Transparency Register - Significant Individuals

An individual can be a significant individual by having:

- an interest or right, or a combination of them, in a significant number of shares (the central securities register is the place to look)

- the right or ability, or combination of them, to elect, appoint or remove a majority of the directors of the company (through shareholder rights and/or by way of the articles of the company)

- interests or rights held jointly

- interests, rights or abilities exercised in concert under an agreement

Note: the legislation is the true source of defining significant individuals. The descriptions and examples on the meaning of "significant individual" provided here are for the purposes of the B.C. transparency register only. Other statues, including the Income Tax Act, may have a different definition or interpretation of "significant individual" but do not apply in relation to B.C.'s transparency requirement.

1. Significant Number of Shares

A significant individual must be listed in the transparency register of the company if the individual has an interest or rights or any combination of them in a significant number of shares.

Significant Number of Shares

A significant number of shares is 25% or more of the issued shares of the company, or 25% or more of the voting rights of the company. Voting rights are attached to shares and the rights associated with those shares are set out in the articles of the company. While typically one share equals one vote, there may be different classes of shares that may hold special rights that afford the person who owns the shares to more than one vote. You will want to consult your company’s articles and central securities register to determine if there are share structures that provide for any person having a significant number of shares. If you are unsure of how to make this determination, it is recommended you seek advice from a legal professional.

i. Interest in 25% or more of the votes or shares:

As a Registered Owner

A registered owner is an individual whose name is listed as shareholder or stockholder in the central securities register. The registered owner holds the shares personally.

As a Beneficial Owner

The registered owner can also hold the shares for the benefit of another person, e.g., the trustee of a trust is the registered owner and the beneficiary is the beneficial owner (see example below). A beneficial owner is an individual who is legally entitled to receive benefits of property rights (e.g. shareholder rights) in equity even though legal title of the property belongs to another person (e.g. the trustee).

Exception: beneficiaries do not have to be listed in the transparency register if their beneficial interest is conditional on the death of another individual.

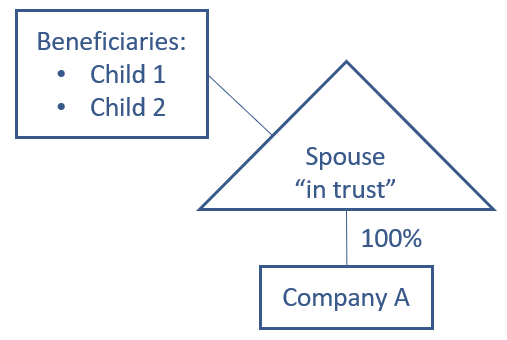

Example of interest as a Beneficial Owner of 25% or more of the votes or shares

The Founder created Company A, and the shares of the company are held in trust by their spouse for the benefit of their two children. On Company A’s central securities register the trustee, the founder's spouse, is listed as the registered owner of the shares and will be listed in the transparency register. However, since the shares are being held in trust by the spouse for the benefit of the two children, the children must also be listed in the transparency register as beneficial owners of the shares.

Example of Exception

The Founder gave the shares of the company to their minor children in a Will but stated that the shares would be held in trust by the spouse until the children turn 19-years-old. The children would not be listed in the transparency register because they do not have an interest in the shares until the passing of the Founder.

ii. Indirect Control of 25% or more of the votes or shares

An individual must be listed as a significant individual if they indirectly control an intermediate entity or a person that holds 25% or more of the shares or votes of a private company. Read more about Indirect Control.

iii. Combination of above interests amounts to 25% of the vote or shares

Companies must also consider whether an individual has rights or interests when combined (or added up) give the individual a significant number of shares of the company.

Example 1 - combination of above interests amounts to 25% of the votes or shares

The Founder is the registered owner of 10% of the shares of a company, has beneficial interest in another 10% of the company's shares, and indirectly controls another 10% of the company's shares. The Founder’s combined holding is greater than 25%.

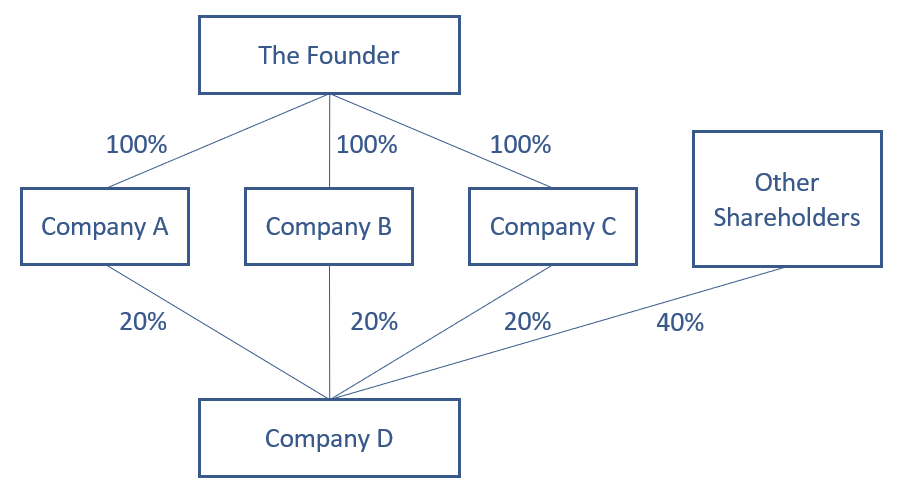

Example 2 - combination of above interests amounts to 25% of the votes or shares

The Founder is the sole owner of Company A, Company B and Company C, where each holds 20% of the shares of Company D. The Founder's combined holdings in Companies A, B and C provide the Founder with indirect control of Company D’s shares (Company A’s 20% + Company B’s 20% + Company C’s 20%).

2. Election, Appointment or Removal of a Majority of the Directors

A significant individual must be listed in the transparency register of the company if the individual has a direct or indirect right or ability to elect, appoint or remove a majority of the directors of the company:

i. Right to Elect, Appoint or Remove a Majority of the Directors

The right to elect, appoint or remove the directors of a company is typically linked to share ownership. In most cases, the owners of a majority of the common shares have the voting rights in the company, which enables them to elect, appoint or remove the directors of the company and consequently have effective control of the company. For example, an individual holding enough of the voting shares of the company (typically more than 50%) will be able to elect a majority of the directors.

However, there may be exceptions. An individual can have the right or ability to elect, appoint or remove a majority of the directors of the company without having an interest in a majority of the shares. The right to elect, appoint or remove the directors will need to be determined by consulting the corporate documents, notably the articles of the company.

An individual who can cause a change in the majority of the directors because of their shareholdings or special rights provided for in the articles of company or shareholders’ agreement is a significant individual and required to be listed in the transparency register of the company.

ii. Indirect Control of Right to Elect, Appoint or Remove a Majority of the Directors

Indirect control of the right to elect, appoint or remove a majority of the directors can give an individual the legal ability to cause a change in the majority of the directors. Read more about Indirect Control.

iii. Direct and Significant Influence Over an Individual with the Right or Ability to Elect, Appoint or Remove a Majority of the Directors

It is sometimes possible for an individual with no voting share or special right or ability to elect, appoint or remove directors to still be able to cause a change in a majority of the directors of the company. This is because of their direct and significant influence over someone who has that right or ability. As a result, this individual – with direct and significant influence – is a significant individual and required to be listed in the transparency register of the company.

To meet the “direct and significant influence” test the individual must be able to influence, in a very direct way, another person’s decision-making when that other person is exercising their right or ability to elect, appoint or remove a majority of the board of directors. The facts must show that the decision-making power of the company lies with the individual having direct and significant influence and not with the person subject to the influence.

The test for direct and significant influence is based on factual control of the board of directors or its powers, not on control of the day-to-day operations or business of the company.

The direct and significant influence must come from a legally binding or enforceable arrangement, such as a legal agreement or contract. It is not meant to capture situations where an individual’s opinion is simply persuasive or influential because of moral authority, family relationship or economic dependence.

For example, an individual who influences how a shareholder exercises their right to elect the directors of a company due to a familial relationship is not enough for the individual to be considered a significant individual. This kind of influence does not arise from a legally binding or enforceable arrangement.

An individual with direct and significant influence may be difficult to identify. If there is any uncertainty with this issue, you should seek advice from a legal professional.

Examples where Significant Influence Exists

Example 1

The Founder agreed to transfer all the shares of the company to two adult children. The Founder was not ready to let go of their control over the company entirely and wanted to make sure that the children would involve them in all major decisions, including any changes to the board of directors. Their share transfer agreement includes a clause requiring the children to get the Founder’s approval before replacing the directors of the company. The Founder should be listed in the register because of their direct and significant influence on the children’s right to elect, appoint or remove the directors.

Example 2

To finance Company A, the Founder took a major loan from their grandparent. Under the loan agreement, the grandparent has the right to recall the loan for any reason, at any time in their sole discretion. The grandparent also made it clear that the loan will be recalled if they disagree with who sits on the board of directors. The Founder knows that the company will not survive if the grandparent withdrew financial support. The grandparent should be listed in the register because of their direct and significant influence on the Founder’s right to elect, appoint or remove the directors.

Examples where Significant Influence Does Not Exist

Example 1

The Founder takes advice from their parents before making major business decisions. The parents are seasoned business people and share their experience with the Founder whenever asked. While the parents’ opinions may sometimes influence the Founder’s business decisions, the decision-making power to elect, appoint or remove a majority of the directors still lies with the Founder. Any recommendation the parents make as to who they think should sit on the board of directors is not legally enforceable. The parents should not be listed in the register.

Example 2

The Founder is the sole shareholder of a metal fabricating business that has been in the family for the last 100 years. Over time, the business has lost customers to overseas metal fabricators. Currently, the business has one major customer that represents 60% of the business' revenue. The Founder is worried that if this customer finds another supplier, the metal fabricating business will not be able to continue operating. Despite the situation of economic dependence, the customer is not considered to have direct and significant influence over the Founder. Even if the customer could use the situation to dictate who sits on the board of directors of the company, such influence would not be grounded in a legally binding or enforceable arrangement. The customer should not be listed in the register.

iv. Combination of above rights and abilities enables the election, appointment or removal of a majority of the directors

Companies must consider whether an individual has any combination of the above rights and abilities that if exercised would result in the election of a majority of the directors of the company.

Example of Combined Above Rights and Abilities

Company A has five directors. According to the articles of Company A, each of the three founders (X, Y and Z) are entitled to appoint one director. The other two directors are elected by the shareholders of Company A. Each of the three founders owns 15% of the voting shares. The other 55% is owed by Company B. A closer look at Company B’s central securities register shows that Founder X owns 100% of the shares of Company B. Adding up Founder X’s direct and indirect rights means that Founder X can elect, appoint or remove a majority of the directors of Company A (three out of five directors).

3. Interests or Rights Held Jointly

When two or more individuals jointly own one of the above interests or rights, then all those individuals must be listed in the transparency register. The interests are not divided amongst the joint owners, they are fully attributed to all joint owners.

4. Interests or Rights Exercised in Concert

Groups of individuals who are acting in concert, must add their interests together. If the group meets either the 25% threshold or has the direct or indirect right to elect, appoint or remove a majority of the directors of a private company, the company must list every member of the group in its transparency register.

Companies must also include in their transparency registers persons who have the following relationships with each other if their combined interests meet the requirements to be a significant individual:

- spouses

- relatives who live in the same home