Benefits for excluded employees

Under the Flexible Benefits Program, you can tailor your health and life insurance benefits to best meet your needs.

Rather than all employees having the same benefits coverage, eligible employees get to decide how to allocate flex credits for benefits coverage.

You decide what suits you best.

- For a comprehensive overview, review the 2024/2025 Flexible Benefits Guide (PDF, 769KB)

- For a quick summary of your benefits, review the 2024/2025 Flexible Benefits Choices at a Glance (PDF, 197KB)

- To evaluate your choices, use the 2024 Flexible Benefits Calculator Tool (XLS, 53KB) or the 2025 Flexible Benefits Calculator Tool (XLSM, 54KB)

- For a list of forms related to pay and benefits, visit the Careers & MyHR forms and tools index

To enrol for benefits, employees MUST complete the application form(s) to be eligible for benefits when coverage begins.

Open Enrolment in the Flexible Benefits Program for excluded employees runs from October 21 to November 8, 2024.

Changes made during Open Enrolment take effect January 1, 2025. If you are applying to increase your basic life insurance, your optional life insurance and/or your spouse’s optional life insurance, evidence of insurability is required, and the increase is not effective until approved by Canada Life.

In addition to the information and tools listed above, please review your choices for 2025 using the 2025 Flexible Benefits Calculator Tool (XLSM, 54KB).

The Flexible Benefits Guide provides a comprehensive overview of the health and life insurance benefits program for excluded employees. Share the details with your family so you can make the most of your benefits program.

The information provided in the guide is intended to accurately summarize the terms and provisions of the Flexible Benefits Program for excluded employees.

In the event of any conflict between the contents of the guide and the actual plans, contracts or regulations, the provisions outlined in those documents apply.

Employees are responsible for reading the information provided in the Flexible Benefits Guide or on Careers & MyHR. Contact AskMyHR (IDIR restricted) if you have any questions.

Value of your benefits program

Benefits are an important part of your total compensation package. There’s no cost to you to participate in the fully funded extended health and dental plan options. The reimbursements you receive under the plan for eligible items and services are paid for by the employer (up to plan limits).

The Employee Basic Group Life Insurance plan provides employee life insurance at a reasonable group premium rate, and a portion of your premium is paid by your employer.

On average, your benefits add over 20% to your overall compensation.

Know your benefits, know your options

With choice comes responsibility. You must enrol in the Flexible Benefits Program to take an active role in choosing your benefits. Take the time to learn about your options and to decide how to best apply them to your personal situation.

You'll have the opportunity to update your options every year during the open enrolment period and after an eligible life event.

Program overview

The plans

A number of health and life insurance benefits plans make up the Flexible Benefits Program. They fall into the categories of Core and Optional plans. The difference between the two categories is that the employer provides funding towards coverage under each of the three core benefits plans. You fund your participation in the optional benefits programs.

Core benefits

- Extended health plan

- Dental plan

- Employee Basic Life Insurance (mandatory, but ends when you turn 65)

Optional benefits

- Health Spending Account (HSA)

- Optional Family Funeral Benefit

- Employee Optional Life Insurance

- Spouse Optional Life Insurance

- Child Optional Life Insurance

- Employee Optional Accidental Death & Dismemberment Insurance

- Spouse Optional Accidental Death & Dismemberment Insurance

- Child Optional Accidental Death & Dismemberment Insurance

Your choices

Employee Basic Life Insurance is mandatory. This means you must maintain a minimum level of coverage, you cannot waive coverage. You can waive coverage in any, or all, of the remaining plans. It’s your choice.

All core plans offer multiple levels of coverage ranging from coordination to enhanced coverage. Each level of coverage is called an option and has a cost (or price) associated with it. Most optional plans also offer multiple levels of coverage that can be selected by the employee.

In a given plan, the higher the option or the amount of coverage selected, the more it costs.

Your costs and flex credits

Funding dollars are called flex credits and each flex credit equals $1. Flex credits are before-tax dollars and are allocated as follows:

- You receive $200 annual general flex credits that you can spend however you choose (such as higher dental coverage)

- You receive the number of flex credits required towards your coverage for the Comprehensive option for both extended health and dental and the employer paid portion of your Employee Basic Group Life Insurance, regardless of your family status (employee only, employee plus one, employee plus two or more)

- Waive or Coordination option: you’ll receive additional flex credits to use elsewhere

- Comprehensive option: the cost is $0

- Enhanced option: you pay for the extra coverage using flex credits or by paying monthly premiums based on your family status

Use the 2024 Flexible Benefits Calculator Tool (XLSM, 53KB) or the 2025 Flexible Benefits Calculator Tool (XLSM, 54KB) to determine:

- The total number of flex credits you receive

- The cost of your benefits

- The maximum number of flex credits you may allocate to your Health Spending Account (HSA)

You’ll see a security warning telling you that the macros have been disabled. To enable the macros, click on the 'Enable Content' button located below the menu. The security warning will disappear, and the worksheet will populate and be ready for you to use.

To explore your options, insert various scenarios into the worksheet. Your final balance can be determined by summing up the net prices. Any leftover flex credits will be paid out monthly as taxable cash. Should you have a balance owing, monthly deductions will be taken from your paycheque.

If it's a partial year, your HSA allocation will be pro-rated over the number of months of coverage you have during the year.

Employees

The Flexible Benefits Program is offered to regular excluded employees, including part-time employees, and eligible excluded auxiliary employees who have completed 1,827 hours of work in 33 pay periods in the following categories:

- Orders in Council: Categories A, B and C

- Managers in the six bands of the Management Classification Compensation Framework

- Schedule A, Crown and Legal Counsel, Executive Administrative Assistants and Senior Executive Assistants

- Salaried Physicians

- Deputy Ministers, Associate Deputy Ministers and Assistant Deputy Ministers

- Officers of the Legislature

Auxiliary employees who are not eligible for health and welfare benefits receive a compensation allowance, as calculated in accordance with the provisions in effect for the majority of bargaining unit employees.

You must enrol to be eligible for coverage.

You can extend your benefits to your spouse and to children who meet eligibility requirements. You must enrol your dependants to receive coverage.

Spouse

Your legal or common-law spouse (same or opposite sex) who’s living with you is eligible for coverage. By enrolling your common-law spouse in your benefits plans, you’re declaring that person as your common-law spouse and that you’ve been living in a common-law relationship or cohabiting for at least 12 months. The cohabitation period may be less than 12 months if you claimed your common-law spouse’s child/children for tax purposes. A separate declaration form is not required.

If your spouse is also a BC Public Service employee or enrolled in a benefits program with an employer outside of the BC Public Service, you can both enrol in each other's benefits plans, listing the other as a dependant. You may be able to submit your extended health and dental receipts to both plans and receive up to 100% reimbursement (to plan limits) of your eligible expenses. Consider your enrolment choices (such as whether you just need the Coordinated benefits option).

If you separate from your spouse, they’re no longer eligible for coverage under your benefits plan. Any terms and conditions under separation and divorce agreements are the responsibility of the employee, not the employer. Once a common-law spouse has been enrolled in your benefits plan, a different common-law spouse and any eligible dependents may be enrolled in the plan 12 calendar months after you’ve cancelled coverage for the previous common-law spouse and applicable dependants. This waiting period does not apply when you’re going from legal spouse to common-law spouse, legal spouse to legal spouse, or common-law spouse to legal spouse. You’re responsible for cancelling your spouse’s coverage when they’re no longer eligible for coverage.

Dependent children

Children (natural, adopted, stepchildren or legal wards) are eligible for coverage if they’re unmarried/not in a common-law relationship, mainly supported by you, dependents for income tax purposes, and any of the following:

- Under the age of 19

- Under the age of 25 and in full-time attendance at a school, university or vocational institution which provides a recognized diploma, certificate, or degree

- Mentally or physically disabled and past the maximum ages stated above. This only applies if they become disabled before reaching the maximum ages, if the disability has been continuous and if the child is covered as a dependent on the employee's benefits when disabled dependent status was approved. The child, upon reaching the maximum age, must still be incapable of self-sustaining employment and must be completely dependent on you for support and maintenance

- Residing with your former spouse who’s not eligible for health and dental coverage

A grandchild is not an eligible dependent unless adopted by, or a legal ward of, the employee or the employee’s spouse.

Dependent children over 19

Extended health and dental coverage for a dependent child will automatically end on the date the child turns 19 unless you certify that your child is in full-time attendance at a school, university or vocational institution which provides a recognized diploma, certificate or degree or your child has been approved for coverage as a disabled dependent prior to becoming ineligible for coverage as a dependent child or student.

To certify as an eligible student your child before they turn 19:

- You’ll receive a Confirmation of Dependent Eligibility form from Canada Life

- Submit your Confirmation of Dependent Eligibility form to Canada Life as per instructions on the letter

In subsequent years, return the Confirmation of Student Eligibility form back to the Benefit Service Centre before August 30, advising that your child is still a full-time student.

Include your child’s name, date of birth and the school they’re attending. You’re responsible for cancelling coverage for dependent children who are no longer eligible for coverage. Coverage for a dependent child with full-time student status will automatically end at age 25 unless the child has disabled status.

To apply for disabled dependent status, you must complete the Application for Over-Age Dependant Coverage form and forward the completed form to Canada Life as per instructions on the form.

Optional life insurance plans do not end automatically therefore you must cancel them when your dependents are no longer eligible for coverage under your benefit plan.

|

Benefit |

Regular employee |

Auxiliary employee |

|---|---|---|

|

Extended health and dental plans |

|

|

|

Employee Basic Life Insurance plan |

|

|

|

Optional Family Funeral Benefit |

|

|

|

Optional Life and Optional Accidental Death & Dismemberment (AD&D) Insurance |

|

|

Coverage for eligible dependents is effective on the date on which your coverage is effective, or on the first of the month following the date the enrolment form is received by the Benefit Service Centre, whichever is later.

Where evidence of insurability and approval is required, coverage will begin once approval is granted by the carrier. Ensure that the amount on the evidence of insurability form matches the amount of insurance that you have applied for.

Verify that the coverage is in effect prior to using the services.

To check that coverage is in place after you've enrolled, log into Time and Pay > Employee Self Service > Benefits Summary.

- Time and Pay: from work (IDIR restricted)

- Time and Pay: from home (IDIR restricted)

For questions regarding coverage, submit an AskMyHR (IDIR restricted) service request, using the categories Myself (or) My Team or Organization > Benefits > Excluded Employees.

How to enrol for the first time

During initial enrolment, you must enrol within 31 days of hire or becoming eligible for benefits, or you’ll receive the default options.

- Do your homework so you can tailor your benefits to meet your needs:

- Read this guide carefully

- Review your medical and dental expenses over the past year

- Review your spouse’s coverage, if applicable

- Use the 2024 Flexible Benefits Calculator Tool (XLSM, 52KB) or the 2025 Flexible Benefits Calculator Tool (XLSM, 54KB) to review your choices

- Complete these forms:

Choosing life insurance coverage

If you're under age 65, maintaining Employee Basic Life Insurance coverage is a condition of employment and cannot be waived. The minimum coverage required is $25,000, and there are two other options available. You must pick three times annual salary if you would like to purchase additional life insurance for yourself. You may want to designate a beneficiary (otherwise it defaults to your estate). The rules around when you need to provide evidence of insurability (good health) are outlined below.

Carefully consider the life insurance options available to you during initial enrolment, especially if you (or your spouse) have medical conditions that may prevent you from increasing your life insurance in the future.

The optional life insurance plans available are:

- Optional Family Funeral Benefit

- Employee Optional Life Insurance

- Spouse Optional Life Insurance

- Child Optional Life Insurance

- Employee Optional Accidental Death & Dismemberment Insurance

- Spouse Optional Accidental Death & Dismemberment Insurance

- Child Optional Accidental Death & Dismemberment Insurance

Premiums for these plans can be found in the 2024/2025 Flexible Benefits Choices at a Glance (PDF, 197KB).

Evidence of insurability (good health)

Not required:

- Any option of Employee Basic Life Insurance on initial enrolment only

- Up to $50,000 of optional life insurance for yourself and/or your spouse on initial enrolment only

- Child Optional Life Insurance initial enrolment and subsequent increases

- Accidental Death & Dismemberment Insurance initial enrolment and subsequent increases

- Family Funeral Benefit initial enrolment and subsequent increases

Required:

- If you choose more than $50,000 of optional life insurance for yourself and/or your spouse during your initial enrolment

- All other increases in life insurance for yourself and/or your spouse

Remember to list your dependents and select them for the benefit on the enrolment form.

To have dependents covered under extended health and dental, you must record their information in the 'Dependent' section of the enrolment form and select the dependents you wish to cover under each benefit plan. Take the time to ensure that your dependent information is correct and that you’ve selected the right dependent(s) for coverage in each plan.

Be sure to designate beneficiaries for your Employee Basic and Optional Life Insurance.

Complete and sign a Group Life Beneficiary Designation form (PDF, 174KB). If you do not designate your beneficiary by submitting the signed form, benefits will be paid to your estate in the event of your death. Beneficiary designations are not effective until the completed and signed original form has been received by MyHR.

Submit forms through AskMyHR (IDIR restricted) using the categories Myself (or) My Team or Organization > Benefits > Submit a Health Benefit Form/Application.

Because the Group Life Beneficiary Designation form is a legal document, you must print, sign, date and mail the original document to:

Benefit Service Centre

3980 Quadra Street

Victoria, B.C. V8X 1J9

Once your applications have been processed, you can log into Employee Self Service at any time to view your benefits summary (except for your life insurance beneficiaries).

Time and Pay > Employee Self Service > Benefit Summary.

- Time and Pay: from work (IDIR restricted)

- Time and Pay: from home (IDIR restricted)

If you do not enrol on time, you’ll receive a default package of benefits.

Do not miss out on the opportunity to tailor your benefits package. Take the time to review your benefits and actively enrol. The default package (see table below) may not meet your needs. You will not be able to change your benefits until the annual Open Enrolment period or until you have an eligible life event.

|

Benefit |

Default |

|---|---|

|

General flex credits |

You'll receive the $200 in general flex credits (pro-rated for partial years) |

|

Extended health |

Comprehensive for yourself |

|

Dental |

Comprehensive for yourself |

|

Employee Basic Life Insurance |

Enhanced (3 x annual salary, $100,000 minimum) |

Optional Family Funeral Benefit |

Waive |

Optional Life and Optional Accidental Death & Dismemberment Insurance (for yourself, your spouse, your dependent child(ren) |

Waive |

|

Health Spending Account |

Waive |

|

Unallocated flex credits |

Paid out as taxable cash |

If you're transferring into the Flexible Benefits Program from the Bargaining Unit Benefits Program, you'll be enrolled in the benefits plan (and plan options) that most closely match the coverage you had previously. Previous dependents will also be covered.

Benefits costs and flex credits amounts found in this guide are annual amounts, based on a plan year starting on January 1. If your benefits start during the year, your costs and flex credits will be prorated.

PharmaCare registration

All plan members must sign up for PharmaCare. This will assist with prescription coverage, limiting the impact on your lifetime maximum. Do not submit this form to AskMyHR.

Open Enrolment

Each fall, during Open Enrolment, you’re able to change benefits coverage for you and your dependents for the next benefits plan year. The exception to this rule is, if you select the Enhanced option for extended health and/or dental, you're locked into those options for two plan years.

Each year, information about changes to any of the benefits plans and instructions on how to complete Open Enrolment are sent out to eligible employees by email.

If you do not receive an email during the last week in October, please submit an AskMyHR (IDIR restricted) service request, using the categories Myself (or) My Team or Organization > Benefits > Excluded Employees.

It's recommended that you review your recent claims history through My Canada Life at Work, consider future expenses and then either confirm your current choice or select another option for you and your family using the 2024 Flexible Benefits Calculator Tool (XLSM, 53KB) or the 2025 Flexible Benefits Calculator Tool (XLSM, 54KB) and through Employee Self Service.

View your benefit summary by logging on to Time and Pay > Employee Self Service > Benefits Summary.

- Time and Pay: from work (IDIR restricted)

- Time and Pay: from home (IDIR restricted)

If you do not make choices during Open Enrolment, your benefits will remain the same as the previous year, and you waive the opportunity to have a Health Spending Account. You will not be able to change your benefits until the next Open Enrolment period or eligible life event.

Employee absence during Open Enrolment

If you're away during Open Enrolment and wish to make changes to your options, contact the BC Public Service Agency before you leave. You can access Employee Self Service from home (IDIR restricted), or you can request enrolment forms to be sent to you. Complete the forms and mail them to the Benefit Service Centre (see the Contacts section for the mailing address). The Benefit Service Centre must receive your change form before the Open Enrolment deadline, so be sure to give yourself plenty of time.

Confirming your choices

In early December, check your confirmation statement through Employee Self Service (IDIR restricted). Report any errors immediately (but no later than December 31 at 4 pm) through an AskMyHR (IDIR restricted) service request. Use the categories Myself (or) My Team or Organization > Benefits > Excluded Employees.

Eligible life event

During the year, you may change your benefits options after you experience an eligible life event. Eligible life events allow you to make changes to your benefits options within 60 days of the event.

Life events include:

- Marriage or entering a common-law relationship

- Divorce, separation, or end of a common-law relationship

- Birth or adoption of a child

- Loss of a child’s status as a dependent (marriage, age limit, no longer a student, etc.)

- Change in your child’s eligibility that allows coverage under the program

- Your spouse gains or loses benefits coverage

- Death of a spouse or child

How to update your dependents

To add or cancel dependents, complete and submit the Flexible Benefits Enrolment/Change Form (PDF, 423KB). You must record their information in the ’Dependent Information’ section of the enrolment form and list the dependents you wish to cover under each benefit plan. Take the time to ensure that your dependent information is correct and that you’ve selected the right dependent(s) for coverage in each plan.

Baby enrolment or addition of a newborn

The easiest way to enrol your newborn for the Medical Service Plan (MSP) is to complete the Online Birth Registration through the Vital Statistics Agency. They will send your baby’s information to Health Insurance BC (HIBC).

Increasing life insurance coverage

You or your spouse will be asked to complete an Evidence of Insurability form (a medical questionnaire) if you apply to increase your:

- Employee Basic or Optional Life Insurance from the previous year

- Spouse Optional Life Insurance

The insurance company must review your information and approve your request before increased coverage can take effect.

If you're making changes to your optional life insurance due to an eligible life event or during open enrolment, ensure you complete the application form with your employer as well as the Evidence of Insurability form (if applicable) for Canada Life. The amount of insurance that you are applying for must indicate the total amount of coverage you want on the employer application form (for example: if you currently have $100,000 optional spouse life insurance and you want to increase it to $250,000, you must indicate $250,000 and not only the increased amount of $150,000).

The Evidence of Insurability form should be sent directly to Canada Life. Submission information is on the form.

Effective dates of coverage

Changes will be effective on the appropriate date based on the timing of Open Enrolment, an eligible life event, or the approval of evidence of good health for life insurance.

- Changes made during Open Enrolment will be effective at the start of the following plan year (January 1)

- Changes made as a result of an eligible life event will be effective either on the date of the event or the form signature date, whichever is later, provided either date occurs within 60 days of the life event. If a life event is reported more than 60 days after the event, changes to your options will not be permitted at that time

- Exceptions, back-dating and retroactive adjustments will not be made

- Review your coverage and make changes during the Open Enrolment period or as soon as possible after the eligible life event to ensure that AskMyHR (IDIR restricted) receives your benefits change forms no later than 60 days from the date of the event

Choices at a glance

Everyone is unique and has different needs for benefits. There are a number of choices in the Flexible Benefits Program that enable you to create a benefits package to meet your needs.

For each benefit, you’ll either select the option that best meets your needs, or you’ll waive coverage. The exception is with Employee Basic Life Insurance, you must maintain a minimum ($25,000) level of coverage.

The following tables summarize the coverage in each option of each benefits plan. For your convenience, we’ve included annual net pricing information with each table.

If the cost of the option you choose is less than the fully funded option, you’ll have leftover flex credits. The annual price will show a dollar amount credit (for example, $198 CR).

If the cost of the option you choose is $0, this is the fully funded option.

If the cost of the option you choose is greater than the fully funded option, you’ll have to partially pay for that option. The annual price will show a dollar amount cost (for example, $340).

| Extended health plan options | Waive | Coordination |

Comprehensive (fully funded) |

Enhanced (2-year lock-in) |

|---|---|---|---|---|

| Annual deductible | No coverage | $100 | $100 | $0 |

| Reimbursement (for most expenses, including prescription drugs) | No coverage | Reimbursed at 20% for the first $5,000 paid in a calendar year per person and then 100% for the balance of the year (subject to some restrictions and plan maximums) | Reimbursed at 80% for the first $2,000 paid in a calendar year per person and then 100% for the balance of the year (subject to some restrictions and plan maximums) |

100% |

|

Vision |

No coverage |

$250/24 months for adults |

$250/24 months for adults |

$500/24 months for adults |

|

Paramedical services (acupuncture, chiropractor, massage therapy, naturopathic physician, physiotherapy, podiatry) |

No coverage |

All services combined: $500/year/person |

$750/year for massage/person

|

$1,000/year for massage/person $1,500/year for physio/person $500/year/other services/person |

| In-province lifetime maximum | No coverage | $3 million | $3 million | $3 million |

|

Out-of-province/out-of-country emergency (100% to lifetime maximum of $3 million) |

No coverage |

Business and personal travel |

Business and personal travel |

Business and personal travel |

| You | $300 CR | $198 CR | $0 | $340 |

| You plus 1 dependent | $459 | |||

| You plus 2 or more dependents | $578 |

|

Options |

Waive |

Coordination |

Comprehensive (fully funded) |

Enhanced (2-year lock-in) |

|---|---|---|---|---|

|

Basic |

No dental coverage |

20% recall for adults: 9 months |

100% recall for adults: 9 months |

100% recall for adults and children: 6 months |

|

Major |

50% |

65% |

85% |

|

|

Orthodontic (LTM = lifetime maximum) |

50% with LTM of $2,000 |

55% with LTM of $3,500 |

55% with LTM of $5,000 |

|

|

You |

$300 CR |

$195 CR |

$0 |

$213 |

|

You plus 1 dependent |

$426 |

|||

|

You plus 2 or more dependents |

$633 |

|

Options |

Core |

Comprehensive |

Enhanced |

|

Life Insurance for you to age 65 |

$25,000 |

$100,000 |

3x annual salary |

|

Annual price |

$81.00 CR |

$0 |

(9 cents per $1,000 of insurance above $100,000) x 12 months |

Evidence of insurability is not required on initial enrolment but is required for any future increases

|

Who |

Units of |

Maximum |

|---|---|---|

| You | $25,000 | $1 million |

| Your spouse | $25,000 | $500,000 |

|

For all your dependent children |

$5,000 |

$20,000 (Cost for all dependent children is $11.28 per unit of $5,000) |

You must choose Enhanced Employee Basic Life Insurance to apply for this coverage for yourself.

During initial enrolment, employees have 31 days to apply for up to $50,000 of Employee Optional and/or Spouse Optional Life Insurance evidence free.

Evidence of insurability is required for any amount over $50,000 during initial enrolment and for all future increases. Applications must be approved before coverage can begin.

|

Gender/age (yrs) |

Under 35 |

35 to 39 |

40 to 44 |

45 to 49 |

50 to 54 |

55 to 59 |

60 to 64 |

|---|---|---|---|---|---|---|---|

|

Female (NS) |

$9 |

$12 |

$18 |

$30 |

$48 |

$84 |

$108 |

|

Female (S) |

$12 |

$18 |

$30 |

$60 |

$90 |

$138 |

$192 |

|

Male (NS) |

$18 |

$18 |

$24 |

$48 |

$87 |

$144 |

$189 |

|

Male (S) |

$30 |

$36 |

$60 |

$102 |

$177 |

$294 |

$396 |

|

Who |

Units of |

Maximum |

Annual rate per unit |

|

You |

$25,000 |

$500,000 |

$9.60 |

|

Your spouse |

$25,000 |

$500,000 |

$9.60 |

|

For all your dependent children |

$10,000 |

$250,000 |

$3.30 |

| Option |

Premium |

Coverage |

|---|---|---|

| Optional coverage |

$2.16/month ($25.92/year)

|

Life insurance in the amount of $10,000 for spouse and $5,000 per dependent child |

| Option |

Waive |

Elect |

|---|---|---|

| You can only allocate funds to your HSA during initial enrolment or Open Enrolment |

No HSA |

Minimum: $100 Maximum: Please use the 2024 Flexible Benefits Calculator Tool (XLSM, 53KB) or the 2025 Flexible Benefits Calculator Tool (XLSM, 54KB) to confirm your maximum prior to enrolling. Individual maximum may vary |

Tips

- To submit eClaims, register and log in to My Canada Life at Work, Canada Life’s plan member website to submit eClaims. My Canada Life at Work provides online access to your personalized extended health and dental coverage and claims information.

- Claiming deadline for extended health and dental is 15 months from the date the expense was incurred

- Ask your doctor or pharmacist if there’s a less expensive generic medication that's right for you

- Do not forget to update your benefits coverage as your personal circumstances change

- Remember to designate a beneficiary for your group life insurance

- Naming a beneficiary for your Public Service Pension Plan is a separate process from nominating your group life insurance beneficiary. For more information, contact the Public Service Pension Plan

Medical Services Plan

Impact to extended health plan

New or returning to B.C.

The two step process requires that individuals:

- First visit an ICBC office to obtain a BC Services card

- Then apply for MSP coverage

More information on this process is available on the How to apply page on MSP’s website.

Leaving B.C.

Leaving British Columbia temporarily can impact your continued coverage under MSP. More information related to both temporary and permanent absences from B.C. is available in the Leaving B.C. brochure.

To request MSP account changes (for example: address changes, adding or removing dependants or re-certifying your child as a full-time student) and/or to submit documentation online, please visit the Managing your MSP account page.

Questions

The extended health plan is designed to partially reimburse you for a specific group of medical expenses which are not covered by the Medical Services Plan or the PharmaCare program.

Overview

Canada Life administers your extended health plan on behalf of your employer. Detailed descriptions of expenses eligible for reimbursement under this plan are provided in the table below.

There's a lifetime maximum of $3 million per covered person, which includes coverage for out-of-province or out-of-country medical emergencies. This lifetime maximum may be reinstated after paying for any one serious illness on based on satisfactory evidence provided by the employee to the carrier of complete recovery and return to good health.

Reimbursement

Your rate of reimbursement depends on the option you select. It's your responsibility to verify that an item or service is covered prior to purchase. Contact Canada Life if the item is not listed in this guide. It's recommended that you get an expense pre-approved if the cost is over $1,000.

What's covered by your extended health plan?

The following is a list of services that are eligible for reimbursement under the extended health plan when incurred as a result of a necessary treatment of an illness or injury and, where applicable, when ordered by a physician and/or surgeon. Check My Canada Life at Work for detailed information or contact Canada Life at 1-855-644-0538. The value of your entitlement will be impacted by the option you select.

|

Feature |

Coverage |

|---|---|

|

Accidental injury to teeth |

Dental treatment by a dentist or denturist for the repair or replacement of natural teeth or prosthetics, which is required and performed and completed within 52 weeks after an accidental injury that occurred while covered under this plan. No reimbursement will be made for temporary, duplicate or incomplete procedures, or for correcting unsuccessful procedures. Expenses are limited to the applicable fee guide or schedule. Accidental means the injury was caused by a direct external blow to the mouth or face resulting in immediate damage to the natural teeth or prosthetics and not by an object intentionally or unintentionally being placed in the mouth. |

|

Acupuncture |

Acupuncture treatments performed by a medical doctor or an acupuncturist registered with the College of Traditional Chinese Practitioners and Acupuncturists of British Columbia. See the 'Paramedical services' section of this table for information about reasonable and customary limits. |

|

Braces, prosthetics and supports |

To be eligible for reimbursement, you must include a practitioner’s note for all prosthetics, braces and supports to confirm the medical need for the device. Accepted practitioners include licensed chiropractors, physiotherapists and physicians. The prescription must include the medical condition and the braces must contain rigid material. |

|

Breast prosthetics |

See the 'Mastectomy forms and bras' section of this table for information. |

|

Chiropractor |

Chiropractic treatments performed by a chiropractor registered with the College of Chiropractors of British Columbia. See the 'Paramedical services' section of this table for information about reasonable and customary limits. X-rays taken by a chiropractor are not eligible for reimbursement. |

|

Contraceptives |

Please contact Canada Life or sign in to My Canada Life at Work and enter the product DIN to confirm if the prescribed contraceptive is covered.

|

|

Counselling (registered clinical counsellor, registered clinical psychologist, recognized social worker) |

Service fees of a recognized social worker, registered clinical psychologist or counsellor payable to a maximum of $750/year/per covered individual. The practitioner must be registered in the province where the service is rendered. To determine if a psychologist is registered for claiming purposes, contact the College of Health and Care Professionals of BC at 604-742-6715 (toll free 1-877-742-6715) or use the searchable registry at https://chcpbc.org. To determine if a counsellor is registered for claiming purposes, contact the BC Association of Clinical Counsellors at 250-595-4448 (toll free 1-800-909-6303) or use the searchable registry at https://bcacc.ca/counsellors/. To determine if a social worker is qualified for claiming purposes, contact the BC College of Social Workers at 604-737-4916 (toll-free 1-877-576-6740) or use the searchable registry https://onlinememberservice.bccsw.ca/webs/bccsw/register/#/. Visit Careers & MyHR for information about short-term counselling available through the Health and well-being program. |

|

Drugs and medicines |

Covered drugs and medicines purchased from a licensed pharmacy, which are dispensed by a pharmacist, physician or dentist subject to PharmaCare’s policies including reference-based pricing and lowest cost alternative. Drugs and medicines include:

Reimbursement of eligible drugs and medicines will be based on a maximum dispensing fee of $7.60 and a maximum mark-up of 7% over the manufacturer’s list price. All plan members must sign up for PharmaCare to assist with prescription coverage, limiting the impact on your lifetime maximum. Unless medical evidence is provided to Canada Life that indicates why a drug is not to be substituted, Canada Life can limit the covered expense to the cost of the lowest priced interchangeable drug. Prior authorization For more information regarding prior authorization and specialty drug processes, sign in to My Canada Life at Work and click on Info centre > Benefits information sheet or see the 'Prior authorization and specialty drugs' section. No benefits will be paid for:

|

|

Emergency ambulance services |

Emergency transportation by licensed ambulance to the nearest Canadian hospital equipped to provide medical treatment essential to the patient. Air transport when time is critical and the patient’s physical condition prevents the use of another means of transport. Doctor’s note may be required. Emergency transport from one hospital to another only when the original hospital has inadequate facilities. Charges for an attendant when medically necessary. |

|

Examinations: medical |

Medical examinations rendered by a physician, required by a statute or regulation of the provincial and/or federal government for employment purposes, for you and all your registered dependents, provided such charges are not otherwise covered. |

|

Examinations: vision |

Fees for routine eye examinations to a maximum of $100/24 months/person over the age of 19 when performed by a physician or optometrist. Exams for persons under age 19 and over age 64 are covered under the Medical Services Plan. The balance not covered by the Medical Services Plan for individuals over age 64 is eligible for reimbursement under the extended health plan to plan maximum. |

|

Hairpieces and wigs |

Hairpieces and wigs, when medically necessary, are eligible for reimbursement to a maximum of $500/24 months. |

|

Hearing aids and repairs |

When prescribed by a physician or audiologist, reimbursements at $1,500/ear/48 months for adults and $1,500/ear/24 months for children. This benefit is not subject to an annual deductible. The prescription must be included with the claim. Batteries, recharging devices or other such accessories are not covered. |

|

Hospital charges |

Additional charges for semi-private or private accommodation over and above the amount paid by provincial health care for a normal daily public ward while you're confined in a hospital under active treatment. This does not include telephone or TV rental or other amenities. |

|

Massage therapy |

Massage treatments performed by a massage practitioner registered with the College of Massage Therapists of British Columbia. See the 'Paramedical services' section of this table for information about reasonable and customary limits. X-rays taken by, and drugs, medicines or supplies recommended and prescribed by a massage therapist are not covered. |

|

Mastectomy forms and bras |

Mastectomy forms and bras are eligible for reimbursement to a maximum of $1,000/12 months. |

|

Medical aids and supplies |

A variety of medical aids and supplies as follows: For diabetes:

NOTE: To be eligible for CGM coverage, you must first apply for coverage through BC PharmaCare Special Authority. Portions of the cost that are not paid by BC PharmaCare, such as the deductible and the coinsurance amount, can be claimed under the extended health plan.

NOTE: If you switch from using testing supplies to an insulin injector, testing supplies are not covered for the next 60 consecutive month period.

Standard durable equipment as follows: The cost of renting, where more economical, or the purchase cost of durable equipment for therapeutic treatment including:

Pre-authorization is recommended for items costing over $1,000 and is required for items over $5,000. |

|

Naturopathic physician |

Naturopathic services performed by a naturopathic physician licensed by College of Naturopathic Physicians of British Columbia. See the 'Paramedical services' section of this table for information about reasonable and customary limits. X-rays taken, and drugs, medicines or supplies recommended and prescribed by a naturopathic physician are not covered. |

|

Needleless injectors |

When prescribed by a physician:

|

|

Orthotics and orthopedic shoes |

When prescribed by a physician or podiatrist when medically necessary, custom-fit orthotics or orthopedic shoes, including repairs, orthotic devices and modifications to stock item footwear but not including arch supports/inserts. Payable to a maximum of $400/person/calendar year. Not all casting techniques are approved for coverage, so please confirm with Canada Life prior to purchase. Custom-made orthotics When submitting claims for custom-made orthotics, include the following information:

Custom-made orthopedic shoes When submitting claims for custom-made orthopedic shoes, include the following information:

|

|

Out-of-province/out-of-country emergencies |

Reasonable charges for a physician’s services due to an emergency are eligible for reimbursement, less any amount paid or payable by the Medical Services Plan, subject to the lifetime maximum of $3 million for extended health and out-of-province/out-of-country emergencies. |

|

Paramedical services |

Services provided by licensed paramedical practitioners. For the purposes of this plan, paramedical services are a defined group of services and professions that supplement and support medical work, but do not require a fully-qualified physician. These services include:

Paramedical services are subject to reasonable and customary (R&C) limits until the annual maximum is reached. R&C represents the standard fees healthcare practitioners would charge for a given service. They're reviewed regularly and are subject to change at any time. If your healthcare practitioner charges more than a R&C limit, you'll be responsible for paying the difference. For R & C charges, log into My Canada Life at Work, go to Benefits > Coverage and balances > Health, Drugs, Vision & Dental (50088) > Health > Health professionals to view. If you have any questions about R&C limits for a given service, contact Canada Life at 1-855-644-0538. |

|

Physiotherapist |

Professional services performed by a physiotherapist registered with the College of Physical Therapists of British Columbia. See the 'Paramedical services' section of this table for information about reasonable and customary limits. |

|

Podiatrist |

Professional services performed by a podiatrist registered with the British Columbia Association of Podiatrists. See the 'Paramedical services' section of this table for information about reasonable and customary limits. X-rays taken or other special fees charged by a podiatrist are not covered. |

|

Prostate-serum antigen test |

Once per calendar year. |

|

Smoking cessation products |

Drugs and supplies for prescriptions and non-prescription smoking cessation. Maximum: $300/year/person to a lifetime maximum of $1,000. You must register with the Quittin’ Time Program prior to purchasing any products.

|

|

Vision care |

This benefit is not subject to the deductible. Purchase and/or repair of corrective eyewear, charges for contact lens fittings and laser eye surgery, when prescribed or performed by an optometrist, ophthalmologist or physician. Corrective eyewear includes lenses, frames, contact lenses, prescription sunglasses, prescription safety goggles, and vision care repairs. Charges for non-prescription eyewear are not covered. Check My Canada Life at Work to verify your personal eligibility period as coverage for vision care is determined using a rolling eligibility date. Eye exams are a separate feature. See the 'Examinations: visions' section of this table for information about eye exams. No benefits will be paid for vision care services and supplies required by an employer as a condition of employment. |

Any item not specifically listed as being covered under this plan is not an eligible item under this extended health plan.

Extended health general exclusions

No benefits will be paid for:

- Expenses that private benefit plans are not permitted to cover by law

- Services or supplies for which a charge is made only because the person has coverage under a private benefit plan

- The portion of the expense for service or supplies that is payable by the government health plan in the person’s home province, whether or not the person is actually covered under the government health plan

- Any portion of services or supplies which the person is entitled to receive or for which they are entitled to a benefit or reimbursement by law or under a plan that is legislated, funded or administered in whole or in part by a government plan without regard to whether coverage would have otherwise been available under this plan

- Services or supplies that do not represent reasonable treatment

- Services or supplies associated with treatment performed for cosmetic purposes only

- Services or supplies associated with recreation or sports rather than with other regular daily living activities

- Services or supplies associated with the diagnosis or treatment of infertility or contraception except as may be provided under the prescription drug provision

- Services or supplies associated with a covered service or supply unless specifically listed as a covered service or supply, or determined by the plan administrator to be a covered service or supply

- Extra medical supplies that function as spares or alternatives

- Services or supplies received outside Canada except as provided under the out-of-country care provision

- Services or supplies received out-of-province in Canada, unless:

- The person is covered by the government health plan in their home province, or the government coverage replacement plan sponsored by the employer, and

- This plan would have paid benefits for the same services or supplies if they have been received in the person’s home province

- Medical evacuation services covered under the employer’s global medical assistance plan

- Expenses arising from war, insurrection or voluntary participation in a riot

- Hospital care for conditions where significant improvement or deterioration is unlikely within the next 12 months. This is considered chronic care

Your extended health plan options

No coverage

If you waive extended health coverage under the Flexible Benefits Program, you'll receive flex credits to use elsewhere.

All employees, regardless of family status, will receive the same number of flex credits upon waiving a benefit plan.

This option has no travel medical emergency coverage.

Coordination

This is a low-cost option which provides a low level of coverage for most services.

This option has a deductible.

This option may work well if you're able to coordinate your benefits with your spouse’s plan, depending on terms of their plan.

If you're coordinating benefits with your spouse and you select this option, your reimbursements under this option (like when you go to the pharmacy) will be the lower portion (that is, 20%). The more significant portion will be reimbursed through your spouse’s plan, after you've submitted a claim to that plan. It’s important to be aware of this so there are no surprises when you're paying for products and services.

You have business and personal travel medical emergency coverage of up to $3 million.

Comprehensive

This option provides a comprehensive level of coverage in all identified areas (for example: prescription drugs, vision care, paramedical services and medical equipment) and is the fully funded option. This option has a deductible. You have business and personal travel medical emergency coverage of up to $3 million.

Enhanced

This option has no deductible and a higher reimbursement rate than the other options.

It includes higher coverage for:

- Vision care

- Massage therapy

- Physiotherapy

You have business and personal travel medical emergency coverage of up to $3 million.

This option has a two year lock-in so if you choose it, you must remain under this option for two plan years.

Details to consider

- Given your claims history and any anticipated future medical expenses, which option offers the best value? Reviewing your past claims information can help you with anticipating future expenses

- If you're covering dependents, which dependents will you cover? Given their claims history, which option offers the best value for you?

- If you're able to coordinate benefits with a spouse, which option offers the best value to you?

Out-of-province/out-of-country emergency coverage under the extended health group plan

If you’re covered under the Provincial Government Medical Service Plan and the extended health plan (meaning you have not waived coverage) and you travel out-of-province or out-of-country for business or personal travel, you’re covered for medical emergencies. This includes medical emergencies resulting from pre-existing conditions (except for a few exclusions) up to the combined extended health lifetime maximum of $3 million per person.

Your spouse and/or dependents covered under the Provincial Government Medical Service Plan and your extended health group plan are also covered for medical emergency travel benefits while travelling for pleasure.

Eligible emergency medical expenses are subject to your extended health plan annual deductible and will be reimbursed at 100% (to plan maximums).

Eligible emergency out-of-province/out-of-country expenses

- Local ambulance services when immediate transportation is required to the nearest hospital equipped to provide the treatment essential to the patient

- The hospital room charge and charges for services and supplies when confined as a patient or treated in a hospital. Members should contact Travel Assistance for assistance if they have a medical emergency. Refer to the Travel Assistance Brochure (PDF, 2MB) for contact information. When the patient’s medical condition permits, they'll be returned to Canada. Canada Life's standard out-of-country confinement is up to a semi-private ward rate

- Physician, laboratory and x-ray services

- Prescription drugs

- Other emergency services and/or supplies, if Canada Life would have covered the expenses in your province/territory of residence

- Medical supplies provided during a covered hospital confinement

- Paramedical services provided during a covered hospital confinement

- Medical supplies provided out of hospital if you would have been covered in Canada

- Out of hospital services of a professional nurse

- A sudden and unexpected injury

- The onset of a condition not previously known or identified prior to departure from B.C. or Canada

- An unexpected episode of a condition known or identified prior to departure from B.C. or Canada

An unexpected episode means it would not have been reasonable to expect the episode to occur while travelling outside of Canada. If a person was suffering from symptoms before departure from Canada, Canada Life may request medical documentation to determine whether, in the circumstances, it could have reasonably been anticipated that the person may require treatment while outside Canada.

Non-emergency continuing care, testing, treatment and surgery, and amounts covered by any government plan and/or any other provider of health coverage are not eligible.

Exclusions

- Expenses incurred due to elective treatment and/or diagnostic procedures

- Complications related to such treatment expenses incurred due to therapeutic abortion, childbirth, or complications of pregnancy occurring at week 35 or later, or if high risk, during pregnancy

- Charges for continuous or routine medical care normally covered by the government plan in your province/territory of residence

Business travel medical insurance

Employees without extended health coverage through their employment with the BC Public Service are not covered under the group business travel insurance plan. There are limited exceptions. Employees without extended health coverage should confirm their travel medical insurance status before making travel arrangements. If out-of-province or out-of-country business travel is required, employees without coverage under the corporate travel medical policy should purchase an individual travel insurance plan and claim the expense through their travel claim. When purchasing travel insurance, make sure to read and understand the fine print. Most individual travel insurance plans exclude coverage for pre-existing conditions. Employees should carefully consider their personal health circumstances before agreeing to travel for work.

Optional medical travel insurance

Canada Life has a travel insurance website to enable you to purchase optional travel medical insurance. For more information, review Canada Life’s Optional Emergency Travel Medical Benefit Information Sheet (PDF, 141KB). This travel medical insurance is first payer to your group plan with Canada Life, and you’ll save 10% by purchasing it from this website.

If you have other similar coverage, such as through a credit card plan or another group or individual insurance plan, claims will be coordinated within the guidelines for out-of-province/out-of-country coverage issued by the Canadian Life and Health Insurance Association.

To apply, you'll need your Canada Life group plan number (50088) and your identification number from your Canada Life ID card.

This travel insurance has a maximum amount payable per covered trip of $2 million Canadian. Single or annual travel policies are available if you're under age 80. There are exclusions for pre-existing conditions.

Travel Assistance

Canada Life's Travel Assistance provides assistance if you or an eligible dependent experiences a medical emergency while traveling out-of-province/out-of-country. Trained personnel who speak various languages will provide advice and coordinate services for you.

This service is available 24 hours a day, 365 days a year and assists members in locating hospitals, clinics and physicians. Travel Assistance also provides the following services:

- Medical advisers

- Advance payment when required for hospital admission

- Helping to locate qualified legal assistance, local interpreters and appropriate services for replacing lost passports

- Assisting unattended children

- Return of vehicle

- Transportation reimbursement

- Medical evacuation

- Travelling companion expenses

- Transportation of remains if a plan member dies while travelling. Expenses for preparing and transporting the plan member’s remains home are covered. The assistance company can also help make the appropriate arrangements

Travel Assistance provides advice and coordinates services at no additional charge. However, it's not a means of paying for any healthcare expenses that you may require.

The actual cost for any service(s) received is your responsibility. Some of these expenses may be claimed through:

- Medical Services Plan of B.C.

- Travel insurance purchased by you

- Your extended health plan

Please ensure that you have the Travel Assistance phone numbers with you when you travel.

Canada Life has simplified the phone numbers and you will just require the following two phone numbers:

- Canada or U.S.: 1-855-222-4051

- All other locations: 1-204-946-2577

You can find these phone numbers, as well as your plan and personal ID numbers, on your digital benefits ID card available through My Canada Life at Work. Be sure to have access to those numbers and your provincial health care number when you travel for personal identification.

See the Travel Assistance page for more information.

Out-of-country non-emergency coverage

The following non-emergency services and supplies are covered when out-of-country, if benefits would have been paid for the same services and supplies had they been incurred in Canada, subject to the same deductibles, maximums, reimbursements and limitations of the plan.

- Ambulance services

- Prescription drugs

- Medical supplies

- Paramedical services

- Visioncare

- Dental accident treatment

Prior authorization and specialty drugs

Canada Life’s prior authorization process is designed to provide an effective approach to managing claims for specific prescription drugs.

How prior authorization works

Prior authorization requires that you request approval from Canada Life for coverage of certain prescription drugs. When a claim is submitted for any of these drugs, they’ll ask for information to help them assess the claim. Your request must be approved before your claim is paid. To ensure your claim is processed without delay, please provide all necessary information before filling a prescription.

Why we require prior authorization

Drugs that are approved for one or more medical conditions are sometimes prescribed for other conditions without being proven as an effective treatment. The practice of requesting additional information is designed to help:

- Provide coverage for appropriate drug treatment

- Ensure the drugs prescribed are considered reasonable treatment for the condition

- Keep your drug plan affordable and accessible

Drugs requiring prior authorization

Canada Life maintains a limited prior authorization drug list, and the corresponding forms.

Before a claim for any of these drugs is approved, they review the circumstances to determine whether the drug is a reasonable treatment for the condition for which it was prescribed.

The prior authorization drug form list does change. Your group benefits plan may not provide coverage for all the prior authorization drugs listed, as coverage depends on the terms of your plan.

To view the prior authorization drug form list, sign in to My Canada Life at Work > Info centre > Forms > Prior authorizations to determine which drug requires prior authorization.

If you have questions about which drugs are covered by your plan, call Canada Life's Group Customer Contact Services Office at 1-855-644-0538.

How to request prior authorization

If you’re prescribed a drug that requires prior authorization, you must complete the appropriate section(s) of the drug-specific prior authorization form with your prescribing doctor and submit the form to Canada Life.

Your claim cannot be considered for reimbursement until they receive this form.

If you anticipate submitting a claim for a drug that requires prior authorization, take the appropriate prior authorization form to your doctor’s appointment.

Completed forms can be emailed, faxed or mailed to Canada Life:

Email

cldrug.services@canadalife.com

Fax

Canada Life

Fax: 1-204-946-7664

Attention: Drug Claims Management

Mail

Canada Life

Attention: Drug Claims Management

Drug Services PO Box 6000

Winnipeg MB R3C 3A5

If your claim is approved, in most cases, additional prior authorization forms for the drug will not be required.

Future claims for the drug will be processed in the same manner as prescription drugs that do not require prior authorization.

Certain drugs may require additional approval after a specified period. In these situations, you may be asked to provide further information regarding the progress of your treatment.

All requests for prior authorization are reviewed by Canada Life. Their decision is based on the information provided to determine whether the prescribed drug represents reasonable treatment.

Notification regarding the claim decision

Once Canada Life reviews your completed prior authorization form, they’ll advise you by letter if the request for prior authorization has been approved, or not. If the request is declined, you may wish to discuss your medication needs with your doctor or pharmacist. You have the option of paying for the total cost of the drug yourself.

Specialty drug program

Canada Life’s enhanced drug coordination process coordinates eligible drugs under specific provincial programs. You may be required to apply to the provincial program for drug coverage. Some drugs included in this program are also under prior authorization.

How the specialty drug program works

Go to your pharmacy to fill a prescription.

1. The drug is included in the specialty drug program:

- The claim will be paid, but you’ll need to apply to your provincial program

- You’ll receive a letter to apply to the provincial program and respond to Canada Life within 70 days

- Canada Life will coordinate your drug plan with your provincial plan

OR

2. The drug is included in the specialty drug program and the prior authorization program:

- If your claim is denied, you’ll receive a letter to apply to your provincial program

- If approved, Canada Life will pay any amounts not eligible under the provincial program

- If the provincial plan declines your claim, send the prior authorization form to Canada Life to assess eligibility under the drug plan

- You’ll be notified if your claim is accepted or not

Prescription drug coverage: BC Public Service extended health plan

The following information provides details of the prescription drug coverage under the extended health plan for BC Public Service employees.

What’s BC PharmaCare and how does it coordinate with your drug plan?

BC PharmaCare helps all B.C. residents with the cost of eligible prescription drugs, even if you have private drug coverage through the BC Public Service extended health plan.

If you fill a prescription that’s eligible with BC PharmaCare, BC PharmaCare will start paying for these drugs once your total annual prescription costs reach your deductible, which is based on 3% of your net family income.

Your extended health plan will pay your deductible portion in accordance to the plan’s reimbursement limits until the deductible is satisfied, then PharmaCare will start paying for you and your dependents’ eligible drugs for the rest of the calendar year.

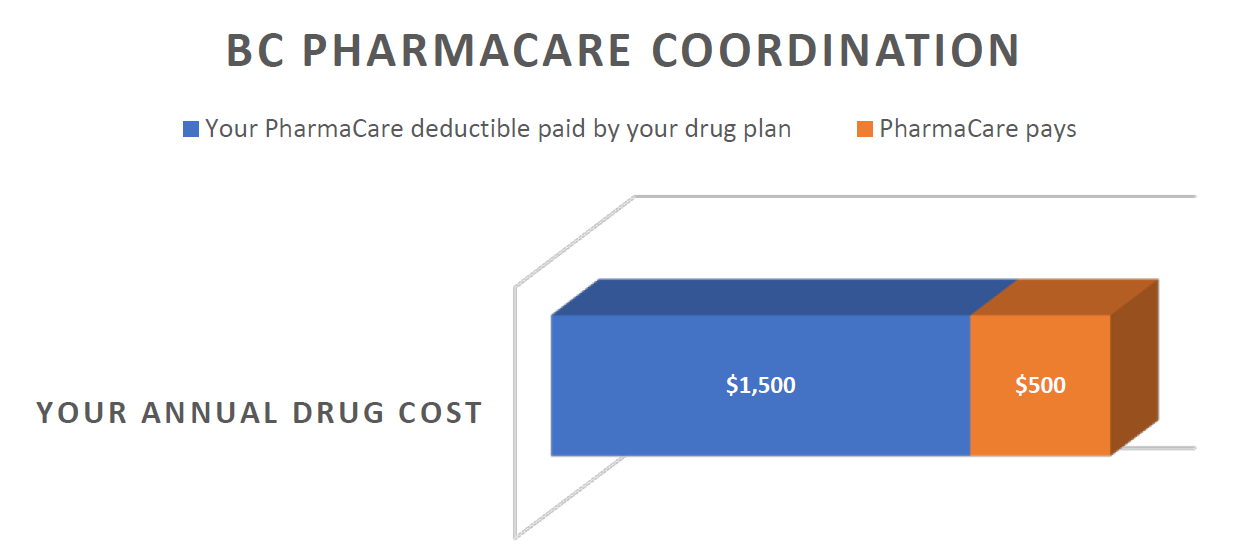

In the example pictured below, based on a net family income of $50,000 and total eligible family drug costs of $2,000 for the year, BC PharmaCare will start paying after your family’s eligible drug costs have reached $1,500 ($50,000 x 3%) within a calendar year.

How does PharmaCare know how to calculate my deductible?

You must register for Fair PharmaCare for BC PharmaCare to access your income tax returns to calculate your deductible.

If you do not register, your deductible will be set at the maximum of $10,000, which will add unnecessary costs to your drug plan.

What if I have not registered with Fair PharmaCare?

If the eligible drug costs for you and your dependent(s) have accumulated and reached a certain threshold within a calendar year, Canada Life will notify you that you need to register for Fair PharmaCare or your drug claims will be temporarily suspended until Canada Life receives confirmation of Fair PharmaCare registration. Learn more about Fair PharmaCare.

In addition to coordinating drug costs with BC PharmaCare, the drug plan for BC Public Service employees follows BC PharmaCare’s pricing policies which include the Low Cost Alternative (LCA) Program and the Reference Drug Program (RDP).

What’s the Low Cost Alternative (LCA) Program?

When the same drug is made and sold by more than one manufacturer, the plan covers the less costly version. Drugs deemed the 'low cost alternative' are usually (but not always) generics. The LCA drugs (usually generics) are fully covered by the plan, but the more costly brand name drugs are only partially covered up to the LCA price.

For example:

- Celexa™ is the brand name version of a popular antidepressant

- The cost of one Celexa 20mg tablet = $1.52 (partially covered)

- The generic version of one Celexa 20mg tablet = $0.26 (fully covered)

Your drug plan would only pay up to the cost of the generic version ($0.26) if you filled a prescription for Celexa™, subject to the terms of your group benefits plan. To get fully reimbursed, you would need to purchase the generic version which can be done by the pharmacist without authorization from your doctor.

If there’s a medical reason that requires you to take the brand name drug, ask your physician to complete a Request for Brand Name Drug Coverage form (available on the Canada Life website) to provide the medical information why you require the brand name drug.

What’s the Reference Drug Program (RDP)?

Sometimes there are several drugs that treat the same illness or condition that are very similar in effectiveness, chemical structure and safety.

There are 7 therapeutic categories in the Reference Drug Program.

- Angiotensin receptor blockers for high blood pressure

- Proton pump inhibitors for acid reflux and ulcers

- Statins for high cholesterol

- H2 blockers for acid reflux

- Calcium channel blockers for high blood pressure

- Angiotensin converting enzyme inhibitors for high blood pressure

- Non-steroidal anti-inflammatories for pain and inflammation

PharmaCare reviews the cost of the drugs within each category and determines the maximum daily cost it will cover.

Each therapeutic category has reference drugs which are the most cost effective and these are fully covered by the plan, in accordance with the plan’s reimbursement formula. However, the more expensive drugs within a therapeutic category are considered non-reference drugs and these will only be partially covered, up to the maximum daily price.

For example, let’s take the statins, a popular class of drugs for high cholesterol:

- Reference statin drugs: atorvastatin and rosuvastatin are fully covered

- Non-reference statin drugs: fluvastatin, lovastatin, pravastatin, simvastatin are only reimbursed to a daily maximum of $0.26

Can I get fully reimbursed for a non-reference drug within the Reference Drug Program if my doctor thinks it’s medically necessary?

If your doctor thinks that it’s medically necessary for you to take a non-reference drug because you’ve already tried a reference drug and it has not been effective, you may ask your doctor to apply to BC PharmaCare’s Special Authority Program on your behalf.

Once approved, you can send in the form to Canada Life to get a pricing exception and full coverage, to plan limits, for your non-reference RDP drug.

For any additional information regarding the Reference Drug Program, please refer to the PharmaCare website.

What if I am already at the pharmacy and realize that my doctor prescribed a non-reference drug? What can I do to get the drug changed to a fully covered drug?

You can go back to your doctor and ask them to prescribe a reference drug within that therapeutic category or ask your pharmacist if they have the ability to adapt the prescription to a reference drug.

Under very limited conditions, pharmacists in British Columbia can change certain prescriptions from one drug to another without consulting your doctor.

BC PharmaCare’s Special Authority drugs

In addition, some drugs may be eligible for coordination with BC PharmaCare’s Special Authority (SA) Program.

If you’re claiming a drug included in the SA Program, you may be eligible for coverage under the government plan.

Your pharmacy will submit your claim to the provincial program and if approved, the decision will be automatically shared with Canada Life.

If you are declined by the provincial program, a copy of the BCSA application form with the provincial decline included on the form can be sent to Canada Life at:

Canada Life Drug Claims Management

Email

cldrug.services@canadalife.com

Mail

PO Box 6000

Winnipeg MB R3C 3A5

Fax

1-204-946-7664

Dental plan

The dental plan is designed to assist you with the cost of your dental care and reimburses most basic and major dental and orthodontic services.

Overview

Canada Life administers your dental plan on behalf of your employer. Dental coverage is available for services in B.C. and for emergency dental services while traveling anywhere outside of B.C. The plan will cover eligible expenses up to the amount it would have covered had the services been performed in B.C.

What's covered by your dental plan?

Dental services fall into three categories:

- Basic preventative and restorative services

- Major services

- Orthodontic services

Reimbursement

Your rate of reimbursement depends on the option you select.

Dentists set their own rates for service, but reimbursement of dental fees under this group plan is subject to the dental fee schedule published by the BC Dental Association for dentists, dental specialists, denturists, and to plan limits.

You're responsible for any fees that exceed plan limits. Always ask for pre-approval.

If services are performed by a specialist, the fee is equal to that of the general practitioner, plus 10%.

It's your responsibility to verify that an item or service is covered prior to treatment. Contact Canada Life if the item is not listed in this guide.

Basic services

Basic dentistry comprised of routine services available in the office of a general practicing dentist and are necessary to restore teeth to natural or normal function.

Diagnostic services

Procedures conducted to determine or diagnose the dental treatment required, including:

- Standard oral examinations

- Specific oral examinations

- X-rays (including panoramic X-rays once every five years)

- A specific oral exam will be reimbursed once for any specific area and only if a standard oral exam has not been reimbursed within the previous 60 days

- A complete oral exam will be reimbursed only once every three years, but not if the plan has not reimbursed for any examination during the preceding nine months

Preventative services

Procedures that prevent oral disease, including:

- Cleaning and polishing teeth

- Scaling

- Topical fluoride: Once every nine months

- Pit and fissure sealants, preventative restorative resins

- Fixed space maintainers intended to maintain space and regain lost space, but not to obtain more space

Restorative services

- Fillings: amalgam fillings and composite (white) fillings on all teeth. Specialty fillings and crowns such as synthetic porcelain, plastic, composite resin, stainless steel and gold may result in additional cost to be paid by the employee or dependent

- Stainless steel crowns on primary and permanent teeth

- Inlays and onlays

Only one inlay, onlay or other major restorative service involving the same tooth will be covered in a five year period.

Surgical services

All necessary procedures for extractions and other surgical procedures necessary for the treatment of disease of the soft tissue (gum) and the bones surrounding and supporting the teeth.

Endodontics

Treatment of diseases of the pulp chamber and pulp canal, including but not limited to basic root canal.

Periodontal services

Treatment of diseases of the soft tissue (gum) and bones surrounding and supporting the teeth including occlusal adjustment, root planing, gingival curettage and scaling.

Replacements and repairs

- The repair of fixed appliances and the rebase or reline of removable appliances (may be done by a dentist or by a licensed dental mechanic). Relines will only be covered once per 24-month period

- With crowns, restoration for wear, acid erosion, vertical dimension and/or restoring occlusion is not covered. Check with Canada Life before proceeding

- Temporary procedures (for example: while awaiting repair of an appliance) are not covered

Recall check-up schedule

For dependent children under 19 years of age, general recall services (oral exam, polishing, scaling, and fluoride) are covered once every six calendar months.

For adults and students covered under the dental plan, age 19 and older, these services are covered once every 9 calendar months under the Coordination and Comprehensive option, and six calendar months if you’re under the Enhanced option.

Major services

Major services apply to services required for reconstruction of teeth and for the replacement of missing teeth (for example: crowns, bridges and dentures), where basic restorative methods cannot be used satisfactorily. To determine how much of the cost will be paid by the plan, and the extent of your financial liability, you should submit a treatment plan to Canada Life for approval before treatment begins.

Only one major restorative service involving the same tooth will be covered in a five year period.

Restorative services

- Veneers

- Crowns and related services

- Specialty crowns and fillings, such as synthetic porcelain plastic, composite resin, stainless steel and gold may result in additional cost to be paid by the employee or dependant

Fixed prosthetics

Bridgework to artificially replace missing teeth with a fixed prosthesis.

Removable prosthetics

- Full upper and lower dentures or partial dentures of basic standard design and material

- Full dentures can be provided by a dentist or a licensed dental mechanic

- Partials can only be provided by a dentist

No benefit is payable for the replacement of lost, broken or stolen dentures.

Broken dentures, however, can be repaired under basic services.

Replacement and repairs

Removal, repairs and re-cementation of fixed appliances.

Plan limits

A dentist may charge more for services than the amount set in the governing schedule of fees or may offer to provide services more frequently than provided for in the fee guide.

You're responsible for any financial liability resulting from services performed which are not covered, or that exceed the costs covered by the plan.

Orthodontic services

This plan is designed to cover orthodontic services provided to maintain, restore or establish a functional alignment of the upper and lower teeth. The plan will reimburse orthodontic services performed after the date coverage begins.

Pre-approval

To claim orthodontic benefits, Canada Life must receive a treatment plan (completed by the dentist or orthodontist) before treatment starts.

Reimbursement

The carrier will pay benefits monthly.

Photocopies of receipts, as treatment progresses, must be submitted monthly (do not hold receipts until the treatment is complete).

You can also submit monthly claims through My Canada Life at Work.

If you pay the full amount to the dentist in advance of completed treatment, the carrier will prorate benefit payment over the months of the treatment period.

No benefit is payable for the replacement of appliances which are lost or stolen.

Treatment performed solely for splinting is not covered.

Dental general limitations

No benefits will be paid for:

- Expenses that private benefit plans are not permitted to cover by law

- Services and supplies the person is entitled to without charge by law or for which a charge is made only because the person has coverage under a private benefit plan

- Services or supplies that do not represent reasonable treatment

- Services or supplies associated with treatment performed for cosmetic purposes only

- Services or supplies associated with congenital defects or developmental malformations in people 19 years of age or over, except orthodontics

- Services or supplies associated with temporomandibular joint (TMJ) disorders