Operating Funding Model

The Operating Funding Model is one way government is supporting child care centres through funding under the $10 a Day ChildCareBC program.

On this page

- How child care providers are funded

- Wages and benefits

- Staffing levels

- Reporting and oversight

- Previous funding models

The Operating Funding Model started in 2023 with a small group of child care centres that are part of the $10 a Day ChildCareBC program. The model:

- Helps families by keeping child care more affordable

- Supports providers by giving funding in a way that’s fair and consistent

- Limits extra profits, so public funding stays focused on helping families find affordable child care

- Improves over time, using feedback from child care centres and others working in the child care sector

How child care providers are funded

The amount of funding providers receive is based on factors such as:

- How many days and hours they are open each year

- What kind of child care programs they offer

- How many child care spaces they have

Funding is divided into five categories

Human resources funding (staff costs)

This funding covers costs for:

- Wages and paid time off, based on provincial median wages

- Benefits at 18% of the wage amount

- $250 for professional development expenses and 15 paid hours for professional development for eligible full-time employees

- Funding to support staff breaks during the day and paid time off for vacation and sick days

- This goes beyond what is required in B.C. Child Care Licensing Regulation

What is not covered:

- Gifts for staff cannot be paid for with this funding. Additionally, staff for administrative, janitorial or similar services are funded through different categories

Programming funding (children’s activities)

This funding helps cover everyday costs to run early childhood programs:

- Snacks

- Supplies and small equipment

- Activities

- Cultural and inclusion materials

- Health and safety supplies

What is not covered:

- Fees and costs for providers’ own programming, training or certification

- Salary bonuses for staff

Administrative funding (business costs)

This funding helps with running the business aspects of the centre:

- Wages for staff who do not directly provide care for children

- Pre-approved business costs like:

- Licensing fees and professional dues

- Liability insurance

- Marketing, communication and legal support, at the ministry’s approval

- Office needs - supplies, bank charges, hiring costs, financial reporting, account and audit services

- Mileage for business travel such as grocery shopping for the program

What is not covered:

- Unpaid family fees

- Private loans or debt payments

- Business meals, entertainment, fundraisers

- Vehicle rentals

- Travel to transport children is supported through the transportation programming allowance

Exceptions:

- Exceptions are possible for eligible mortgages covered under the facility category and car loans under the transportation programming allowance

Operations funding (daily maintenance)

This funding supports keeping centres clean and safe:

- Maintenance and minor repairs

- Property insurance

- Janitorial services, garbage removal and upkeep

- Utilities such as heat and electricity

- Office furniture and equipment such as laptops, business phones, desks and chairs

What is not covered:

- Capital assets such as large equipment purchases

Facility funding (building costs)

This funding helps with building costs:

- Rent or lease payments

- Mortgage payments only for not-for-profit or Indigenous governing entities

- Strata fees and property taxes

What is not covered:

- Goods and Services Tax (GST) on rent or lease and payments and mortgage payments for corporations, partnerships or sole proprietors

Providers can move funds between these categories when needed. Sometimes approval is needed from the ministry to do this via My ChildCareBC Services. This helps the government learn how funding is used and make changes to the model if needed.

Wages and benefits

Early childhood educators play a key role in providing care, connection and guidance to children. The Operating Funding Model wage grid for the child care workforce helps to address compensation pressures in the child care sector.

Wage grid

The wage grid sets minimum pay for child care roles. Providers receive funding that lets them pay above these minimum wages.

Extra funding can be used to increase wages, for example to:

- Recognize supervisory and leadership roles, long service or special certifications

Centres cannot receive the Early Childhood Educator Wage Enhancement because the funding through the model is structured to enable providers to pay their staff at the similar levels to the wage enhancement.

Benefits, time off and professional development

Funding also covers:

- Paid time off for vacation and sick days

- Professional development (courses, training, learning opportunities)

- Employee benefits, including:

- Required deductions (Canada Pension Plan, Employment Insurance)

- WorkSafe premium

- Extended benefits depending on staff need (e.g. health, dental, or retirement savings plans)

Staffing levels

Staffing under the Operating Funding Model is informed by the requirements of the Child Care Licensing Regulation.

Additional funding provided helps with:

- Staff breaks

- Paid time off

- Other staffing needs

The amount of funding provided varies based on each provider's circumstance including:

- Hours and days of operation

- Types of programs offered

- The number of child care spaces

This flexible approach helps centres build a staffing plan that works for them.

Staffing example

Here is an example of how staffing can work at a typical centre:

- The centre has 22 spaces for infants and toddlers and 44 spaces for children aged 3-5

- It is open Monday to Friday, 7:00 AM to 6:00 PM

In this scenario, licensing regulation requires at least 12 staff. The Operating Funding Model, however, provides funding for up to 21 full-time staff. Funding can be used to:

- Add more staff during busy times

- Pay staff higher wages

- Incorporate leader top-ups and reallocate funds to the human resources funding category

This structure is intended to be flexible and support the centre with balancing staff coverage while maximizing resources.

Reporting and oversight

Child care providers are required to provide regular reports to the ministry. They must also complete a Provider Profile Survey yearly. This helps the province learn more about child care needs and improve the funding model over time.

Providers also submit annual financial statements. The Verification and Audit Unit may conduct reviews for administrative errors and overpayments and reviews for compliance with program policies, requirements and obligations. Questions about the audit process can be directed to the Verification Audit Unit team.

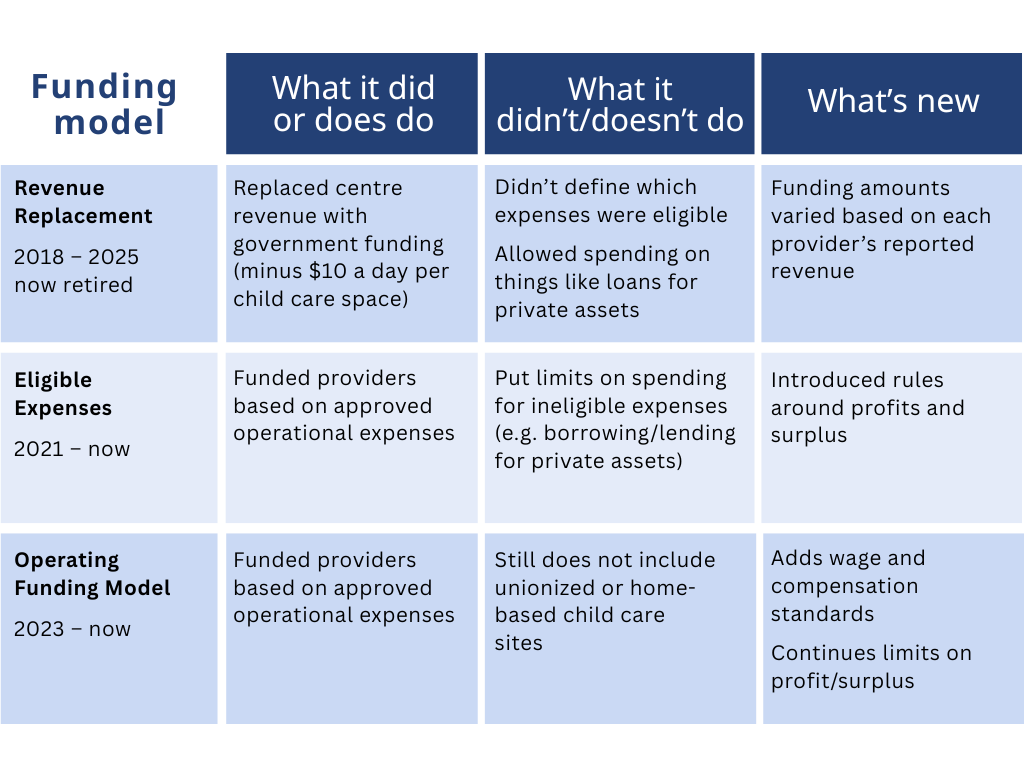

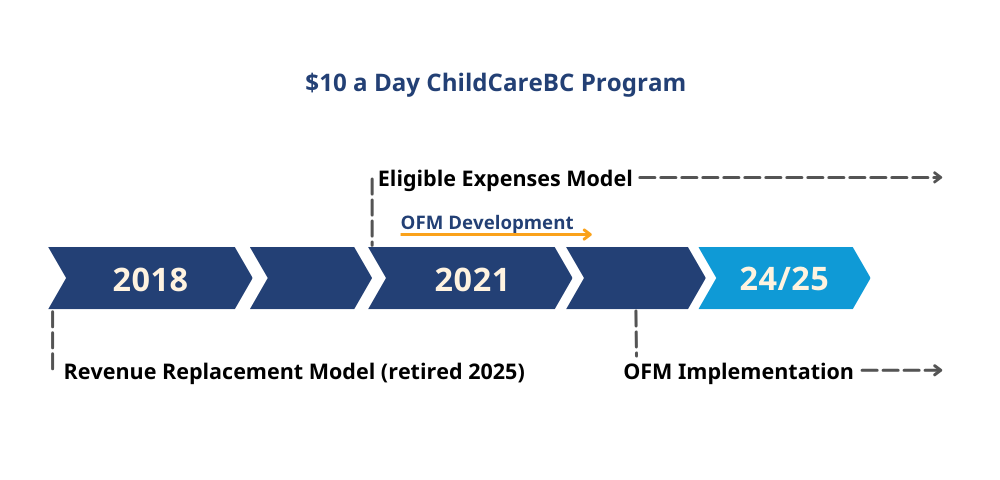

Previous funding models

Before the Operating Funding Model, providers operated under the Revenue Replacement model, followed by the Eligible Expenses model.

These earlier models helped shape today’s Operating Funding Model, through feedback and learning, to be clearer and fairer for all participants.

Many providers are either receiving more funding or have maintained their current level of funding compared to previous funding models.

Revenue replacement model (2018 - 2025)

- This was the first version used in the $10 a Day ChildCareBC program

- It was meant to change based on feedback and learning from providers

- All centres who used this model have transitioned to updated funding models

Eligible expenses model (2021 - now)

- In this model, providers are funded for eligible operational costs

- It was developed to help identify specific costs that the ministry would fund, as well as those that were not eligible for funding

- Expenses that are not funded include:

- Optional programming for extra-curricular activities

- Costs related to loans or borrowing for privately owned assets