Understanding Your Invoice

Starting January 1, 2020, your invoice will no longer detail all premiums and adjustments for your employees. Instead, only a list of adjustments for the previous months are detailed. Your invoice will list your employees in one of the following ways:

- alphabetical by employee surname

- by account number

- by employee number

- by department number (subtotal by this category is also available)

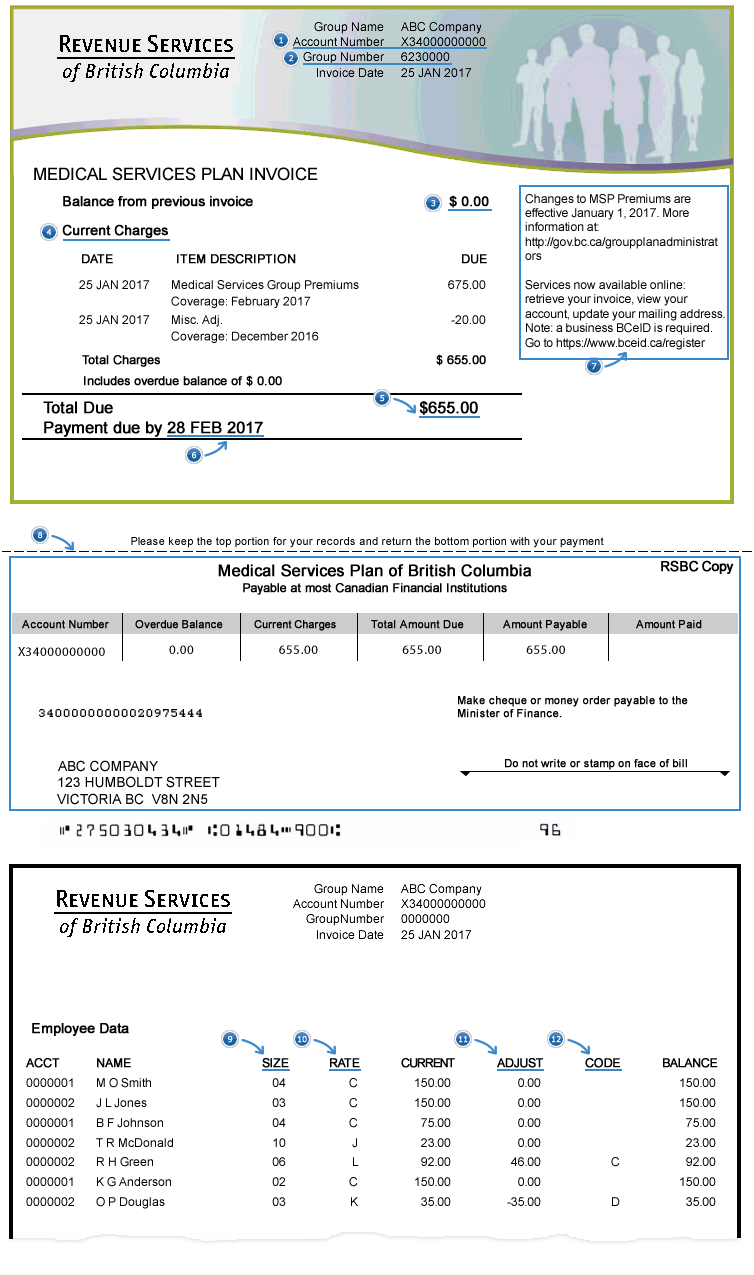

Example Invoice

The following is an example of the invoice you may receive.

-

Account Number

A number assigned to your Medical Services Plan (MSP) group plan account for invoicing. You need this number to make a payment. -

Group Number

A number assigned to your organization's MSP group plan that can be used to contact Health Insurance BC. -

Previous Invoice Balance

The balance from your previous invoice. If you overpaid a previous invoice, any credit you have on your account will be shown as a negative amount (e.g. -$ 8.00). -

Current Charges

A list of the new items you’re being charged for on this invoice. Charges may include next month’s MSP premiums and any premium adjustments. -

Total due

The amount you owe after the balance from your previous invoice and current invoice are added together. -

Due Date

The date your payment must be received by our office. -

Additional Information

Information or news about MSP that can change on each invoice you receive. -

Payment Coupon

This coupon should be submitted with your payment if you’re mailing a cheque or paying at your bank. -

Size

The number of people covered under the employee's account.00 Cancelled coverage

01 to 99 Number of persons covered

-

Rate (Subsidy Code)

One of the following subsidy codes is displayed to explain the premium rate charged for the employee.Subsidy Code Adjusted Net Income 2018-2019 MSP Premium Rate H $0 - $24,000 $0.00 I $24,001 - $26,000 $0.00 J $26,001 - $28,000 $23.00 K $28,001 - $30,000 $35.00 L $30,001 - $34,000 $46.00 M $34,001 - $38,000 $56.00 N $38,001 - $42,000 $65.00 C over $42,000 $75.00

-

Adjustment Code

When an adjustment has been made to MSP premium amounts, one of the following adjustment codes is displayed to explain the reason for the adjustment.Adjustment Code Reason for Adjustment A New application C Addition of dependent D Cancelled coverage/deletion of dependent E Retroactive change in effective date F Change in amount billed (Regular Premium Assistance) G Forward effective date change L Re-establishment of coverage M Multiple adjustments; combination of two or more adjustments N Forward change in cancellation date O Retroactive change in cancellation date R Premium for prior month(s) retroactive to last cancellation date T Recertification subsidy change V Premium adjustment for prior month(s) due to verification of income