Instructions for authorization or cancellation of a representative form (FIN 146) for the speculation and vacancy tax

You must complete the Authorization or Cancellation of a Representative (FIN 146) form in full if you want to:

-

Authorize someone to represent you to do any of the following:

- Complete your speculation and vacancy tax declaration

- Apply for a speculation and vacancy tax credit

- Make a speculation and vacancy tax payment

- Talk with the us about your declaration or speculation and vacancy tax account

-

Cancel or remove an existing authorized representative

If you have a legal representative, such as a Power of Attorney or an Executor of a will, you must submit the supporting documents that prove they’re your legal representative instead of this form.

How to open the form

Some web browsers may not support all the features of PDF forms, such as hyperlinks and fillable calculating fields, and may produce errors. We recommend you download the form and open it using the latest version of Adobe Reader.

You may also print the blank form and complete it by hand if you prefer.

Open the form (FIN 146) (PDF, 260KB)

How to complete the form

All required fields, indicated by an asterisk (*), must be completed for the form to be accepted.

Part 1 – Taxpayer information

This section is information about you – the person or business on the title of the property.

Enter the requested information about you and your contact information. A fax number and email are optional.

Part 2 – Representative information

This section is information about the person you are authorizing.

Enter the requested information about the person you want to authorize. A fax number and email address are optional.

-

Under the Account Authorizations Act drop down menu, select “Speculation and Vacancy Tax Act” or, if you're completing the form manually, write "Speculation and Vacancy Tax Act"

-

Under the Folio/Return/Client Account Number field, enter one of the following:

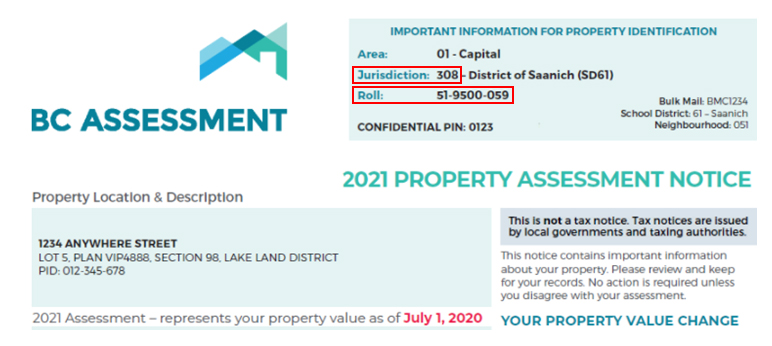

- Your jurisdiction and roll number from your BC Assessment notice issued each January (as shown below)

- Your jurisdiction and roll number (also called folio or account number) from your property tax notice, or

- Your SPT account number (SPT-####-####) if you have one

Note:

- Property IDs (PIDs) and Letter IDs will not be accepted

- Do not indicate "ALL" under the Folio/Return/Client/Account Number field. You must list the jurisdiction and roll number (also called folio or account number) or SPT account number of each property you're authorizing in a separate row

You can add up to 12 people to represent you on this form. If you require more space, attach a separate sheet.

Part 3 – Cancel your representative

This section is information about the person you want to remove as your representative.

If you want to remove everyone who currently represents you, check “Cancel all existing authorizations”.

If you want to remove a specific person as your representative:

- Check “Cancel all existing authorizations given to the representative below:”

- Enter the requested information about the person you want to remove and your folio number (jurisdiction and roll number) or account number (SPT-####-####)

You can remove up to 6 authorized representatives on this form. If you require more space, attach a separate sheet.

Part 4 – Certification

This section is for you to confirm the information entered is correct.

If you’re the individual in Part 1, enter your full legal name and date. If your business is on title for the property, enter your business title.

If you’re a legal representative of the individual in Part 1:

- Enter your full legal name, date and your title in relation to the individual in Part 1

- Submit supporting documents to prove that you’re their legal representative, which could include a Power of Attorney agreement, a copy of a will or letters of administration

All supporting documents must be in English or translated to English.

Print and sign the form with a pen. You can also sign the form with an electronic signature.

Part 5 – Submit your form

If you were working with a specific Ministry of Finance employee, enter their name.

Submit your form to the Ministry of Finance through one of the methods listed on the form.