of production than BC. This is primarily due to the difference in feed type used in chicken production in BC related to geographic and transportation limitations (i.e., access to wheat versus corn). Processors that operate nationally advocate for a BC chicken price that is competitive with Ontario, while BC chicken growers seek a price that accurately reflects their production costs including the higher BC feed costs.

Although chicken is a nationally supply managed commodity, the pricing authority for live chicken lies with each provincial marketing board, in BC’s case, BCCMB. The price at which processors sell processed chicken into the marketplace is established by chicken processors.

6) What does a BC cost of production formula mean for the sectors, and will this affect the price BC consumers pay?

The implementation by BCBHEC and BCCMB of their ‘cost of production’ formulas means the method they use to calculate the price that hatching egg producers are paid by hatcheries and the price chicken growers are paid by processors is changing. These prices will now be determined every eight weeks using cost of production formulas that include verifiable and transparent inputs, which are also based on the cost of producing these commodities in BC.

The BCBHEC and BCCMB regulate producers of regulated products (i.e., broiler hatching eggs, saleable chicks, and broiler chicken), and how those products are marketed. As such, neither BCBHEC nor BCCMB have regulatory authority for pricing beyond the farm gate. BCFIRB’s supervisory authority within BC’s chicken industry is limited to supervising BCCMB and BCBHEC to ensure they make decisions that accord with their respective statutory authorities and ensure orderly production and sound marketing policy.

The move to a pricing model that uses cost of production will result in changes to the prices paid by hatcheries for hatching eggs and to the prices paid by processors for live chicken. Price changes will fluctuate each pricing period due to inputs in the cost of production formulas that are indexed and change over time (i.e., utilities, feed price, chick cost, etc.). Paragraph 74 of BCFIRB’s decision on BCCMB’s recommendation notes, for example, that applying BCCMB’s recommendation to a previous pricing period – in this case, period A-184 – using the new cost of production formula would increase the price paid by BC chicken processors to BC chicken growers by approximately $0.18/kg for that period. As observed by BCCMB, this increase is similar to those found within the turkey and egg sectors and appears to reflect the reality of BC as a higher cost of production province.

The price consumers pay for chicken is dependent not only on the price paid for live chicken but also on the business decisions of stakeholders further down the supply chain including processors, retailers, restaurants and others.