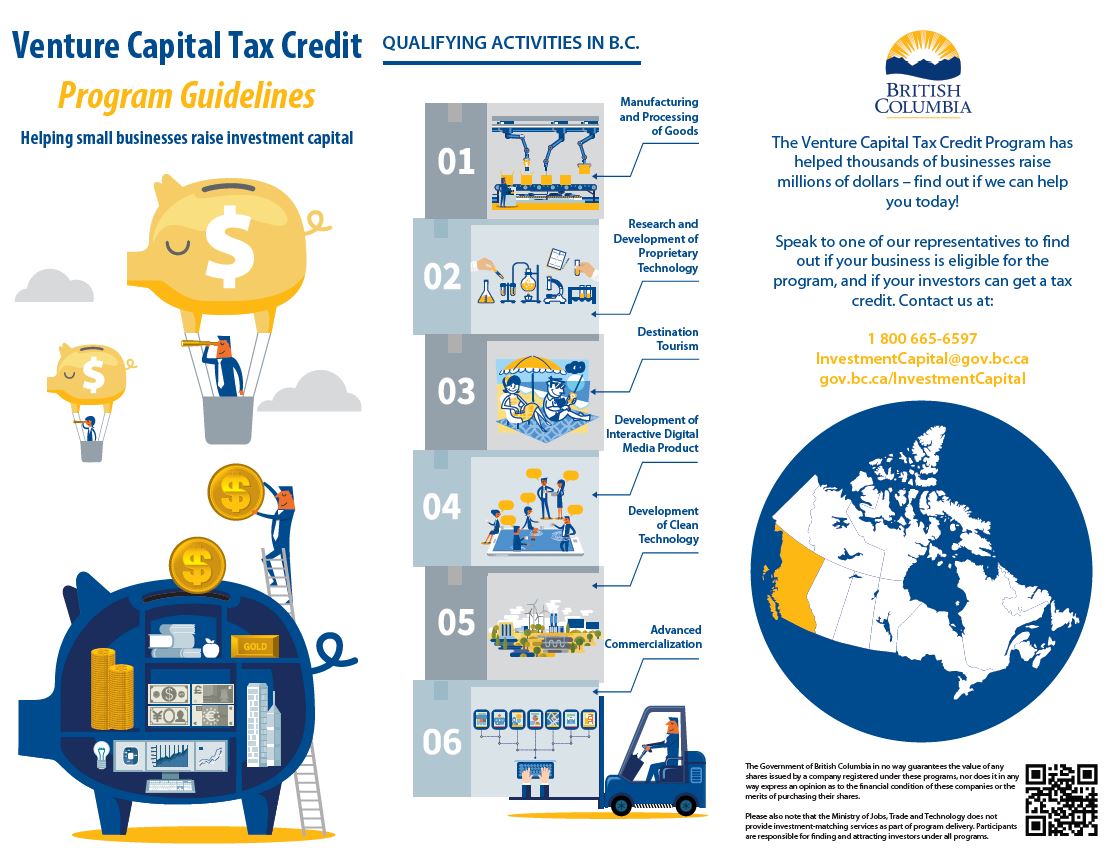

Venture Capital Program

The Small Business Venture Capital Program offers tax credits to investors to encourage them to make equity capital investments in B.C.-based small businesses.

The government recognizes that creating new small businesses and expanding existing ones will contribute to a healthy economy. These programs give small business continuous access to early stage venture capital to help them develop and expand.

B.C. investors receive a 30% tax credit on their investment in a venture capital corporation (VCC) or an eligible business corporation (EBC).

2025 Tax Budget Year

The 2025 tax budget year started on January 1, 2025 and ends December 31, 2025.

VCCs and EBCs planning to raise tax credit supported investment require a 2025 equity authorization.

To apply for an equity authorization, please submit a completed Additional Equity Application to your Portfolio Manager. Application forms are available under the EBC Forms and VCC Forms sections.

Tax credit budgets are limited. EBCs and VCCs can only raise tax credit supported investment up to the authorized amount, between the dates stated in their Equity Authorization approval letter.

EBCs and VCCs should claim tax credits on behalf of investors through the eTCA system soon after investment has been raised, and investors have completed Share Purchase Reports.

2025 and 2026 Tax Credit Certificates

To ensure that all investors who invested in a registered business receive a tax credit, we have changed the way we manage our tax credit budgets. As a result, those investors who invested during calendar 2025 will receive a tax credit certificate with a Taxation Year of 2025 listed on the certificate. This refers to the tax budget year a tax credit was claimed in.

Individual investors who invested in the first 60 days of the calendar year – from January 1 to March 1, 2026 will receive a tax credit certificate with a Taxation Year of 2026.

The Canada Revenue Agency (CRA) uses the Investment Date on the certificate to determine if the tax credit can be applied to the previous year’s tax return.

Therefore, an individual investor who receives a tax credit certificate with the Taxation Year of 2026, and where the certificate’s Investment Date is between January 1 to March 1, 2026, can elect to claim the tax credit when filing their 2025 tax return.

2025 Tax Credit Budget and Tax Credit Amount Changes

Effective for the 2025 to 2027 calendar years, Budget 2025 increased the program’s annual maximum budget for venture capital tax credits from $38.5 million to $53.5 million.

Effective for 2025 and subsequent taxation years, Budget 2025 increased the maximum allowable annual tax credit from $120,000 to $300,000. Individual investors who invested $1 million or more on or after March 4, 2025 are eligible to claim the maximum tax credit of $300,000 when filing their 2025 tax return.

The maximum allowed tax credit for individual investor investments made prior to March 4, 2025 is $120,000.

Details of these changes may be found on page 61 and 63 in the Budget 2025 - Budget and Fiscal Plan 2025/26 - 2027/28.

Convertible Right (SAFE) Instrument Policy Statement

As part of Budget 2019, “convertible right” (i.e. Simple Agreement for Future Equity, or “SAFE”) was added to the definition of “equity share” under the Small Business Venture Capital Act.

Read the Convertible Right (SAFE) Instrument Policy Statement (PDF, 140KB).

Tax Credit Application Certification

The Tax Credit Application Certification are the terms and conditions the EBC/VCC certifies when entering an investment through the electronic Tax Credit Application system (eTCA).

Read the Tax Credit Application Certification Text from eTCA (PDF, 77KB)

Service Costs Associated with the Export of Goods or Technology

The following policy statement defines the "service costs" that are acceptable "activity costs" when a small business is involved in the export of goods or technology.

Read the Service Costs Associated with Exports Policy Statement (PDF, 150 KB).

How to submit an EBC registration application

To register an EBC with the Venture Capital Tax Credit Program the following registration application documents are required:

The following registration application documents are required:

- A completed EBC Registration Application (PDF, 680 KB)

- Business plan or executive summary of business plan

- Central securities register showing $25,000 in equity capital

EBCs are encouraged to submit the Registration Application and required attachments online via the electronic Tax Credit Application (eTCA) system. Alternately, a completed Registration Application (PDF, 680 KB) form and required attachments may be submitted electronically to the Venture Capital Tax Credit Program at InvestmentCapital@gov.bc.ca.

How to submit a VCC registration application

VCCs are encouraged to submit the Registration Application and required attachments online via the electronic Tax Credit Application (eTCA) system. Alternately, the Registration Application (PDF, 746 KB) form and all required attachments may be submitted electronically to their Portfolio Manager or to the Venture Capital Tax Credit Program at InvestmentCapital@gov.bc.ca.

VCC registration information can be found on the Venture Capital Corporation Registration page.

Small Business Support Information

The document available in the link below contains information on government and non-government support programs and other resources that are available to British Columbia's small businesses.

View Government and Non-Government Business Support Information (PDF, 422 KB)