Provincial Sales Tax Exemption & Refund Regulation, Part 5 - Production Machinery and Equipment

Division 1 — Definitions and Interpretations

Section 90 – Definitions

PSTERR - SEC.90(1)/Clean Energy Resource/Int.

Clean Energy Resource

References:

PSTERR: Section 90 "manufacture", "qualifying part"; Section 101

Interpretation (Issued: 2024/08)

Effective February 23, 2024, B.C. Reg. 134/2024 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], “clean energy resource” means sunlight, wind or air, water, and ocean tides, currents or waves. Clean energy projects using these inputs may be eligible for the production machinery and equipment manufacturing exemption. See SEC.90(1)/Manufacture/Int.

PSTERR - SEC.90(1)/Cost Of Development/Int.

Cost Of Development

References:

Act: Section 1 "Excise Tax Act"

PSTERR: Section 1 "Part 4 software"; Section 57; Part 5; Section 90 "software developer"

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "cost of development", in relation to Part 4 software, means the

(a) direct cost of materials,

(b) direct cost of labour, and

(c) Part 4 software development overhead

of the software developer, but does not include tax under Part IX of the Excise Tax Act.

PSTERR - SEC.90(1)/Cost Of Extracting Or Processing/Int.

Cost Of Extracting Or Processing

References:

Act: Section 1 "Excise Tax Act"

PSTERR: Section 1 "mineral"; Section 57; Part 5; Section 90 "mine operator", "oil and gas producer", "process"

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "cost of extraction or processing", in relation to petroleum, natural gas or minerals, means the

(a) direct cost of materials,

(b) direct cost of labour, and

(c) extraction or processing overhead

of the oil and gas producer or mine operator, but does not include tax under Part IX of the Excise Tax Act.

PSTERR - SEC.90(1)/Develop/Int.

Develop

References:

Act: Section 1 "Excise Tax Act"

PSTERR: Section 1 "Part 4 software"; Section 57; Part 5; Section 90 "software development site"

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "develop", in relation to Part 4 software, does not include

(a) providing a service, or

(b) testing the Part 4 software, unless the testing is one step in, or occurs immediately after, the development of the Part 4 software and occurs at the software development site.

PSTERR - SEC.90(1)/Local Government Body/Int.

Local Government Body

References:

PSTERR: Section 57; Part 5; Section 90 "manufacturing cost"; Section 105; Section 115

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "local government body" has the same meaning as in Schedule 1 of the Freedom of Information and Protection of Privacy Act.

PSTERR - SEC.90(1)/Local Government Corporation/Int.

Local Government Corporation

References:

PSTERR: Section 57; Part 5; Section 90 "manufacturing cost"; Section 105; Section 115

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "local government corporation" means a corporation whose taxable income, determined for the purposes of the Income Tax Act (Canada), is exempt from tax imposed under paragraph 149(1)(d.5) or 149(1)(d.6) of that Act.

PSTERR - SEC.90(1)/Logging/Int.

Logging

References:

PSTERR: Section 57; Part 5; Section 90 "non-qualifying activity", "process"; Section 104; Section 114

PSTR: Section 24

Bulletin PST 112

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "logging" means

(a) felling or bucking trees,

(b) skidding or otherwise moving trees or logs to a landing or other first point of accumulation, or

(c) loading, unloading, sorting, storing or processing trees or logs at landings, log dumps, sort yards, dry land sorts, booming grounds or mill yards,

but does not include

(d) construction or maintenance of landings, log haul roads or other roads, or

(e) silviculture.

PSTERR - SEC.90(1)/Machinery Or Equipment/Int.-R.1

Machinery Or Equipment

References:

Act: Section 1 "apparatus"

PSTERR: Section 57; Part 5; Section 91.1; Section 92; Section 93; Section 94; Section 95; Section 96; Section 97; Section 98; Section 99; Section 100; Section 101; Section 102; Section 103; Section 104; Section 105; Section 106; Section 107; Section 108; Section 109; Section 110; Section 111; Section 112; Section 113; Section 114

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "machinery or equipment" includes apparatus.

R.1 Drill Bits (Issued: 2014/04)

Drill bits are equipment.

PSTERR - SEC.90(1)/Manufacture/Int.-R.5

Manufacture

References:

PSTERR: Section 57; Part 5; Section 90 "clean energy resource", "manufacturer", "manufacturing cost", "non-qualifying activity", "qualifying tangible personal property", "process"; Section 92; Section 93; Section 95; Section 97; Section 99; Section 100; Section 101; Section 102; Section 105

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02; Revised 2024/08)

Effective February 23, 2024, B.C. Reg. 134/2024 adds paragraph (a.1) to clarify that manufacturing includes generating energy from a “clean energy resource,” as defined elsewhere in this section. Clean energy projects using those renewable resource inputs (e.g. a wind farm) may qualify for the production machinery and equipment exemption for manufacturing.

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "manufacture", subject to PSTERR subsection 90(2), means

(a) to fabricate or manufacture tangible personal property to create a new product that is substantially different from the material or tangible personal property from which the new product was made, or

(b) to process tangible personal property by performing a series of operations or complex operation that results in a substantial change in the form or other physical or chemical characteristics of the tangible personal property,

but does not include performing a non-qualifying activity.

Note: Subsection 90(2) provides that the definition of "substantially" in section 1 [definitions] of the Act does not apply to the definition of "manufacture".

R.1 Pasteurization (Issued: 2014/04)

Pasteurizing milk is processing. However, the processing does not result in a substantial change in the form or other physical or chemical characteristics of the milk; therefore, pasteurization does not meet the definition of manufacture. Pasteurization reduces the number of microbes in milk rather than changing the physical or chemical composition of the milk itself.

R.2 Powder Coating (Issued: 2014/04)

Powder coating is processing. The powder coating process involves a series of operations that results in metal becoming chemically bonded with the coating. This is a substantial change in the chemical characteristic of the product; therefore, powder coating meets the definition of manufacture. Powder coating changes the metal to make it rust resistant and impervious to the environment.

R.3 Producing Hydrolysate (Issued: 2014/04)

Creating fish hydrolysate is processing. The processing of fish waste and fishing by-catch involves a series of operations that results in the destruction of chemical bonds of the waste and by-catch. This is a substantial change in the chemical characteristics of the fish waste and fishing by-catch; therefore, creating fish hydrolysate meets the definition of manufacture. The creation of high-protein hydrolysate (liquid or dry) changes the fish waste and by-catch into a product that is sold for use in animal feed, as a fertilizer, or for human consumption.

R.4 Lumber Processing (Issued: 2014/04)

Drying, leveling and cutting lumber to size is processing provided that each service is performed to the same piece of lumber. The processing involves a series of operations that results in a substantially different piece of lumber from the original. This is a substantial change in the physical characteristic of the product; therefore, drying leveling and cutting lumber to size provided that each service is performed to the same piece of lumber meets the definition of manufacture.

Performing limited services to the lumber (e.g., only one or two of kiln drying, leveling, cutting etc.) is processing. However, limited processing does not result in a substantial change in the form or other physical or chemical characteristics of the lumber; therefore, limited services to lumber do not meet the definition of manufacture.

Each process must be looked at individually to determine whether the process meets the definition of manufacture.

R.5 Embroiderers And Printers (Issued: 2015/04)

Embroidery and printing processes provided in relation to TPP such as apparel, pens, mugs, umbrellas, calendars, golf balls, and similar goods result in the creation of goods that are substantially different or substantially changed from the inputs to the processes.

A business that produces customized TPP of this sort is manufacturing TPP to the extent that these processes are not services. (The provision of a service is a non-qualifying activity.) This type of business is manufacturing when it embroiders or prints on goods that it purchases for resale. For example, a business that purchases pre-made shirts or pens for customization (e.g., with customer names or images) and resale is manufacturing. Conversely, this type of business is providing a service when it embroiders or prints on goods brought to it by its customers. For example, if a customer brings a case of shirts or pens to a printer and pays the printer to have a corporate name and logo added to each shirt or pen, the printer is providing a service.

A single business may follow a business model that includes a mix of manufacturing and service provision, and will remain eligible for the PSTERR section 92 exemption provided it meets the dollar threshold for qualification as a manufacturer and the primarily and directly tests under PSTERR section 92 are met. For example, a promotional goods business that purchases pre-made apparel for customization (e.g., with customer names or images) and resale, and which sells more than $30,000 of customized apparel per year, is not precluded from purchasing embroidery equipment exempt from PST in a case where the equipment is used (a) 51% in manufacturing and 49% in service provision and (b) directly in the manufacturing process.

PSTERR - SEC.90(1)/Manufacturer/Int.-R.1

Manufacturer

References:

Act: Section 1 "lease", "sale", "tangible personal property", "use"

PSTERR: Section 57; Part 5; Section 90 "manufacture", "manufacturing cost", "qualifying tangible personal property"; Section 92; Section 101; Section 102; Section 103

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "manufacturer" means a person who manufactures a particular class of tangible personal property

(a) for sale, if there is a reasonable expectation that the total value of sales of that class of tangible personal property will exceed $30,000 per year,

(b) for lease or for the person’s own business use, if there is a reasonable expectation that the total manufacturing cost of that class of tangible personal property will exceed $30,000 per year, or

(c) for both a purpose referred to in paragraph (a) and a purpose referred to in paragraph (b), if there is a reasonable expectation that the total manufacturing cost of that class of tangible personal property will exceed $30,000 per year.

R.1 Contracting The Manufacturing To Third Parties (Issued: 2014/08)

A manufacturer is not required to physically manipulate (manufacture) the particular class of TPP they are manufacturing. A manufacturer may use another person or persons (likely a service provider under PSTERR section 103) to perform all or a portion of the manufacturing of their particular class of TPP.

The definition of manufacturer requires that a person manufactures a particular class of TPP but does not specify how the person may accomplish the manufacturing. As such, a person may contract another person to manufacture (fabricate TPP to create a new product that is substantially different, etc.) for them and still qualify as a manufacturer.

PSTERR - SEC.90(1)/Manufacturing Cost/Int.

Manufacturing Cost

References:

Act: Section 1 "Excise Tax Act" , "tangible personal property"

PSTERR: Section 57; Part 5; Section 90 "local government body", "local government corporation", "manufacture", "manufacturer"; Section 105

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "manufacturing cost", in relation to a manufacturer or a local government body or local government corporation that manufactures tangible personal property, means the

(a) direct cost of materials,

(b) direct cost of labour, and

(c) manufacturing overhead

of the manufacturer, local government body or local government corporation, but does not include tax under Part IX of the Excise Tax Act.

PSTERR - SEC.90(1)/Marketable Product/Int.

Marketable Product

References:

Act: Section 1 "sale"

PSTERR: Section 57; Part 5; Section 90 "qualifying part", "process"; Section 114

PSTR: Section 24

Bulletin PST 113

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "marketable product" means petroleum or natural gas, whether it occurs naturally or results from the refining or processing of petroleum or natural gas, that is

(a) available for sale for direct consumption as a domestic, commercial or industrial fuel or as an industrial raw material, or

(b) delivered to a storage facility.

PSTERR - SEC.90(1)/Mine Operator/Int.

Mine Operator

References:

Act: Section 1 "sale", "use"

PSTERR: Section 1 "mineral"; Section 57; Part 5; Section 90 "cost of extracting or processing", "process", "qualifying minerals"; Section 97; Section 101; Section 102; Section 103

PSTR: Section 24

Bulletin PST 111

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "mine operator" means a person who extracts or processes minerals

(a) for sale, if there is a reasonable expectation that the total value of sales of those minerals will exceed $30,000 per year,

(b) for the person's own business use, if there is a reasonable expectation that the total cost of extracting or processing those minerals will exceed $30,000 per year, or

(c) for both a purpose referred to in paragraph (a) and a purpose referred to in paragraph (b), if there is a reasonable expectation that the total cost of extracting or processing those minerals will exceed $30,000 per year.

PSTERR - SEC.90(1)/Non-Qualifying Activity/Int.-R.2

Non-Qualifying Activity

References:

Act: Section 1 "tangible personal property"

PSTERR: Section 1 "mineral"; Section 57; Part 5; Section 90 "logging", "manufacture", "qualifying part", "process", "processing plant"; Section 103

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02; Revised: 2015/09)

Effective April 1, 2013, OIC 279/2015 amended section 90(1)(f) in the definition of "non-qualifying activity" by adding a reference to "crushing" and created a separate subparagraph (iii) related to disposing of goods.

Effective April 1, 2013, B.C. Reg. 97/2013 provides a definition for "non-qualifying activities" under PSTERR subsection 90(1). The definition is used in the definition of "manufacture" and must be considered when determining whether a particular activity is captured by the definition of "manufacture."

R.1 Plant Micropropagation (Issued: 2014/04)

Plant micropropagation is growing seedlings and other agricultural products. Plant micropropagation is a non-qualifying activity as it meets paragraph (a) of the definition of "non-qualifying activity".

R.2 Composting (Issued: 2018/11)

Paragraph (f) of the definition of "non-qualifying activity" includes carrying out an activity that is breaking down TPP for the purposes of recycling.

Generally, composting is the biological process of breaking up organic materials, such as plant material and food waste, into a rich soil called compost that is used as a plant fertilizer. However, for the purpose of paragraph (f) of the definition of "non-qualifying activity", composting is not considered recycling.

PSTERR - SEC.90(1)/Oil And Gas Producer/Int.

Oil And Gas Producer

References:

Act: Section 1 "sale", "use"

PSTERR: Section 57; Part 5; Section 90 "cost of extracting or processing", "process", "qualifying petroleum or natural gas"; Section 95; Section 100; Section 101; Section 102; Section 103

PSTR: Section 24

Bulletin PST 113

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "oil and gas producer" means a person who extracts or processes petroleum or natural gas

(a) for sale, if there is a reasonable expectation that the total value of sales of that petroleum or natural gas will exceed $30,000 per year,

(b) for the person's own business use, if there is a reasonable expectation that the total cost of extracting or processing that petroleum or natural gas will exceed $30,000 per year, or

(c) for both a purpose referred to in paragraph (a) and a purpose referred to in paragraph (b), if there is a reasonable expectation that the total cost of extracting or processing that petroleum or natural gas will exceed $30,000 per year.

PSTERR - SEC.90(1)/Primarily/Int.

Primarily

References:

PSTERR: Section 57; Part 5; Section 91; Section 92; Section 93; Section 95; Section 97; Section 100; Section 101; Section 102; Section 103; Section 105; Section 110; Section 111; Section 112; Section 114

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "primarily" means more than 90%.

PSTERR - SEC.90(1)/Process/Int.

Process

References:

PSTERR: Section 57; Part 5; Section 90 "cost of extracting or processing", "logging", "manufacture", "marketable product", "mine operator", "non-qualifying activity", "oil and gas producer", "processing plant", "qualifying materials", "qualifying part", "qualifying petroleum or natural gas"; Section 94; Section 95; Section 97; Section 98; Section 99; Section 100; Section 101; Section 102; Section 103; Section 104; Section 105; Section 109; Section 111; Section 112; Section 114

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "process" does not include performing a non-qualifying activity.

PSTERR - SEC.90(1)/Processing Plant/Int.

Processing Plant

References:

PSTERR: Section 57; Part 5; Section 90 "non-qualifying activity", "qualifying part"; Section 95; Section 99; Section 100; Section 101; Section 102; Section 103; Section 111; Section 112; Section 114

PSTR: Section 24

Bulletin PST 113

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "processing plant" means a plant in which petroleum or natural gas is processed and includes any of the following units, or a unit that is a combination of any of the following units:

(a) a dehydrator;

(b) a separator;

(c) a sweetener;

(d) a treater.

PSTERR - SEC.90(1)/Qualifying Minerals/Int.

Qualifying Minerals

References:

Act: Section 1 "sale", "use"

PSTERR: Section 1 "mineral"; Section 57; Part 5; Section 90 "mine operator", "process"; Section 97; Section 101; Section 102; Section 103

PSTR: Section 24

Bulletin PST 111

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "qualifying minerals", in relation to a mine operator, means minerals extracted or processed by the mine operator

(a) for sale by the mine operator, or

(b) for the mine operator’s own business use.

PSTERR - SEC.90(1)/Qualifying Part/Int.

Qualifying Part

References:

Act: Section 1 "conveyance", "vehicle"

PSTERR: Section 57; Part 5; Section 90 "clean energy resource", "marketable product", "non-qualifying activity", "process", "processing plant"; Section 92; Section 95; Section 97; Section 99; Section 100; Section 101; Section 102; Section 103; Section 111; Section 112; Section 114

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02; Revised: 2024/08)

Effective February 23, 2024, B.C. Reg. 134/2024 amends the definition of “qualifying part” to clarify that the qualifying part of the manufacturing site is from the point at which the raw material or the clean energy resource is received, to the point at which the finished product is first stored or placed on or transferred to a conveyance for removal from the manufacturing site.

This change is consequential to amendments defining clean energy resources as a type of manufacturing input. The change ensures clean energy projects generating energy using those resources are treated the same way as other manufacturing projects, for the purposes of this exemption.

Note that the updated definition refers to finished products that may be “transferred to” a conveyance, in addition to being “placed on” a conveyance. The change is intended to better reflect how energy may leave the qualifying part of the manufacturing site as a finished product (e.g. by transferring electricity to high voltage lines).

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "qualifying part", in respect of

(a) a manufacturing site, means the part of the manufacturing site from the point at which the raw material is received to the point at which the finished product is first stored or first placed on a vehicle, railway rolling stock, vessel, aircraft or other conveyance for removal from the manufacturing site, whichever occurs first,

(b) a processing plant or refinery, means the part of the processing plant or refinery up to the point at which the petroleum or natural gas being processed or refined has become a marketable product, and

(c) a mine site, means the part of the mine site from the point at which the raw material is extracted from the ground to the point at which the finished product is first stored or first placed on a vehicle, railway rolling stock, vessel, aircraft or other conveyance for removal from the mine site, whichever occurs first.

PSTERR - SEC.90(1)/Qualifying Part/R.1-R.3

(a) Manufacturing Site

R.1 Real Property Contractors Installation Site And Manufacturing Site (Issued: 2014/04)

Persons who are real property contractors may be manufacturers of the TPP they both manufacture and install so that it becomes an improvement to real property. However, the site where the TPP is installed (installation site) so that it becomes an improvement to real property is not a qualifying part of a manufacturing site. Installation of TPP is not manufacturing.

Machinery and equipment that is only used at the installation site are not eligible for the production machinery and equipment (PM&E) exemption. Machinery and equipment that is used at the qualifying part of the manufacturing site may be eligible for exemption.

Machinery and equipment used at the installation site that is also used at the qualifying part of the manufacturing site must meet the requirements of PSTERR section 92 [manufacturing] to qualify for exemption (e.g., the machinery and equipment is obtained for use primarily at the qualifying part of the manufacturing site).

The qualifying part of the manufacturing site may be located on a mobile manufacturing site. The qualifying part of the manufacturing site must be separate from the installation site.

R.2 Hydroelectric Power Plants (Issued: 2014/04)

The production machinery and equipment (PM&E) exemption for manufacturers is limited to the qualifying part of the manufacturing site. The qualifying part of the manufacturing site begins at the point that the raw material is first received.

With respect to hydroelectric power plants, the manufacturing site is limited to the location at which the electricity is generated (i.e., the power plant). Although water (i.e. raw material) is first diverted at the water intake, machinery and equipment at the water intake is only eligible for the PM&E exemption if the water intake is located at the power plant. If the water intake is located outside of the power plant, PM&E used at the intake inlet is not eligible for exemption as PM&E because it is not located within the manufacturing site.

The turbines, generators and switchgear in the power house, including monitoring computers and web cameras, and the electronic components for these, would generally fall within the qualifying part of the manufacturing site and are eligible for exemption as PM&E.

PSTERR section 31 [tangible personal property for use for hydroelectric power generation] provides an additional exemption for prescribed TPP, including water intake equipment, that is part of a penstock system for a hydroelectric power plant.

R.3 Wind Power (Issued: 2014/04)

The qualifying part of the manufacturing site of a wind power generation facility generally includes the turbine towers and on-site substation. The qualifying part of the manufacturing site ends immediately after the step-up transformer where the electricity is prepared to be delivered to the transmission lines. At this point, the electricity is a finished product and, once it leaves the step-up transformer, is placed on a conveyance (high voltage lines) for removal from the manufacturing site.

When located within the qualifying part of the manufacturing site, the following items generally qualify for exemption:

-

turbine towers and all the turbine components normally mounted on them, including rotor blades, hub, shafts, mechanical brake, yaw mechanism, nacelle, gearbox, generator, transformer, electronic controller, hydraulics, cooling unit, anemometer and vane,

-

electrical cables from the turbines to on-site electrical substations,

-

transformers and associated substation equipment involved in collecting the energy from multiple generators and transforming it to a suitable voltage for the transmission lines,

-

transformers to convert power for on-site use, and

-

on-site remote control and monitoring equipment.

Generally, the following do not qualify for the PM&E exemption:

-

high voltage transmission lines from on-site sub-stations to the connection point with a transmission grid, as well as the associated towers and poles because they are not within the qualifying part of the manufacturing site,

-

bases, rings and foundations of turbine towers (including foundations of offshore turbine towers) because PSTERR paragraph 114(j) [tangible personal property excluded from exemptions under Divisions 2 and 2] excludes bases and foundations that become part of real property,

-

maintenance workshops, control buildings and amenities for maintenance staff because they are not used primarily and directly in the manufacture of electricity,

-

substation buildings (unless, they are simply protective coverings closely integrated with the substation equipment in order to protect it from the elements) because PSTERR paragraph 114(a) excludes buildings,

-

wind monitoring towers and fences because they are not used primarily and directly in the manufacture of electricity,

-

equipment used to construct access roads because PSTERR paragraph 114(j.2) excludes machinery and equipment obtained for use in the construction or maintenance of roads,

-

equipment used to clear and prepare the high voltage transmission corridor because PSTERR paragraph 114(j.1) excludes machinery and equipment obtained for use in site preparation,

-

repeater towers for remote control and monitoring equipment because this equipment is not used primarily and directly in the manufacture of electricity, and

-

equipment used to investigate wind resources in order to identify suitable wind farm sites, including wind monitoring stations and associated data collection and processing equipment, because this equipment is not used primarily and directly in the manufacture of electricity.

PSTERR - SEC.90(1)/QUALIFYING PART(B)/R.1-R.2

(b) Processing Plant or Refinery

R.1 Fuel Injection Equipment And Storage Tanks (Issued: 2014/04)

The qualifying part of a processing plant or refinery includes the part of the plant or refinery up to the point at which the petroleum or natural gas has become a marketable product. Under the definition of "marketable product", petroleum and natural gas is a marketable product when it is "available for sale for direct consumption as a domestic, commercial or industrial fuel or as an industrial raw material" or is "delivered to a storage facility."

In the fuel industry, additives are injected into the fuel when the fuel is put into vehicles for delivery (at the terminal or refinery). The industry does not consider the fuel marketable until these additives are injected. However, the fuel that is stored may be sold to various companies and each company may have an additive storage and injection facility at the terminal even though the terminal is owned and operated by only one company. As a result, the fuel meets the definition of marketable product and the additive storage tanks and fuel injection equipment is not eligible for exemption as production machinery and equipment.

R.2 Natural Gas Processing Plants Located On Transmission Lines (Issued: 2014/04)

To qualify for exemption as production machinery and equipment, natural gas processing equipment must be obtained for use primarily at the well site or qualifying part of the processing plant.

The qualifying part of a processing plant ends at the point at which the natural gas being processed has become a marketable product. Natural gas becomes a marketable product when it is pipeline quality, meaning it meets the content specifications required by pipeline operators to enter transmission pipelines (e.g. high pressure intra and inter-provincial transmission pipelines transporting natural gas to distribution centres).

The definition of processing plant includes any standalone dehydrator, separator, sweetener or treater. As a result, any of those pieces of equipment or combination of those pieces of equipment located before the natural gas becomes a marketable product is eligible for exemption. For example, a combination of a compressor and a dehydrator located on natural gas gathering lines is eligible for exemption.

However, once the natural gas is a marketable product, any machinery and equipment used to process that natural gas is not eligible for exemption. For example, the same combination of a compressor and a dehydrator located on natural gas transmission lines is not eligible for exemption.

PSTERR - SEC.90(1)/QUALIFYING PART(C)/R.1-R.2

(c) Mine Site

R.1 Toledo Scales At Gravel Pits (Issued: 2014/04)

The location of toledo scales (weigh scales) used at a mine site will determine if the scales qualify for exemption under PSTERR section 97 [extraction or processing of minerals]. Only machinery and equipment obtained for use primarily at the qualifying part of the mine site is eligible for exemption. The qualifying part of the mine site ends after the point at which the finished product is first stored or placed on a vehicle or other conveyance for removal from the mine site.

It case of a gravel pit, the scale is normally used after the gravel is placed on a truck for shipment from the gravel pit. These scales would not be eligible for exemption because they are outside the qualifying part of the mine site. However, where the scale is used in the processing of minerals, for example to weigh material during processing, the scale is eligible for exemption.

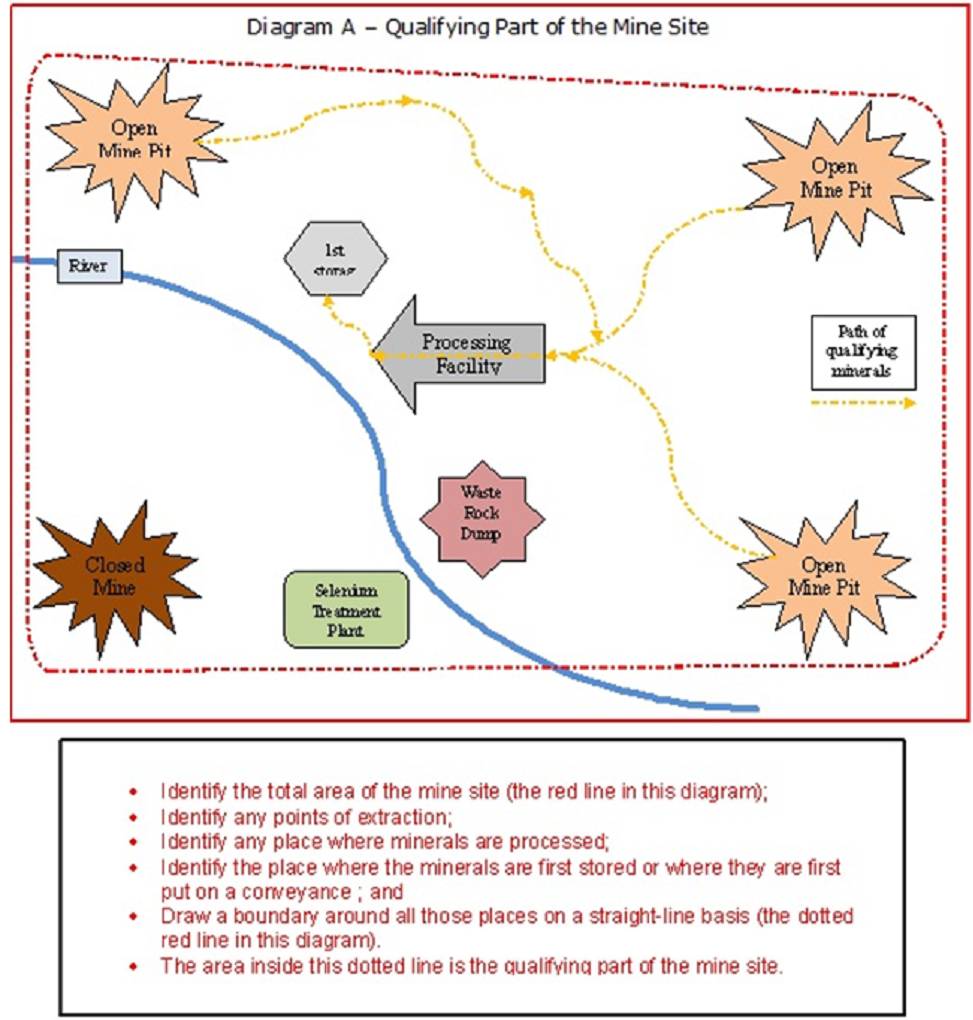

R.2 Qualifying Part Of A Mine Site (Issued: 2014/04; Revised: 2019/03)

Several of the production machinery and equipment exemptions related to mining are restricted to machinery and equipment obtained for use at the qualifying part of the mine site, including PSTERR section 99 [pollution control] and PSTERR section 100 [waste management].

Determining the "qualifying part" of a mine site is complicated by the following:

-

There can be multiple points of raw material extraction or pits,

-

The points of raw material extraction can change within a mine (old pits close and new pits open), and

-

The path of travel of the minerals from the extraction point to the finished product storage point is likely not a straight line and may change over time.

Unlike a manufacturing assembly line, it is not possible to draw a single straight line from a single point A to a single point B to describe the qualifying part of a mine site.

For example, machinery and equipment at a plant that treats run-off water for selenium that is attributable to the extraction of minerals may qualify for exemption under PSTERR section 99, but it must be obtained for use at the qualifying part of a mine site.

When built, the selenium treatment plant may be on a line between a pit and a processing facility. However, if the pit closes and another pit opens, the selenium treatment plant is no longer on a line between the new pit and the processing facility.

To address this type of complexity associated with mining operations, the Ministry determines the qualifying part of the mines site using the following steps:

-

Step 1: Identify the total area of the mine site (the total area that is not bifurcated by a public road);

-

Step 2: Within the mine site identified in step 1, identify any points of extraction -- open or closed mines (i.e., pits, shafts etc.);

-

Step 3: Within the mine site identified in step 1, identify any place where minerals are processed;

-

Step 4: Within the mine site identified in step 1, identify the place where the minerals are first stored or where they are first put on a conveyance -- whichever occurs first (but not both);

-

Step 5: Within the mine site identified in step 1, draw a boundary around all those places on a straight-line basis (i.e., most direct line between two points); and

-

Step 6: If part of the path of the minerals falls outside the boundary drawn in step 5, extend the straight line boundary around the path so that the path is included within the boundary (see Diagram B as an example). This is the qualifying part of the mine site.

Waste management, and pollution control activities are not used to determine the qualifying part of the mine site. However, equipment used in such activities can still fall within the qualifying part of the mine depending on the situation and how the six step test applies to that situation.

PSTERR - SEC.90(1)/Qualifying Petroleum Or Natural Gas/Int.

Qualifying Petroleum Or Natural Gas

References:

Act: Section 1 "sale", "use"

PSTERR: Section 57; Part 5; Section 90 "oil and gas producer", "process"; Section 95; Section 101; Section 102; Section 103

PSTR: Section 24

Bulletin PST 113

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "qualifying petroleum or natural gas", in relation to an oil and gas producer, means petroleum or natural gas extracted or processed by the oil and gas producer

(a) for sale by the oil and gas producer, or

(b) for the oil and gas producer’s own business use.

PSTERR - SEC.90(1)/Qualifying Software/Int.

Qualifying Software

References:

Act: Section 1 "sale", "use"

PSTERR: Section 1 "Part 4 software"; Section 57; Part 5; Section 90 "develop", "software developer"; Section 93; Section 101; Section 102

PSTR: Section 24

Bulletin PST 111

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "qualifying software", in relation to a software developer, means Part 4 software developed by the software developer

(a) for sale by the software developer, or

(a) for the software developer’s own business use.

PSTERR - SEC.90(1)/Qualifying Tangible Personal Property/Int.-R.1

Qualifying Tangible Personal Property

References:

Act: Section 1 "sale", "tangible personal property", "use"

PSTERR: Section 57; Part 5; Section 90 "manufacture", "manufacturer"; Section 92; Section 101; Section 102; Section 103

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "qualifying tangible personal property", in relation to a manufacturer, means tangible personal property

(a) in the particular class of tangible personal property referred to in the definition of "manufacturer" in PSTERR subsection 90(1), and

(b) manufactured by the manufacturer

(i) for sale by the manufacturer, or

(ii) for the manufacturer’s own business use;

R.1 Similar Classes Of TPP (Issued: 2014/04)

The term qualifying TPP is to be broadly interpreted to capture the production of similar classes of TPP. For example, the qualifying TPP produced by a manufacturer of tables would be "furniture" rather than "tables" so that if the manufacturer bought an eligible piece of equipment or machinery to produce chairs, which are also "furniture", the eligible machinery or equipment would qualify for the exemption.

PSTERR - SEC.90(1)/Software Developer/Int.

Software Developer

References:

Act: Section 1 "sale", "use"

PSTERR: Section 1 "Part 4 software"; Section 57; Part 5; Section 90 "cost of development", "develop", "qualifying software", "software development site"; Section 93; Section 101; Section 102

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "software developer" means a person who develops Part 4 software

(a) for sale, if there is a reasonable expectation that the total value of sales of that that Part 4 software will exceed $30,000 per year,

(b) for the person's own business use, if there is a reasonable expectation that the total cost of development of that Part 4 software will exceed $30,000 per year, or

(c) for both a purpose referred to in paragraph (a) and a purpose referred to in paragraph (b), if there is a reasonable expectation that the total cost of development of that Part 4 software will exceed $30,000 per year.

PSTERR - SEC.90(1)/Software Development Site/Int.

Software Development Site

References:

Act: Section 1 "purchaser", "sale"

PSTERR: Section 1 "Part 4 software"; Section 57; Part 5; Section 90 "develop", "software developer"; Section 93; Section 101; Section 102; Section 114

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR subsection 90(1) that in PSTERR Part 5 [Production Machinery and Equipment], "software development site" means the place at which a software developer is located when the software developer is developing Part 4 software, but, in respect of Part 4 software being developed for sale, does not include a place at which the purchaser of that Part 4 software is located.

PSTERR - SEC.90(2)/Int.

References:

Act: Section 1 "substantially"

PSTERR: Section 57; Section 90 "manufacture"

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides PSTERR subsection 90(2).

Subsection 90(2) provides that the definition of "substantially" in section 1 [definitions] of the Act does not apply to the definition of "manufacture" in PSTERR subsection 90(1).

Section 91 – Interpretation

PSTERR - SEC.91/Int.-R.1

References:

Act: Section 1 "substantially", "use"

PSTERR: Section 57; Part 5; Section 90 "primarily"

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02; Revised: 2015/09)

Effective April 1, 2013, OIC 279/2015 amended PSTERR section 91. The amendment adds three new subsections. Subsection (2) provides that using machinery or equipment to construct buildings, prepare sites or construct or maintain roads is not a use that qualifies the machinery or equipment for the PM&E exemption. In result, using equipment to construct buildings, prepare sites or construct or maintain roads are not a qualifying use for the production machinery and equipment exemption.

Subsection (2) is notably different from (1). Subsection (1) removes storage from the "use" calculation altogether (e.g., if a person stores equipment for 355 days out of the year and one day out of the year they use it only to manufacture TPP, the equipment can still be exempt because the 355 days of storage is not "use"). Subsection (2) is different. The use of the equipment to construct buildings, prepare sites or construct or maintain roads is still "use." However, it is not a "use" that qualifies for exemption.

The new subsection (3) and (4) provide exceptions to the general rule in subsection (2).

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR section 91 that in PSTERR Part 5 [Production Machinery and Equipment], a reference to use in relation to substantially or primarily does not include storing, keeping or retaining.

R.1 Construction Or Maintenance Of Mine Roads (Issued: 2015/09; Revised: 2016/06)

The general rule under subsection 91(2) is that using machinery or equipment to construct buildings or roads, maintain roads or prepare sites is not the type of use that can qualify the equipment for the production machinery and equipment exemption.

However, subsection 91(4) provides a special rule. In the case of section 96 and section 97, using machinery or equipment to construct or maintain roads within the qualifying part of the mine site is a use that qualifies the machinery or equipment for exemption. Where machinery or equipment is used to construct or maintain a road, it must nevertheless still meet the conditions of section 96 or 97. Generally, the question will arise whether such equipment is used "directly" in the exploration or development of mines or "directly" in the extraction or processing of minerals. In many situations, "directly" means physical contact with the goods being extracted or processed. However, depending on the context and the processes involved, "directly" may be something other than direct physical contact. In the case of the construction or maintenance of mine roads, physical contact is not the standard. Generally, machinery or equipment used to construct or maintain roads on the mine site will be considered to be used "directly." The focus of the analysis should be on whether the machinery or equipment is used "substantially" (in the case of section 96) or "primarily" (in the case of section 97) for that purpose and whether the machinery or equipment is used primarily at the qualifying part of the mine site.

Because the PSTERR has specific provisions contemplating road construction and maintenance, no inference should be made from the interpretation of "directly" in the context of road equipment for other scenarios. Each scenario must be analyzed on its own facts to determine whether the "directly" test is met.

Qualifying Part

The qualifying part of the mine site means the part of the mine site from the point at which the raw material is extracted to the point that the finished product is first stored or first placed on a conveyance for removal from the site (see PSTERR SEC.90(1)/QUALIFYING PART(c)/R.2 for further information on determining the scope of the qualifying part of a mine site).

It is common for operating mines where mineral extraction is underway to also have parts of the mine that are under development. For example, a mine site may have a number of pits, some of which are currently producing and others that are under development. Some of the pits that are under development may fall within the qualifying part of the mine site.

However, if the machinery and equipment is obtained for use at a mine site that is only under development and no extraction or processing is taking place, then the machinery and equipment is excluded under section 91(2) because there is no "qualifying part of the mine site".

PSTERR Section 96 or PSTERR Section 97

Even if the machinery and equipment obtained for use in the construction or maintenance of roads is obtained for use within the qualifying part of the mine site, to qualify under the PM&E exemption, the machinery and equipment must qualify under one of the following provisions:

-

PSTERR section 96 - The machinery and equipment must be obtained for use substantially and directly in the development of mines. As discussed above, the machinery and equipment must be obtained for use in the development at an operating mine. For example, a grader may be obtained exempt from PST if it obtained for use substantially in the development of new mine pit roads at a mine site that already has operating mine pits.

OR

-

PSTERR section 97 - The machinery and equipment must be obtained for use primarily and directly in the extraction or processing of qualifying minerals). However, the machinery and equipment may also be obtained for use in the construction or maintenance of roads, as long as it is obtained primarily for the extraction of minerals. For example, an excavator may be obtained exempt from PST if it obtained for use 55% of the time to extract minerals in the mine pit and 45% of the time for the construction of mine pit roads.

Division 2 — Exemption for Machinery and Equipment

Section 91.1 – Definition

PSTERR - SEC.91.1/Int.

References:

PSTERR: Section 1 "obtain"; Section 57; Part 5; Section 90 "machinery or equipment", "manufacturer", "mine operator", "oil and gas producer"; Section 99; Section 103

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, OIC 151/2013 added PSTERR section 91.1.

PSTERR section 91.1 provides that in PSTERR Division 2 [Exemptions for Machinery and Equipment] of PSTERR Part 5 [Production Machinery and Equipment], "qualifying person" means a manufacturer, an oil and gas producer, a mine operator or a person who is entitled to obtain machinery or equipment exempt under PSTERR section 103 [service providers] from tax imposed under the Act.

Section 92 – Manufacturing

PSTERR - SEC.92/Int.-R.2

References:

Act: Section 1 "use"; Part 3; Part 3 – Division 9

PSTERR: Section 1 "obtain", "Part 4 software"; Section 57; Section 90 "develop", "machinery or equipment", "manufacture", "manufacturer", "primarily", "qualifying part", "qualifying tangible personal property"; Section 100; Section 102

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 as amended by OIC 441/2013 provides under PSTERR section 92 exemptions from tax for specified machinery or equipment obtained by a manufacturer for use in British Columbia primarily and directly in:

-

the manufacture of qualifying tangible personal property;

-

the manufacture of tangible personal property or the development of Part 4 software for use in British Columbia in the manufacture of qualifying tangible personal property.

Subsection 92(1) provides that subject to PSTERR subsections 92(2) and 92(3), the following are exempt from tax imposed under Part 3 [Taxes in Relation to Tangible Personal Property] of the Act, other than Division 9 [Change in Use], if obtained by a manufacturer:

(a) machinery or equipment obtained for use in British Columbia primarily and directly in the manufacture of qualifying tangible personal property;

(b) machinery or equipment obtained for use in British Columbia primarily and directly in

(i) the manufacture of tangible personal property, or

(ii) the development of Part 4 software

for use in British Columbia in the manufacture of qualifying tangible personal property.

Subsection 92(2) provides that the exemption under PSTERR subsection 92(1) applies only to machinery or equipment obtained for use primarily at the qualifying part of the manufacturing site.

Subsection 92(3) provides that the exemption under PSTERR subsection 92(1) does not apply to

(a) machinery or equipment, including transformers, pipes, valves, fittings, pumps, compressors and regulators, obtained for use in relation to the transmission or distribution of tangible personal property, or

(b) machinery or equipment obtained for use in relation to the transmission or distribution of Part 4 software.

R.1 Air Compressors (Issued: 2014/04)

Air compressors used in the manufacturing process are exempt if used primarily and directly for that purpose. For example, if a single compressor is used both to power shop tools and to remove molten metal from smelting pots, then the compressor is eligible for exemption only if it is used primarily for the latter purpose. If the air compressor is used primarily to power shop equipment, it is not eligible for exemption.

Air compressors may also qualify for exemption if they are integrated with exempt production machinery and equipment to such an extent that the compressor is considered to be directly involved in the manufacturing of qualifying TPP.

R.2 Kiln And Lath Strips (Issued: 2014/04)

A kiln strip is a reusable strip of wood or other material used to space lumber while it is dried in a kiln. A kiln strip may be exempt from PST as production machinery and equipment provided the conditions in PSTERR section 92 are met:

-

The kiln strips must be obtained by a "manufacturer",

-

The kiln strips must be obtained for use primarily and directly in the kiln drying process and the kiln drying process must be part of the "manufacture" of lumber (e.g., the lumber producer must cut, plane and kiln dry the lumber), and

-

The kiln strips must be obtained for use primarily at the "qualifying part" of the manufacturing site.

If all of the above conditions are not met, the purchase of kiln strips for use in kiln drying is subject to PST.

Section 93 – Software Development

PSTERR - SEC.93/Int.

References:

Act: Section 1 "use"; Part 3; Part 3 – Division 9

PSTERR: Section 1 "obtain", "Part 4 software"; Section 57; Section 90 "develop", "machinery or equipment", "manufacture", "primarily", "qualifying software", "software developer", "software development site"; Section 102; Section 114

PSTR: Section 24

Bulletin PST 110

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 as amended by OIC 441/2013 provides under PSTERR section 93 exemptions from tax for software developers for machinery or equipment obtained for use in British Columbia primarily and directly in:

- the development of qualifying software;

- the manufacture of tangible personal property for use in British Columbia in the development of qualifying software.

Subsection 93(1) provides that subject to PSTERR subsections 93(2) and 93(3), the following are exempt from tax imposed under Part 3 [Taxes in Relation to Tangible Personal Property] of the Act, other than Division 9 [Change in Use], if obtained by a software developer:

(a) machinery or equipment obtained for use in British Columbia primarily and directly in the development of qualifying software;

(a) machinery or equipment obtained for use in British Columbia primarily and directly in the manufacture of tangible personal property for use in British Columbia in the development of qualifying software.

Subsection 93(2) provides that the exemption under PSTERR subsection 93(1) applies only to machinery or equipment obtained for use primarily at the software development site.

Subsection 93(3) provides that the exemption under PSTERR subsection 92(1) does not apply to machinery or equipment obtained for use in relation to the transmission or distribution of Part 4 software or tangible personal property.

Section 94 – Exploration For, Discovery Of Or Development Of Petroleum Or Natural Gas

PSTERR - SEC.94/Int.

References:

Act: Section 1 "substantially", "use"; Part 3; Part 3 – Division 9

PSTERR: Section 1 "obtain"; Section 57; Section 90 "machinery or equipment"; Section 114

PSTR: Section 24

Bulletin PST 114

Interpretation (Issued: 2014/02; Revised: 2015/09)

Effective April 1, 2013, OIC 279/2015 amends section 94(2). The amendment adds a new subparagraph (g.1) covering equipment used in fracturing.

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR section 94 an exemption from tax for machinery or equipment obtained by a person who, for commercial purposes, regularly engages in the exploration for, discovery of or development of petroleum or natural gas, for use substantially for those activities.

Subsection 94(1) provides that subject to PSTERR subsections 94(2) and 94(3), machinery or equipment is exempt from tax imposed under Part 3 [Taxes in Relation to Tangible Personal Property] of the Act, other than Division 9 [Change in Use], if the machinery or equipment is obtained

(a) by a person who, for commercial purposes, regularly engages in the exploration for, discovery of or development of petroleum or natural gas, and

(b) for use substantially in the exploration for, discovery of or development of petroleum or natural gas.

Subsection 94(2) provides that the exemption under PSTERR subsection 94(1) applies only to the equipment listed in the subsection.

Subsection 94(3) provides that the exemption under PSTERR subsection 94(1) does not apply to automotive units on which machinery or equipment, other than truck-mounted service rigs, referred to in PSTERR subsection 94(2), is transported.

Section 95 – Extraction Or Processing Of Petroleum Or Natural Gas

PSTERR - SEC.95/Int.

References:

Act: Section 1 "use"; Part 3; Part 3 – Division 9

PSTERR: Section 1 "obtain", "Part 4 software"; Section 57; Section 90 "develop", "machinery or equipment", "manufacture", "oil and gas producer", "primarily", "process", "processing plant", "qualifying part", "qualifying petroleum or natural gas"; Section 100; Section 102; Section 114

PSTR: Section 24

Bulletin PST 113

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 as amended by OIC 441/2013 provides under PSTERR section 95 exemptions from tax for oil and gas producers for

-

machinery or equipment obtained for use in British Columbia primarily and directly in the extraction or processing of qualifying petroleum or natural gas;

-

machinery or equipment obtained for use in British Columbia primarily and directly in the manufacture of tangible personal property or the development of Part 4 software for use in British Columbia in the extraction or processing of qualifying petroleum or natural gas;

-

generators to be located substantially at a well site for use in relation to the extraction or processing of qualifying petroleum or natural gas.

Subsection 95(1) provides that subject to PSTERR subsections 95(2) and 95(3), the following are exempt from tax imposed under Part 3 [Taxes in Relation to Tangible Personal Property] of the Act, other than Division 9 [Change in Use], if obtained by an oil and gas producer:

(a) machinery or equipment obtained for use in British Columbia primarily and directly in the extraction or processing of qualifying petroleum or natural gas;

(b) machinery or equipment obtained for use in British Columbia primarily and directly in

(i) the manufacture of tangible personal property, or

(ii) the development of Part 4 software

for use in British Columbia in the extraction or processing of qualifying petroleum or natural gas.

Subsection 95(2) provides that the exemption under PSTERR subsection 95(1) applies only to machinery or equipment obtained for use primarily at the well site or at the qualifying part of the processing plant or refinery.

Subsection 95(3) provides that the exemption under PSTERR subsection 95(1) does not apply to

(a) machinery or equipment, including transformers, pipes, valves, fittings, pumps, compressors and regulators, obtained for use in relation to the transmission or distribution of tangible personal property, or

(b) machinery or equipment obtained for use in relation to the transmission or distribution of Part 4 software.

Subsection 95(4) provides that generators to be located primarily at a well site are exempt from tax imposed under Part 3 of the Act, other than Division 9 of that Part, if the generators are obtained

(a) by an oil and gas producer, and

(b) for use in relation to the extraction or processing of qualifying petroleum or natural gas.

Section 96 – Exploration For Minerals Or Development Of Mines

PSTERR - SEC.96/Int.-R.1

References:

Act: Section 1 "substantially", "use"; Part 3; Part 3 – Division 9

PSTERR: Section 1 "mineral", "obtain"; Section 57; Section 90 "machinery or equipment"; Section 114

PSTR: Section 24

Bulletin PST 111

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 as amended by OIC 441/2013 provides under PSTERR section 96 exemptions from tax for specified machinery or equipment obtained by persons who, for commercial purposes, regularly engage in the exploration for minerals or the development of mines.

Subsection 96(1) provides that subject to PSTERR subsection 96(2), machinery or equipment is exempt from tax imposed under Part 3 [Taxes in Relation to Tangible Personal Property] of the Act, other than Division 9 [Change in Use], if the machinery or equipment is obtained by a person who, for commercial purposes, regularly engages in the exploration for minerals or the development of mines and that machinery or equipment is

(a) obtained for use substantially and directly in the exploration for minerals or the development of mines,

(b) a generator or motor for use substantially to operate machinery or equipment for the use referred to in PSTERR paragraph 96(1)(a), or

(c) safety equipment, a pump, ventilating equipment or a compressor obtained for use substantially in the exploration for minerals or development of mines.

Subsection 96(2) provides that the exemption under PSTERR subsection 96(1) does not apply to cement trucks.

R.1 Tailings Ponds (Issued: 2014/04)

Tailings ponds are areas of refused mining tailings where the waterborne refuse material is pumped into a pond to allow the sedimentation of solid particles from the water. The development of tailings ponds is not considered the "development of mines" for the purpose of PSTERR section 96.

PSTERR section 96 provides an exemption for machinery and equipment obtained for use substantially and directly in the exploration for minerals or the development of mines. Other provisions in PSTERR Part 5 [Production Machinery and Equipment] refer to the "mine site" rather than "mine". A "mine site" is intended to capture a larger area than "mine". The "mine" referred to in PSTERR section 96 is restricted to the actual mine pit and not the broader "mine site". Because tailings ponds are not located at the actual mine pit, the development of a tailings pond is not considered the development of a mine.

Section 97 – Extraction Or Processing Of Minerals

PSTERR - SEC.97/Int.

References:

Act: Section 1 "substantially", "use"; Part 3; Part 3 – Division 9

PSTERR: Section 1 "obtain", "Part 4 software"; Section 57; Section 90 "develop", "machinery or equipment", "manufacture", "mine operator", "primarily", "process", "qualifying minerals", "qualifying part"; Section 100; Section 102; Section 114

PSTR: Section 24

Bulletin PST 111

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 as amended by OIC 441/2013 provides under PSTERR section 97 exemptions from tax for

-

machinery or equipment obtained by a mine operator for use in British Columbia primarily and directly in the extraction or processing of qualifying minerals;

-

machinery or equipment obtained by a mine operator for use in British Columbia primarily and directly in the manufacture of tangible personal property or the development of Part 4 software for use in British Columbia in the extraction or processing of qualifying minerals.

Subsection 97(1) provides that subject to PSTERR subsections 97(2) and 97(3), the following are exempt from tax imposed under Part 3 [Taxes in Relation to Tangible Personal Property] of the Act, other than Division 9 [Change in Use], if obtained by a mine operator:

(a) machinery or equipment obtained for use in British Columbia primarily and directly in the extraction or processing of qualifying minerals;

(b) machinery or equipment obtained for use in British Columbia primarily and directly in

(i) the manufacture of tangible personal property, or

(ii) the development of Part 4 software

for use in British Columbia in the extraction or processing of qualifying minerals.

Subsection 97(2) provides that the exemption under PSTERR subsection 97(1) applies only to machinery or equipment obtained for use primarily at the qualifying part of the mine site.

Subsection 97(3) provides that the exemption under PSTERR subsection 97(1) does not apply to

(a) machinery or equipment, including transformers, pipes, valves, fittings, pumps, compressors and regulators, obtained for use in relation to the transmission or distribution of tangible personal property, or

(b) machinery or equipment obtained for use in relation to the transmission or distribution of Part 4 software.

Section 98 – Geophysical Surveying

PSTERR - SEC.98/Int.

References:

Act: Section 1 "substantially", "use"; Part 3; Part 3 – Division 9

PSTERR: Section 1 "mineral", "obtain"; Section 57; Section 90 "machinery or equipment"

PSTR: Section 24

Bulletin PST 111; Bulletin PST 114

Interpretation (Issued: 2014/02)

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR section 98 exemptions from tax for specified geophysical surveying machinery or equipment obtained by persons who, for commercial purposes, regularly engage in the exploration for petroleum, natural gas or minerals or the development of petroleum, natural gas or mineral deposits.

Subsection 98(1) provides that subject to PSTERR subsection 98(2), machinery or equipment is exempt from tax imposed under Part 3 [Taxes in Relation to Tangible Personal Property] of the Act, other than Division 9 [Change in Use], if the machinery or equipment is obtained

(a) by a person who, for commercial purposes, regularly engages in the exploration for petroleum, natural gas or minerals or the development of petroleum, natural gas or mineral deposits, and

(b) for use substantially in the exploration for petroleum, natural gas or minerals or the development of petroleum, natural gas or mineral deposits.

Subsection 98(2) provides that the exemption under PSTERR subsection 98(1) applies only to the following machinery or equipment:

(a) magnetometers, gradiometers and magnetic susceptibility meters;

(b) gravity meters and other instruments designed to measure the elements, variations and distortions of the natural gravitational force;

(c) field potentiometers, meggers, non-polarizing electrodes and electrical equipment for making measurements in drill holes;

(d) equipment for electrical or electromagnetic surveying, including self-potential meters, resistivity survey equipment, time and frequency domain-induced polarization equipment, time and frequency electromagnetic surveying equipment and inductive conductivity probes;

(e) ground-penetrating radar equipment and side-looking aperture radar;

(f) equipment for remote sensing, including

(i) ultraviolet lamps, and

(ii) reflectance, infrared and hyperspectral spectrometers;

(g) instruments or equipment for seismic prospecting, including the recording system, seismic instrumentation, geophones, cables, data processing units, global positioning and navigation systems, recorder box, blasting system, blaster and controller, seismic drilling equipment, heli-drills, enviro-drills, vibrators and integrated navigation systems;

(h) scintillometers, spectral gamma-gamma density and Geiger-Muller counters, gamma-ray spectrometers, potassium gradiometers and other instruments for radioactive methods of geophysical prospecting;

(i) acoustical survey equipment, including sonar, side-scanning sonar and full wave form sonic loggers;

(j) electrical amplifying devices, electronic amplifying devices and electrical thermostats, designed for use with any of the machinery or equipment described in PSTERR paragraphs 98(2)(a) to 98(2)(i).

Section 99 – Pollution Control

PSTERR - SEC.99/Int.

References:

Act: Section 1 "substantially", "use"; Part 3; Part 3 – Division 9

PSTERR: Section 1 "mineral", "obtain"; Section 57; Section 90 "machinery or equipment", "manufacture", "process", "processing plant", "qualifying part", "qualifying person"; Section 91.1; Section 102

PSTR: Section 24

Bulletin PST 110; Bulletin PST 111; Bulletin PST 114

Interpretation (Issued: 2014/02; Revised: 2023/09)

Effective February 19, 2020, under B.C. Reg. 242/2020 amended PSTERR section 99 by repealing PSTERR subsection 99(c).

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR section 99 that machinery or equipment obtained for use substantially and directly in the detection, prevention, measurement, treatment, reduction or removal of pollutants in water, soil or air is exempt from tax imposed under Part 3 [Taxes in Relation to Tangible Personal Property] of the Act, other than Division 9 [Change in Use], if

(a) the pollutants are attributable to

(i) the manufacture of tangible personal property, or

(ii) the extraction or processing of petroleum, natural gas or minerals,

(b) the machinery or equipment is obtained by a qualifying person.

Section 100 – Waste Management

PSTERR - SEC.100/Int.

References:

Act: Section 1 "substantially", "use"; Part 3; Part 3 – Division 9

PSTERR: Section 1 "mineral", "obtain"; Section 57; Section 90 "machinery or equipment", "manufacture", "oil and gas producer", "primarily", "process", "processing plant", "qualifying part"; "qualifying person"; ; Section 91.1; Section 92; Section 95; Section 97; Section 102; Section 114

PSTR: Section 24

Bulletin PST 110; Bulletin PST 111; Bulletin PST 113

Interpretation (Issued: 2014/02; Revised: 2023/09)

Effective February 19, 2020, under B.C. Reg. 242/2020 amended PSTERR section 100 by repealing PSTERR subsection 100(3)(e).

Effective April 1, 2013, B.C. Reg. 97/2013 provides under PSTERR section 100 exemptions from tax for

-

specified waste gas machinery or equipment obtained by an oil and gas producer for use solely to transmit specified waste gas within a natural gas processing plant or from a natural gas processing plant to a disposal well;

-

specified machinery or equipment obtained for use in British Columbia substantially and directly in carrying refuse or waste, or exhausting dust or noxious fumes, from machinery or equipment that is exempt under PSTERR section 92, 95 or 97.

Subsection 100(1) provides that in PSTERR section 100, "waste gas machinery or equipment" means pipes, valves, fittings, pumps, compressors and regulators, and other related machinery or equipment, obtained for use solely to transmit

(a) within a natural gas processing plant, or

(b) from a natural gas processing plant to a disposal well

waste gas composed primarily of hydrogen sulphide and carbon dioxide for use solely to inject the gas into the disposal well for permanent disposal.

Subsection 100(2) provides that waste gas machinery or equipment is exempt from tax imposed under Part 3 [Taxes in Relation to Tangible Personal Property] of the Act, other than Division 9 [Change in Use], if the waste gas machinery or equipment is obtained by an oil and gas producer.

Subsection 100(3) provides that machinery or equipment obtained for use in British Columbia substantially and directly

(a) in carrying refuse or waste from machinery or equipment that is exempt under

(i) PSTERR section 92 [manufacturing],

(ii) PSTERR section 95 [extraction or processing of petroleum or natural gas], or

(iii) PSTERR section 97 [extraction or processing of minerals], or

(b) for exhausting dust or noxious fumes from machinery or equipment referred to in PSTERR paragraph 100(3)(a)

is exempt from tax imposed under Part 3 of the Act, other than Division 9, if

(c) the refuse, waste, dust or noxious fumes are attributable to the manufacture of tangible personal property or the extraction or processing of petroleum, natural gas or minerals,

(d) the machinery or equipment is obtained by a qualifying person.

Section 101 – Transmission Or Distribution Of Tangible Personal Property Or Software

PSTERR - SEC.101/Int.-R.1

References:

Act: Section 1 "use"; Part 3; Part 3 – Division 9

PSTERR: Section 1 "obtain", "Part 4 software"; Section 57; Section 90 "clean energy resource", "develop", "machinery or equipment", "manufacture", "manufacturer", "mine operator", "oil and gas producer", "primarily", "process", "processing plant", "qualifying minerals", "qualifying part", "qualifying petroleum or natural gas", "qualifying tangible personal property", "qualifying software", "software developer", "software development site"; Section 102

PSTR: Section 24

Bulletin PST 110; Bulletin PST 111; Bulletin PST 113

Interpretation (Issued: 2014/02; Revised 2024/09)

Effective February 23, 2024, B.C. Reg. 134/2024 adds PSTERR subsection 101(1.1). It clarifies that production machinery and equipment obtained by a manufacturer for use in B.C. primarily and directly in the transmission or distribution of a clean energy resource at the qualifying part of the manufacturing site is exempt from tax imposed under Part 3 of the Act, other than Division 9.

Effective April 1, 2013, B.C. Reg. 97/2013 as amended by OIC 441/2013 provides under PSTERR section 101 exemptions from tax for machinery or equipment obtained by a manufacturer, mine operator, oil and gas operator or software developer for use in British Columbia primarily and directly in the transmission or distribution of tangible personal property or Part 4 software at specified sites.

Subsection 101(1) provides that machinery or equipment is exempt from tax imposed under Part 3 [Taxes in Relation to Tangible Personal Property] of the Act, other than Division 9 [Change in Use], if

(a) the machinery or equipment is obtained by a manufacturer for use in British Columbia primarily and directly in the transmission or distribution of tangible personal property or Part 4 software at the qualifying part of the manufacturer's manufacturing site,

(b) the tangible personal property or Part 4 software to be transmitted or distributed is primarily

(i) qualifying tangible personal property,

(ii) tangible personal property or Part 4 software that is to be attached to or processed, fabricated, manufactured or incorporated into qualifying tangible personal property, or

(iii) tangible personal property or Part 4 software that is to be attached to or processed, fabricated, manufactured or incorporated into tangible personal property or Part 4 software for use in the manufacture of qualifying tangible personal property, and

(c) the machinery or equipment is obtained for use primarily at the qualifying part of the manufacturing site.

Subsection 101(2) provides that machinery or equipment is exempt from tax imposed under Part 3 of the Act, other than Division 9, if

(a) the machinery or equipment is obtained by a software developer for use in British Columbia primarily and directly in the transmission or distribution of tangible personal property or Part 4 software at the software developer's software development site,

(b) the tangible personal property or Part 4 software to be transmitted or distributed is primarily

(i) qualifying software,

(ii) Part 4 software that is to be attached to or processed, fabricated, manufactured or incorporated into qualifying software, or

(iii) tangible personal property or Part 4 software that is to be attached to or processed, fabricated, manufactured or incorporated into tangible personal property or Part 4 software for use in the development of qualifying software, and

(c) the machinery or equipment is obtained for use primarily at the software development site.

Subsection 101(3) provides that machinery or equipment is exempt from tax imposed under Part 3 of the Act, other than Division 9, if

(a) the machinery or equipment is obtained by an oil and gas producer or mine operator for use in British Columbia primarily and directly in the transmission or distribution of tangible personal property or Part 4 software at the oil and gas producer's well site, the qualifying part of the oil and gas producer's processing plant or refinery or the qualifying part of the mine operator's mine site,

(b) the tangible personal property or Part 4 software to be transmitted or distributed is primarily, as applicable,

(i) qualifying petroleum or natural gas or qualifying minerals,

(ii) tangible personal property that is to be attached to or processed, fabricated, manufactured or incorporated into qualifying petroleum or natural gas or qualifying minerals, or

(iii) tangible personal property or Part 4 software that is to be attached to or processed, fabricated, manufactured or incorporated into tangible personal property or Part 4 software for use in the extraction or processing of qualifying petroleum or natural gas or qualifying minerals, and

(c) the machinery or equipment is obtained for use primarily at the well site, the qualifying part of the processing plant or refinery or the qualifying part of the mine site.

R.1 Interpretation Of "Incorporated" (Issued: 2016/06)

Section 101 uses the word "incorporated" in subparagraph 101(1)(b)(ii), 101(2)(b)(ii), and 101(3)(b)(ii). Read alone, the word conceptually could include both temporary and permanent incorporation. However, words must be read in their entire context to determine their meaning. In this case, the word "incorporated" appears in a list of "attached to", "processed", "fabricated", and "manufactured." The words "processed", "fabricated" and "manufactured" suggest a degree of permanency in the sense that when a thing is "processed", "fabricated" or "manufactured" into something else, the thing loses its original identity and becomes the new thing.

Additionally, the word "incorporated" is followed by the phrase "into qualifying tangible personal property." "Qualifying tangible personal property" is defined under section 90 as tangible personal property (TPP):

…

manufactured by the manufacturer

- for sale by the manufacturer, or

- for the manufacturer's own business use.